Kirkikis/iStock Editorial via Getty Images

Earnings of Atlantic Union Bankshares Corporation (NASDAQ:AUB) will most probably dip this year on the back of higher net provision expenses. On the other hand, moderate loan growth and margin expansion will help support the bottom line. Further, the recent branch consolidation will save costs, thereby offering further support to earnings. Overall, I’m expecting Atlantic Union Bankshares to report earnings of $2.85 per share in 2022, down 12% year-over-year. The year-end target price suggests a high upside from the current market price. Therefore, I’m adopting a buy rating on Atlantic Union Bankshares.

Management’s High-Single-Digit Loan Growth Target Appears Achievable

Atlantic Union Bankshares’ loan portfolio grew by a remarkable 2.0% in the first quarter of 2022, or 8.0% annualized. The management is expecting high-single-digit loan growth for the full year, as mentioned in the earnings presentation. The target appears achievable given the recent performance as well as the historical trend. Atlantic Union Bankshares’ loan portfolio has managed to grow at a compounded annual growth rate of 16.6% from 2017 to 2021.

The target is also made achievable by the management’s openness to acquisitions. As mentioned in the presentation, Atlantic Union Bankshares considers M&A as a supplemental strategy. The company has also relied on acquisitions for loan growth in past years.

For the last couple of years, Atlantic Union Bankshares has been in the process of transitioning from its brick-and-mortar model toward greater reliance on digital capabilities. Although all banks are adopting digital platforms, what sets Atlantic Union apart is that it has reduced its physical footprint by at least a quarter in the past two years. Moreover, Atlantic Union Bankshares has recently sped up its consolidation process. The company consolidated 16 branches in March 2022, representing 12% of the branch network, as mentioned in the presentation. The full-quarter impact of the consolidation completed in March will be visible in the second quarter of 2022. In my opinion, Atlantic Union Bankshares may see an initial dampening of product demand as a result of the fast-paced consolidations.

However, Atlantic Union Bankshares plans to continue working on its digital strategy in the year ahead, as mentioned in the presentation. The improvement in the digital platform should help loan growth and partly compensate for the branch consolidations.

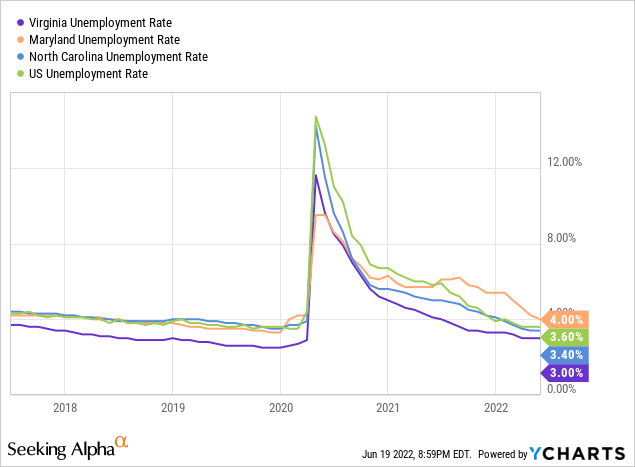

Atlantic Union Bankshares mostly operates in Virginia, with some presence in Maryland and North Carolina. The continued strength of the economies of these states bodes well for product demand. The fall in unemployment rates of all three states signals that economic activity has mostly returned to the pre-pandemic level.

Considering these factors, I’m expecting the loan portfolio to grow by 8.2% by the end of 2022 from the end of 2021. Meanwhile, deposit growth will likely underperform loan growth because the deposit book declined during the first quarter of the year. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Financial Position | |||||||||

| Net Loans | 7,103 | 9,675 | 12,569 | 13,861 | 13,096 | 14,174 | |||

| Growth of Net Loans | 13.3% | 36.2% | 29.9% | 10.3% | (5.5)% | 8.2% | |||

| Other Earning Assets | 1,331 | 2,486 | 2,960 | 3,596 | 4,829 | 4,528 | |||

| Deposits | 6,992 | 9,971 | 13,305 | 15,723 | 16,611 | 17,493 | |||

| Borrowings and Sub-Debt | 1,219 | 1,756 | 1,514 | 841 | 507 | 531 | |||

| Common equity | 1,046 | 1,925 | 2,513 | 2,542 | 2,544 | 2,452 | |||

| Book Value per Share ($) | 23.9 | 29.2 | 31.3 | 32.2 | 32.9 | 32.5 | |||

| Tangible BVPS ($) | 16.7 | 17.4 | 19.6 | 19.6 | 20.2 | 19.5 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

Loan Mix Makes the Top Line Quite Rate-Sensitive

Atlantic Union Bankshares’ loan portfolio is quite sensitive to interest rate changes and will likely respond well to the recent interest rate hikes. The portfolio’s rate sensitivity is mostly attributable to its concentration in Commercial and Industrial (“C&I”) and Commercial Real Estate (“CRE”) non-owner-occupied loans, which are mostly based on variable rates. Altogether, around 43% of the total loan portfolio is based on variable rates, according to details given in the first quarter’s 10-Q filing. Additionally, some fixed-rate loans will also mature this year.

Atlantic Union Bankshares’ deposit mix is diversified, with no outstanding concentrations in one deposit type. Transactional accounts, including money market, savings, and NOW deposits, made up 58% of total deposits at the end of March 2022, as mentioned in the presentation. These deposits will re-price soon after every rate hike. The remaining deposits will anchor the deposit portfolio’s average cost. Therefore, I’m expecting only a moderate impact of interest rate hikes on the deposit cost.

