Bet_Noire

Pivoting into Areas of Visible Growth

Market Overview

Stocks entered a bear market in the second quarter as intensifying inflation and corresponding aggressive actions from the Federal Reserve weighed on corporate results and investor sentiment. Persistent price pressures and global supply chain disruptions from earlier in the year met with rising recession fears and clobbered the benchmark Russell 3000 Index down 16.70% for the quarter, capping the worst start to the year for equities since 1970.

Rising interest rates continued to weigh most heavily on higher multiple and smaller cap growth stocks, whose earnings are discounted well into the future, with the small and mid cap focused Russell 2500 Growth Index falling 19.55% for the quarter while the Russell Midcap Growth Index declined 21.07%. Growth has trailed value over the trailing three and six months, with the dispersion between investment styles among the widest in history.

In addition to multiple compression and a flight to the relative safety of large caps, the ClearBridge Select Strategy has exposure to areas that derated after a surge in demand during the pandemic, including consumer technology and e-commerce. For the quarter, the consumer discretionary (-25.73%) and information technology (IT, -21.37%) sectors, which represent two of the Strategy’s primary exposures, were the worst performers in the benchmark. Sectors that held up better, including consumer staples (-4.96%), utilities (-5.18%). and energy (-5.99%), collectively represent a smaller, weighting in the Strategy. Health care (-7.34%) also outperformed but our smaller cap orientation detracted.

As a result, the Strategy underperformed the benchmark for the second quarter. Given the rapidly changing dynamics in the economy we have made a number of key changes to the strategy and are willing to wait out what we expect to be a volatile period to maintain exposure to stocks we view will prove to be long-term compelling investments.

Our investment philosophy is to lean into growth, owning companies that control their own destinies, are taking market and mind share and are levered to secular tailwinds such as elevating efficiency and implementing data-driven decisions. At the same time, we have been tactically pivoting the portfolio to favor companies with less risk to near-term earnings and revenue numbers. Monster Beverage (MNST) and Constellation Brands (STZ), two beverage makers we added at advantageous prices in 2021, are examples of steady compounders that have held up well through the equity downturn.

Portfolio Positioning

Among our holdings of rapid disruptors, the higher growth segment of the portfolio featuring companies with highly innovative business models, we reduced our exposure to consumer-facing businesses and shifted toward software. Activity during the quarter was highlighted by the sale of online used car retailer Carvana (CVNA) and e-commerce software maker VTEX (VTEX) in favor of adding Snowflake (SNOW), a cloud-based data platform that is a key beneficiary of data analytics and moving to the cloud. Purchases of Everbridge (EVBG) (critical response) and LivePerson (LPSN) (customer service) provide exposure to catalyst-rich software companies we have followed for some time, each with a growing activist presence pushing for improvement and potential sale of the business. We also added to existing positions ServiceNow (NOW) (workflow software), SentinelOne (S) (cybersecurity), GitLab (GTLB) (developer operations) and PayCor (PYCR) (payroll and talent management).

Health care is another sector where innovation is enabling companies to take share from incumbent players or create new markets. New addition Doximity (DOCS) operates the largest professional social network for physicians, with a long runway for growth within its core market for medical professional marketing, hiring, and telehealth solutions. Progyny (PGNY) is a leading provider of fertility benefit management services to self-insured employers. The company is underpenetrated in its total addressable market and with logical adjacencies (labs/diagnostics, return to work support) and demographic tailwinds (families getting started later leads to higher infertility risk) that should allow it to sustain elevated top-line growth. Both companies are growing well above the industry average while being increasingly profitable.

Energy has proved a recent source of new ideas. Here we target evolving opportunities, companies with specific drivers toward operating improvement trading at depressed valuations. Pioneer Natural Resources (PXD) fit that narrative in 2020 when we made the oil exploration & production company a core holding. Intra-quarter, it grew into the largest holding in the Strategy. We subsequently trimmed Pioneer to reduce our direct oil exposure and rotated into natural gas with new positions in leading producer Chesapeake Energy (CHK) and drilling, services and technology supplier Baker Hughes (BKR). Energy remains one of the tighter commodity markets on the supply side and is experiencing a sea change from taking Russia out of the market. Europe will become more reliant on U.S. natural gas, which can be sold more profitably there than domestically.

The pressure on equities has created new opportunities to put excess cash to work. As prices fell, we reduced our cash position from 9% at the start of the period to approximately 2% by the end. In addition to the activity previously mentioned, we trimmed several industrials positions while adding to steady compounders including car auction operator Copart (CPRT).

