Richard Drury/DigitalVision via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published on June 5th, 2022. The markets have been extremely volatile, check the latest data before making any investing decisions.

Aberdeen Standard Global Infrastructure Income Fund (NYSE:ASGI) was launched nearly two years ago. For some investors, this is still too new of a fund to consider. However, there are some compelling reasons to consider investing or putting it on an investor’s watchlist.

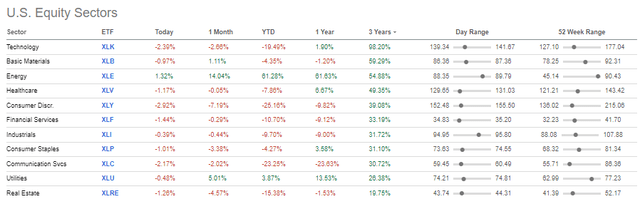

This year, the fund has been holding up relatively well due to its sizeable allocation to utilities. That is the fund’s second-largest weighting behind industrial holdings. Industrials haven’t been faring as well but aren’t the bottom-performing sector either. The fund also has some exposure to energy, the leading industry by a wide margin this year.

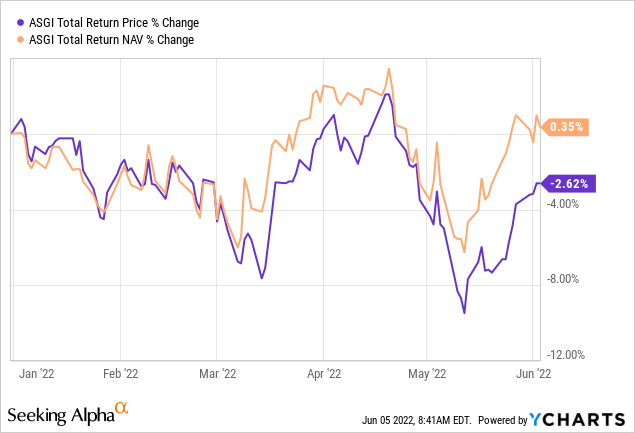

We can see below that the total NAV return has outpaced the total share price return on a YTD basis. When this happens for a closed-end fund, that means discount expansion or premium declines. In this case, it meant further discount expansion from the attractive level it was already trading at previously. This all just makes it an even more attractive buying candidate, in my opinion.

Ycharts

Another point to consider in this current environment is that ASGI doesn’t utilize any leverage. At least not at this time. In their Prospectus, that they are allowed but don’t intend to. Since I’ve owned and followed the fund, I haven’t seen any leverage show up. While I don’t necessarily see anything wrong with using leverage – I won plenty of highly leveraged funds – it can be a bonus in an environment where interest rates are rising. Often, closed-end funds employ floating rate borrowings that can increase interest expenses as rates rise.

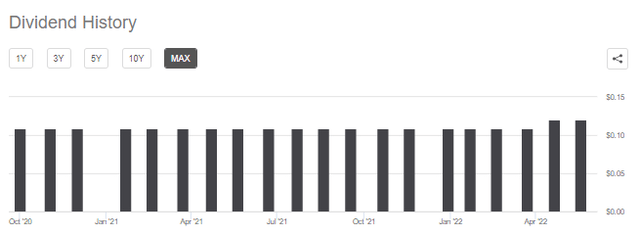

Since we last covered the fund, investors got a raise, too, with the distribution bumped up. Not bad for being a newish fund that doesn’t quite have its roots fully grown in yet.

The Basics

- 1-Year Z-score: -1.06

- Discount: 13.84%

- Distribution Yield: 8.16%

- Expense Ratio: 1.73%

- Leverage: N/A

- Managed Assets: $200 million

- Structure: Term (anticipated liquidation date around July 29th, 2035)

ASGI’s investment objective is “to seek to provide a high level of total return with an emphasis on current income.”

