Umnat Seebuaphan/iStock via Getty Images DMS), an online documentation database, to correctly manage files, knowledge, and documentation in an ERP-enabled company. Corporations” use of technology’ data-id=”1361739010″ data-type=”getty-image” width=”1536px” height=”969px” >

DMS), an online documentation database, to correctly manage files, knowledge, and documentation in an ERP-enabled company. Corporations” use of technology’ data-id=”1361739010″ data-type=”getty-image” width=”1536px” height=”969px” >

Investment Thesis

Atlassian (NASDAQ:TEAM) is down more than 50% from its previous highs. The workflow planning platform hasn’t been spared the multiple compression that has ravaged the tech sector.

However, compared with the multiple its peers trade at, Atlassian still carries a very punchy multiple.

Arguably, the best way to describe Atlassian is, an amazing company at a very fair multiple. For investors with a very long-term horizon, this is a reasonable entry point.

For investors that typically have a two to three-year time horizon, they’ll struggle to find enough near-term upside given the challenging backdrop the company will have to navigate.

Revenue Growth Rates Remain Attractive, But

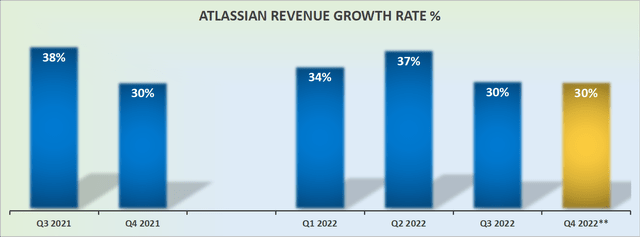

If Atlassian were to grow below 30% CAGR, that would be a mental threshold that would make this ”high-growth” SaaS stock look substantially less interesting to the high-growth investor.

High-growth investors typically crave, as the name entails, hyper-growth stocks, which are typically viewed as anything above 30% CAGR. And the higher, the better.

For those sorts of companies with sustainable high growth rates, depending on the conviction that the shareholders have, investors can often be willing to pay any price.

Even though it appears that Atlassian’s guidance for Q4 is pointing towards 30% y/y growth, I believe that it’s highly likely that Atlassian is conservative with its guidance.

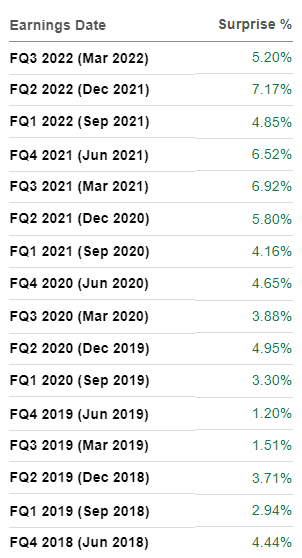

After all, this is a company that is notorious for lowballing estimates. Indeed, consider the following quarterly beats:

TEAM revenue beats

As you can see above, for the past 12 quarters, Atlassian has handily beaten analysts’ revenue estimates.

Consequently, I believe that it’s reasonably safe to assume that even if, for some reason, Atlassian were to miss quarterly estimates for its upcoming Q4 earnings, it would be a temporary setback, and nothing more pernicious than that.

That being said, there are very clear concerns near-term that investors should be mindful about.

Clouds on the Horizon

We are now navigating the most challenging investment environment for years. We have very little visibility right now into how this earnings season is about to unfold.

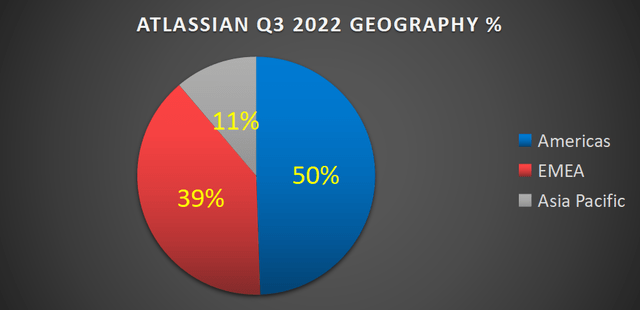

What we do know is that companies with a significant amount of overseas revenues are suffering from substantial currency headwinds, as the dollar has been particularly strong this year.

Tech investors don’t normally consider FX currencies to be a factor, but if a 10% headwind in the y/y comparisons is on the cards, that could impact Atlassian’s reported high-growth rates.

Within its Americas revenues, the majority comes from America, with approximately 5% of total revenues coming from Other Americas.

This means that over half of its revenues have exposure to currencies that are not the dollar. That could cause some headwinds for Atlassian’s Q4 2022 reporting and into early 2023.

Also, the other pressing issue is what we heard from ServiceNow’s (NOW) CEO yesterday.

ServiceNow is the bluest of tech blue chips. Its business model especially targets the largest enterprises in the world. Outside of Microsoft (MSFT) and a handful of names, ServiceNow is probably the best equipped to navigate a recessionary environment.

And even then, the commentary pointed to ”rising energy costs and the ongoing war between Ukraine and Russia” as having a detrimental impact on its business.

Given that Atlassian’s business model is aimed at selling its products to large numbers of much smaller businesses with a small group of developers, I’m inclined to believe that Atlassian could in the near term negatively surprise investors in its upcoming earnings.

Smaller-sized companies typically have less financial resources to navigate a downturn, as you know.

TEAM Stock Valuation – 14x Fwd Sales, Fairly Priced

Looking out to next year, Atlassian is priced at approximately 14x forward sales. Atlassian believes that its stock isn’t being commensurately priced relative to its peers, so Atlassian is looking to redomicile to the US. This is meant to raise investor awareness and get its stock bought by more ETFs.

Objectively, I don’t believe that would add much to its multiple. If we adjust for the different fiscal periods, Asana’s (ASAN) is now being priced at 5x forward sales. And monday.com (MNDY) is valued at 8x forward sales.

While we can obviously acknowledge that Atlassian is vastly more profitable than its peers, we must also keep in mind that its peers are growing dramatically faster, too.

So, I don’t believe one can pound their fist on the table by contending that this move makes a lot of sense.

The Bottom Line

Atlassian is a very well-managed company, with both founders very much active in leading executive positions. They have always had an eye toward profitability and maximizing shareholder value.

Yet, at 14x forward sales, with so much near-term macro uncertainty, it’s difficult to make the case that the stock is particularly undervalued.

Be the first to comment