luismmolina

This is a potential sale of a biopharma which could possibly escalate into a bidding war.

Recently, rumors appeared that two large Indian pharmaceutical companies, Intas Pharmaceuticals and Dr. Reddy’s Laboratories (RDY), are in talks to acquire cancer-focused biopharma Athenex (NASDAQ:ATNX). The estimated offer was in the $200m-$250m price range which would imply a 160%-225% upside from current price levels. The report also mentioned interest from a handful of healthcare-focused private equity funds in the US. Reportedly, ATNX hired investment advisory Cowen and the discussions are ongoing.

The rumors follow a strategic change announced by the company in March. The management decided to discontinue most of its oral cancer treatment development program, monetize non-core assets and focus R&D resources solely on developing its key cell therapy programs. Since the announcement, the company has executed on its plan well and has sold $144m worth of non-core assets (detailed below) and managed to come close to its operation expense reduction target – in Q2’22 expenses were 41% lower year-over-year compared to 50% that the company has set for 2022. Assuming the management can progress towards this goal, quarterly liquidity needs would be at $10m-$15m. Currently, ATNX has $37m in gross cash while net cash is negative at -$9m.

Recent reports of acquisition discussions/hiring of Cowen have not been confirmed by ATNX. However, in the light of the strategic shift initiative, I see several reasons why a company sale is likely here:

-

ATNX has a promising NKT cell therapy treatment portfolio that should be attractive for the potential buyers. Moreover, the company owns a large injectable manufacturing business that the market does not seem to attribute significant value to. Non-core manufacturing business has been growing at 20%+ and generates the majority of the company’s revenues (78% in 2021).

-

Rumored buyers are large and credible firms in the industry and already have numerous acquisitions of foreign biopharmas under their belt.

-

Despite cost-cutting efforts, ATNX has explicitly stated that liquidity is likely insufficient for the next 12 months:

The Company projects insufficient liquidity to fund its operations through the next twelve months beyond the date of the issuance of these condensed consolidated financial statements. This condition raises substantial doubt about the Company’s ability to continue as a going concern.

Admittedly, the company has ~$63m remaining in a funding agreement with SVB Securities while non-core asset sales are also possible. However, in the current macroeconomic environment and considering the long timeframe that Phase 1 drug development requires, it seems that ATNX does need liquidity that a larger buyer could provide.

Importantly, while I was researching the company, ATNX announced a $30m equity offering (29% of outstanding stock at $0.75/share accompanied by the issuance of 4.7m warrants). The share price has fallen some ~50% following the announcement. However, even after the equity raise, the company will have $43m in cash net of short-term debt – enough for about three quarters assuming the management can continue to execute on its operating expense reduction plan. Given this and the fact that the sale process could likely be extended, the equity raise does not undermine the acquisition rumors. In fact, the recent sell-off creates an attractive entry point for a potential company sale.

Business

ATNX operates three segments: Oncology Innovation Platform, Global Supply Chain Platform and Commercial Platform. The latter two segments are non-core and are discussed in the next section.

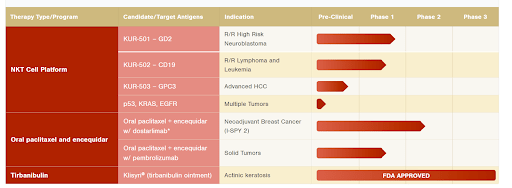

The Oncology Innovation segment performs clinical trials and related activities on the company’s oncological drugs. After the strategic shift, ATNX sold its royalty and milestone revenues on the company’s only FDA-approved drug Tirbanulin. Since then, the company has focused on NKT cell therapy where the two key programs are KUR-501 and KUR-502. While I am not an expert in the field, I see several factors suggesting that the company’s NKT drugs are promising and have a potential of eventually reaching clinical stage:

-

In Q2’22, ATNX appointed Darrel Cohen as its Chief Medical Officer (CMO). Cohen has led several companies towards regulatory approvals for oncological treatments, including Pfizer (crizotinib for lung cancer approved in 2011 and sunitinib for renal cell carcinoma approved in 2017) and EUSA Pharma (dinutuximab beta for neuroblastoma approved in 2021). Given the CMO’s solid track record, the fact that he has recently decided to join ATNX is encouraging.

