tornado98/iStock Editorial via Getty Images

Atmos Energy Corporation (NYSE:ATO) is a blue-chip regulated natural gas utility and midstream pipeline & storage operator based primarily in the state of Texas. In fact, through its various retail utility businesses, ATO is the largest pure-play gas utility in the nation.

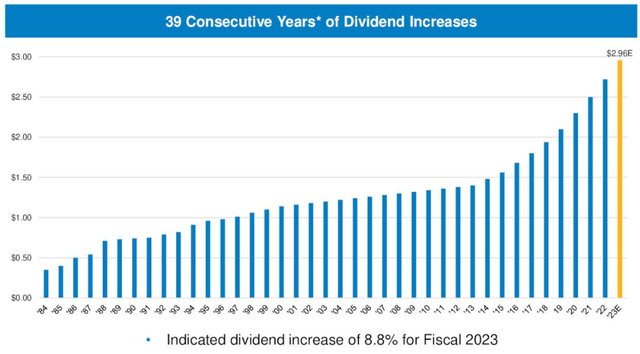

In addition, ATO’s management has exhibited a longstanding skill and conservatism with the company’s balance sheet and capital allocation, consistently investing in projects with returns in excess of its peer-leading cost of capital. This success has laid the groundwork for ATO to become a Dividend Aristocrat, consistently raising its dividend year after year.

ATO now boasts 20 consecutive years of EPS growth along with 39 consecutive years of dividend growth, with the dividend growth rate jumping significantly in the last five or so years.

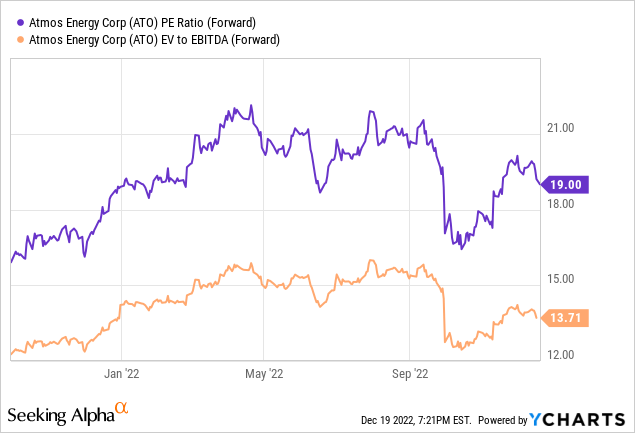

That said, at a dividend yield of 2.6% (though only paying out ~49% of earnings) and a P/E ratio of about 20x (or 18.9x based on the midpoint of fiscal 2023 EPS guidance), ATO does not strike me as being a particularly good value right now.

I’d prefer buying ATO on a dip back down around $100, which would represent a 17.9x P/E ratio based on 2022 earnings and 16.7x based on 2023 earnings.

Currently, I do not own ATO, but I would be a buyer around $100 per share. At that price, the stock would offer a dividend yield just shy of 3%.

In what follows, I’ll explain why ATO is a worthy addition to a dividend growth portfolio.

Overview of Atmos Energy

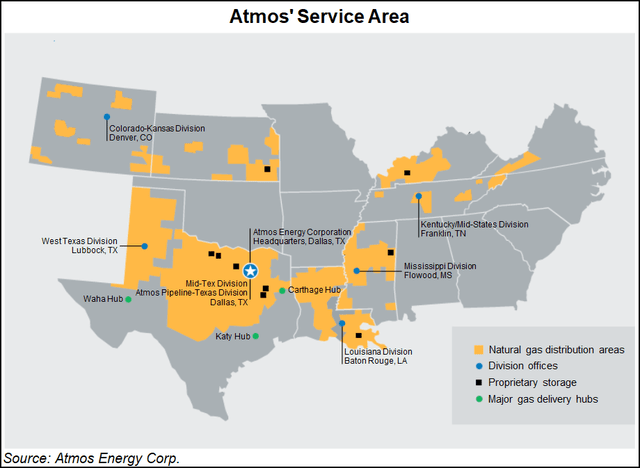

About 2/3rds of ATO’s operating income comes from its retail gas distribution business (~65% of which is located in Texas), while the remaining 1/3rd comes from midstream pipeline & storage.