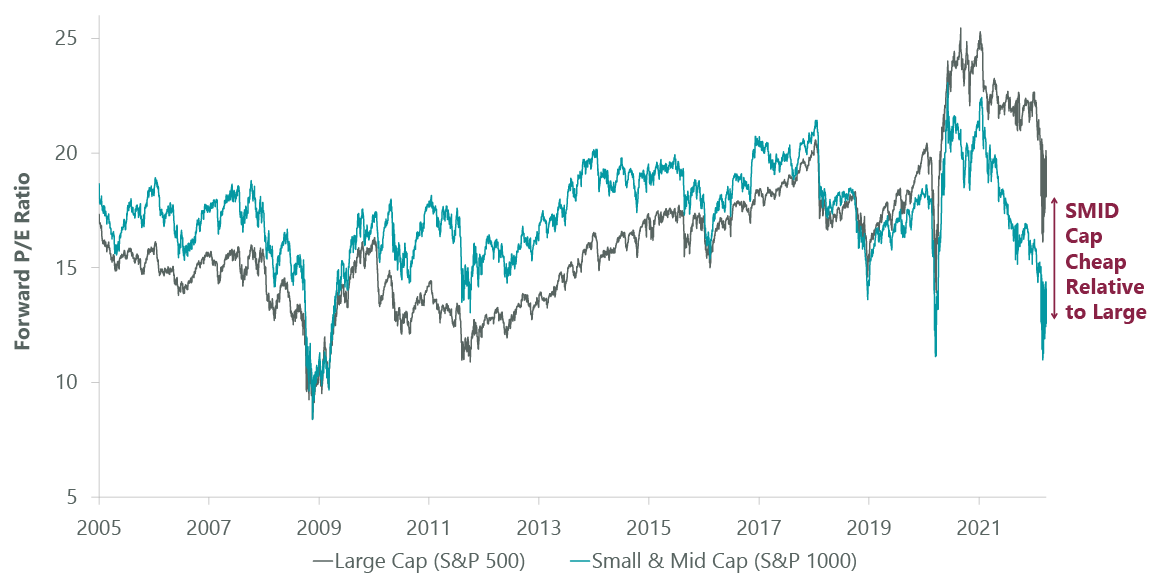

Exhibit 1: Valuations Support Small & Mid Cap Stocks

Data as of June 30, 2022. Source: FactSet, Standard & Poor’s.

Outlook

The second quarter saw investors shift from a fear over owning growth stocks to a broader fear of a looming recession. While risks have evolved, the negative impacts continue to be most acute among small cap stocks (Exhibit 1). Elevated recession concerns have taken momentum out of recent performers like commodities, while more growth-oriented segments of the market are seeing improvement. We believe this speaks to the long-term alpha generation potential from taking an unconstrained approach not dependent on mega caps.

Given the pressures facing the global economy – inflation exacerbated by war in Ukraine, a slowdown in China, dollar strength – we think it makes sense to invest closer to home and expect a leadership rotation back to U.S.-based small caps. Despite tightening liquidity, innovation is not slowing down and we continue to harness it through investing in companies with stronger balance sheets that offer distinctive products and services. We believe such leaders will be stronger emerging from this challenging environment. Competing against young upstarts starved for cash, established growth franchises should find it easier to hire, acquire customers and innovate at their own pace and scale. This philosophy has benefited our performance exiting prior bear markets, and we expect to use the same playbook this time around.

Portfolio Highlights

The ClearBridge Select Strategy underperformed its benchmark during the second quarter. On an absolute basis, the Strategy posted losses across nine of the 10 sectors in which it was invested (out of 11 sectors total). The lone contributor was the consumer staples sector while the primary detractors from performance were in the IT, consumer discretionary, industrials and health care sectors.

Relative to the benchmark, overall stock selection detracted from performance. In particular, stock selection in the IT, health care and consumer discretionary sectors hurt results. On the positive side, stock selection in the consumer staples and financials sectors, an overweight to consumer staples and an underweight to communication services contributed to performance.

On an individual stock basis, the leading contributors were positions in Monster Beverage, Gitlab, Doximity, Global-e Online (GLBE) and Carvana. The primary detractors were Expedia (EXPE), MercadoLibre (MELI), Surgery Partners (SGRY), Workday (WDAY) and Apple (AAPL).

In addition to the transactions mentioned above, we initiated a position in Global-e Online in the consumer discretionary sector and sold a position in Definitive Healthcare (DH) in the health care sector.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment