Brett_Hondow

In today’s economy, there is a lot of competition in the brick-and-mortar discount retail sector. The big players like Walmart (WMT), Costco (COST), and Target (TGT) dominate the space. Dollar stores like Dollar General (DG) serve their niche well, too. And, as countless indicators point to a recession ahead, many of these discount retail stores will be leaned-upon by price-sensitive consumers to get through the tough times.

One of these companies is beginning to stand out as a true diamond in the rough, or a cigar butt as legendary investor Ben Graham would say. That company is a discount home retailer, Big Lots, Inc. (NYSE:BIG). Below, I will explain all the reasons why Big Lots is such an attractive investment right now.

A True Cigar Butt

Ben Graham and Warren Buffett perfected the value investing strategy in the 30s and 50s, buying dirt cheap stocks and riding them back to normal valuations.

“A cigar butt found on the street that has only one puff left in it may not offer much of a smoke, but the “bargain purchase” will make that puff all profit.” – Warren Buffett

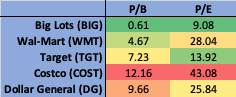

Two important valuation metrics they often sought out were companies with Price to Book (P/B) below 1, and Price to Earnings (P/E) below 10. They found companies with these characteristics tend to outperform the market. Over the past few years, sky-high valuations seemed to rid the market of many opportunities like this, but Big Lots flies under the radar, checking both boxes with a P/B of 0.61 and a P/E of 9.08. For comparison’s sake, look at where some of their big competitors rank here.

Retail P/B & P/E (finviz.com)

As you can see, Big Lots blows away the peers in terms of relative valuation, trading for the cheapest earnings and almost half the value of their assets. This is a true Cigar Butt.

Huge Tailwinds Coming

The U.S. Consumer Price Index (CPI) has risen 9.1% over the past twelve months, behind record inflation spurred by pandemic stimulus, supply chain struggles, and geopolitical turmoil. Paired with that, CNBC reported this week that U.S. household debt topped $16T for the first time ever. And for the cherry on top, Reuters reported this week that U.S. job openings have fallen to nine-month lows, signaling labor market tightening. These are not good trends. And while consumers have largely avoided feeling the effects thus far, many experts believe a recession is imminent. And where do consumers shop when times get tough? Discount Retail stores like Big Lots.

Like everyone else, Big Lots will surely feel pressure from rising interest rates and other effects tied to economic pullback. But as store traffic and sales continue to increase as wallets get tighter, this should outweigh the effects. Through excellent foresight, they have also been increasing inventories significantly over the past year, as to get out ahead of supply chain disruptions and rising shipping costs. Inventories have increased 42% since January of last year, which they prudently funded much of through capital efficient sale-leasebacks on four of their distribution centers. Through loading up for oncoming forecasted demand, as well as clever marketing campaigns like their recent back-to-school campus living sale, it seems as though Big Lots is ready to capitalize on the times ahead.

Supreme Dividend Yield

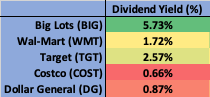

Not only does Big Lots offer positive free cash flow at a ridiculously cheap price, but they also pay shareholders outsized dividends for holding their stock. Big Lots’ 5.73% annual yield bests the competition by a long shot. Take a look at the comparables below.

Retail Dividend Yields (finviz.com)

For context, dividend yield for the S&P 500 index was 1.69% in Q2 2022 and has hovered around this level for years. Big Lots’ market-beating dividends make this cheap stock even more attractive to hold long term, something many of the company insiders are doing through the form of stock grants.

Big Lots leadership has been loading up on shares recently. Over the last six months, 465,446 restricted shares have been granted to insiders, valued around $16MM. Conversely, only 178,498 have been sold. Granted, these newly awarded shares have a vesting period, incentivizing insider ownership. And while the vast majority of Big Lots’ equity is held by institutions, the stock has great float at 26.69MM shares, or 92% of shares outstanding.

Short Squeeze Potential

Given the right catalyst and publicity, Big Lots could present an interesting short squeeze opportunity. Typically, some indicators that a company could possibly undergo a short squeeze in the near future are:

- High short volume (>5x average daily volume)

- High number of shares short as a percentage of float (>10% of float)

- Increasing shares short

Big Lots’ short volume was 9.9MM shares as of 7/15. This is 7.45x average daily trading volume of 1.3MM shares. Check.

Big Lots shares short as a percentage of float was 37.4%, signaling a significant portion of tradable shares is being shorted. Check.

And with 7.45 days to cover (or short interest ratio), it would take over a week for short sellers to cover their positions given a sizeable uptick in the share price. However, it is interesting to note that volume has been trending down in recent months. This past month saw a reduction to around 975,000 average daily volume, which extends days to cover to 10.15 days; over two full trading weeks. This lengthy amount of time could prove a burdensome liquidation risk for short sellers, causing them to close their positions, in turn driving Big Lots’ price higher.

The one portion of this three-pronged approach that Big Lots might be missing is the increasing number of shares short. Since the end of April, short interest has increased at an average rate of 8.2% every two weeks, which is a good sign. However, as the share price has declined heavily, so has the short interest, dropping 5.9% from 6/30. This is not a great sign for the short squeeze opportunity, as it means short sellers are exiting their positions in the green and relieving sell pressure from the stock. However, share prices have been increasing over the past week faster than the shorts have been exiting, which is a good sign for this strategy. A large catalyst, like Q2 earnings outperformance (which should be in a couple of weeks), could be enough to tip the scale and set off a short squeeze.

Valuation

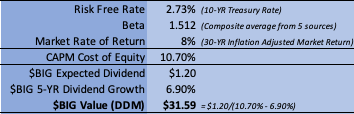

With conservative assumptions in a basic dividend discount model, Big Lots looks undervalued. See my DDM valuation assumptions below:

Big Lots DDM Valuation (various sources)

To come up with a conservative Cost of Equity I used the Capital Asset Pricing Model, where the risk-free rate is equal to the current 10-year treasury rate, Beta is a composite average from five separate sources, and market rate of return is equal to the 30-year Inflation Adjusted Market Return. This boils down to a CAPM Cost of Equity of 10.7%. Big Lots is expected to pay another $1.20 annual dividend per share next year, and have experienced an impressive five-year dividend growth rate of 6.9%. Combining these figures results in a target share price of $31.59, a 53% premium over 8/4/22 closing price. This does not include the effects of a potential short squeeze.

In my opinion, it is not entirely useful to use a Discounted Cash Flow (“DCF”) Model for Big Lots because there are so many factors that could impact future cash flows, and cost of capital assumptions are rapidly changing due to macro trends. I also believe that comparable performance will be a huge key to Big Lots’ value creation in the near term, and the DCF model does not consider this.

Summary

I’m not going to ignore the many risks associated with Big Lots’ less than desirable financials, questionable growth prospects, and recent earnings miss. And I would normally caution against a relatively small retail chain going up against giants during a time of economic strife. But the way I see it, the pros outweigh the cons. Big Lots trades extremely cheap, they are Free Cash Flow positive, they pay an incredible dividend yield, they have serious oncoming macro tailwinds, and they are one headline away from a massive short squeeze. Solid fundamentals with huge optionality. What’s not to love?

Be the first to comment