guruXOOX/iStock via Getty Images

Businesses in the 21st century need to be especially agile, adaptable, and fiscally responsible to sustain growth in an industry that is dominated by large, established companies and a plethora of young, entrepreneurial startups. The construction industry, and the electrical subsector specifically, is growing unevenly in modern economies in fits and spurts between Covid shutdowns, supply chain constraints, labor shortages, inflation, and other exogenous factors that are often outside the control of management.

One company that has demonstrated resilience to some of those challenges and is benefitting from an increase in construction of healthcare facilities, data centers, and electrical infrastructure to support renewable (especially solar and wind) energy, is Atkore Inc. (NYSE:ATKR). Atkore was founded in 1959 and is headquartered in Harvey, IL. With a network of manufacturing and distribution facilities worldwide, Atkore provides electrical, safety, and infrastructure solutions. ATKR represents an excellent buying opportunity in a growth stock that is trading at a fair value at the current market price under $100.

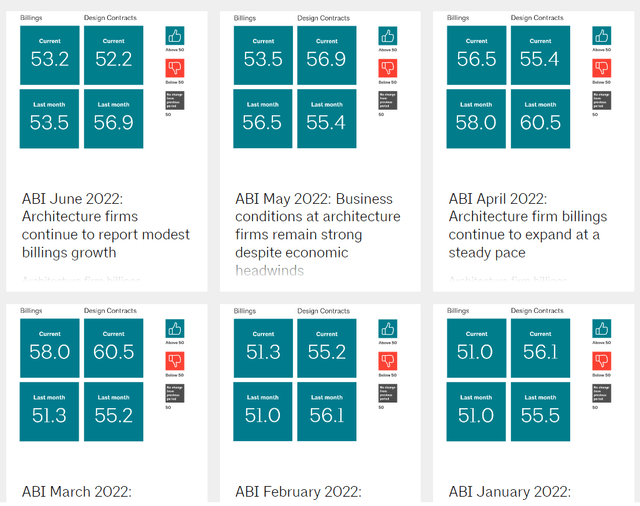

According to the ABI (Architecture Billings Index), which provides a glimpse into the economic indicators of non-residential construction activities, the trend in 2022 has been steady growth with minor pullbacks and advances over the first 6 months.

ABI readings for first half of 2022 [ABI]

As a result, business has been good for Atkore and that is reflected in the stock price over the past one-year period with ATKR easily outperforming the S&P 500.

ATKR 1-year price chart (Seeking Alpha)

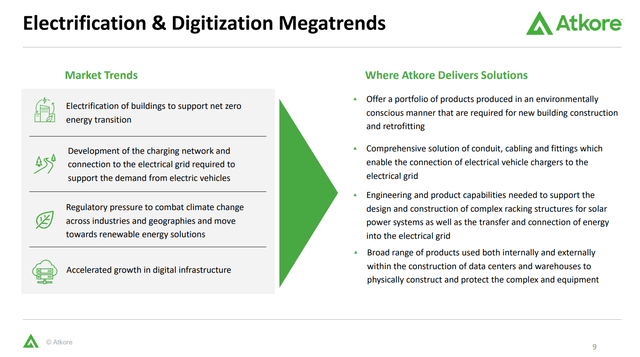

More Data Centers and Electrification of Buildings in the Future

One driver of growth in Atkore’s business is the boom in construction of data centers. Tech giants like Apple (AAPL), Google (GOOGL), Amazon (AMZN), and Microsoft (MSFT), continue to spend billions on new facilities. According to Mordor Intelligence:

The US data center construction market was valued at USD 7.24 billion in 2020, and it is expected to achieve a value of USD 14.17 billion by 2026, registering a CAGR of 11.64% over the forecast period of 2021-2026.

Atkore makes many of the parts needed for data centers and for that matter, the electrical systems of many types of commercial buildings that are becoming ever more electrified.

Electrification megatrends (May investor presentation)

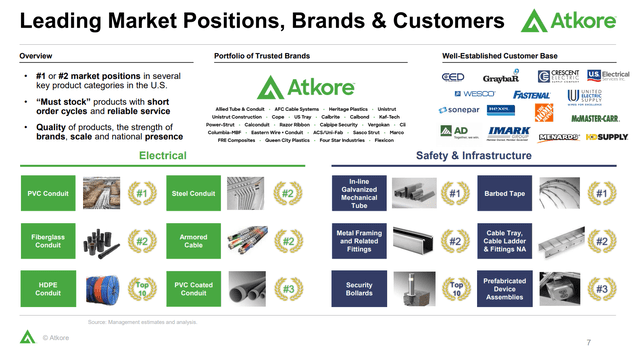

In addition to building electrification, the push toward more renewable energy, and solar in particular, is also driving future demand for Atkore’s products. Atkore, like Mueller Industries (MLI), another parts supplier that I wrote about earlier this year, offers “must stock” high quality parts that are provided by a portfolio of trusted brands to a well-established base of customers. As Atkore acquires new businesses, including 4 so far in FY 2022, they add to their repertoire of high quality, in-demand electrical, safety, and infrastructure products.

Leading brands and customers (May investor presentation)

Atkore’s Capital Deployment Focused on Growth

In the first half of 2022, Atkore deployed over $325 million on capital expenditures, M&A, and stock repurchases. Of the total, $25 million was spent on capital expenditures and key investments in digital tools and capabilities, $39 million was spent on 2 acquisitions, and $261M on share repurchases. The company expects to exceed the plan to spend over $1B in cash over the next 2 to 3 years.

The most recent acquisition of United Poly Systems was announced on June 22, 2022 and marked the 4th acquisition in fiscal year 2022. With the increasing demand for HDPE pressure pipe and conduit in the telecom, water, wastewater, and renewable energy markets, that acquisition positions them for continued growth in business areas that they did not have a strong presence in previously, further expanding the diversity of their offerings.

