Kimberly White

Asana (NYSE:ASAN) initially rallied after releasing its last quarter’s earnings results but soon gave up those gains. That has created an attractive buying opportunity in the stock. The company addressed two of the biggest concerns held by investors: first, the ability to sustain growth in a difficult macro environment and second, the dwindling cash on the balance sheet. Not only did ASAN beat and raise guidance, but CEO Moskovitz stepped in to assist on an equity raise, giving the company enough cash to reach positive cash flow generation as expected by the end of 2024. ASAN remains a compelling pick as a beaten down name in the tech sector.

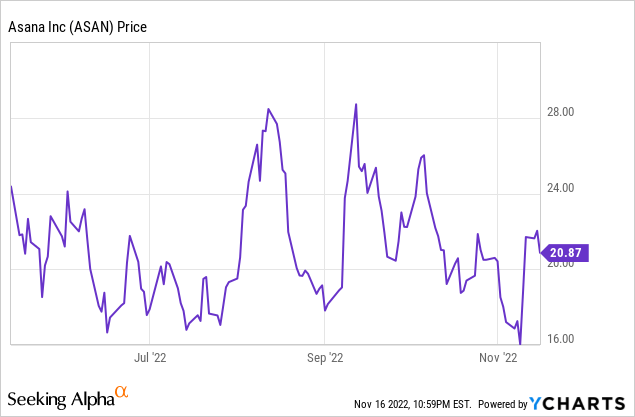

ASAN Stock Price

ASAN has fallen greatly from its $145 per share peak achieved in late 2021.

I last covered ASAN in September where I rated the stock a buy on account of the attractive risk-reward profile following a 90% plunge in the stock price. The stock is up 17% since then, as strong results and a capital raise have significantly de-risked the thesis. There’s more upside ahead.

ASAN Stock Key Metrics

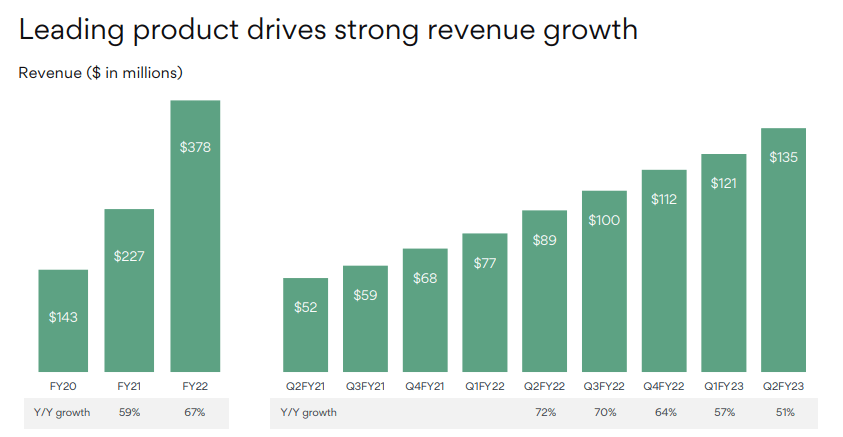

ASAN generated 51% revenue growth to $135 million in the latest quarter. ASAN had previously been guiding to only $128 million in revenue – representing a sizable beat.

FY23 Q2 Presentation

ASAN actually would have generated stronger results if it was not for some unfavorable currency exchange fluctuations, as seen below.

FY23 Q2 Presentation

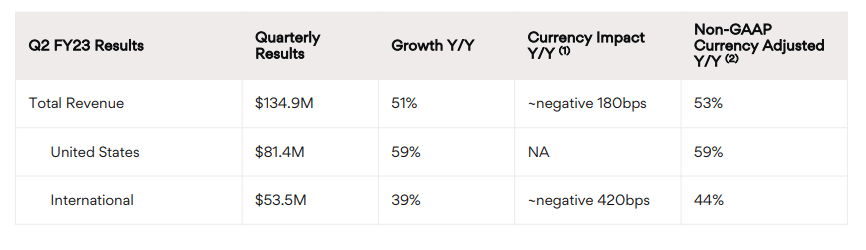

ASAN generated a 120% dollar-based net retention rate, with a stronger 145% DBNRR among larger customers.

