BlackJack3D/E+ via Getty Images

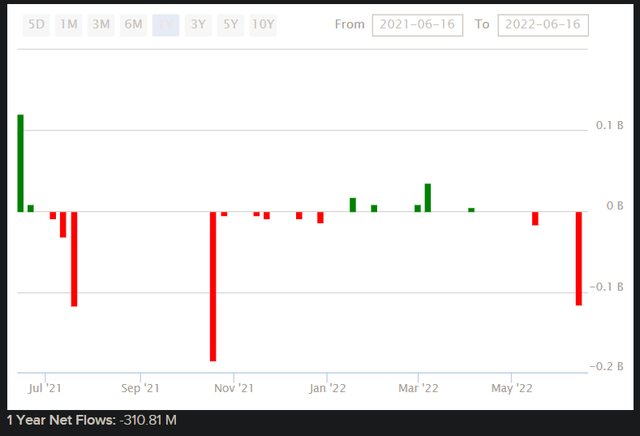

The iShares Global Materials ETF (NYSEARCA:MXI) is an exchange-traded fund that invests in publicly-listed companies around the world that are involved in the production of raw materials, such as metals, chemicals and forestry products. The fund carries an expense ratio of 0.43%, which is not cheap but in line with other industry-specific ETFs. Assets under management were $473 million as of June 17, 2022, making MXI a relatively unpopular or obscure product. This does however follow significant outflows (illustrated below).

As illustrated, MXI’s net outflows over the past year were $311 million, which would have been circa 40% of the fund’s total assets around a year ago.

MXI seeks to track the performance of its benchmark index, the S&P Global 1200 Materials Sector Index, which is an index that consists of all members of the S&P Global 1200 (a broader global equity index) that are classified within the materials sector. A recent factsheet for the benchmark tells us that there were 101 constituents in the index, basically matching the 100 holdings that MXI had as of June 16, 2022.

The factsheet also serves as a rough proxy for MXI in terms of key statistics: trailing and forward price/earnings ratios were reported for the S&P Global 1200 Materials Sector Index, as of May 31, 2022, of 11.48x and 10.17x, respectively, implying a forward earnings yield of 9.8% and forward one-year earnings growth of 12.88%. The price/book ratio was 2.15x, and the indicative dividend yield was 3.86%, implying a forward return on equity of 21%, and a distribution rate of profits into dividends of about 44%.

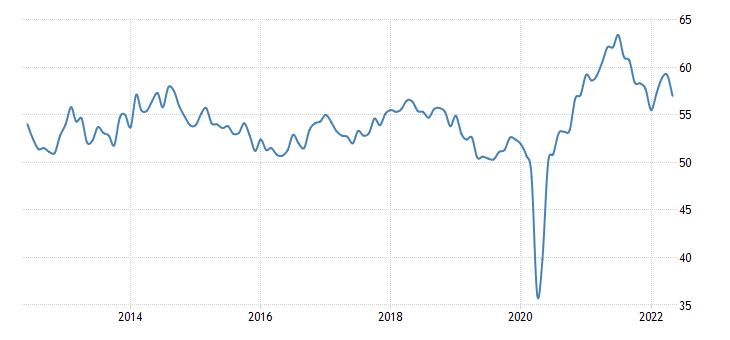

The Materials sector can be volatile in line with general consumer demand, the business/economic cycle, and commodity prices. The industrials sector can also have a business cycle that does not quite match the broader economic cycle on average. At the moment, for example, the U.S. Manufacturing Purchasing Managers’ Index is on the decline.

TradingEconomics.com

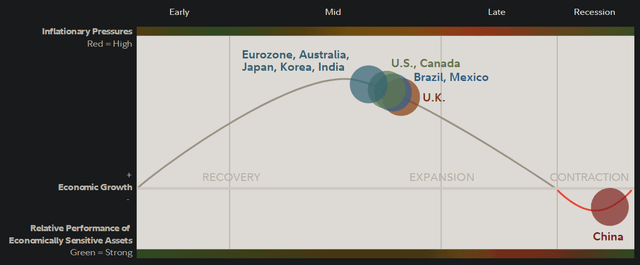

You can also gauge from Fidelity research that while some of the major global economies such as the United States are not in recession yet, they are probably approaching the later stages of the cycle (from Q2 2022).

