Carsten Koall/Getty Images News

Dear Readers/followers,

Atos (OTCPK:AEXAF) isn’t exactly an investment for the weak-stomached investors among us. Nor should it be called anything but a “mistake”, if invested in some of the earlier high valuations that I covered it at.

But any investment and any company have an inflection point. Atos doesn’t hold the most solid or convincing of upsides here, but there is an eventual upside to cover.

Whether you should even consider investing in it, that’s another story entirely.

Let’s look at what we have here.

Revisiting Atos SE

If you recall my articles on Atos, Atos is a multinational French IT consulting company, which derives from a merger of a French and a Netherland giant a few years back. It’s headquartered in France, and while many US investors may not have heard of the company, it’s a 21-year old business with annual revenues of over €11B, an annual income of €500M, and over 100,000 employees worldwide.

So far, so good. The company has plenty of employees and a future-proof sort of segment. Its “bones” are not to be trifled with either, given that they include some very solid historical companies, like the former divisions of Siemens (OTCPK:SIEGY), Bull S.A, Xerox IT (XRX), Syntel, and others.

Its strategy includes M&A-based growth – and for several years, this worked out well.

The company does what an IT consultancy does best – it focuses on IT services in the form of transactional services, communications, cloud, big data, and cybersecurity. It operates under several large brands, including Atos, Atos|Syntel, Atos Consulting, Atos Healthcare, Atos Worldgrid, Groupe Bull, Canopy and Unify.

Again – well-known brands in Europe are used by companies across the continent. When I started writing about it, it had a BBB+ credit rating – which is now down to a BB with a negative outlook.

The company has become a warning on how quickly a company can lose its grace. The company, of course, does not admit to expecting any major impacts from this lowering. Though I will say that Atos does not have any significant debt problems. Its largest debt instrument is a €2.4B revolver, at least with exposure to the rating grid – but bond terms remain unchanged for the time being.

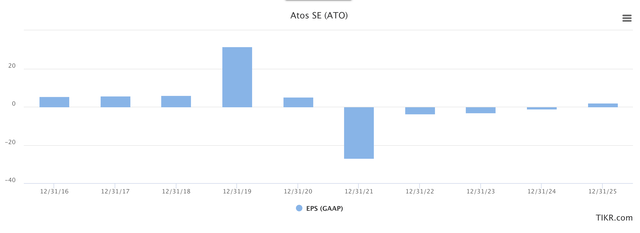

I wrote in one of my earlier articles that I expect 2023E to be a sort of turnaround year for Atos, the year when it finally goes back into positive. I no longer expect this to be the case – nor does the market. In fact, I don’t expect Atos to be able to generate positive GAAP until 2025E at the earliest. This is why the company is trading like garbage, why the credit institutions are treating it like garbage, and why you shouldn’t be investing in Atos without a very thorough preparation.

The latest set of results we have is the 3Q22 results.

Was there any positive to these results?

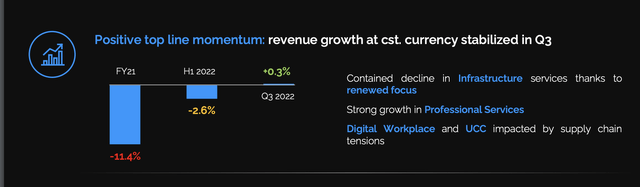

Sure! The company saw revenue growth of 5.7% YoY, with organic growth stabilized in the top line. Book-to-bill is up to a factor of 0.71x again and is expected to recover further in 4Q22. The company is adding thousands of people in preparation for what they believe to be significant demand.

The company wants to present the quarter as an earlier-than-expect rev stabilization.

The company is also slowly rebuilding its commercial pipeline and is trying to add sales capacities to improve its win rate while trying to stay selective in order to make sure that profitability metrics aren’t declining.

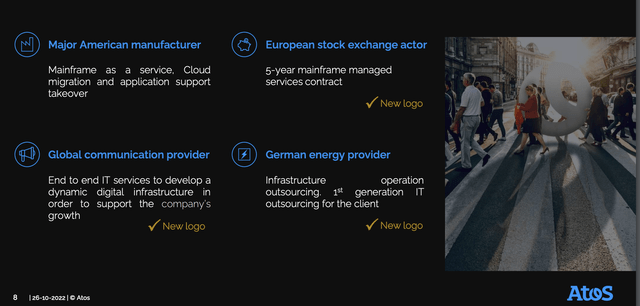

And Atos is winning some attractive contracts – company appeal isn’t the issue…

…nor is the company’s ability and appeal as an employer – Atos is retaining its talents, even scoring awards as a great place to work. The company has also been able to raise some debt €2.7B of it, as a matter of fact, which really ensures that the company has really no liquidity issues in the near future – even if the rates that the company had to lock, like a EURIBOR +160 bps is fairly steep, all things considered.

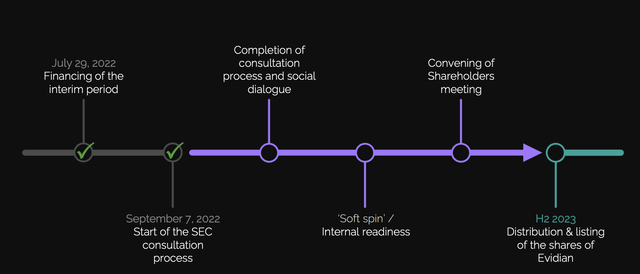

The company’s lauded and oft-announced transformation is ongoing – and even now, anything before 1H24 really won’t bring around that much change, given that’s when the distribution of Evidian is planned.

