boggy22/iStock via Getty Images

The market has no shortage of formerly high-flying tech stocks that are now struggling to keep their stock prices above water. With mass layoffs in Silicon Valley, plus deflating share prices that make it difficult for employees who are compensated through equity to remain motivated, it’s not difficult to see why pessimism for tech and growth stocks is at multi-year highs.

At the same time, however, we have to also acknowledge that the industry is full of high-quality businesses and products that have built up solid recurring-revenue bases. While sales momentum may slow in the near term as companies retrench both their headcount and capex/IT investment spending, high-margin software businesses with established customer bases and strong balance sheets are highly likely to make it through an economic downturn.

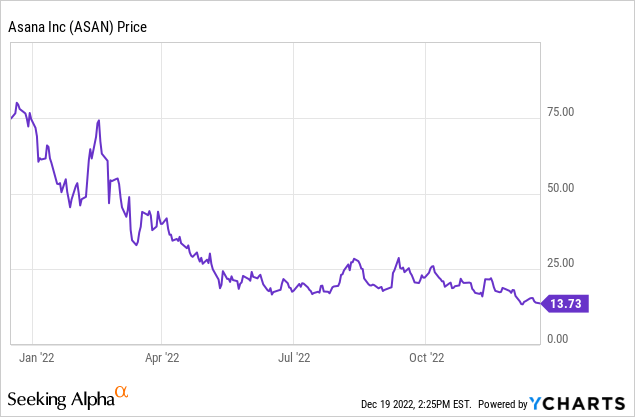

With that lens in mind, it’s a great time to take a second look at Asana (NYSE:ASAN), a workflow and collaboration tool that is led by founder Dustin Moskovitz, also famous for co-founding Facebook (META). Year to date, the stock is down more than 80%:

While still acknowledging that Asana is indeed subject to some macro risk and a near-term slowdown; owing to the sharp declines in this stock amid unprecedented pessimism, I am now very bullish on this name. Long term-oriented investors (like myself) who are comfortable shouldering near-term volatility have a fantastic opportunity to buy into a solid software business at what I view to be pennies on the dollar (recall as well that CEO/Founder Dustin Moskovitz also purchased $350 million of stock earlier in September at just north of $18 per share).

Here is the full bull case for Asana:

- Asana’s long-term demand will be bolstered by the ongoing shift to remote and distributed teams. More and more companies are embracing a distributed working model, if not a fully remote one. With fewer in-person touchpoints, software tools become critical to keeping teams together and in sync.

- Massive global TAM. Asana believes it has a $51 billion TAM by 2025 and is applicable to the global base of ~1.25 billion information workers. By that metric, Asana’s current user base represents only <5% of the global eligible workforce.

- Land and expand. Asana adopts the classic software go-to-market playbook, which is to prove its concept and value with smaller teams at first, but eventually expand to entire organizations and companies. Dollar-based net retention rates are clocking in above 140% for companies spending more than $100,000 annually on Asana, a leading indicator that Asana’s traction among larger enterprises is growing.

- Continuous innovation. The company added over 200 new product features in calendar year 2021, and in February 2022 unveiled a new workflow tool. In fall this year as well, the company boosted its integration capabilities with Google Drive.

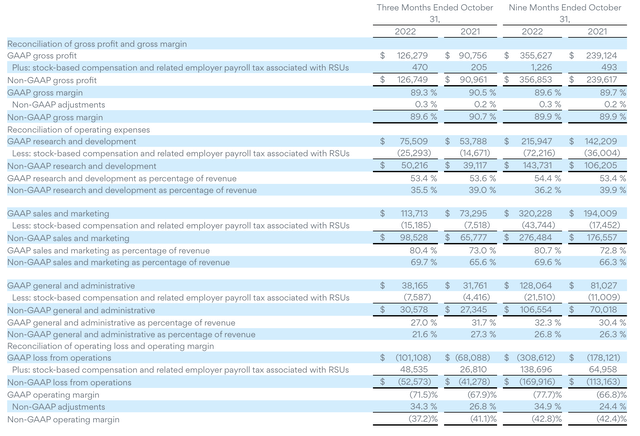

- Huge gross margin profile. Asana’s pro forma gross margins are in the ~90% range, making it one of the highest-margin software companies in the market. While the company isn’t profitable today, that gross margin profile gives Asana plenty of leeway to scale profitably when it’s larger, as nearly every dollar of incremental revenue flows through to the bottom line.

An ultra-cheap valuation, of course, remains the top reason to invest in Asana today. At current share prices near $14, Asana trades at a market cap of only $2.93 billion. After we net off the $509.1 million of cash and minimal $30.5 million of debt on Asana’s most recent balance sheet, the company’s resulting enterprise value is $2.45 billion.

For next fiscal year FY24, meanwhile (the fiscal year for Asana ending in January 2024), Wall Street analysts have a consensus revenue target of $651.6 million for the company, representing 20% y/y growth (data from Yahoo Finance). This may be a touch conservative: While it’s true that the company is concerned about macro impacts to near-term sales, the implied deceleration from the company’s current ~40% growth rate is quite sharp. Regardless, taking consensus at face value, Asana’s resulting valuation multiple is just 3.7x EV/FY23 revenue (versus a pandemic peak multiple in the high teens).

