Justin Sullivan/Getty Images News

Introduction: Why Is AT&T Stock Down?

AT&T Inc. (T) released Q4 2021 results Wednesday morning (January 26).

AT&T stock closed down 8.4% for the day, while Discovery (DISCA), which has agreed to merge with AT&T’s WarnerMedia business, closed down 9.2%.

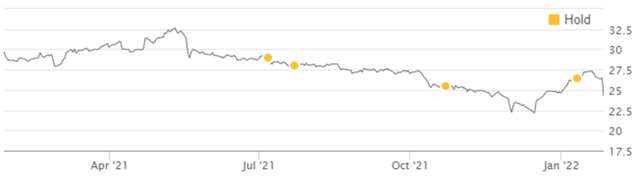

We initiated our Neutral rating on AT&T in July 2021. Since then shares have lost 13.5% (after dividends) in 6 months:

|

Librarian Capital Rating History vs. AT&T Share Price (Last Year)  Source: Seeking Alpha (26-Jan-22). |

We believe Q4 results disappointed investors because it shows evidence of structural challenges in all of AT&T’s businesses. We continue to believe investors should avoid AT&T stock.

Neutral Case Recap

Our Neutral rating on AT&T has been based on what we consider structural problems in its Mobility and Wireline businesses:

- Mobility operates in a commoditizing market, with low revenue and EBITDA growth despite large volume growth, and faces an increasing threat from Mobile Virtual Network Operators operated by U.S. Cable players

- Consumer Wireline is only partially ungraded to fiber and is still losing subscribers to U.S. Cable; EBITDA has hit a lower plateau in 2021 after an effective price cut, when AT&T added HBO Max to its Internet bundle

- Business Wireline is in structural decline, due to losses in legacy services as well as market share gains by U.S. Cable among SMB customers

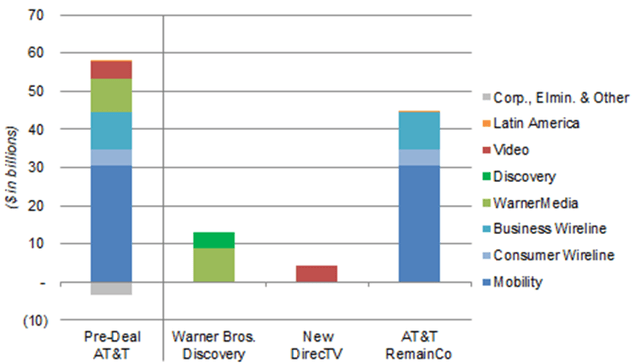

These businesses contribute substantially all of the EBITDA of the “RemainCo” that is being created by the sale of DirecTV (completed in August) and the spin-off of WarnerMedia (now expected to be completed in Q2 2022):

|

AT&T EBITDA by Segment – Pre- and Post-Deal (2020)  Source: Company filings. NB. Not adjusted for smaller divestitures (e.g. Playdemic, Xandr). |

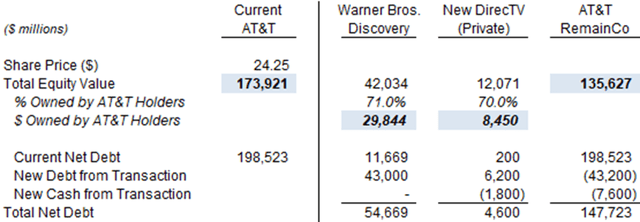

AT&T retains a 70% stake in DirecTV and, when WarnerMedia merges with Discovery, shareholders will receive 71% of the shares in the new Warner Bros Discovery. Based on the agreed DirecTV deal value and the current Discovery share price, “RemainCo” represents 78% of the current value in AT&T stock:

|

AT&T Valuation – Current and Post-Deal Constituents  Source: Company filings. |

Unfortunately Q4 2021 results were negative for all of AT&T’s businesses.

EBITDA Declines in Most AT&T Segments

In Q4 2021, 4 of the 5 segments in AT&T saw a year-on-year EBITDA decline, except Mobility, where EBITDA rose 4.3%. Similarly, 4 of the 5 segments saw EBITDA fell from Q3, except Consumer Wireline:

The spin-off of DirecTV and Video during 2021 means group-level EBITDA is not comparable with prior periods. Excluding these businesses, group revenues grew 4% but EBITDA fell 8% year-on-year in Q4 2021.

