Michael Vi

Thesis

In August, I highlighted ASML Holding N.V. (NASDAQ:ASML) stock as a ‘Sell’ idea, arguing that the stock is overvalued with 40% downside. Since my article, ASML stock has lost about 20%, but the valuation is clearly still above my $315/share price target.

Although I continue to believe that ASML stock is priced at an excessively rich valuation, I am slowly turning more positive on the Dutch-based semiconductor equipment maker. ASML’s Q3 results have clearly highlighted that demand for semiconductor equipment remains strong – despite macroeconomic challenges. Moreover, I would like to point out that the latest negativity surrounding U.S.-China tensions, that prohibited ASML from exporting certain U.S.-made technology to Chinese customers – is arguably less severe than what markets have feared.

Following an improved valuation since my coverage initiation, paired with a strong Q3 report, I upgrade ASML stock to “Hold.”

ASML’s Q3 Results

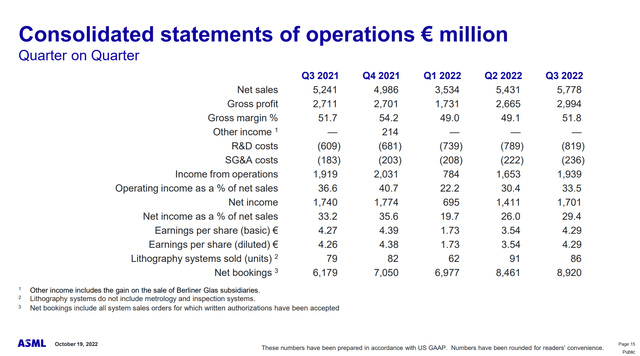

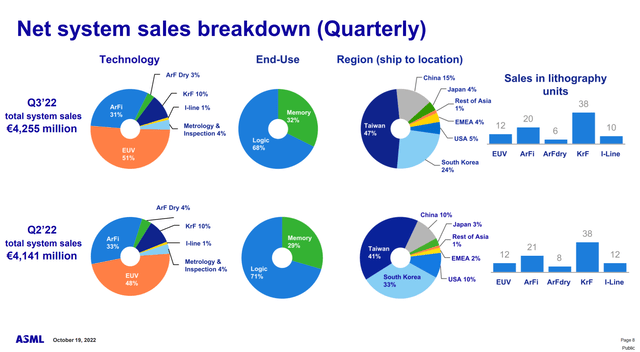

During the period from July to end of September, ASML managed to generate revenues of about €5.8 billion – of which €4.3 billion are attributable to new systems sales and €1.5 billion attributable to “installed base management” sales. Over the period, ASML managed to claim a gross margin of 51.8%, an operating margin of 33.5%, and a net-income margin of 29.4% (indicating that margins clearly remain above the industry). Earnings per share came in at €4.29, which compares to €4.27 for the same period one year prior.

Reflecting on strong results, despite multifaceted macro-economic challenges, management commented, that (emphasis added):

[G]lobal megatrends in the electronics industry, supported by a highly profitable and fiercely innovative ecosystem, are expected to continue to fuel growth across the semiconductor market… driving demand for our products and services.

Outlook Remains Strong

ASML’s Q3 was strong, but Q4 will likely be even stronger – as the company is working to satisfy a €33 billion order backlog that stretches into 2024.

Europe’s largest technology company expects that Q4 sales will fall somewhere between €6.1 billion and €6.6 billion, which compares to €4.98 billion for the same period one year prior. For the full year 2022, ASML now expects 21.1 billion of sales and a gross margin around 50%.

After an (expected) record year 2022, management has reiterated confidence that by 2025 ASML may claim annual revenues as high as €30 billion, and a gross margin between about 54% and 56%.

Shareholder Distributions Continue To Increase

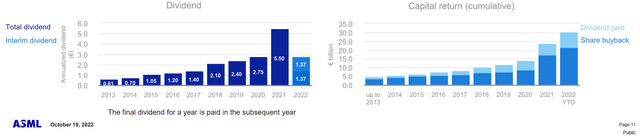

ASML shareholders are arguably rewarded in line with the company’s performance – steadily increasing at a pace similar to the business expansion.

In Q3, ASML paid to investors dividends equal to €1.37 per ordinary share and has highlighted that an additional €1.37 per ordinary share will be distributed on November 14 2022.

Adding to the dividends, ASML rewarded investors also with share buybacks. In Q3, the company retired about €1.0 billion of equity, equal to approximately 2.1 million shares. ASML has now completed the current share buyback program, but has highlighted to investors that the company will consider “our long-term business plan, including any new share buyback program” as soon as on November 11, 2022, when the company’s shareholders convene for the annual Investor Day.

China Restrictions Less Severe Than Feared

In the context of escalating tensions in the China-U.S. technology war, ASML was caught in the crossfire. Less than a week ago, investors were spooked by the news that ASML reportedly told employees to:

refrain — either directly, or indirectly — from servicing, shipping or providing support to any customers in China until further notice…

But the impact is arguable less restrictive than what investors originally feared. ASML’s CFO Roger Dassen affirmed:

[T]he direct implication for us is fairly limited… First off, as you know we are a European company. So there is not a lot of US technology in our tools.

Moreover, investors should consider that China currently accounts for less than 15% of the group’s revenues. So, even in a worst case scenario, the impact would be manageable.

But this doesn’t mean that China-U.S. tensions may be ignored – especially not if the topic of argument relates to Taiwan (as it currently does). As of Q3 2022, Taiwan accounts for 47% of ASML’s revenues.

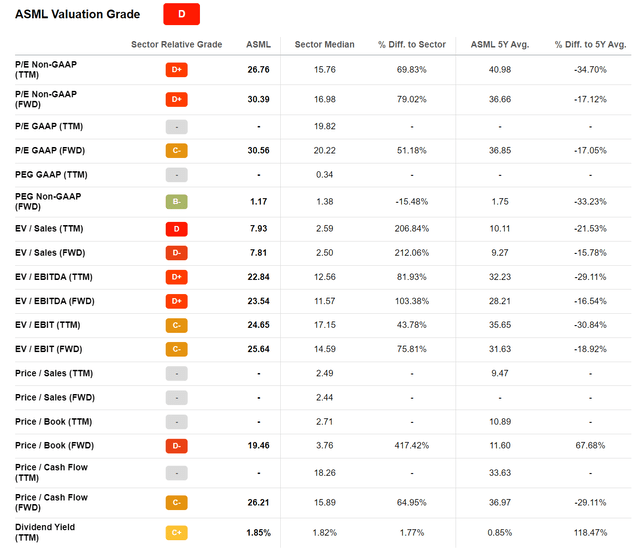

Still An Expensive Stock

ASML’s valuation has compressed since I have initiated coverage. However, the stock is still very expensive. For reference, ASML is now valued at a one year forward EV/Sales of x7.8 and an EV/EBIT of x25.6. These ratios imply a premium to peers of 212% and 76% respectively.

Conclusion

Strong Q3 results from ASML – despite economic headwinds and a broadly slowing demand cycle for semiconductors – highlights once again the business quality of the most valuable European technology company. From a management and finance perspective, there is little that an analyst can challenge. But the problem remains with regards to valuation – which in my opinion demands an excessive premium.

As a function of valuation, I do not think the opportunity of investing in ASML is yet attractive. But most certainly, shorting the stock is equally unattractive. I upgrade my recommendation to “Hold.”

Be the first to comment