The bottom line here: when we strip away short-term noise, I still find a lot of appeal in Asana’s product platform, its huge net expansion rates and strong ARR base, and its sky-high gross margin that makes eventual profit scaling feasible. The opportunity to buy this stock at a low single-digit multiple is too good to pass up.

Q3 download

Let’s now go through Asana’s latest quarterly earnings in greater detail. As a reminder, Q3 wasn’t the issue – it was guidance and commentary for Q4 that dealt a blow to the stock price.

Let’s start with the Q3 earnings summary below:

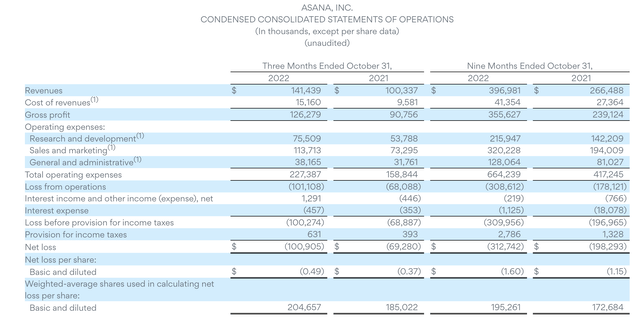

Asana Q3 results (Asana Q3 earnings release)

Asana’s revenue grew 41% y/y to $141.4 million, beating Wall Street’s expectations of $139.0 million (+39% y/y) by a two-point margin. It’s worth noting that beats versus consensus in the current earnings season have become fewer and further between in the tech sector, whereas in 2020/2021 beats were more the expectation than the outlier. Growth did, however, decelerate from 51% y/y in Q2.

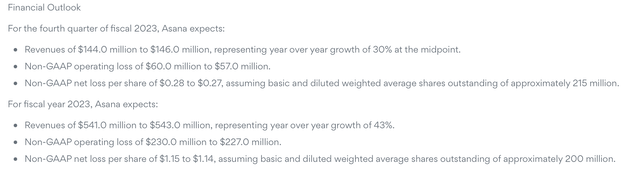

It was the company’s Q4 guidance that caught investors by surprise: the company’s range of $144-$146 million represents a further ten-point deceleration to 30% y/y growth, versus Street expectations of $151.1 million (+35% y/y growth).

Asana outlook (Asana Q3 earnings release)

We have to ask ourselves two questions here, however:

- Do we believe this full deceleration will materialize? Asana has a track record of guiding rather conservatively. The company had guided to a high end of $139.5 million in revenue for Q3, and ended up coming in two points stronger than that.

- Even if Asana does decelerate to ~30% y/y growth, is the ~15% hit to the stock since the earnings release in early December (or for that matter, the 80% hit to the stock since the start of the year) justified? I’d say Asana’s low valuation now already prices in plenty of risk.

Note as well that FX headwinds are partially to blame for the optical slowdown in growth. In a constant currency scenario in Q3, revenue growth would have been two points stronger at 43% y/y.

Here’s some commentary from COO Anne Raimondi on what the company is observing on the go-to-market front, taken from her prepared remarks on the Q3 earnings call:

As Dustin mentioned, we noticed increasing pressures on our customers at the end of September when the budget tightening and longer deal cycles became more apparent in the US. The macro environment was having an impact on some of our customers’ ability to increase headcount.

As a result, some of our expansion activity slowed, especially in mid market and smaller accounts. By the end of the quarter, we made the hard decision to restructure and realign our business. Despite the macro backdrop, we continue to see thousands of organizations and large enterprises realizing the value of work management and choosing Asana. While the SMB and very small business markets are softer, we continue to see strong traction in the enterprise organizations and larger deployments. The category is large and we are still in the early innings, so the competitive dynamics in the market are unchanged.”

So, it’s mainly headcount tightening at Asana’s customers that are driving down sales momentum – which makes sense, as Asana is priced on a per-seat basis and is best suited to large, fully-staffed teams that need to coordinate their workflows. At the same time, however, the company reported some good news: A) dollar-based net expansion still remained above 120%, indicating strong upsell activity within the current install base, and B) the company notes that the number of multi-year commitments is up both sequentially versus Q2 and y/y, which signals that the customers that are still implementing Asana view it as a long-term solution.

From a profitability standpoint, we note that Asana achieved four points of y/y pro forma operating margin expansion to -37.2%.

Asana margins (Asana Q3 earnings release)

While still far from optimal, it’s important to note that most software companies reported operating margin declines this earnings season due to opex pressures; whereas Asana was swift at managing headcount and expense growth as its sales pace slowed down. We note that general and administrative costs (pure overhead which I view to be the “least productive” category of opex) dropped 570bps as a percentage of revenue. We note as well that Asana announced layoffs in November amounting to 9% of its overall headcount – which, unfortunately, will help profitability optics in FY24.

Key takeaways

Ultra-cheap valuation, a still-robust growth rate despite recent deceleration, and a largely recurring revenue base with high gross margins and net expansion rates: there is a lot to like about Asana at current levels. Ignore the short-term noise and dive in here.

Be the first to comment