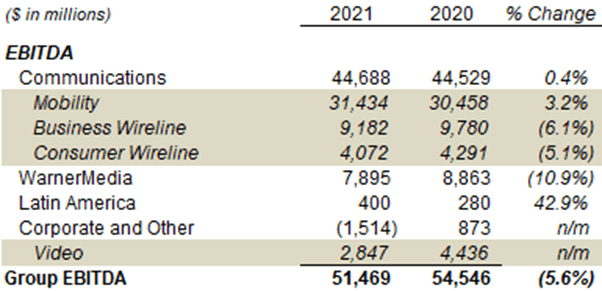

For full-year 2021, Business Wireline, Consumer Wireline and WarnerMedia all saw a significant year-on-year EBITDA decline, while Mobility and the relatively small Latin America segment saw EBITDA growth:

|

AT&T EBITDA by Segment (2021 vs. Prior Year)  Source: AT&T results supplement (Q4 2021). |

Performance has in fact deteriorated for all of AT&T’s businesses in Q4, including Mobility, as we will explain below.

Mobility: Sequential Deceleration in Q4

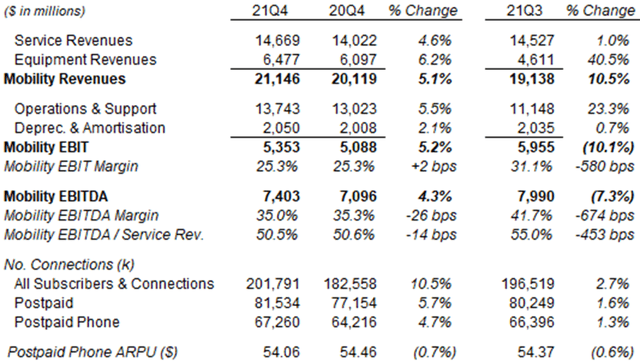

The Mobility segment was a relatively bright spot in Q4 2021 on a year-on-year basis, with revenues growing 5.1% and EBITDA growing 4.3% (or 7.8% excluding $130m of 3G shutdown costs in Q4):

|

AT&T Mobility P&L and KPIs (Q4 2021 vs. Prior Periods)  Source: AT&T results supplement (Q4 2021). |

However, performance decelerated sequentially: Service revenue growth was only 1.0% in Q4, compared to 1.3% in Q3, and Postpaid Phone Average Revenue Per User (“ARPU”) fell another 0.6%; EBITDA was down 7.3% sequentially. Higher Equipment losses were likely a factor, from more new subscribers and more 5G handset upgrades subsidised by AT&T.

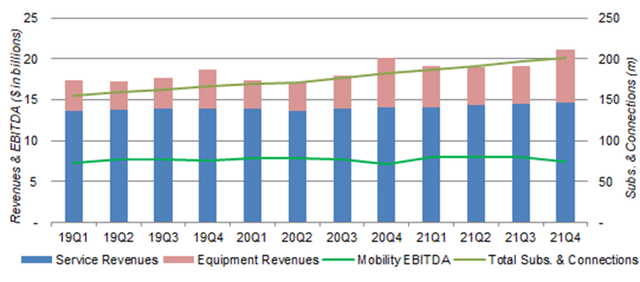

Historically, AT&T Mobility Service Revenues and EBITDA had stagnated, even as subscribers and connections continued to grow:

|

AT&T Mobility EBITDA, Revenues & Connections (Since 2019)  Source: AT&T company filings. |

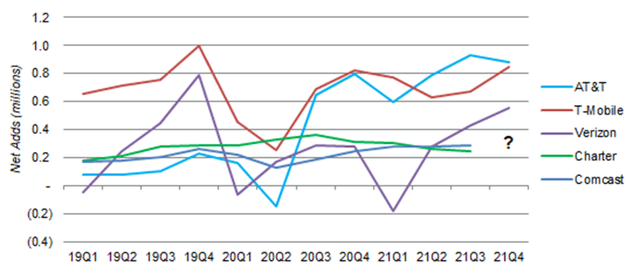

The slower revenue growth and sequential EBITDA decline in Q4 2021 may mark a return to this trend, especially as we expect tougher competition from Verizon (VZ), T-Mobile (TMUS) and U.S. Cable. Both Verizon’s and T-Mobile’s postpaid phone net adds accelerated again in Q4, while AT&T’s fell:

|

Wireless Postpaid Phone Net Adds – Key Players (Since 2019)  Source: Company filings. NB. Comcast (CMCSA) and Charter (CHTR) Q4 2021 figures not yet released. |

AT&T may be disadvantaged by its slower 5G roll-out. As we noted recently, it only targets covering 75m POPs by 2022 year-end and 200m by 2023 year-end, whereas T-Mobile’s Ultra Capacity 5G already covers 210m, and Verizon’s C-band roll-out will cover 100m by the end of Q1 2022.

We expect Mobility earnings growth to be more challenged in future.

