Michael Vi

What is so Special About ASML?

ASML Holding N.V. (NASDAQ:ASML) is the gold standard when it comes to semiconductor lithography manufacturing equipment.

Lithography uses light projection to shrink patterns onto photo sensitive wafers, which are then stacked layer by layer to create an integrated circuit. Lithography is the key to creating more powerful, faster and energy efficient chips.

ASML is the only manufacturer making EUV (Extreme Ultraviolet) machines. Much of the technology innovation or advances in chip making would not be possible without EUVs. For example, over the last decade, semiconductors have moved from a 17 nm (NanoMeter) standard to a 3 nm standard by what ASML calls affordable scaling, the ability to make transistors more energy efficient, by packing them on smaller wafers. EUV machines use a special light source with a wavelength of only 13.5 nm, while DUV (Deep Ultraviolet) machines use upwards of 193 nm, which is a wavelength of almost 15 times.

Since chips can have 40 to over 150 layers, EUVs are vital for the complex 150 layers, while the industry’s workhorses DUVs take care of the less critical layers with larger features. The key to success is affordable scaling, the ability to make transistors more energy efficient.

EUV strengths are well detailed in two excellent articles by Growth and Value Trading and Gregory Shiskov.

To summarize:

- ASML has spent more than €6Bn in R&D and close to 2 decades building EUV.

- Amongst its competitors, Canon never caught up and according to Tech Monitor, Nikon chose the wrong process.

- The complexity of more than 100,000 components and time to build the machines makes it difficult for new entrants to penetrate this market — customers can’t wait.

- ASML is fully vertically integrated — making it difficult for competitors to get access to critical components and technology to create competing machines.

ASML’s Premium is Justified

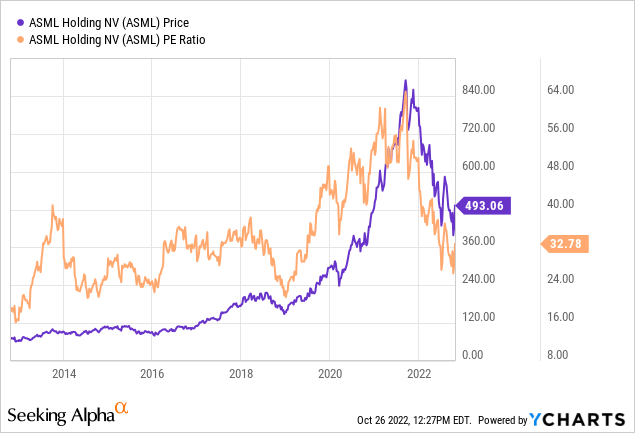

ASML 10 Year Stock Price and PE (Seeking Alpha, Y Charts)

I analyzed ASML’s 10-year prices and forward P/E ratios – is the premium justified, why are we paying 27X earnings and 8X sales? Between 2014 and 2020, P/E’s ranged between 24 and 40, before rising on stimulus-induced zero interest rates from April 2020 to a peak of 58 in late 2021, when the S&P itself peaked at 4,818 — more than 21X forward earnings.

For a company of ASML’s caliber with an almost monopolistic position in a vital and growing industry, the premiums are more than justified and not out of whack with its historical valuation of 24-40X earnings. Looking at ASML’s 10 year chart, we’re getting a good deal. Of course, the 58X earnings is way out of whack, but a P/E of 27 is a very attractive entry point for ASML given its expected growth of over 25% in the next 3 years. As and when interest rates stabilize, multiples will also move in step.

