Mlenny/E+ via Getty Images

Investment Thesis

Given ASML Holding’s (NASDAQ:ASML) exemplary FQ2’22 earnings call, it is no wonder that the stock had recovered from its previous malaise and rallied swiftly. In addition, due to its record high backlogs worth approximately $38B, we expect the company to continue outperforming ahead, especially given the sustained robust demand in the IoT, data center, automotive, and green energy segments.

Assuming no recession ahead, ASML would easily achieve the high end of its $35B annual revenue by FY2025, based on its Investor Day presentation in September 2021. We will also be eagerly waiting for new updates in November 2022. Especially its ambitious capacity targets by 2025, indicating sustained hyper-demand ahead from the global foundries. Thereby, triggering a bull run for the ASML stock ahead.

ASML Proved Why The Semiconductor Demand Remains Strong

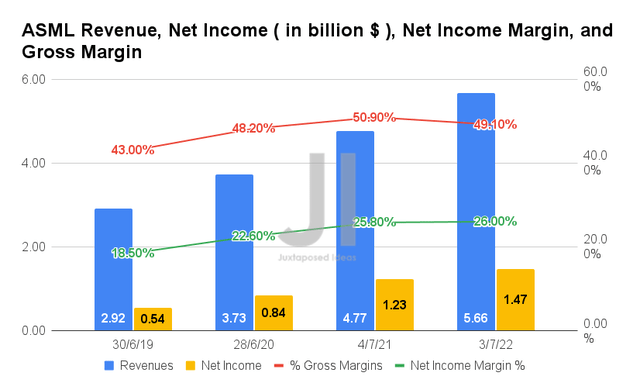

In FQ2’22, ASML reported impressive revenues of $5.66B and gross margins of 49.1%, representing YoY growth of 18.6% though a moderation of 1.8 percentage points, respectively, due to the rising inflation. In the meantime, the company continues to report improved net incomes of $1.47B and net income margins of 26% in the latest quarter, indicating an increase of 19.5% and 0.2 percentage points YoY, respectively.

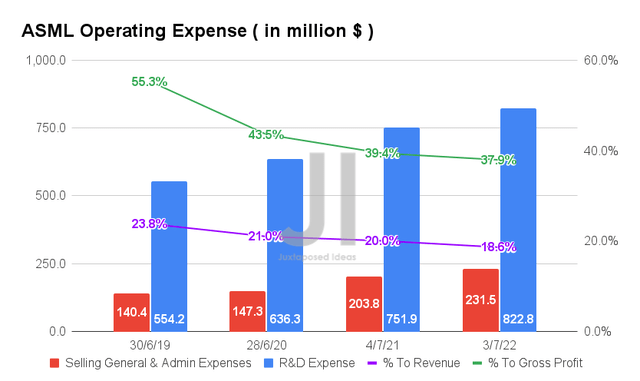

From the chart above, it is evident that ASML’s operating expenses have been growing moderately to $1.04B by FQ2’22, representing an increase of 8.9% YoY. However, the ratio to its growing sales has also been declining thus far, at 18.6% of its revenues and 37.9% of its gross margins in FQ2’22, compared to 23.8% and 55.3% from FQ2’19 levels, respectively. Therefore, triggering ASML’s improved profitability despite the global supply chain issues and rising inflation.

In addition, ASML continues to invest heavily in R&D, accounting for 14.4% of its revenue in FQ2’22. Thereby, demonstrating the company’s determination to remain at the top of the game for many years to come.

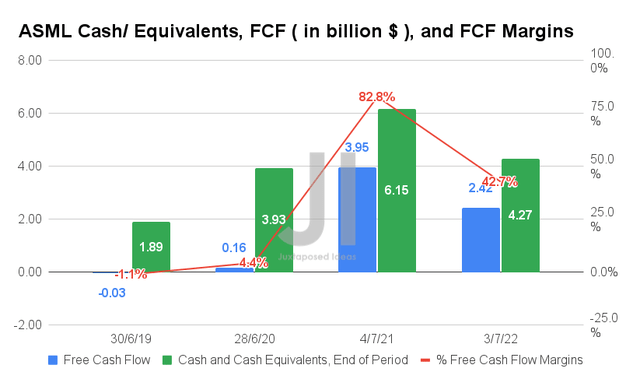

The improved profitability has directly boosted ASML’s Free Cash Flow (FCF) generation thus far, at an FCF of $2.42B and an FCF margin of 42.7% in FQ2’22. After adjusting for the changes for other net operating assets accordingly, ASML would have reported an excellent adj. increase of 12% in FCF generation for the latest quarter, instead of the perceived YoY decline of 38.7%.