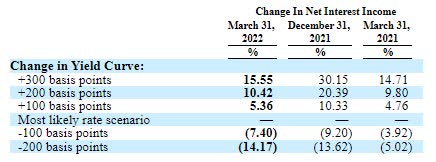

The management’s interest-rate sensitivity analysis given in the 10-Q filing shows that a 200 basis points increase in interest rates can boost the net interest income by 10.42% over twelve months.

1Q 2022 10-Q Filing

Considering these factors, I’m expecting the margin to increase by 60 basis points in the last nine months of 2022 from 2.97% in the first quarter of the year.

Higher Interest Rates to Affect Provisioning for the Year Ahead

After reporting net provision benefits in every quarter last year, Atlantic Union Bankshares reported a net provision expense in the first quarter of the year. Last year’s reserve releases were in line with the movement in credit quality, as allowances were 275.2% of non-accrual loans and loans 90 days past due at the end of March 2022 almost unchanged from 276.7% of non-accrual loans and loans 90 days past due at the end of March 2021.

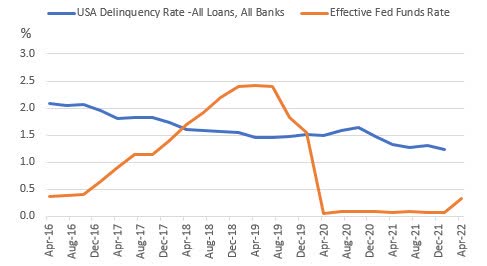

For the next few quarters, the provision expense will be higher than in the first quarter partly because of loan additions. Further, higher interest rates will require higher provisioning as they threaten the debt servicing ability of borrowers. The last time the Fed funds rate was above 1.5%, the banking industry’s average delinquency rate was at least 30 basis points higher than it is right now.

St. Louis Fed

Overall, I’m expecting the provision expense, net of reversals, to make up 0.15% of total loans in 2022, which is the same as the average ratio from 2017 to 2019, but a bit higher than the average for the last five years.

Expecting Earnings to Dip by 12%

The expected higher provision expense will drag earnings this year relative to last year. On the other hand, the single-digit-loan growth and slight margin expansion will support the bottom line. Further, the consolidation of 12% of the branch network in March 2022 will curtail operating expenses for the remainder of the year. However, the management is planning to invest in its digital framework which will lift total non-interest expenses. As mentioned in the presentation, the management is expecting non-interest expenses to be between $385 million to $390 million for 2022. In my opinion, the management’s target is too ambitious; therefore, I’m expecting operating expenses to remain north of $400 million this year.

Overall, I’m expecting Atlantic Union Bankshares to report earnings of $2.85 per share, down 12% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Income Statement | |||||||||

| Net interest income | 279 | 427 | 538 | 555 | 551 | 587 | |||

| Provision for loan losses | 11 | 14 | 21 | 87 | (61) | 21 | |||

| Non-interest income | 62 | 104 | 133 | 131 | 126 | 127 | |||

| Non-interest expense | 226 | 338 | 418 | 413 | 419 | 417 | |||

| Net income – Common Sh. | 73 | 146 | 194 | 153 | 252 | 215 | |||

| EPS – Diluted ($) | 1.67 | 2.22 | 2.41 | 1.93 | 3.26 | 2.85 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses.

High Price Upside Justifies a Buy Rating

Atlantic Union Bankshares is offering a dividend yield of 3.4% at the current quarterly dividend rate of $0.28 per share. The earnings and dividend estimates suggest a payout ratio of 37% for 2022, which is below the five-year average of 42%. Therefore, the outlook of an earnings decline poses no threat to the dividend level.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Atlantic Union. The stock has traded at an average P/TB ratio of 1.79 in the past, as shown below.

| FY18 | FY19 | FY20 | FY20 | Average | ||

| T. Book Value per Share ($) | 17.4 | 19.6 | 19.6 | 20.2 | ||

| Average Market Price ($) | 38.0 | 35.6 | 26.2 | 37.1 | ||

| Historical P/TB | 2.18x | 1.81x | 1.33x | 1.84x | 1.79x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $19.5 gives a target price of $35.0 for the end of 2022. This price target implies a 7.1% upside from the June 17 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.59x | 1.69x | 1.79x | 1.89x | 1.99x |

| TBVPS – Dec 2022 ($) | 19.5 | 19.5 | 19.5 | 19.5 | 19.5 |

| Target Price ($) | 31.1 | 33.0 | 35.0 | 36.9 | 38.9 |

| Market Price ($) | 32.6 | 32.6 | 32.6 | 32.6 | 32.6 |

| Upside/(Downside) | (4.8)% | 1.1% | 7.1% | 13.1% | 19.1% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 14.2x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 2.22 | 2.41 | 1.93 | 3.26 | ||

| Average Market Price ($) | 38.0 | 35.6 | 26.2 | 37.1 | ||

| Historical P/E | 17.1x | 14.8x | 13.5x | 11.4x | 14.2x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $2.85 gives a target price of $40.5 for the end of 2022. This price target implies a 24% upside from the June 17 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 12.2x | 13.2x | 14.2x | 15.2x | 16.2x |

| EPS 2022 ($) | 2.85 | 2.85 | 2.85 | 2.85 | 2.85 |

| Target Price ($) | 34.8 | 37.6 | 40.5 | 43.3 | 46.2 |

| Market Price ($) | 32.6 | 32.6 | 32.6 | 32.6 | 32.6 |

| Upside/(Downside) | 6.5% | 15.3% | 24.0% | 32.7% | 41.4% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $37.7, which implies a 15.6% upside from the current market price. Adding the forward dividend yield gives a total expected return of 19.0%. Hence, I’m adopting a buy rating on Atlantic Union Bankshares.

Be the first to comment