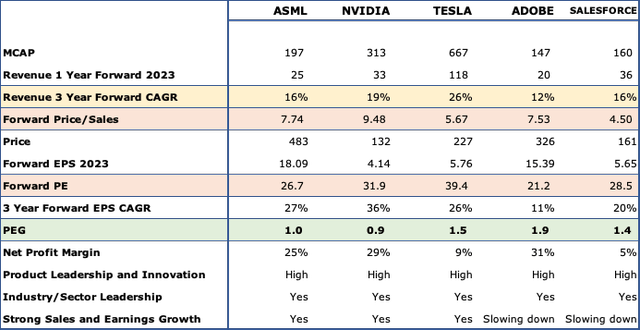

I also compared ASML with a handful of other innovative, fast-growing leaders in their respective industries to see how it stacks up and emphasize that quality stocks usually get a premium.

ASML Valuation (Seeking Alpha, ASML, Fountainhead)

ASML is cheaper than Nvidia (NVDA) another innovative leader whose strengths are highlighted by Seeking Alpha contributors including Rethink Technology, Julian Lin, and myself. Nvidia has several moats and produces best in its class, top of the line products – it is way ahead of Advanced Micro Devices (AMD) and Intel (INTC) and is also slated to grow rapidly over the next 3-5 years. ASML has a cheaper P/E of 27 to Nvidia’s 32, a cheaper P/S ratio at 7.8 compared to 9.5, but a slightly higher PEG at 0.98 to 0.85 – mostly because Nvidia is coming off a really disastrous year and is going to grow much faster on a smaller base.

I also added three non-industry players: Tesla (TSLA), Adobe, Inc (ADBE), and Salesforce Inc. (CRM). These three companies made The Wall Street Journal’s innovation list, have had huge sales and earnings growth in the past 5 years, and are still expected to grow in the next 5. This is to emphasize that industry leaders rarely come cheap.

ASML stands shoulder to shoulder with the mighty Tesla, beating it handily in the PEG sweepstakes at 1 to 1.49 (that’s also because Tesla simply takes net profits of only 10% of revenues as compared to 25% for ASML). However, ASML loses out on a P/S basis 7.32 to 5.71, because of Tesla’s amazing revenue growth, which dwarfs that of much-smaller ASML.

Adobe and Salesforce have both lost some luster, with future growth getting slower, but they’re still industry leaders and innovative.

ASML trounces both on earnings multiples, its PEG is 0.98 compared to 1.84 and 1.45 to Adobe and Salesforce. On a sales multiple, ASML is the same as ADOBE, which shows that ASML is a lot cheaper than the slower growing ADBE. Importantly, the point is to demonstrate that other industry leaders also command a premium and ASML should too.

ASML’s Strengths

ASML’s Q3-2022 came in better than expected.

In his Q3 statement to shareholders ASML’s CEO, Peter Wennink was emphatic that macroeconomic factors are not going to further impact growth.

“Our third-quarter net sales came in at €5.8 billion with a gross margin of 51.8% – above our guidance. There is uncertainty in the market due to a number of global macro-economic concerns including inflation, consumer confidence and the risk of a recession. While we are starting to see diverging demand dynamics per market segment, the overall demand for our systems continues to be strong. We are continuing to assess and follow the new US export control regulations. Based on our initial assessment, the new restrictions do not amend the rules governing lithography equipment shipped by ASML out of the Netherlands and we expect the direct impact on ASML’s overall 2023 shipment plan to be limited.”

Record Bookings – At the end of Q3-2022, ASML had record bookings of €8.9Bn, a massive jump over €6.2Bn in Q3-2021.

EUV Sales Dominate – 67% of its sales are the more expensive EUV (Extreme Ultraviolet) machines as compared to 33% of DUV (Deep Ultraviolet). EUV’s have also grown faster in the past five years and should continue to lead growth for the next decade.

Recurring Revenues – About 28% of ASML’s revenues come from installed base management, which is recurring, sustainable and carries better margins.

