vdvornyk/iStock via Getty Images

Assertio (NASDAQ:ASRT), formerly Depomed, is a small ($119 million market cap) specialty pharmaceutical company that currently has seven FDA-approved products. For the second quarter, the company beat both the Street’s revenue and earnings per share (or EPS) estimates. On August 25, the company issued $70 million of convertible senior notes due 2027 to redeem their earlier higher-interest notes, but the market responded negatively. However, price/earnings (or PE) ratio are now much lower (better) compared to industry peers. These factors make ASRT a Strong Buy.

Product Line:

INDOCIN accounted for 55% of Assertio’s revenue in 2021, while CAMBIA, Zipsor and SPRIX brought in 23%, 9% and 8%, respectively. There is no patent protection for INDOCIN (indomethacin) oral suspension (average wholesale price per Medi-Span of ~$2,500 per 8oz bottle) or suppositories (~$12,500 per box of 30), but so far there is no generic competition for these gout treatments. For the diclofenac products, generic versions of Zipsor (~$2,200 per bottle of 120) exist at ~25% discount, while generic CAMBIA (~$1,000 per box of 9 packets) will be on the market next year. Otrexup ($825 per box of 4) competes with other branded methotrexate products, including other injection and auto-injector products. OXAYDO is no longer manufactured and Assertio will sell through the remaining inventory.

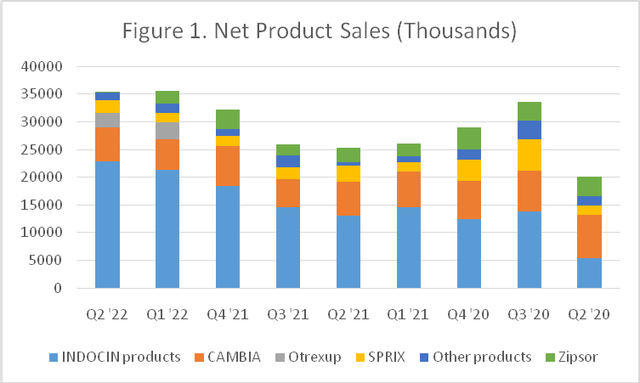

The three large national drug wholesale distributors-Cardinal Health (CAH), McKesson (MCK), and AmerisourceBergen (ABC)-represent approximately 85% of Assertio’s product sales revenues (see Table 1 and Figure 1), as well as 95% of accounts receivable. SPRIX DIRECT is the exclusively source for the branded ketorolac nasal spray and the generic is very difficult to find. Assertio receives royalties from Miravo Pharmaceuticals on net sales of CAMBIA in Canada. Other revenue consists of sales adjustments for previously divested products such as Gralise, Nucynta and Lazanda.

Table 1. Quarterly Revenues (in thousands in US$)

|

Q4 ’21 |

Q1 ’21 |

Q4 ’20 |

Q3 ’20 |

|||||

|

INDOCIN products |

22,841 |

21,357 |

18,344 |

14,541 |

13,075 |

14,597 |

12,477 |

13,773 |

|

CAMBIA |

6,183 |

5,473 |

7,344 |

5,038 |

6,128 |

6,462 |

6,847 |

7,449 |

|

Otrexup |

2,616 |

3,078 |

||||||

|

SPRIX |

2,216 |

1,766 |

1,765 |

2,272 |

2,942 |

1,697 |

3,833 |

5,642 |

|

Other products |

1,358 |

1,644 |

1,316 |

2,147 |

518 |

1,049 |

1,827 |

3,405 |

|

Zipsor |

216 |

2,228 |

3,383 |

1,999 |

2,581 |

2,222 |

4,025 |

3,395 |

|

Total product sales, net |

35,214 |

33,318 |

28,769 |

23,998 |

22,663 |

23,805 |

24,984 |

30,269 |

|

Royalties and milestone revenue |

451 |

992 |

1,187 |

416 |

542 |

434 |

361 |

299 |

|

Other revenue |

-750 |

-9 |

-941 |

-413 |

378 |

806 |

602 |

|

|

Total revenues |

35,131 |

36,538 |

33,330 |

25,472 |

25,373 |

26,839 |

30,176 |

34,565 |

Net product sales (in $thousands) (Assertio)

Debt:

The Senior Convertible Notes issued by Assertio was for $70 million, which can clear the $59 million of 13% Senior Secured Notes due 2024. The current Notes pay 6.5% (or $4.55 million in aggregate interest per year to the purchasers) and converts into 244.2003 shares of common stock per $1,000 principal at $4.09 per share. If fully converted, 17,094,021 shares represent about 26.5% dilution. Accordingly, the market priced this in by driving the stock price down by 25% ($3.64 to $2.74) on August 23. Part of the price action could be attributed to some institutional purchasers employing convertible hedges. If a $1 million note buyer who would be getting $65k interest also shorted 244k shares at $2.66, this $650k short position adjusts the cost basis to $350k, thereby nearly tripling the yield from 6.5% to 18.5%. Of course, if the stock recovers, the institution will need to close their short.