-

Phase 1 trial results for both KUR-501 and KUR-502 have been positive so far in terms of both safety and efficacy as both drugs successfully completed Phase 1 dose escalation studies. In Mar’22, the FDA approved the company’s IND application to expand ongoing KUR-502 study to multiple sites. Several quotes from the management showing optimism on the recent results – ATNX’s Cell Therapy President during the Q2’22 earnings call (emphasis is author’s):

Data from GINAKIT2 and ANCHOR both support a highly encouraging safety profile without any inclusion reactions, dose-limiting toxicities, neurotoxicity, graft-versus-host disease or Grade 3 or higher side effects related to KUR-501 or KUR-502. So, we now have two Phase 1 clinical trials in which durable objective responses were observed, which is remarkable this early in oncology drug development program for both solid and hematological malignancies.

CMO Cohen (emphasis is author’s):

My interest in Athenex was driven by the novel therapeutic potential of combining the unique intrinsic biology of NKT cells with the tumor antigen targeted approach of chimeric antigen receptors to create a disruptive innovation that could better address the challenges of and enable the transition of immune effector cell therapy to the treatment of patients with advanced solid tumors. This has already been evidenced in early Phase 1 clinical trials, as Dan just summarized, which is both impressive and predictive of a high probability of technical success for both KUR-501 and KUR-502.

-

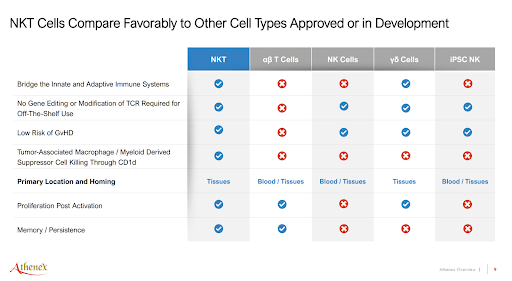

Fundamentally, the NKT cell therapy treatment has several advantages over the currently prevalent therapies, including NK and T cell-based cancer treatments. Without going into too much detail, unlike T cells, NKT treatment does not require genetic manipulation and has a low risk of a serious condition graft versus host disease, suggesting that allogeneic (cells transplanted from donors versus from patient himself) NKT therapy can be produced at much larger scale and lower cost. Moreover, NKT cell-based pharmaceuticals do not target tumor cells but rather activate a patient’s immune function – this means that the treatment would work irrespective of the cancer type.

Athenex Investor Presentation, August 2022

-

Overall, the fact that the company decided to shift its focus solely on these treatments suggests that the management (which has a lot of experience in the field) sees a path for the drugs to be approved.

Further updates on both key NKT treatments are expected in late 2022-early 2023.

Athenex’s Clinical Pipeline (Company’s Website)

Non-Core Assets

In addition to NKT Cell Therapy drugs, the company researches oral paclitaxel whose Phase 2 clinical trial data is expected in the coming months. The management has suggested that the company has an 85% chance of Phase 3 trial success if the results are positive. This drug, however, is considered non-core and the company has openly said it would be willing to monetize it.

The other two segments – Global Supply Chain Platform (Athenex Pharma Solutions or APS) and Commercial Platform (Athenex Pharmaceutical Division or APD) – entail the company’s non-core drug manufacturing, distribution and sales operations. APS supplies sterile injectable drugs while APD focuses on specialty pharmaceuticals. Currently, both segments offer 37 products with 73 SKUs and form the majority of ATNX’s revenues (78% in 2021) with the share expected to increase in 2022 given that the company sold its tirbanulim royalties. What’s important here is that APD and APS businesses have been growing rapidly (26% in 2021). Growth of 20% to 25% is planned for 2022 with 8 additional product launches in 2022 and more than 20 in 2023. ATNX’s COO during the earnings call (emphasis is author’s):

Last quarter, I discussed the new United States partnership with Merck and its injectable company. We have already added the first three products from this collaboration and expect to launch them later in the year. Additionally, we have also identified the next 20 products from this collaboration, which we will be launching in 2023. The majority of these products have markets that currently generate annual sales of approximately $40 million per year, but several have much larger markets with annual sales exceeding $400 million each. We believe that these launches can be a significant growth drive for our business.

