Sakorn Sukkasemsakorn

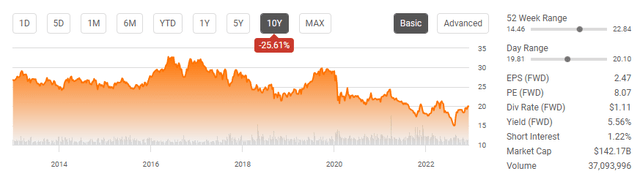

AT&T (NYSE:T) has been a battleground stock as some Seeking Alpha contributors have been very bullish over the years, such as myself, while others have made a case for AT&T being a broken company and to stay away. In the end, Mr. Market is the ultimate judge, and AT&T has been a destroyer of capital for at least a decade. After the spinoff of WarnerMedia (WBD) is accounted for, AT&T has declined by -25.61% over the past decade and -29.44% over the previous 5 years. Tech led the way throughout the bull market, and capital appreciation from the tech sector grabbed many of the headlines. Many investors weren’t interested in AT&T as it was viewed as a boring company saddled with immense debt that continuously made questionable acquisitions. For years AT&T couldn’t shake this image, and investor sentiment was murky at best. Now that the WMB spinoff is in the past, investors should give AT&T another look. I think the future looks bright for AT&T, and that Mr. Market will come around now that they are focused on its core business. Management gave several hints on the Q4 conference call that the dividend could be increased in the future. AT&T provided strong guidance with growth across the board from revenue to free cash flow (FCF), and I still feel that AT&T is being undervalued by Mr. Market. While I have been incorrect on AT&T, I believe there is still an opportunity, and AT&T’s best days are ahead of them.

AT&T is generating large amounts of FCF and could start providing dividend increases in the future

There is no way to know how much research investors conduct prior to making an investment, but I read every conference call transcript, quarterly press release, presentation, and just about every SEC filing for the companies I am invested in. The Q4 conference call for AT&T was strong, and my personal interpretation was that management was insinuating that the door has been left open for future dividend increases.

Management didn’t talk in absolutes and talked in generalizations which is a powerful sign. Mr. John Stankey, CEO, stated that AT&T is committed to generating sustained cash earnings growth while delivering an attractive dividend. Using the word attractive is a critical aspect. For argument’s sake, if AT&T went to $30, its divided would yield 4.07% rather than the current level of 5.56%. There is an argument to be made that a 4.07% dividend isn’t attractive in an environment where a higher yield can be generated from CDs or T-bills. Verizon (VZ) also offers a 6.42% yield, so if AT&T’s yield falls to around 4%, investors could be enticed to invest in VZ for the larger yield.

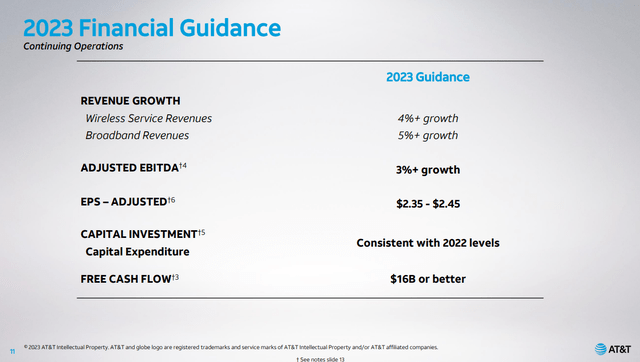

The next aspect that Mr. Stankey touched on was that one of AT&T’s priorities was to generate meaningful levels of free cash flow even with record levels of investment. AT&T is expecting, not projecting, that its cash generation will grow over time and will correlate to an attractive dividend. He also outlined that AT&T’s CapEx will see peak investment levels in 2022 and 2023, and going forward, the CapEx level is expected to moderate, which will create larger amounts of FCF and improved financial flexibility.

My interpretation of Mr. Stankey’s remarks is that as FCF increases, investors will be rewarded with either special dividends or dividend increases. Management knows that the dividend has been a large factor when investing in AT&T and that if the dividend isn’t considered high-yield, then investment interest could deteriorate even further. By using the phrase “attractive dividend”, it leaves the door open for additional capital being returned to shareholders through dividends in the future.