This information is based on several factors including growth, credit creation, profits, government policy, and inventories. Still, over the next three to five years, Morningstar estimate that the average earnings growth rate for MXI will reach circa 13.78%. If we include the first year’s projection provided by MSCI of 12.88% noted earlier, that takes us to a fairly strong period of growth over the next few years. I imagine these consensus analyst estimates are most likely optimistic, given that it is unlikely (though not impossible) that the Materials sector will remain buoyant and even accelerate during the weaker phases of the business cycle.

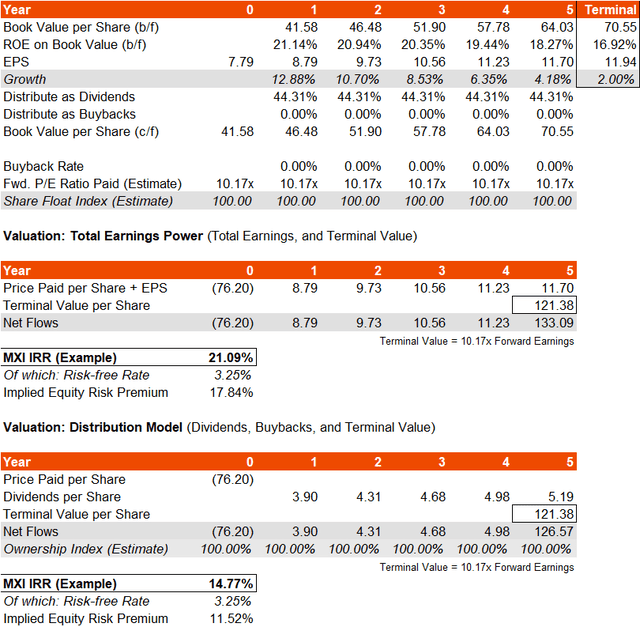

So, instead, I am going to base my gauge of MXI on a declining earnings growth rate over the next few years to 2% by my terminal year six. That gives me a more conservative average for three years and five years (for earnings growth) of 10.69% and 8.48%, respectively (8.48-10.69% vs. Morningstar’s 13.78%). This also implies a steady decline in the return on equity from 21% to about 17%, and I will also hold the forward price/earnings multiple constant (at just 10.17x) and assume no buybacks through the period.

The IRR gauge below suggests that MXI is likely undervalued, with an implied IRR in the range of 14-21% even without buybacks.

With buybacks, the latter model’s IRR would increase (the lower bound estimate, basically), but otherwise, MXI’s total underlying earnings power (prospectively speaking) indicates that there is a very high equity risk premium embedded in the fund. That is, in spite of a historical beta of 1.11x.

It is probable that the market is pricing in even weaker forward earnings results than myself. If we assume that current earnings are unsustainable, and next year’s earnings fall by 10%, and then steady themselves by gradually moving back to 2% by year six, the IRR in the former (more favorable) model drops all the way to 7.77%. However, on a risk-free rate of 3.25%, that still implies an equity risk premium of about 4.5%, which is not too bad. In this adverse scenario, dividends would drop, and so valuing MXI on forward distributions (dividends and buybacks) would likely underwhelm during a recessionary scenario. Nevertheless, if Fidelity are correct that the United States and other major economies are not even in recession yet (although notably they view China as being in that territory), it is more than possible that a steep earnings decline can be avoided.

I think some caution is probably needed, but generally speaking it would appear that MXI is priced with very high positive skewness when it comes to the range of potential outcomes. At worst, your equity risk premium is roughly in line with broader equity markets over history, and at best, you could achieve a much higher IRR and possibly even an expansion of the forward earnings multiple. While one should probably cap one’s total exposure to funds like MXI in a broader equity portfolio, I think it deserves a position.

Be the first to comment