DieterMeyrl/E+ via Getty Images

Investment Thesis

Assertio (NASDAQ:ASRT) is a company that has been on an extraordinary journey over the past decade, and the fact that it is still a going concern – with a share price that has risen in value by 98% across the past 12 months – is a testament to the turnaround engineered by the current management team.

Back in March 2021 I covered Assertio’s journey from a company that rejected a buyout offer from Horizon Therapeutics (HZNP) at $33 per share, after acquiring the opioid drug Nucynta, and anticipating blockbuster sales, to one facing multiple lawsuits, escalating debt, and the forced sale of Nucynta for a fraction of the $1.05bn it paid to acquire the drug in 2015.

In 2020 Dan Peisert, who had joined Assertio in 2017 and held a variety of different roles within the company, took over as president and CEO of the company. Faced with a daunting task – at the time I described it as “bankruptcy, sale or success” – Peisert and the rest of Assertio’s management team, who seemed to almost inherit their roles by default after two sets of senior execs came and went (see my former coverage for more detail), have guided Assertio to something resembling a position of strength.

After the company reported its Q322 earnings this week, it feels like a good time to update on progress and assess where Assertio goes from here.

Q3 Results and Assertio Business Overview

Based on the Q223 earnings presentation and earnings call with analysts Assertio seems to have had a strong quarter. Revenues were down slightly sequentially, falling from $35.4m in Q222, to $34.3m, but that reflects a 32% year-on-year uplift.

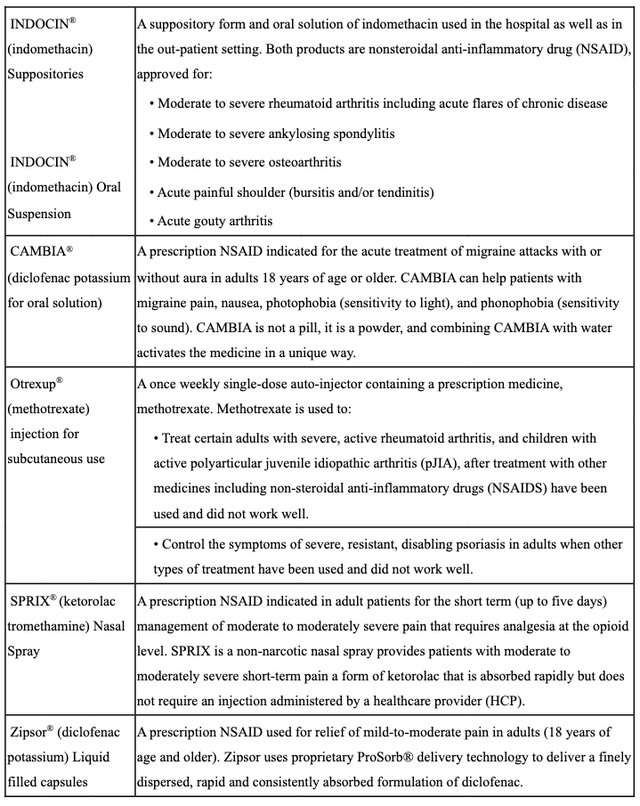

These days Assertio markets and sells a variety of nonsteroidal anti-inflammatory drugs (“NSAID”) as follows.

Assertio product overview (Assertio 10Q Q322)

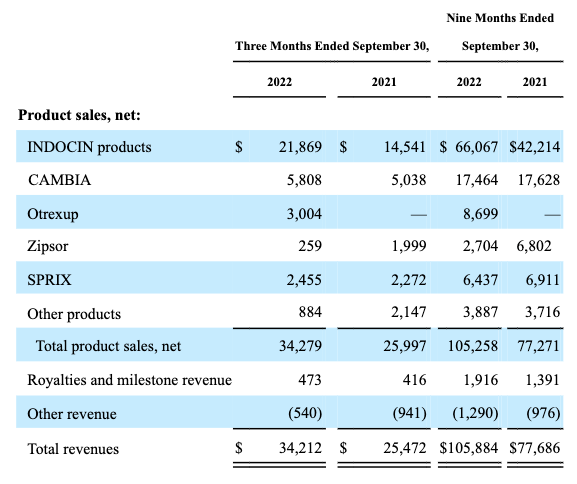

Revenues generated in Q322 and across the first 9m of 2022 are shown below.