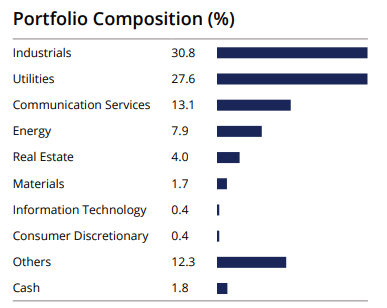

To achieve this objective, the investment strategy is quite simple. They will “invest in a portfolio of income-producing public and private infrastructure equity investments from around the world.” Interestingly, the most significant exposure in ASGI is to industrial stocks, making this fund a bit unique in the infrastructure space. However, utilities are right up there in terms of exposure.

The fund is smaller, with around $200 million in assets. That could turn some investors off as well through relatively low volume. That can limit an investor’s ability to get out at a reasonable price. However, that’s more a problem for investors who are prone to sell during panics. If you are buying, this can work to your advantage.

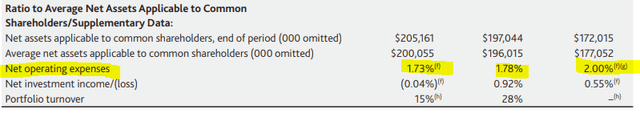

Despite not employing leverage, the fund’s expense ratio is on the higher end anyway. This is something to watch, but the 1.73%. Since its launch, the expense ratio has been reduced as the fund has been growing. Still, this is elevated, and as they bumped up the distribution, its chance to continue to grow could be limited. CEFs don’t tend to grow assets over time, though there are exceptions, as always.

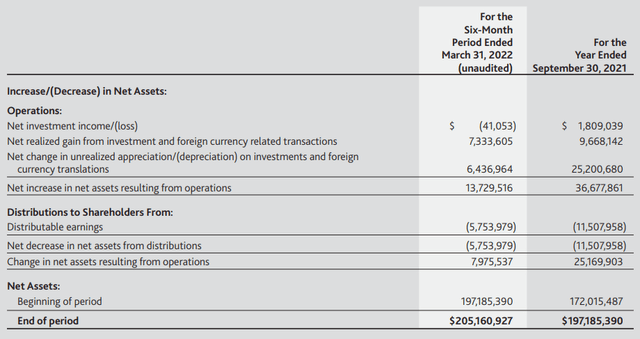

The below highlighted periods would have been for the six months ended March 31st, 2022, then fiscal year September 30th, 2021 and for the partial period of September 30th, 2020.

ASGI Ratios (Aberdeen (highlights from author))

The fund is a limited-term fund that is expected to terminate on its 15th anniversary. Meaning we could expect this fund to liquidate in 2035. They can extend this term “(1) for one period that may in no event exceed one year following the Termination Date, and (2) for one additional period that may in no event exceed six months.”

ASGI also has the wording in their Prospectus to switch to a perpetual fund, which is fairly standard. This would be done through the standard tender offer of 100% outstanding shares at 100% of NAV. After such a tender offer, if the fund still has $100 million in total net assets, they can switch to a perpetual fund.

Performance – Holding Its Own

As mentioned at the opening, the fund has been performing well on a YTD basis thanks to its weighting towards utilities. The utility sector has been receiving a lot of love this year. It is only one of two sectors in the green when writing this, only behind energy. Which ASGI also has a smaller sleeve of energy exposure too.