Any positive trend presented in this quarter doesn’t mean that there is a significant bottom-line turnaround. Based on company trends and Atos’s roadmap, I expect 2025E to be the turnaround year, seeing a reversion in EPS of at least half of the 2020 level of €5/share.

This would constitute a 150% growth in EPS, continued by EPS improvements in 2025 and forward. I’m not alone in these expectations – S&P Global doesn’t expect or forecast any major reversal until that time either, even if the margin of error does allow for some normalization in 2024E.

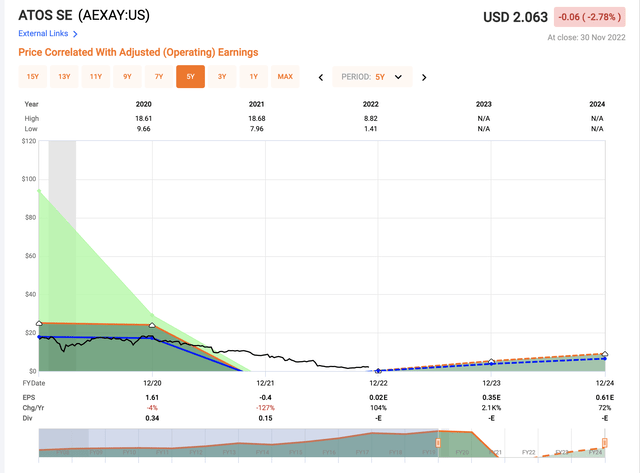

Atos EPS forecast (S&P Global/TIKR)

The current forecast is for a stable revenue normalization of either flat, slightly negative or slightly positive with an operating margin of 3%, and negative or slightly positive FCF for the year. The transformation plan is ongoing, and it’s still a value-destroying horror show for any investor putting significant capital to work here in the short term. You should not be investing in this company expecting a shorter-term reversal – it won’t happen, as I see it.

This all started due to a scandal (or in part, at least). There were issues found in 11% of the company’s revenues, all of it found in the USA, but not related to Syntel. There are misstatements that are important to overall consolidated financial statements. This forced the company to do a full accounting review of its US businesses, and it implemented entirely new processes in the company’s US business segment – kind of like repairing the barn after the horses are already in the next county.

Atos – The valuation

In the end, this is what it’s all about. What am I paying for your cash flows? What does the market demand if I want a share of that pie?

Well, the company is trading like dirt – unfortunately, in this case, that is because it can be considered to be unworthy- and it’ll be some time before there’s an argument for normalization here.

Atos valuation (F.A.S.T Graphs)

We’re a long way off from that still, as I see it. The company does not pay a dividend, any upside here is unclear given the path to GAAP normalization is, as I see it, at least 2 years off at this time.

There is no question that this is a dicey forecast and expectation. That is also why I’m still not pouring money into Atos at this particular time.

It remains a high-risk investment in the sense that we don’t know when a reversal will come – though I think it’s well-established that it will come, eventually.

Still, there are companies on the market today that give an upside that’s far better, far safer, and comes with a dividend without necessitating you to take these risks.

My valuation models for Atos continue to show a massive potential upside in every perspective except P/E and dividend yield. This continues to make a lot of sense because P/E is dependent on earnings, of which the company had very little in 2021A, and yield is dependent on, you know, dividends, which the company has cut. The potential upside for Atos here is absolutely massive – well over 200% in the case of even a small sort of normalization, even when impairing the company by 40-50%. The same is true for EV/EBITDA. More importantly, any sort of non-trough, non-impaired EPS numbers and actual earnings call for a triple-digit upside in my DCF model.

Breaking the company apart and studying the individual components gives us a similar view of pre-split/spin-off.

We value the company’s parts – Infrastructure, Big Data, Business, and the Worldline asset – at either listed or sector-relevant pre-tax earnings multiples, and this calls for total gross assets of no less than €5.5B, even impaired by another 40%. This brings us, net of debt and payables, to around €4B of NAV, which on a per-share basis comes to ~€28-29/share.

You can discount this NAV, the DCF or the EV/EBITDA however you want. You won’t reach the company’s current share price of €10/share unless you completely abandon logic and fundamentals.

Unlike before though, I wouldn’t go into this company at the valuation of €10 here. That’s despite the current average valuation PTs for Atos being around €10.5/share from 12 analysts valuing the company between around €8 on the low end and €15 on the high end. Let me remind you that around a year ago, that valuation was €47 on average, with a high PT of €60/share.

Oh, how some companies can fall.

At this stage, I want visibility before I invest any further. Until I get that, I’m switching to a “HOLD”.

Thesis

My thesis for Atos is as follows:

- Atos is a fundamentally questionable company at this time. While I see no scenario where Atos, the 11th largest IT business in the world, is worth 7.5X P/E long term, in one of the best industry situations for decades, I also want better visibility before committing any further capital to the company.

- The question is how long this will take. When FCF turns positive and when operating margins tick up above 3% for more than a quarter at a time, I would be seriously interested in this company.

- I’m going to “HOLD” due to the speculative nature of the timing of the turnaround – for that reason, I’m staying out here, and I believe you should as well.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company fulfills only one of my criteria – making it not a “BUY”, but a “HOLD”.

Be the first to comment