The distribution business has several service areas spread across several states:

Part of the appeal of ATO is its substantial exposure to central and northern Texas, most notably the Dallas/Fort Worth area. Growth in the population here more or less translates into growth in ATO’s customer base, although it may be the case that a shrinking share of new residential and commercial buildings are being outfitted with gas heating and appliances.

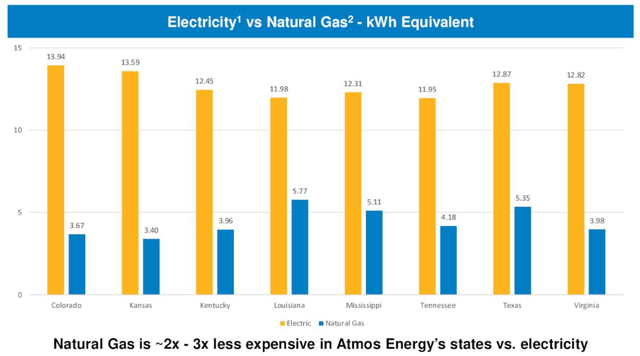

It’s notable that from both a cost-effectiveness and an environmental standpoint, there is a good argument for the superiority of gas to the alternative.

For environmental purposes, natural gas emits less carbon than the average emissions of the power production sector, a sizable portion of which is coal-fired plants.

As for the cost, ATO points out that gas is less expensive than electricity in each of the states in which it operates.

For what it’s worth, ATO absorbed around 62,000 new customers in fiscal 2022, so gas utilities don’t appear to be going the way of the dodo bird anytime soon (at least in ATO’s service areas).

Moreover, ATO owns ~5,700 miles of intrastate natural gas pipelines in Texas, connecting several of the major shale gas basins in the state to the main population centers.

The blended return on equity for the various gas distribution businesses is 9.8%, while the ROE for the pipeline & storage segment is 11.5%.

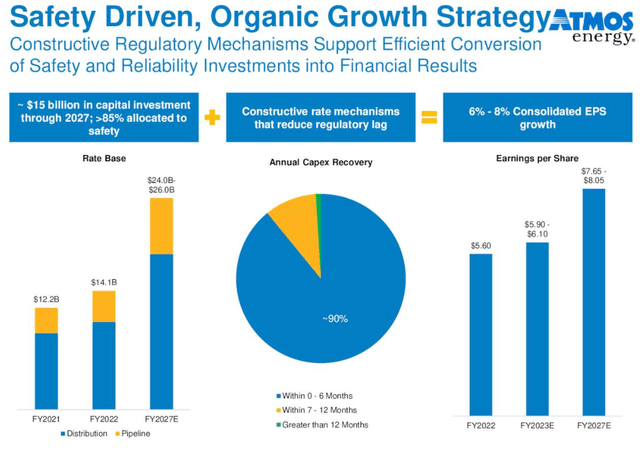

The primary growth channel for ATO involves upgrades to its pipeline network, basically replacing older, steel pipes with new, safer, more reliable pipes. These investments increase ATO’s rate base, which should translate into steady (6-8% annual) earnings per share growth as well.

In fiscal 2022, ATO replaced around 900 miles of distribution and midstream pipelines, which represents 1.1% of the total network.

Around 90% of these capital expenditures begin to earn returns within 6 months from its completion date.

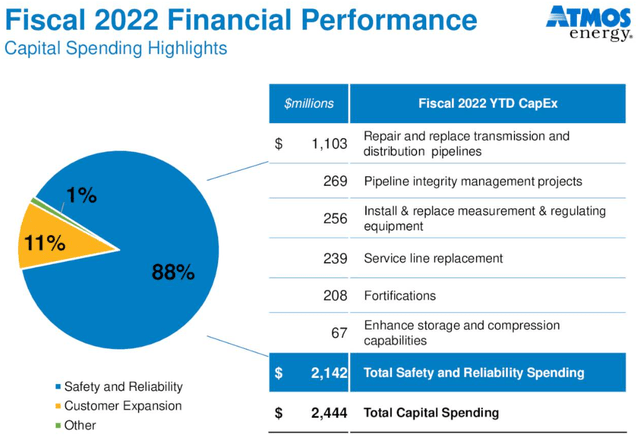

Looking at total capex, we find that nearly 90% goes toward “safety and reliability” investments while 11% facilitates customer expansion.