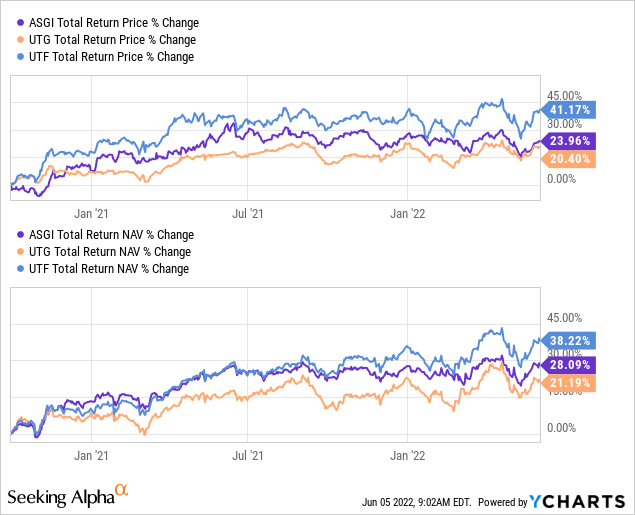

If we take a look at the performance of the fund in comparison to what could be seen as reasonable peers, the fund is also holding its own. In the chart below, I’ve included Reaves Utility Income Fund (UTG) and Cohen & Steers Infrastructure Fund (UTF) for comparison. I used the starting date of September 30th, 2020, to today’s date. This would allow for some time when ASGI would set up their portfolio and get positions bought.

Ycharts

What we can see is encouraging. The fund has outperformed UTG in this period. This is notable because both ASGI and UTF have done this and hold a heavier weight to global positions. UTG has historically leaned more heavily in U.S.-weightings. However, we have seen some international exposure pop up in more recent years.

While ASGI underperformed UTF, that isn’t so much of a concern for me because UTF is leveraged, and ASGI isn’t. During periods of positive returns, this is exactly what we should see. Unfortunately, UTG is also leveraged, but we still saw an underperformance. I believe this is due to UTG having a larger allocation to REITs lately, which has been the weakest performing sector over the last three years.

U.S. Equity Sectors on June 5th, 2022 (Seeking Alpha)

I’ve used these three funds to compare and give us some context on how ASGI has performed. However, I own all three funds. I believe that all have differences enough to make them worthwhile.

Distribution – Show Me The Money!

The fund’s distribution yield comes to 8.16%, while the NAV yield comes to 7%. Thanks to a rising NAV due to solid performance from the fund, investors recently received a raise from a monthly distribution of $0.1083 to $0.12 – a boost of around 10.8%.

ASGI Distribution History (Seeking Alpha)

Now, here’s the interesting part that most investors won’t like to see. They haven’t earned any net investment income in their last six-month report. NII is the dividends and interest received minus the expenses of the fund.

ASGI Semi-Annual Report (Aberdeen)

It isn’t odd to have an equity fund that earns most of the distribution to pay shareholders through capital gains. However, it is strange to see no NII for a fund with heavier exposure to utilities.

There are a few reasons for this, which leads me to believe it isn’t any concern. First of all, they’ve been able to grow the NAV, meaning they’ve been earning the distribution. That was quite easy for them, though, since they experienced basically a straight shot higher for the market for the first year after launch.

A second reason for the lack of NII is that the fund holds several larger positions in international names. International companies don’t generally put the same emphasis on regular dividends that U.S. companies do. Several of the names in ASGI’s portfolio pay semi-annual. The amounts are generally different for every payout too.

Finally, this is where the higher expense ratio comes to bite. That takes away from what NII there would be leftover for shareholders. Since it is higher than usual, that means a bigger chunk is taken away from shareholders.

For tax purposes, a large portion of 2021’s distributions was characterized as ordinary income. That could be income or short-term capital gains. Since the fund hadn’t been around for over a year during a significant portion of 2021, this makes sense that they would be limited on long-term capital gains at that point. Going forward, I would anticipate seeing more long-term capital gains in the distribution.

ASGI’s Portfolio

When looking at the fund’s sector allocation, industrials and utilities are the most significant exposure by a significant amount. Though they aren’t the only weightings in the fund. Communication services and energy also make up a fairly meaningful allocation. This was the portfolio position at the end of April 2022.

ASGI Sector Weighting (Aberdeen)

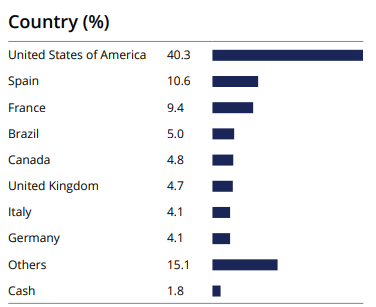

This fund has a truly global tilt too. While international exposure shows up in other “global funds,” they often have less than 50% outside the U.S. In this case, ASGI holds nearly 60% of its portfolio outside the U.S.