FY23 Q2 Presentation

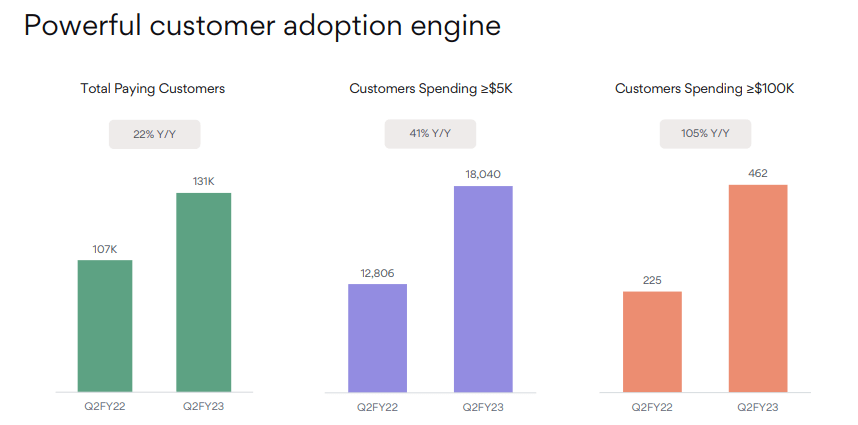

That bodes well considering that customer growth was strongest among those larger customers.

FY23 Q2 Presentation

On the conference call, management communicated that it views growth among larger customers to be more indicative of “core growth.”

At 64% growth, revenue from customers spending $5,000 or more on an annualized basis is a good leading indicator of our core growth. This cohort represented 72% of our revenues in Q2, up from 66% in the year-ago quarter and speaks to our success as we continue to move up-market. The revenue growth for this cohort of customers in the U.S. grew even faster at 73% year-over-year.

ASAN still was not profitable in the quarter, losing $111.3 million in GAAP operating losses or 82% of revenue – surpassing the 67% negative margin in the year prior. On a non-GAAP basis, the operating loss margin was 46% (43% in the prior year).

Management reiterated its guidance for positive free cash flow generation by the end of 2024, but the huge losses had previously been an important bearish thesis considering that ASAN had a dwindling cash reserve. That has changed as after the quarter, ASAN sold $350 million to CEO Moskovitz, comprising 19.3 million shares for a price of $18.16 per share. That gives ASAN a pro-forma balance sheet consisting of $589 million of cash versus $32 million of debt. That appears to be enough to last at least the next 2 years based on the current cash flow burn rate.

What’s more, management noted that it has “front-loaded” many investments this year (in other words, aggressively increased headcount), suggesting that the company should begin to see operating leverage (and lesser cash burn) moving forward.

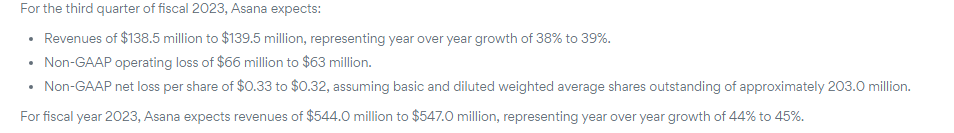

Looking forward, ASAN guided for up to 39% in revenue growth in the next quarter and increased full-year guidance to up to 45% revenue growth (an increase from the prior guidance of up to 43% growth).

FY23 Q2 Press Release

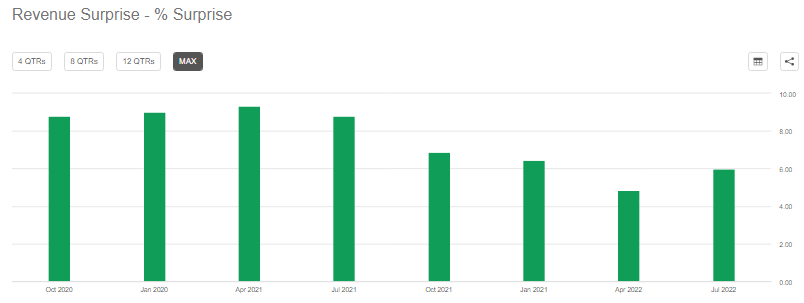

ASAN has a history of outperforming consensus estimates, but it is nonetheless impressive that the company continues to beat-and-raise even in what is shaping up to be a difficult macro-environment.