Assertio product sales Q322 (Assertio 10Q Q322)

In December 2020, Assertio made >100 staff redundant and let go its entire field sales force, opting to market and sell its products using what Peisert refers to as a “nonpersonal digital model” – i.e. online – which has helped to drastically reduce costs. As we can see above this does not seem to be damaging sales of lead product Indocin, with revenues across the year to date increasing by 56% over the same period last year, to $66m.

Sales of pain relief capsule Zipsor are down substantially year-on-year, although management talks about a “favorable channel mix across the portfolio due to lower volume in unprofitable channels” in its earnings presentation, which we can assume refers to Zipsor and “other products” (which includes OXAYDO – an oral tablet form of the opioid Oxycodone), and newly acquired (in December 2021) Otrexup more than makes up the deficit.

Assertio says it has taken action to withdraw Indocin from the Medicaid drug rebate program, including 340B which allows “covered entities” such as hospitals to acquire certain drugs at significantly reduced prices. Chief Financial Officer Paul Schwichtenberg told analysts that the company was at “penny pricing” with 340B and were losing money even at the revenue line.

Assertio was able to report EBITDA of $21.44m in Q322, up slightly from the figure of $20.9m reported for the same quarter last year. Earnings per share (“EPS”) were $0.22, and $0.85 across the first three quarters. If we assume EPS in the fourth quarter is the average of the first three quarters, Assertio would be looking at FY22 EPS of $1.13, which would translate to a price-to-earnings ratio of ~2.5x, which is very low and suggests the share price has a good chance of growing.

Finally, management raised FY22 guidance from revenues of $129m – $137m, to >$141m, and raised EBITDA guidance from $73 – $79m, to >$86m. The company’s forward price-to-sales ratio is therefore <1x at current market cap valuation of $137, another indication that the share price valuation could be due an upgrade.

Assertio – The Wider Picture

During the Q322 earnings call CEO Peisert updated on the company’s progress towards five goals highlighted at the beginning of 2022. Retaining employees and attracting talent, proving the efficacy of the commercial model, reduce dependence on Indocin revenues, execution of a life-cycle management opportunity for Indocin, and improving balance sheet / reducing cost of capital.

Assertio has been broadly successful with each. The business has added eight new employees, reflecting growth of 42%. The transition of Otrexup to the digital only model appears to have been successful, whilst reducing dependence on Indocin revenues somewhat, and Assertio plans to file an Investigational New Drug application with the FDA, and initiate a clinical program aimed at expanding the drug’s label.

Although Assertio does not seem to have disclosed much detail about precisely what indications these trials will target, this may be an attempt to establish patent protection for the drug, which currently has none and therefore could face competition from rival developers. Assertio’s 10Q mentions a “503B compounder” i.e. manufacturing pharmacies which are permitted to produce batches of medications without patient-specific prescriptions, which Assertio believes is acting unlawfully.

A label expansion and accompanying patent protection may allow Assertio to grow revenues of Indocin, or sustain them at current levels if there’s increased competition in existing markets going forward, but without further clarity, this appears to be one of the most significant risk facing Assertio – falling revenues of its lead asset (by some distance).

Regarding the fifth goal in 2022, Assertio completed a $70m convertible note offering in August this year, which depressed its share price, but enabled management to redeem existing secured notes for $59m, which were paying 13% interest. The new notes convert at a price of ~$4.1, and CFO Schwichtenberg told analysts:

The new convertible notes provide additional benefit by cutting our interest rate in half, carrying no amortization and eliminating any near-term maturities

After its one-to-four reverse stock split completed last May, Assertio is no longer struggling to maintain a share price >$1, and putting itself in danger of delisting, and the convertible notes appear to be another step in the right direction, easing the debt burden and making Assertio’s long-term survival all the more likely. To have also successfully completed a $44m deal to acquire Antares Pharma and Otrexup speaks to the capabilities of the current management team, which are promising further acquisitions.