The Growth In ASML’s Dividend Payouts & Yields

We are also not concerned about ASML’s declining cash and equivalents of $4.27B in FQ2’22, since most of these are attributed to the $9.21B worth of share repurchase programs and $2.35B worth of dividend payouts in the last twelve months (LTM). Thereby, returning incredible value to its existing shareholders indeed.

ASML Will Continue Growing Its Profitability And Relevance Through FY2025

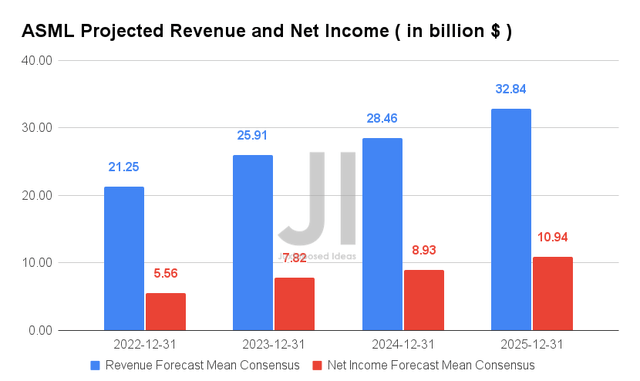

Over the next four years, ASML is expected to report excellent revenue and net income growth at a CAGR of 11.59% and 13.08%, respectively. These numbers represent a notable moderation of -5.2% from previous estimates in May 2022. Nonetheless, it is apparent that consensus estimates remain optimistic about ASML’s growth ahead, given the sustained improvement in its net income margins of 33.3% by FY2025, compared to 21.9% in FY2019 and 31.6% in FY2021.

Some investors may be alarmed by ASML’s FY2022 revenues of $21.25B and net incomes of $5.56B, but these are the direct result of its fast shipment strategies, which delayed the realization of approximately $2.85B revenues until FY2023. Therefore, bringing its YoY revenue growth to an excellent adj. rate of 13.7%, instead of the perceived in line. In the meantime, the company provided excellent revenue guidance of up to $6.3B for FQ3’22, with $1.2B deferred to FQ4’22. This would represent an exceptional YoY growth of 20.2% then.

In the meantime, ASML continues to grow its net bookings to a record quarterly sum of approximately $8.65B, representing YoY growth of 2.4%. Despite the perceived slowing growth of the semiconductor market in 2022, it is apparent that semiconductor chips continue to be in high demand, since the litho tool utilizations remain at elevated levels. Thereby, pointing to the durability of consumer demand in the long-term, despite the fears of an economic slowdown. With a bull run market, we should expect to see ASML live long and prosper moving forward, given the massive projected growth in the global semiconductor market from $527.8B in 2021 to $1.38T in 2029 at a CAGR of 12.2%.

In the meantime, we encourage you to read our previous article on ASML, which would help you better understand its position and market opportunities.

So, Is ASML Stock A Buy, Sell, or Hold?

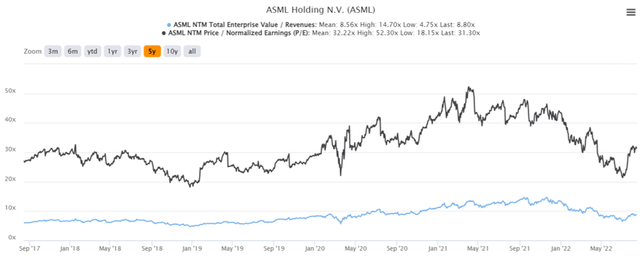

ASML 5Y EV/Revenue and P/E Valuations

ASML is currently trading at an EV/NTM Revenue of 8.8x and NTM P/E of 31.30x, slightly higher than its 5Y EV/Revenue mean of 8.56x though slightly lower than its 5Y P/E mean of 32.22x, respectively. The stock is also trading at $566.68, down 36.7% from its 52 weeks high of $895.93, though at a premium of 37.3% from its 52 weeks low of $412.67.

ASML 5Y Stock Price

It is apparent from the market movement in the past few weeks that ASML had recovered from the November 2021 malaise affecting the entire semiconductor market. Despite their reduced guidance ahead, even Nvidia’s (NVDA) and Advanced Micro Devices’ (AMD) stock performances have recovered in the past three weeks, due to the favorable effect of the Chips Act lifting most, if not all boats.

Therefore, we reckon that the ASML stock is forming a relatively sustainable support level here for long-term investing, giving interested investors an attractive entry point to this excellent stock. That is if one had missed the recent bottom of $400s in July 2022, which we are unlikely to see in the short-term, barring any detrimental market events.

As a result, we rate ASML stock as a Buy.

Be the first to comment