Seeking Alpha

Is ASAN Stock A Buy, Sell, or Hold?

ASAN is an enterprise tech company that seeks to increase the productivity of its customers’ employees through digitizing coordination. What is coordination? That simply refers to the process of managing ongoing projects, answering questions like who is working on what, when they will work on future projects, when they expect to deliver on certain projects, etc.

FY23 Q2 Presentation

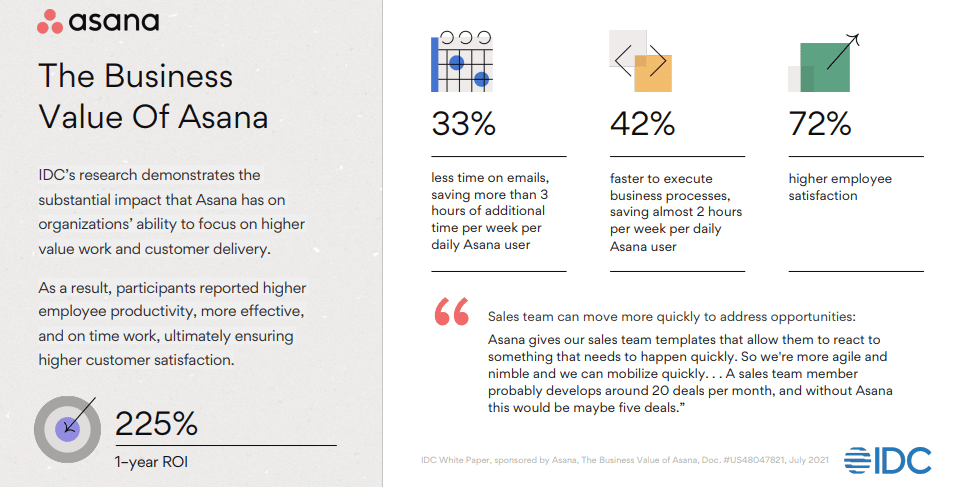

ASAN’s products have a measured impact on productivity, saving as much as 5 hours per week between reducing email and business process management.

FY23 Q2 Presentation

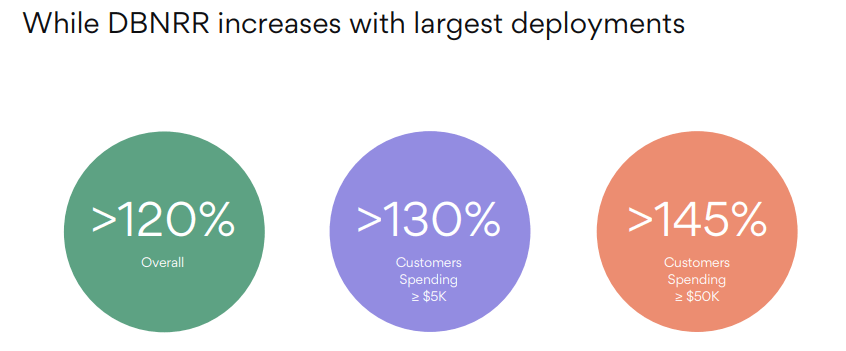

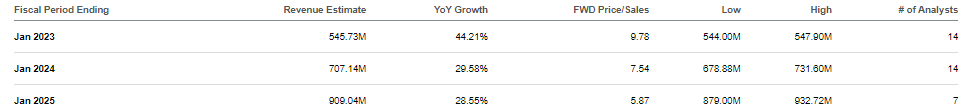

Consensus estimates call for growth to decelerate to the 30% range moving forward. In my opinion those estimates look conservative considering the strong DBNRR among larger customers.

Seeking Alpha

I can see the company sustaining at least 30% GAAP net margins over the long term. Applying a 1.5x price to earnings growth ratio (‘PEG ratio’), ASAN might trade around 13x sales, implying a stock price of $54 per share by 2024, or a 65% compounded annual return through the next 2 years.