Outlook:

Continues to be top-heavy, as the company still leaves most heavily on Indocin and CAMBIA. As Zipsor dwindled away, Otrexup has taken its #3 revenue spot in the lineup. Normally it takes a couple of months for an authorized generic to become available at the national wholesalers, and another couple to land on health plan formularies, so it may be a year (Q2 2023) before the impact to CAMBIA becomes pronounced. Thus, CAMBIA will still bring in $5 million per quarter and makes Assertio’s updated guidance calls for net product sales between $129 million to $137 million a conservative estimate, especially given they already banked $71 million in the first half.

CEO Daniel Peisert expects INDOCIN sales to be a little bit lower in Q3 before recovering in Q4. However, its Q3/Q2 sales ratio had always been positive in the 3 years since they took over; it seems they plan to sell fewer units to the wholesalers. Scarcity usually precedes a price increase. Nonetheless, FY 2022 should stay ahead of the Street’s expectation of $135.86 million sales.

Costs and expenses have been flat the past 6 quarters and should remain at the $25 million level for Q3 and Q4. With quarterly revenues most likely to exceed $30 million, Assertio should have no trouble notching its sixth and seventh consecutive quarters of positive cash flows. If they somehow finish at the lower end of guidance, they should still end 2022 with more than $60 million cash.

Valuation:

According to SA, the current P/E (FWD) (last close price of $2.51 from Friday divided by the next fiscal year consensus GAAP EPS estimate (FY1)) is 4.94, compared to the much higher 14.68 average for the Zacks Medical – Drugs Industry, which is comprised of 197 specialty pharmaceutical and biopharmaceutical companies. Similarly, the trailing twelve month (TTM) P/E (last close divided by the sum of the last 4 quarter’s GAAP diluted EPS) is 4.6. This means ASRT is trading much lower based on the prices the market is willing to pay for companies in the same industry. The company’s PEG (TTM) ratio (P/E ratio divided by its growth rate over the past 12 months) is 0.47 compared to 1.60 for the Medical – Drugs industry. So ASRT is undervalued to its growth rate and investors are paying less than one third for each unit of earnings growth compared to others in the industry. At the very least, investors were comfortable with a P/E of 8x before the note restructuring, which wasn’t a dilution event so the price (and P/E) drop was unwarranted.

NES Therapeutic Partnership:

Due to delays and uncertainty surrounding it, is a 2018 agreement with NES Therapeutic isn’t part of most people’s valuation of the company. Assertio purchased a Convertible Secured Promissory Note (NES Note) for $3 million which accrues 10% annual interest, with both the principal and accrued interest maturing on August 2, 2024. The NES Note is convertible into a 12% equity stake based on 1) the Food and Drug Administration (FDA) acceptance of the New Drug Application (or NDA) for NES-001 (pleconaril); 2) initiation of any required clinical trials by NES; or 3) a qualified financing event by NES. If the NDA is approved, Assertio also gains 12% of a resulting priority review voucher.

Pleconaril is the first of a new class of drugs known as capsid inhibitors. These investigational drugs prevent viral attachment and binding onto target host cell receptors, as well as remove the coating of viral nucleic acid, which inhibits viral replication. In 2015, the National Institute of Allergy and Infectious Disease Collaborative Antiviral Study Group of the US National Institutes of Health published results on the largest pleconaril trial thus far. The randomized, double-blind, placebo-controlled trial evaluated a 7 day regimen of pleconaril compared to placebo in 61 infants with presumed enterovirus (or EV) sepsis (hepatitis, coagulopathy, and/or myocarditis) with onset prior to 15 days of life (43 had confirmed EV infection). The primary endpoint was the percentage of patients with a positive viral culture from the oropharynx 5 days after initiating study drug. Because both groups had 100% clear cultures at 5 days, the trial was officially a wash. However, in the intent-to-treat population, mortality was lower in the pleconaril group (23% versus 44% mortality; P = 0.02). Pleconaril patients also became culture negative faster than the placebo group (median 4 vs 7 days, P = 0.08), and fewer subjects in the pleconaril group remained polymerase chain reaction (or PCR)-positive from the oropharynx (23% vs 58%, P = 0.02). There are several other trials that may indicate pleconaril efficacy against EV, but they are smaller and older.

Risks & Conclusion:

INDOCIN generics could appear at any moment, although the fact that none have may be indicative of some difficulty in manufacturing suppositories, and there is likely little profit in going against liquid ibuprofen.

Longer-term (> 1 year) investors might be pricing in the loss of CAMBIA revenue. However, Assertio is sitting on a lot of cash and say they are on constant lookout for acquiring rights to profitable products.

As far as NES-001, it is unlikely for the FDA to approve an NDA without a confirmatory trial, and Assertio had been waiting for hard updates from NES since Q1. They also posted a $1.9 million expected credit loss on the NES Note since the end of last year, signifying a greater than 50:50 chance that NES defaults. Still, neonatal EV infections have high mortality and there are no commercially available antiviral therapies, so there is hope for a priority review of some sort. Nevertheless, even if Assertio’s investment sours, it doesn’t detract from the bull thesis that this stock is severely undervalued. Even the initial conversion price of $4.09 (and P/E of 8x) represents a 63% appreciation from last week’s closing price.

Be the first to comment