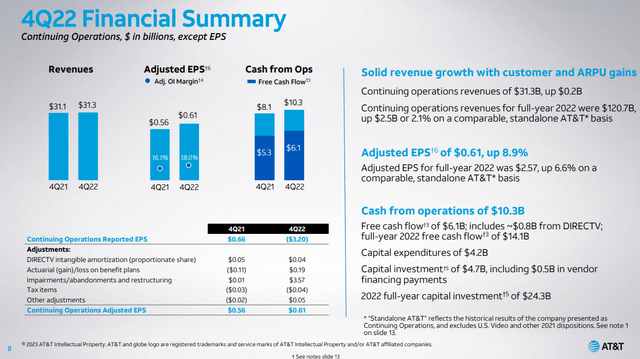

In Q4 2022, AT&T generated an additional $2.2 billion in cash from operations (27.16%) and $800 million in FCF (15.09%) YoY. In AT&T’s 2023 financial guidance, they indicated that FCF would come in at $16 billion or better. AT&T has 7.128 billion shares outstanding, which would amount to $2.24 of FCF per share if AT&T generates $16 billion of FCF in 2023 without issuing or buying back shares. Paying a $1.11 per share dividend is 49.45% of its FCF, as the dividend would amount to $7.91 billion of FCF, leaving $8.09 billion in annual FCF remaining. If AT&T were to deliver $18 billion of FCF, its $1.11 dividend would amount to 43.96% of the FCF per share ($2.53) generated, and there would be $10.09 billion in annual FCF remaining. I think it’s a matter of when, not if, investors will see additional dividend income from AT&T. 2023 is projected to be the last year of peak investment levels in CapEx, so I would speculate that 2024’s FCF would be marginally larger than 2023. Increased levels of FCF is important to any company as it’s the pool of capital companies utilize to pay back debt, reinvest in the business, pay dividends, buy back shares, and make acquisitions. There is certainly a chance that AT&T will be delivering in excess of $20 billion of FCF in the future, and this level of FCF provides many opportunities to reward shareholders, and strengthen AT&T’s financial metrics.

I think AT&T is undervalued, and eventually, Mr. Market will come around

The big red flag that many contributors and Seeking Alpha members cited was AT&T’s massive debt pile. Yes, having $166.94 billion in long-term debt in 2018 was a large amount that attributed to $7.96 billion in interest expenses. I had always argued that debt is only an issue if the company is unable to service the debt or if servicing the debt impedes reinvesting in the business. AT&T has always been able to service the debt, and while it’s a large number on the balance sheet, it never stopped AT&T from making the capital allocations they saw fit for the business.

Since 2018, AT&T has reduced its long-term debt by -$38.52 billion or -23.07%. In 2021, AT&T’s total debt, found in the balance sheet’s supplemental items, breached the $200 billion level for the first time and finished the year at $208.66 billion. Over the next 2 years, AT&T reduced its total debt by -$53.98 billion or -25.87%. The spinoff of WBD allowed AT&T to strengthen its balance sheet, which correlated to less capital being allocated toward interest payments. In 2019, AT&T’s total interest expenses amounted to $8.42 billion, and over the previous 3 years, this number has declined by -$2.31 billion or -27.48%. By reducing its debt levels, AT&T will subsequently lower its interest payments, while decreasing its leverage ratio. Strengthening its balance sheet is critical to reaching AT&T’s goal of a 2.5x range for net debt to adjusted EBITDA ratio.

When I look at AT&T compared to VZ, I think AT&T looks undervalued. In 2022, AT&T generated $142.17 billion in revenue and $12.4 billion in FCF, while VZ generated $170.68 billion in revenue and $14.05 billion in FCF. VZ has a larger market cap by 20.05% or $28.51 billion. What’s interesting is that VZ generates 13.33% more revenue and 13.37% more FCF than AT&T, yet they both have an FCF yield of 10.27%. AT&T is trading at an FCF multiple of 11.47x, while VZ trades at 12.14x. In a shifting investment environment where profits are preferred over revenue growth, it’s perplexing that companies that generate this much FCF can trade at such low FCF multiples. Then when I look at other companies that could be considered boring, such as PepsiCo (PEP), it makes me wonder why there is such a large disparity among these valuations. PEP trades at a $236.44 billion market cap, generated $83.44 billion of revenue in the TTM, and $6.38 billion of FCF. Its FCF yield is 7.63%, and it trades at a 37.04x FCF multiple.

|

T |

VZ |

|

|

Market Cap |

$142,170,000,000.00 |

$170,680,000,000.00 |

|

Revenue |

$120,741,000,000.00 |

$136,835,000,000.00 |

|

Cash From Operations |

$32,023,000,000.00 |

$37,141,000,000.00 |

|

CapEx |

$19,626,000,000.00 |

$23,087,000,000.00 |

|

FCF |

$12,397,000,000.00 |

$14,054,000,000.00 |

|

FCF Yield |

10.27% |

10.27% |

|

FCF Multiple |

11.47 |

12.14 |

I think AT&T will appreciate in value throughout 2023 as it delivers more FCF, and pays down more debt. Hypothetically, if AT&T increases its revenue by 4% to $125.57 billion and generates $16 billion of FCF, it will have an FCF yield of 12.74%. If AT&T’s market cap stays the same throughout 2023, it will place its FCF multiple at 8.89x based on the current market cap of $142.17 billion and $16 billion of FCF. If AT&T can deliver, I don’t believe we will see depreciation in its share price in 2023.

Conclusion

I still believe there is an opportunity in shares of AT&T. It may not be an exciting name, but the revenue and profits are real, and the business is expected to grow in 2023. I think that over time AT&T will continue to improve its financial leverage and allocate additional FCF to shareholders by either paying a special dividend or increasing the current dividend of $1.11 per share. I feel that the current FCF multiple placed on AT&T’s valuation of 11.47x is undervaluing the business and if AT&T meets its 2023 projections and the share price doesn’t move the FCF, multiple could decline to the high single digits. AT&T is a highly profitable company, and over the next several years, it could start to rewrite its history from being a highly indebted company to being a fiscally responsible dividend machine. Only time will tell, but I am still bullish on shares of AT&T.

Be the first to comment