One of ATO’s best attributes is its strong cost of capital, illustrated by its A1/A- credit ratings and lightly leveraged balance sheet relative to other gas utilities and midstream operators.

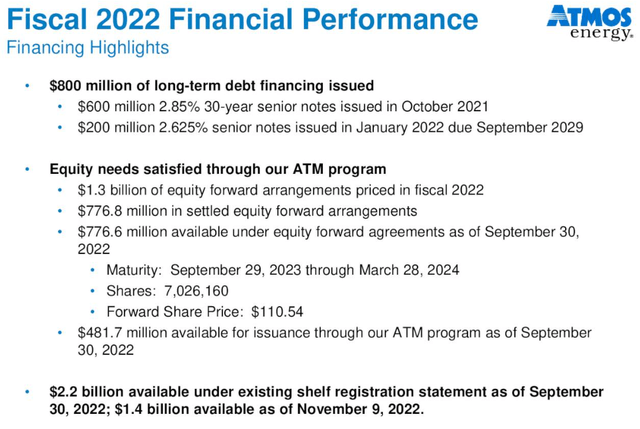

Toward the end of 2021 and into the beginning of 2022, ATO issued some well-timed bonds at what now looks like extremely low rates. What’s more, they have also issued plenty of equity at times when the stock price facilitated a low cost of equity.

ATO’s total capitalization is now 54% equity and 46% debt.

The company also enjoys $3.1 billion in total liquidity, mostly in the form of credit facility availability but also $777 million in forward equity and $52 million in cash.

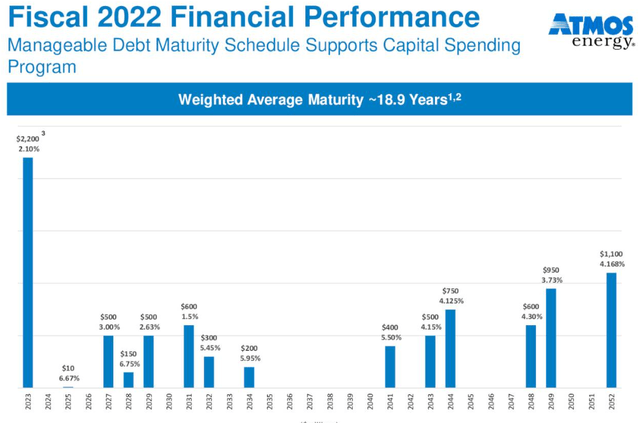

For the most part, ATO has a very extended debt maturity ladder with a weighted average maturity of nearly 19 years. After the $2.2 billion coming due in 2023 is rolled over, that average maturity should get bumped even further out.

After the rollover of next year’s debt, ATO will have virtually no further debt coming due until 2027.

Bottom Line

ATO is a high-quality company as well as a Dividend Aristocrat, but unfortunately investors all seem to know about its qualities and tend to bid its valuation up to a relatively high level most of the time.

As you can see above, ATO’s forward P/E ratio of 19x and forward enterprise value to EBITDA of 13.7x are around the middle of their range from the last year or so.

As a dividend growth investor, there is admittedly something psychologically satisfying to me about buying a stock at a starting yield of at least 3%. There’s nothing magical about that number, but the higher the starting yield, the less aggressive one’s future dividend growth assumptions need to be.

At a 3% dividend yield, ATO’s 7-9% dividend growth rate looks attractive to me. Any less than that, however, and ATO’s dividend growth profile becomes less attractive.

As such, my target “buy price” for ATO is $100, or around a 3% dividend yield.

Be the first to comment