Importantly, several of the new launches are expected to be high-margin (emphasis is author’s):

Another important update is that we have signed a partnership with Gland Pharma, a company focused on injection. This deal will allow to significantly improve gross margin on our APS business. We have also licensed another significant product from Miller Pharmaceutical, which is expected to launch in Q4 2022. Our team also has its eye on several other meaningful opportunities to launch products currently on the FDA shortage list later in the year, which have historically been a revenue and margin generate for Athenex.

[…]

In the second half of the year, we are going to launch at least eight additional products. We think some of these products are significant. They are high margin.

To estimate the potential value of the non-core segments, I looked into the non-core transactions the company has already executed:

-

US and European royalty and milestone interests in tirbanibulin sold for $85m in Jun’22.

-

Dunkirk manufacturing facility sold for $40m in Feb’22. The buyer ImmunityBio (IBRX) will continue to manufacture ATNX’s products with a 15% margin over its costs.

-

China’s active pharmaceutical ingredients (API) business sold for $19m in Jul’22.

Dunkirk facility and China API business, which were both a part of the APS business, were sold at comparable levels to their previous book value (mostly PP&E) – Dunkirk manufacturing facility was accounted for at ~$28m in Q4’21 while China API business book value was ~$27m in Q2’22. Admittedly, comparison with the remaining business is somewhat complicated given that the company now outsources manufacturing and has few PP&E assets. That said, the remaining business has a book value of $84m with most of it in accounts receivable ($34m) and inventories ($38m). Taking into account that working capital has been rising only gradually in recent years, I conservatively estimate that non-core assets could be sold for at least $70m. Bear in mind that this liquidation valuation does not consider ~$112m in H1’22 run-rate revenues that APS and APD businesses generate and the expected growth. The business has generally been turning towards profitability as evidenced by recent performance:

|

APS and APD Segments |

2018 |

2019 |

2020 |

Q1’21 |

Q2’21 |

Q3’21 |

Q4’21 |

2021 |

Q1’22 |

Q2’22 |

|

Revenues ($m) |

62 |

84 |

110 |

21 |

22 |

28 |

24 |

95 |

30 |

26 |

|

Net income ($m) |

-27 |

-23 |

-57 |

-19 |

-14 |

-11 |

-30 |

-74 |

0 |

-6 |

Intrinsic value of non-core segments has also been emphasized by the CEO:

The fact that the APD, APS business, they are growing at 20%, 25% and then the first year – first half of the year was performing very well at some color with regard to the fact that there is a lot of intrinsic value.

Given all of this, it seems that the non-core assets could be overlooked here and owning these businesses alone could be lucrative for the potential buyer.

Buyers

The two rumored buyers – Intas Pharmaceuticals and Dr. Reddy’s Laboratories – are large and credible multinational pharmaceutical companies. Intas (which is among 10 largest Indian pharmaceutical companies by revenues) generated $1.8bn in sales as of 2019. The company has numerous cross-border acquisitions in the biopharma space, including:

-

UK’s Actavis in 2016 in a deal valued at £603m.

-

US-based Essential Pharmaceuticals in 2017.

-

Spain’s Combino Pharm in 2015.

Meanwhile, Dr. Reddy’s Laboratories’ revenues stood at $2.83bn in FY2022. Multiple previous acquisitions as well:

-

Germany’s Nimbus Health in 2022.

-

US-based Trigenesis Therapeutics in 2013 in a deal valued at $11m.

-

Netherlands-based OctoPlus in 2012 for €27.4m.

Notably, both companies have bought assets from pharmaceutical giant Teva – Intas acquired its UK and Ireland assets for $764m while Dr Reddy bought Teva’s product portfolio in the US in a $350m deal.

Conclusion

I believe ATNX presents an interesting buying opportunity. The company seems to have a promising drug pipeline while also owning a high-revenue non-core business. In my view, the company could realistically fetch the rumored $200m-$250m price tag which at current prices would translate to a more than 160% upside. Given this, I will open a long position in ATNX.

Great News

Our new premium marketplace service is on its way to launch on September 15! The marketplace will feature only our highest-conviction special situation investment ideas backed by high-quality/original research. More details are coming shortly so stay tuned!

Be the first to comment