ASGI Country Weighting (Aberdeen)

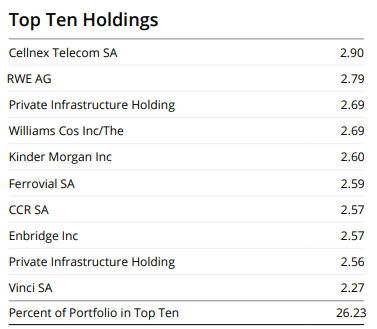

The tilt toward global investments is reflected when looking at the fund’s top ten.

ASGI Top Ten (Aberdeen)

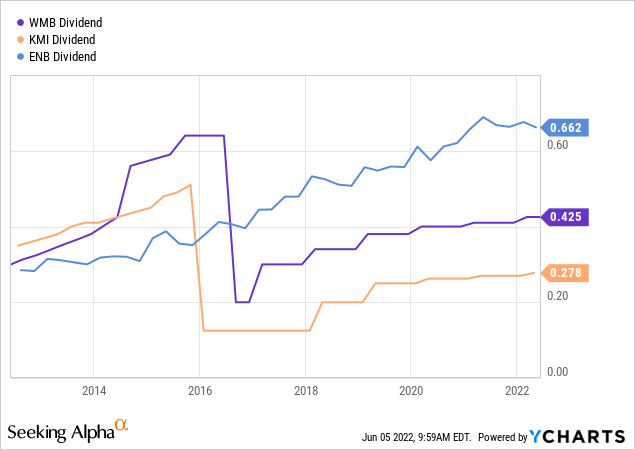

The Williams Companies (WMB) and Kinder Morgan (KMI) are the only two U.S.-based companies. Then there is Enbridge (ENB) which has significant operations in the U.S. but is based in Canada. Besides the 2015/16 reductions in their dividends. These are all fairly steady payers, with quarterly distributions to their investors. They’ve been raising their payouts since those cuts, too.

Ycharts

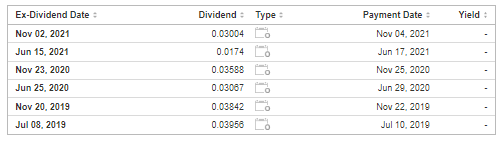

These other European holdings are where the dividends get quite unpredictable.

Cellnex Telecom (OTCPK:CLLNY) is traded OTC in the U.S. That can add risks for investors due to potentially less stringent reporting requirements and lower trading volume. This is what their semi-annual dividend payments have looked like.

CLNXF Dividend History (Investing.com)

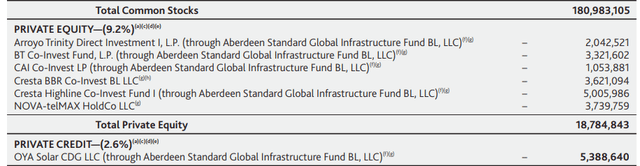

Among these top holdings are “private infrastructure holding” positions. These positions can be found in the latest Semi-Annual Report.

ASGI Private Holdings (Aberdeen)

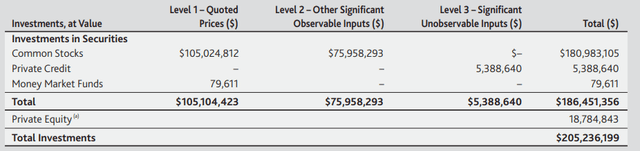

Private investments can be attractive to get into. Investing in names before they potentially go public or just providing a different risk/reward approach. However, it does have some added risks. The actual valuation can be questioned because they can be level 3 securities. For ASGI, it seems only a small portion of these are level 3 securities, so that should make it a bit less of an unknown.

ASGI Securities Level (Aberdeen)

Conclusion

ASGI has been performing rather well given the current environment, thanks to its utility and energy exposure. Those are the only two green sectors for the year at this point. This has seemingly made the Board comfortable raising the fund’s distribution a couple of months ago. It could still be seen as a somewhat newer fund, but I believe it remains attractive.

Be the first to comment