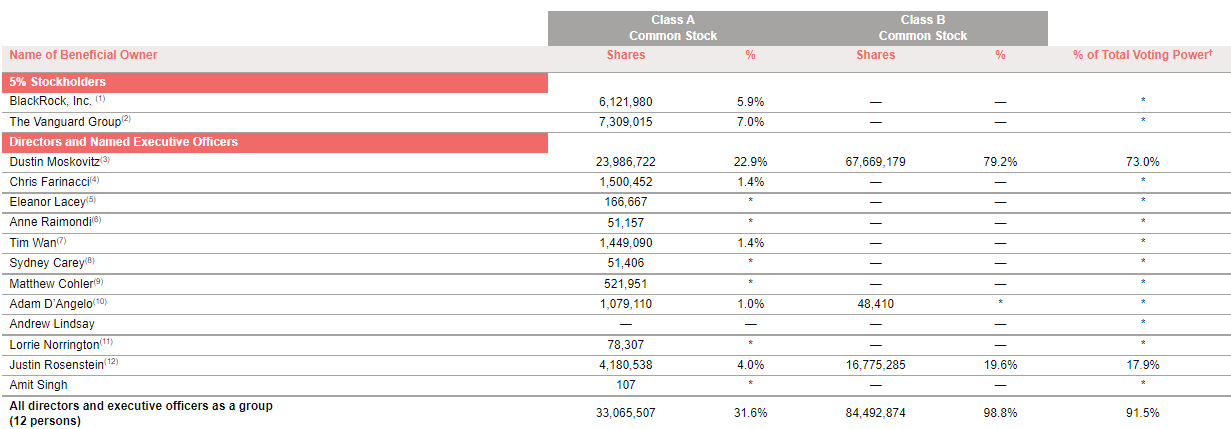

Even prior to the latest $350 million purchase, CEO Moskovitz already owned over 90 million shares meaning he now owns around 109 million shares of the stock. I note that even excluding CEO Moskovitz, insider ownership at the company is significant.

2022 DEF14A

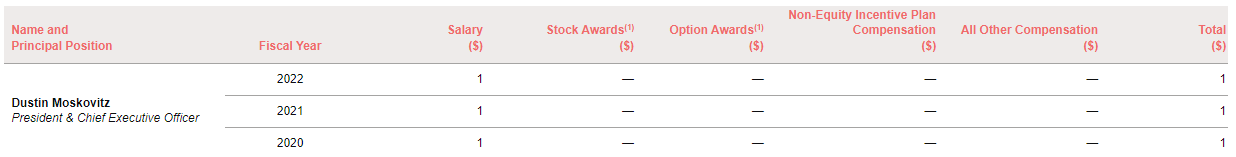

It is also worth noting that CEO Moskovitz receives zero compensation as CEO and member of the Board of Directors – by request.

2022 DEF14A

CEO Moskovitz has become a critical part of the bullish thesis. Perhaps previously that contribution was mostly due to him being a co-founder of Facebook and the potential for visionary leadership. At this particular moment, however, it is arguable that the greatest factor is his implicit backing of the company’s financial position. His numerous and sizable insider purchases in 2021 plus this latest participation in capital raising show his financial commitment to the company. It is very rare to find an owner-operator type company to the extent of ASAN.

What are key risks here? While management has guided for positive cash flow generation by the end of 2024, that is just guidance and there is no guarantee that the company will reach that goal so fast. In the meantime, the company continues to burn through cash and there is the possibility that they will need to raise cash again in the future. There are also numerous competitors in the coordination space, including incumbent Atlassian (TEAM) and another up and coming competitor in monday.com (MNDY). These companies will at some point begin taking market share from each other, but it is not clear when market saturation will occur. The macro-environment is highly unpredictable and it is not clear if enterprise tech will continue to report strong results even with heightened interest rates. The valuation model is highly predicated on ASAN’s ability to sustain strong growth rates. I have discussed with subscribers to Best of Breed Growth Stocks regarding my view that a diversified basket of undervalued tech stocks is how I’m taking advantage of the tech stock crash. ASAN fits right into such a basket, offering secular growth trading at compelling valuations – I rate the stock a buy.

Be the first to comment