Despite the steady growth of the past 3 years, the relative value of the stock has recently improved as the current TTM P/E is the lowest it has been in over two years (since March 2020).

Trailing Twelve Month P/E (Seeking Alpha)

With earnings for the fiscal 3rd quarter of 2022 set to be reported on August 2, the price is starting to rise in anticipation of another solid quarter. But at the current price of just under $100 ($99.27 as of market close on July 29) ATKR is trading at a forward P/E of less than 5, which represents an excellent buying opportunity for growth-oriented investors.

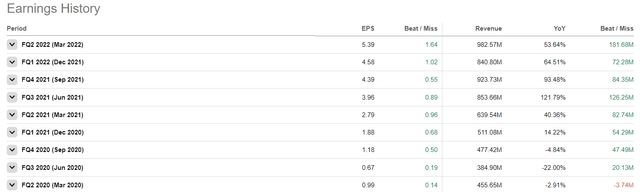

Over the past 2 years plus, ATKR has increased earnings and revenues every quarter, and has beaten estimates for both earnings and revenues every quarter since the June 2020 reporting period.

Past 2 years earnings history (Seeking Alpha)

As the company continues its growth plans and share buybacks, the stock is priced for a poor quarter. If they should continue the trend to beat estimates when they report on August 2, I expect to see a jump in the share price as investors realize that the growth story is intact.

Outlook for Second Half of 2022

During the first quarter report on January 31, 2022, full year net sales were expected to increase by mid-single digits over the previous fiscal year, and adjusted net income per share was expected to increase to a range of $12.80 to $13.60. During the 2nd quarter report, the increase in full year net sales was expected to increase by 25 to 30% compared to fiscal year 2021. Full year adjusted net income per diluted share outlook was increased to a range of $19.65 to $20.45. The Board of Directors increased the share repurchase authorization expiring in November 2023 from $400M to $800M.

From the May report for the 2nd quarter (3-month period ending March 25, 2022) the outlook for the 2nd half of the year was discussed by CEO William E. Waltz:

We enter the back half of the fiscal year with a stronger base from which to grow and the financial flexibility and expected cash flow generation to continue to deliver on our capital allocation priorities. We are on track to repurchase at least a cumulative total of $400 million in shares in fiscal 2022, while also continuing to prudently execute on our robust M&A pipeline. In addition, we are raising our fiscal year 2022 outlook for Adjusted EBITDA to $1.25 to $1.30 billion.

One company that is somewhat of a peer to ATKR is Encore Wire (WIRE). WIRE makes components and equipment for electrical use including wire and cable products. With a market cap of $2.65B (versus ATKR with a market cap of $4.28B) trading at a forward P/E of 4.49 with considerable revenue and earnings growth, the price action and market response to earnings reports can provide a potential indication of what to expect when ATKR reports. On July 25, 2022, WIRE reported Q2 results that included a 12.6% increase in YOY revenues and Q2 GAAP EPS of $10.71, compared to $8.82 in Q2 2021. The price of WIRE jumped to a 6-week high the following day.

That report indicates to me that the demand for electrical products and components is strong and continues to grow as the electrification of buildings and renewable energy increases across the country and in most of the developed world. Atkore is well positioned to take advantage of the growing demand for their high-quality product portfolio and continues to invest in the growth of the business via acquisitions and share buybacks.

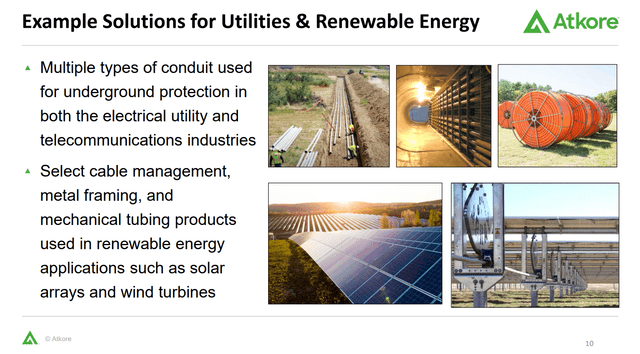

With their expanded product portfolio including the HDPE pipes and conduits that United Poly Systems offers, the anticipated increase in the buildout of renewable energy infrastructure offers yet another growth avenue for the future. This slide from the May investor presentation outlines some of the examples of solutions that can help drive growth from the renewable sector.

Renewable Energy solutions (May investor presentation)

Risks and Rewards

There is certainly a degree of risk associated with any stock that is focused on a continuing increase in construction and infrastructure investment. As the US economy teeters on the brink of recession and suffers from inflationary pressures that may negatively impact future spending, there is a chance that the business could see a slowdown in the growth that they have been witnessing over the past several years. In my opinion, the likelihood of that happening is very small and the company appears to be well managed and is driving growth aggressively but not foolishly.

There is not a lot of risk from competition because many of the products are highly specialized and well entrenched in the customer base who have been buyers of Atkore products for many years. Electrical contractors and equipment providers rely on high quality Atkore products in their businesses and can often pass on the higher prices due to inflation to their customers.

I believe that ATKR stock is value priced under $100 and is likely to soar well above that level in the days following the latest earnings report, unless they fail to deliver a solid report. But in my opinion, that is not the likely outcome. It is more likely that they will report yet another solid quarter, and with continued share buybacks ATKR offers an opportunity for investors to acquire shares in a long-term growth story at a fair price that is very likely to rise 20% or more above current levels within the next year or so.

I am a buyer of ATKR below $100 and suggest that growth-oriented investors take a close look at the company and the outlook for the second half of 2022 to determine whether it makes sense for your investment portfolio, based on your own objectives and risk tolerance.

Be the first to comment