Editor’s note: Seeking Alpha is proud to welcome Unrivaled Investing as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Kimberly White/Getty Images Entertainment

Recently Ray Dalio’s Bridgewater disclosed a $10 billion bet against European equities. One of his largest positions was a $1 billion short against ASML Holdings (NASDAQ:ASML). In this article we’ll discuss the merits behind Ray Dalio’s ASML short and why I suspect ASML stock could head much lower.

Based on my own independent research, I rate ASML as a Sell. In order to understand why ASML has significant downside risk, you first need to understand their business.

What is ASML?

ASML sells the world’s most advanced lithography machines. Lithography machines use light beams to print tiny patterns on silicon wafers which are critical to the mass production of microchips. Their machines are extremely expensive (averaging 40 million EUR), sensitive, and are vital to the development of new and smaller semiconductors.

ASML primarily sells two different types of lithography systems: DUV or deep ultra violet and EUV or extreme ultra violet. While ASML has historically held the dominant market position for DUV machines, they’re the only supplier for their cutting edge EUV technology.

Personally, when I come across a monopoly, I want to buy it because it implies that the company has pricing power and can generate significant free cash flow. Recently, that’s exactly what you’ve seen from ASML. In 2021, revenue was up 33%, they generated record profits and bought back 8.6 billion EUR in stock.

Management has also articulated a very favorable growth outlook. For the 2020-2030 period, management expects new system sales combined with the existing installed base to drive 11% annualized sales growth.

So if ASML has such incredible financials and favorable outlook, why is ASML stock a potential sell now and how is their significant downside potential for ASML stock?

What’s the Downside?

While ASML is an incredible business, they’re constrained by the industry they serve: semiconductor manufacturing. Who buys ASML’s revolutionary machines? Primarily two semiconductor manufacturers: Taiwan Semiconductor (est. 37% of 2021 revenue) and Samsung (est. 29% of 2021 revenue). These top two customers represent a huge concentration risk of more than 66% of ASML’s revenue. If either of these customers see any slowdown in demand, it will have an immediate impact on ASML’s top-line results.

After all, 70% of ASML’s revenue is tied to new system sales and their lithography systems are primarily used to expand semiconductor production capacity. If either Taiwan Semiconductor OR Samsung start operating at OR under capacity, it could lead to an immediate drop in orders and a potential swing from huge profits to unprofitable results.

This would not be without precedent. For example, in the last two economic downturns (2001 and 2008), ASML’s revenue dropped by roughly half each time and they swung from record profitability to hundred million dollar operating losses.

Current Operating Environment

So if waning demand from ASML’s concentrated customer base can so dramatically impact their results, what does the current operating environment look like? Here we see a mixed picture:

On ASML’s 1Q 2022 earnings update, management disclosed that: “We continue to see that the demand for our systems is higher than our current production capacity…. In addition, we are actively working to significantly expand capacity together with our supply chain partners.”

In other words, ASML is seeing such a good operating environment that they need to focus on capacity expansion to sell more machines! This sounds like a very favorable environment!

So once again, why do I think ASML is a sell now? Investing is not about the current performance, but about anticipating future results. News articles have started circling that Samsung, one of ASML’s key customers, is “asking multiple suppliers to delay or reduce shipments of components and parts for several weeks due to swelling inventories and global inflation concerns…”

Since then, more articles have come out claiming that Samsung has 50 million unsold smartphones. Why will Samsung need to expand their production capacity when they’re facing an inventory glut? Could this lead to a precipitous drop in new orders for ASML? It’s a very real risk.

While ASML’s results do not yet reflect this news, if Samsung is indeed at capacity or under capacity, this could mark the turn in the cycle for ASML’s fundamentals.

What’s the Downside Potential for ASML Stock?

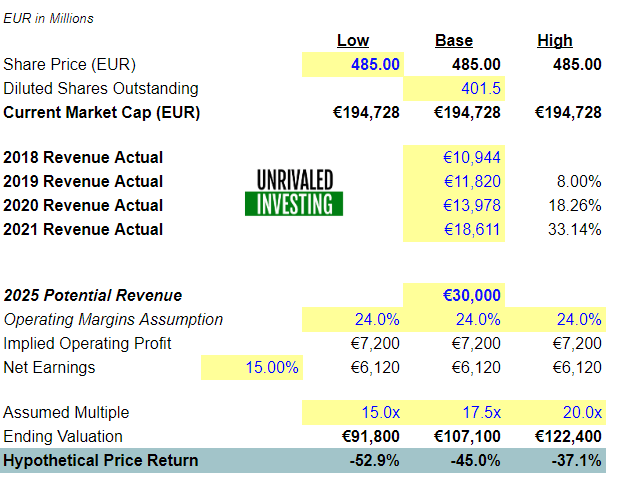

If ASML sees a contraction in demand similar to the last two cycles where their net income turned negative, investors will need to broaden their time horizons and value ASML based on their long-term earnings potential. Management has previously guided to 24 to 30 billion EUR in sales by 2025. Assuming the upper end of this outlook, combined with a 24% operating margin and 15% tax rate, gets 6.1 billion EUR in net income in 2025.