Consumer Wireline: Net Loss in Broadband

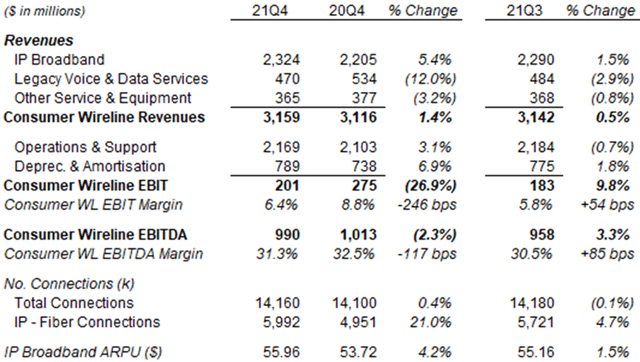

Consumer Wireline EBITDA was down 2.3% year-on-year in Q4 2021,which management attributed to a one-time benefit in the prior-year comparable and higher network costs (including storms):

|

AT&T Consumer Wireline P&L and KPIs (Q4 2021 vs. Prior Periods)  Source: AT&T results supplement (Q4 2021). |

Sequentially, revenue growth was 1.5% in IP Broadband and 0.5% in total, slightly better than Q3 (1.1% and 0.1% respectively). EBITDA was up 3.3% ($32m) sequentially, likely helped by lower costs.

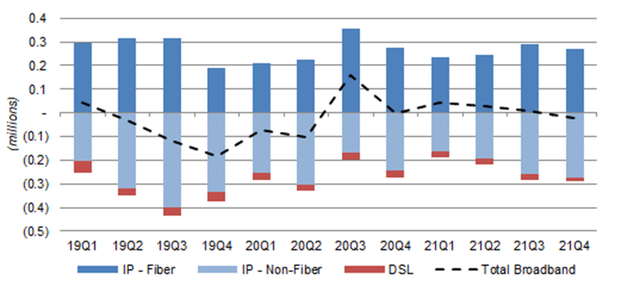

Fiber net add was 271k in Q4 2021, lower than Q3 (289k) and flat-ish from the prior-year (273k), likely due to seasonality and an industry-wide deceleration after the COVID-19 boost in 2020. Non-fiber net losses have been rising, so total broadband net add turned negative in Q4:

|

AT&T Consumer Wireline Net Adds (Since 2019)  Source: AT&T results supplements. NB. Q2 2020 net adds include 104k (28k fiber) “Keep Americans Connected” accounts. |

AT&T added 2.6m households passed in 2021 (compared to 3.0m originally targeted). Management wants to move away from having quarterly targets for new households passed, and instead focus on fiber net adds – they expect these to exceed 300k per quarter “as we move through the year” 2022.

We believe AT&T Consumer Wireline will continue to be outcompeted by U.S. Cable operators in the broadband market.

Business Wireline: EBITDA Down Again

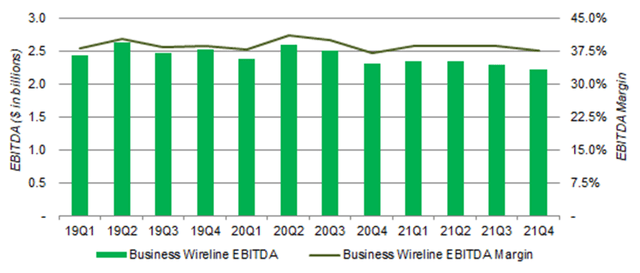

Business Wireline EBITDA fell 3.3% sequentially in Q4 (following a 2.3% decline in Q3), and was down 4.3% year-on-year:

|

AT&T Business Wireline EBITDA (Since 2019)  Source: AT&T company filings. |

The company attributed part of the decline to a rationalization of low-margin services, though this is not consistent with EBITDA margin not improving.

EBITDA is expected to fall again in 2022, with “product rationalization to peak in the first quarter, resulting in more pronounced margin pressures in the first part of the year before recovering in the back half of the year”.

We are less optimistic, as we believe the segment’s problems to be structural, including both legacy products and services, and rising competition from U.S. Cable operators. We expect EBITDA declines to continue.

WarnerMedia: EBITDA Down 20% from Q3

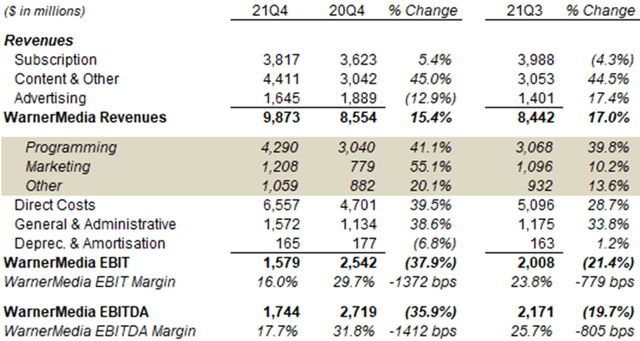

WarnerMedia was a major disappointment in Q4, with EBITDA down 19.7% from Q3 and down 35.9% year-on-year:

|

AT&T Warner Media P&L and KPIs (Q4 2021 vs. Prior Periods)  Source: AT&T company filings. |

Sequentially, Subscription revenues were down 4.3%, primarily due to the end of the Amazon (AMZN) wholesale relationship at the end of Q3, and despite global DTC subscribers rising from 69.4m to 73.8m.

