Justin Sullivan

Thesis

eBay (NASDAQ:EBAY) delivered a solid Q3 2022 beat with regards to both EPS and revenues. And as price-conscious consumers turn increasingly to second-hand consumption, there is a good argument to be made why eBay may continue to outperform e-commerce competitors. Moreover, in relation to business fundamentals, eBay is trading cheap – priced at a one year forward EV/EBIT of about x8.9.

Personally, I calculate that eBay stock should be fairly valued at about $60/share. I anchor my argument on a residual earnings valuation framework based on analyst consensus EPS.

For reference, YTD eBay stock has underperformed the broad market by a factor of x2 and is down about 40%, versus a loss of 21% for the S&P 500 (SPY).

Seeking Alpha

eBay’s Strong Q3

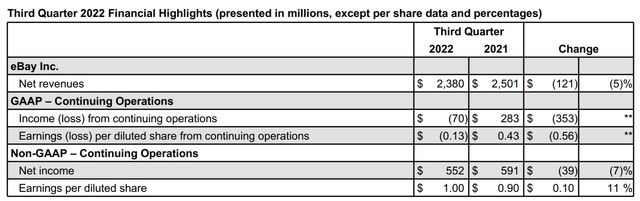

eBay positively surprised analyst consensus with solid results during the September quarter – as the company beat on both sales and profitability. During the period from July to end of September, eBay generated revenues of $2.38 billion, which compares negatively to Q3 2021 by about -5 percentage points, but positively to analyst consensus expectations around $2.32 billion (7 percentage point best). As eBay’s international business suffered from a strong dollar, the company noted that on a FX-neutral basis, sales would have been about 3 percentage point higher.

- Net Transaction revenues were of $2.26 billion, down 4% as compared to the same period one year earlier

- Marketing Services and Other decreased by 20% year over year, to $121 million.

eBay’s non-GAAP operating income decreased by about 7% year over year, to $552 million, or $1/share. But similar to sales expectation, profitability positively surprised analyst consensus estimates, as eBay has previously guided for Q3 EPS as low as 0.89/share.

eBay Q3 results

Jamie Iannone, CEO of eBay, commented: (emphasis added)

Our third quarter results demonstrate significant progress against our long-term objectives and exceeded expectations for all key business metrics

I’m proud of our team and community for remaining resilient in the face of a challenging macroeconomic environment. With the investments we’ve made in our tech-led reimagination, we’re able to provide even more opportunity and value to our customers during these difficult times.

Investors might want to appreciate that eBay’s annualized yield has surpassed 7.5% during the September quarter: In Q3, eBay returned $421 million to shareholders, $301 million in form of share repurchases and $120 million paid in cash dividends.

Solid Guidance

eBay’s guidance for Q4 2022 came in slightly lower than what analyst had expected. The e-commerce company said that sales for the December quarter will likely fall between $2.42 billion and $2.50 (versus analyst expectations at the high-end around $2.49 billion). Profits are expected to be in line with Q4 2021.

However, investors should note that eBay management has a history of beating analyst consensus expectations, as the company generally tends to guide bearishly versus the actual realized performance. Thus, it would not be unreasonable to assume that eBay might deliver around 5% above guidance – in my opinion.

Moreover, in the post-earnings conference call with analysts Jamie Iannone, was tendentially more bullish than bearish – I feel:

As consumers in our major markets face persistent inflation, higher interest rates and rising home energy costs, they are increasingly turning to eBay for better value.

Long-Term Opportunities

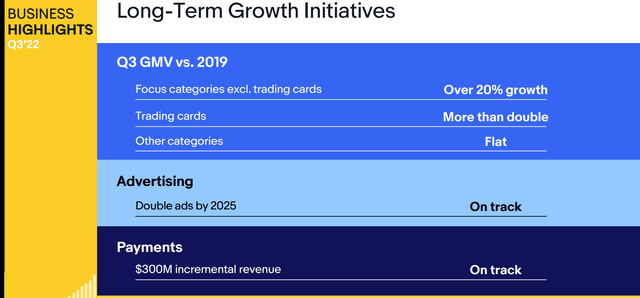

Looking beyond short-term challenges, which have been acknowledged by all major consumer platforms – including Amazon (AMZN) and Walmart (WMT), eBay remains well positioned to capture more value from long-term initiatives.

In Q3, eBay’s first party advertising products generated $249 million of revenue, which represents as much as a 27% year over year growth versus the same period one year earlier. And the company reiterated its ambitions to double the advertising business by 2025.

Moreover, eBay’s strategy to expand in high-value categories such as pre-owned sneakers, jewelry and collector items could continue to sustain a CAGR close to 20%.

eBay Q3 results

Valuation Is Attractive

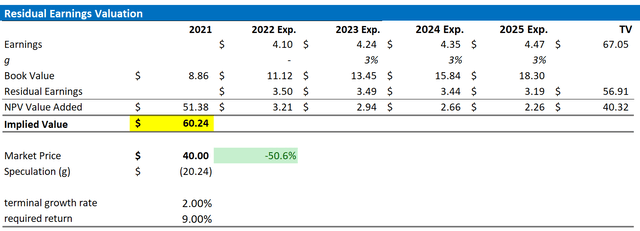

Trading at a one-year forward EV/EBIT of about x8.9, eBay stock looks cheap. But to derive a more precise estimate of a company’s fair implied valuation, I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

With regard to my eBay stock valuation model, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on eBay’s cost of equity at 9%.

- For the terminal growth rate after 2025, I apply 2%, which is conservative in my opinion.

Given these assumptions, I calculate a base-case target price for eBay of about $60.24/share.

Analyst Consensus EPS; Author’s Calculation

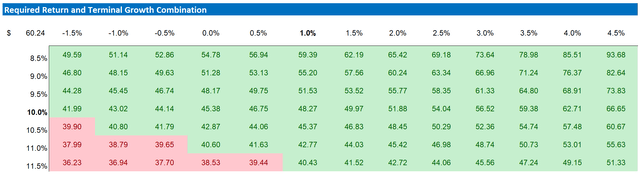

My base case target price does not calculate a lot of upside. But investors should also consider the risk reward profile. To test various assumptions of eBay’s cost of equity and terminal growth rate, I have constructed a sensitivity table. Note that the matrix looks very favorable from a risk/reward perspective.

Analyst Consensus EPS; Author’s Calculation

Risks

Following eBay’s solid Q3 results and guidance, I do not see any material risk to the company’s near/mid term fundamentals and/or competitive positioning. But investors should consider that much of eBay’s share price volatility – like for many other stocks – is driven by investor sentiment towards risk and growth assets in general. Thus, investors should expect price volatility even though eBay’s business outlook remains unchanged. Moreover, if other companies’ valuation would continue to depreciate aggressively, then eBay stock would likely need to trade lower as well – in order to maintain the relative valuation.

Conclusion

Following a 40% sell-off YTD, I believe eBay stock has more than enough accounted for a negative macro-economic outlook – which in Q3 has also proven to be less severe than expected. And given that eBay is now trading at a x8.9 EV/EBIT multiple, there is a good argument to be made that the stock is mispriced in relation to the company’s fundamentals. Personally, I calculate that eBay stock should be fairly valued at about $60/share (which indicates more than 50% upside). Buy.

Be the first to comment