While this is only slightly higher than their 2021 earnings of 5.9 billion EUR, during the last two years ASML’s operating margins expanded at a record clip, from 24% to 36% as there was a chip shortage and ASML received record bookings. Management has openly acknowledged that during this cyclical frenzy some customers were so desperate they were “double ordering.” This was an environment where AMSL expanded their margins by 50%.

In a downcycle, I suspect investors will re-focus on ASML’s pre-COVID operating margins of 24%. So what’s the right multiple for ASML’s 2025 potential earnings power?

On the one hand, ASML is a monopolistic innovator with potentially multi-decade tailwinds as they enable increasingly revolutionary microchips. On the other hand, the semiconductor industry is viciously cyclical and ASML has extreme customer concentration with the leading manufacturers.

I’m going to assume 15-20x 2025 potential earnings, or a shareholders’ yield of 5% to 6.7%. Based on this framework, the downside range is roughly 40-50% lower:

2025 Hypothetical Valuation Framework (Unrivaled Investing)

Even assuming ASML’s revenue grows 61% from 2021 through 2025, from 18.6 billion EUR to 30 billion EUR, ASML stock could still see over 50% downside potential if its valuation compresses to 15x 2025 earnings and margins revert to their pre-COVID levels.

What’s the upside risk to my Sell rating?

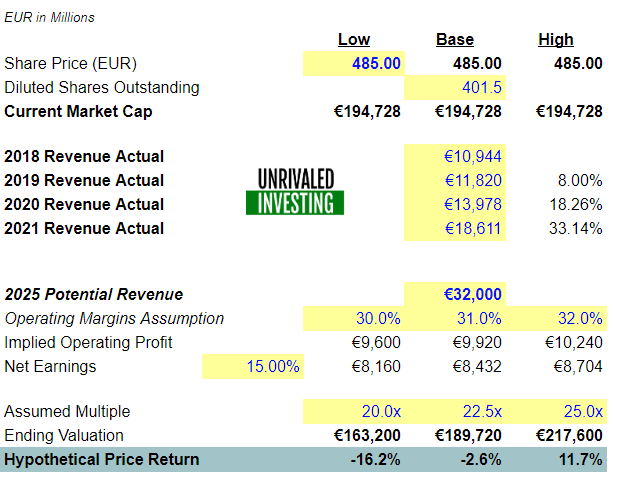

Let’s assume that margins stay elevated at 30% to 32% and management exceeds their 2025 upside revenue target of 30 billion EUR, and delivers 32 billion EUR. This implies 72% revenue growth from 2021 through 2025.

Further, let’s assume that Wall Street rewards ASML with a 20x to 25x earnings multiple, or a 4% to 5% shareholders’ yield. In this scenario it’s possible to see ASML stock roughly flat through 2025:

ASML Hypothetical Valuation Framework (Unrivaled Investing)

In one scenario, ASML stock faces 50% downside through 2025, and in another more optimistic outlook, it’s roughly breakeven. This is an asymmetric set-up skewed heavily to the downside.

But it could be even worse. Both of these scenarios assume investors keep a level head and focus on long-term earnings potential. The reality however, can be quite different.

If for example, there is a cyclical slowdown resulting in a huge drop in revenue and potential cash burn, investors could easily anchor to their underperformance and assign a discount even relative to a long-term earnings outlook. This would suggest even worse downside than the scenarios penciled out above. To consider a range of different assumptions yourself, see the hypothetical valuation framework here.

While I think ASML is a sell now, it won’t always be that way. This is a call based on their huge customer concentration risk and recent signs that Samsung could pull back on new orders.

Long-term, I think ASML is an exceptional company with huge potential. In the short term, it’s priced for no potential economic turbulence, no margin reversion, and no risk from their huge customer concentration. While on my personal investment journey I want to buy unrivaled, monopolistic businesses like ASML, successful long-term investing needs to consider both quality and valuation.

Be the first to comment