Content & Other and Advertising revenues both grew strongly, partly due to the return of theatrical releases and holiday advertising, but were more than offset by higher Direct Costs (including $500m in HBO Max). General & Administrative costs grew, after an extra month of ad revenue sharing with DirecTV (which was sold on August 2, 2021).

The year-on-year comparison follows similar dynamics, except with lower Advertising revenues, due to prior-year U.S. election ad spend, and a full quarter of ad revenue sharing with DirecTV (worth $380m).

The WarnerMedia business remains in flux. Content investment is expected to peak in 2022. Management expects a shift from premium subscribers to ad-supported ones after they made content on the two identical on January 1. More HBO Max launches in Europe, as well as CNN+, are expected in 2022.

We believe the future of WarnerMedia is too uncertain.

2021-2022 Helped by Cost Savings

2021 was helped by an ongoing $6bn cost savings program, which was one-half achieved by year-end, but with savings “reinvested” in the P&L.

The program is expected to be two-thirds achieved by 2022 year-end, and with more of the savings appearing as extra profit in H2:

“We achieved more than half of our $6 billion cost savings run rate target, which we’ve reinvested into operations … We have a clear line of sight to achieving more than 2/3 of our $6 billion cost savings run rate target by the end of this year. And importantly, we expect these savings start to fall to our bottom line beginning in the back half of the year.” –

John Stankey, AT&T CEO (Q4 2021 earnings call)

By nature, cost savings become more difficult over time.

New 2022 Guidance

AT&T provided 2022 guidance for the whole group (including WarnerMedia):

The guidance implies a decline in both FCF and EPS:

- FCF: The $23bn group FCF figure, which includes $4bn of cash distributions from DirecTV, compares with $26.8bn in 2021, which included $1.9bn from DirecTV. Most, but not all, of the FCF decline can be attributed to Net CapEx increasing from $16.5bn to $20bn. (Net CapEx was lowered by approx. $4bn of vendor financing in each year.) C-band CapEx is not disclosed, but is expected to increase from mid-2022.

- Adjusted EPS: The $3.10-3.15 range represents an 7-9% decline from the 2021 figure of $3.40, which management attributes to higher WarnerMedia investments, a 200 bps increase in tax rate, and no investment gains.

The implied $20bn figure for 2022 RemainCo FCF does not compare directly with the existing $23bn guidance for 2023, as the latter assumes vendor financing will be phased out.

More detailed guidance for RemainCo will be provided at the investor day in March.

AT&T Dividend Yield and Valuation

At $24.25, AT&T stock has a market capitalization of $173.9bn.

For P/E, relative to 2021 group Adjusted EPS of $3.40, AT&T stock has a P/E of 7.1x. Relative to the mid-point of 2022 group Adjusted EPS guidance of $3.10-3.15 (which includes WarnerMedia), the P/E is 7.8x.

For FCF Yield, relative to 2021 group FCF of $26.8bn, AT&T stock has a FCF Yield of 15.4%. Relative to 2022 RemainCo FCF guidance of $20bn, and adjusting out $29.8bn implied equity value of the Warner Bros. Discovery stake, AT&T stock has a FCF Yield of 13.9%.

For Dividend Yield, relative to the current dividend of $2.08, the yield is 8.6%. Relative to guided RemainCo payout of $8-9bn, and again adjusting out the Warner Bros. Discovery stake, the yield is 5.9%.

While these figures look superficially attractive, we do not believe they sufficiently compensate for the structural problems at AT&T.

Is AT&T Stock A Buy Now? Conclusion

We believe investors were unnerved by evidence of structural challenges.

The key Mobility segment saw postpaid net adds decelerated in Q4 even as competitors accelerated, and EBITDA fell sequentially.

WarnerMedia saw EBITDA down 20% from Q3 and 38% year-on-year. Content costs are rising and are guided to peak in 2022.

Consumer Wireline’s broadband net adds turned negative, while Business Wireline’s EBITDA continued to decline.

We reiterate our Hold rating on AT&T, meaning we expect its stock to perform no better than the market and believe it should be avoided.

Be the first to comment