Assertio paid $9m upfront to acquire Sympazan, indicated for the adjunctive treatment of seizures associated with Lennox‐Gastaut Syndrome (LGS) in patients aged two years of age or older, plus another $6m should Aquestive successfully win its case to have the drug’s patent protection extended to 2039. CEO was bullish on the prospect of further M&A deals being made on the Q322 earnings call, telling analysts:

Like the prepared comments, we still see a very active BD pipeline. And as I speak, we’re – we’ve got the capabilities to evaluate multiple at the same time and we are evaluating multiple currently. So we feel very confident that we’re going to be able to meet our goals and hopefully exceed our goals like we always try to do.

Assertio’s cash position is currently $65m, meaning there is money to spend, with net debt now standing at just $5.2m. The company is still setting aside cash to deal with legal matters – the current legal contingency accrual is $3.4m according to the latest 10Q submission – and continues to fight several court cases, including against health insurance giant Humana (HUM) in relation to its marketing of a former diabetes drug Glumetza, with a trial set for 2023, and state opioid litigation and insurance litigation in relation to Nucynta.

Conclusion – The Scale Down Worked – Now Assertio Must Scale Up To Reward Investors – Easier Said Than Done

To summarize Assertio’s Q322 results, we can say that progress on almost all fronts has been fairly impressive across the year to date. Revenues are growing, and despite a slight year-on-decrease in Q322, from $0.28 per share to $0.22 per share, profitability grew across the 9m period from $0.27, to $0.85.

The switch to an online sales model appears to be working, and the reduction in headcount has slashed costs, while the debt restructuring appears to have been successful also, with the issue of the convertible bonds replacing debt paying an interest rate of 13%.

Naturally, as a result of the sale of Nucynta and other assets, and the reduction in workforce, Assertio’s revenues – which were $456m in 2016 – have fallen substantially, although if 2022 guidance is met, they will increase by 26% year-on-year. The old business model was clearly unsustainable, but what is the outlook for the new one long term?

The lack of patent protection for Indocin is a potential red flag, given Assertio’s reliance on the drug to generate >60% of its revenues, and smaller M&A deals such as that for Sympazan are not going to plus that hole given the drug is likely to generate just $4-$5m per annum in adjusted EBITDA according to management, and Otrexup not much more than $10m per annum in revenues it seems.

Having effectively shrunk Assertio to avoid going out of business and correct prior management’s mistakes, the new management team now needs to show that it can grow a smaller business into a larger one and reward shareholders. After the reverse stock split in May last year, Assertio’s share price fell by >60%, but the subsequent increase in value has been impressive, notwithstanding the declines after the convertible notes were issued.

In terms of the right investment play with regard to Assertio, I would say shares remain a hold given the uncertainty around future Indocin sales – whilst Zipsor and Cambia have also recently lost their patent exclusivity and are subject to generic competition.

In a year’s time, if management has been able to go out and do some M&A deals, and any drugs acquired can be successfully adapted to a nonpersonal, digital sales strategy, it will be a good sign that the company has a business model that can work, but the deals need to larger than those we have seen to date, in my view, or the business will start to shrink, along with the share price.

I personally like Assertio’s decision to enter clinical trials with Indocin – an area in which management does not have much experience – since it could preserve Indocin’s large revenue contribution. I would also expect outstanding legal matters to be resolved without crippling the company financially, although any looking to buy Assertio’s shares ought to be aware of this risk.

Given the low PE and P/S ratios, there’s a good chance that Assertio shares could grow by another 100% over the next 12 months, but the risk of setbacks that threaten the company’s new business model – most notably in relation to Indocin – makes me think I’d rather wait to see FY23 guidance before making a decision on buying Assertio shares.

Guidance may not arrive until March next year, when Q4 results are announced. For me, Assertio is not quite out of the intensive care unit yet but management continues to impress.

They may need to land a few more M&A deals and reduce the reliance on revenues of legacy products, however, before they can look to the future with confidence. It remains a waiting game in my view, although some risk-on investors will doubtless be attracted by the likely volatility in the share price as management attempts to prove the longer-term viability of the business model.

Be the first to comment