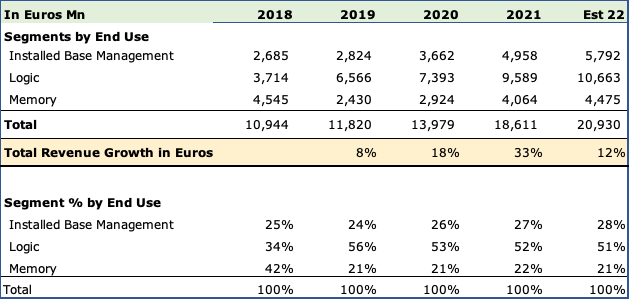

Segment Revenues

ASML segment revenues (ASML, Fountainhead)

ASML’s end use is about 70% towards logic and 30% to memory.

Constant Currency Growth – Due to COVID, ASML grew revenues at 18% and 33% in 2020 and 2021, faster than its long term average of 15%. Demand for capital equipment, like for most sectors of technology and semiconductors got pulled forward as foundries, IDM’s and chip designers rushed forward to meet demand and produce extra to surmount supply chain disruptions. For 2022, ASML should grow revenues by 12% in Euros to 21Bn. However, converting into U.S. Dollars at $21.8Bn, ASML suffers disproportionately, eking out a meager 3% gain, compared to $21.12Bn in sales last year. If you assumed Dollar/Euro parity, at $20.9Bn, ASML would look like it lost revenue! In constant currency, ASML is clearly showing no signs of demand fatigue or growth slowdown, and has and should continue to navigate in a much tougher environment. Furthermore, it should also get some tailwinds if interest rates stop rising and the dollar drops against the Euro.

Challenges

Slowdown in semiconductor demand

Q3-22 earnings so far don’t augur too well for ASML and pose challenges.

Three big end-users of semiconductors are hurting. Microsoft (MSFT) had its slowest revenue growth in its cloud business, growing only 35% down from its usual mid to high forties growth and warned of sluggish growth in Q4 as well. Alphabet (GOOG, GOOGL) grew its cloud business only 37%, also slower compared to previous years. Meta Platforms, Inc. (META) Q3 quarterly revenue came in 4% lower, the second such quarterly decline in a row. While Meta is not in data center or cloud, the metaverse initiative, which was supposed to be a big user of semis with supposed outlays of $15Bn, is off to a very weak start and is going to face a slowdown with such weak company-wide results.

Within the semi space, there have been several warnings, and I’ll highlight a few. Both are ASML’s clients. South Korea’s SK Hynix, Inc. expects to reduce Capex by 50% in 2023. In its press release, it cited “sluggish demand for DRAM and NAND products amid a worsening macroeconomic environment worldwide. The deterioration occurred as the shipments of PCs and smartphone manufacturers, which are major buyers of memory chips, have decreased.” Worse, it expects to close down a plant. Taiwan Semiconductor (TSM), the world’s largest pure play foundry, guided for a lower Capex of $36Bn for 2022, lower than earlier estimates of $40 to $44Bn.

Another major semi manufacturer Texas Instruments (TXN) guided to Q4-22 revenues of $4.4B to $4.8B, short of analysts’ estimates of $4.94B in sales.

The China Sanctions

While ASML has rebuffed notions of a slowdown, it is important to note that it does sell about 15% to China while Taiwan and South Korea account for 71% of revenues. LAM Research (LRCX), which is ASML’s peer, guided to a $2 to $2.5Bn revenue shortfall compared to estimates, citing China sanctions as the main cause.

Investment Case

I own ASML and recommend it a Buy at this price for the following reasons.

- It is the only manufacturer of EUV’s in the world – a deep and wide moat.

- Semiconductors is a critical and growing industry.

- Capital Equipment has an outsize role in an industry dependent upon technological innovations.

- ASML has weathered the downturn in the semiconductor market well and has enough of a pipeline to continue growing.

- Most of the downturn is already reflected in its current price.

- The P/E of 27X is justified given that it has usually traded between a P/E of 24 and 40 and it is expected to grow earnings at 25%.

- Industry leaders and innovators typically have that premium and ASML is relative better priced.

Be the first to comment