jetcityimage/iStock Editorial via Getty Images

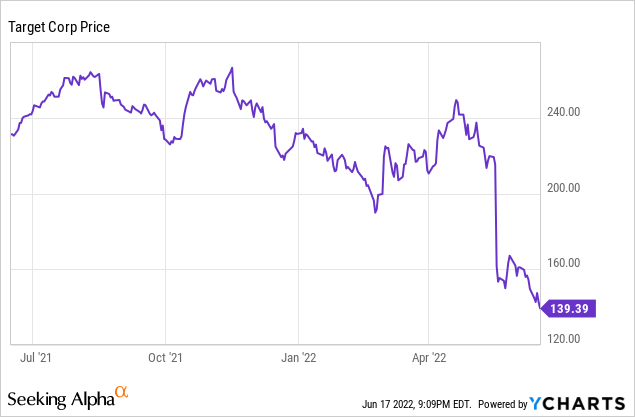

One month ago, on May 18, Target (NYSE:TGT) reported a deeply disappointing Q1 non-GAAP EPS of $2.19, missing expectations by $0.87. Additionally, while Wall Street expected the company’s operating margin to decrease as a result of the macroeconomic pressure squeezing the entire retail industry, few observers could have anticipated a drop to 5.3% from 9.8% year-over-year. Predictably, Target’s already plunging share price took a nose dive, lopping off a full quarter of the price:

At the closing bell on May 17, Target was selling for $215.29 per share. By the start of trading on May 18, shares were selling for $162.17, the stock’s worst single-day drop since Black Monday in 1987. After the company revised its fiscal guidance for the rest of 2022 last week, shares dropped even more. Today, they’re selling for just under $140. That is quite the tumble from its 52 week high of $268.98 in November.

In the short and intermediate term, the sell-off appears to be justified. Target’s return on invested capital dropped from 30.7% one year ago to 25.3%, gross margin dropped from 30% to 27% over the same time frame, and supply chain disruptions don’t look like they’re going to dissipate anytime soon.

I completely understand traders and growth investors unloading Target.

But I am a dividend growth investor and, even with Target share prices likely to shed even more weight, I am buying. Here’s why:

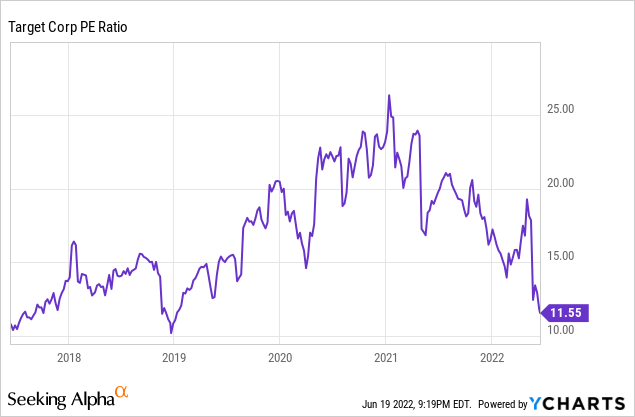

The Company Is Fairly Valued (Finally): As we have all heard ad nauseam, retail stocks have been hammered in 2022 and, as I mentioned at the top of this article, Target has been one of the hardest hit retailers out there. Indeed, there’s no way to put a positive spin on adjusted earnings contracting 40% last quarter, but the company’s plummeting stock price likely has more to do with the stock’s recent climb into the stratosphere during the most recent bull market than any fundamental weaknesses with the company long-term. In fact, if we look at Target’s P/E ratio over the past five years, we see that the company’s average P/E ratio is roughly 16%. This year’s precipitous drop represents a reversion to the mean:

In other words, for those of us who believe the company is a good buy-and-hold stock, now might be a really good time to buy some shares at a substantially more reasonable price than we have seen since at least 2019.

So, yes, shipping costs are way up and customers are spending less on big-ticket items as inflation bites their wallets. Moreover, CEO Brian Cornell reports that Target ended Q1 with 15.1 billion dollars in inventory, much of its excess bulky items costing the company a great deal to store in warehouses. Still, Target is an extraordinarily well-run company whose parking lots are still full of loyal customers and whose aisles are lined with the consumer staples cash-strapped customers will still look for when they pass up on discretionary purchases. Indeed, more than a quarter of the company’s sales come from household goods and hygiene products, another 20% comes from groceries, a further 20% comes from home furnishings, while apparel accounts for another 17%. Hardlines such as sporting goods, patio furniture, and appliances–the sorts of products consumers are most likely to forego during inflationary or recessionary milieus–make up only 18% of the company’s sales.

The company’s stock price may take a long while to return to nosebleed altitudes, but buy-and-hold and income-oriented investors can accumulate shares now and enjoy a steady, growing dividend while they wait.

Which brings us to…

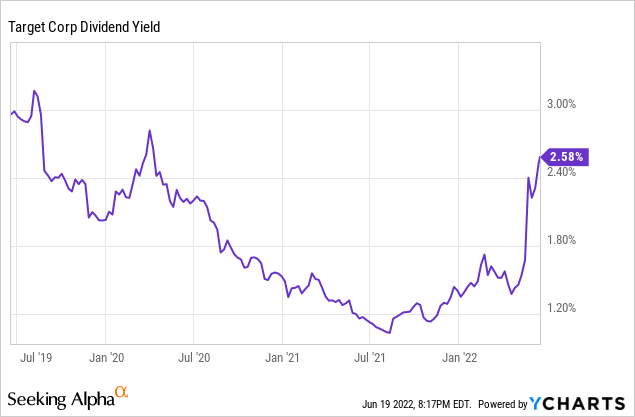

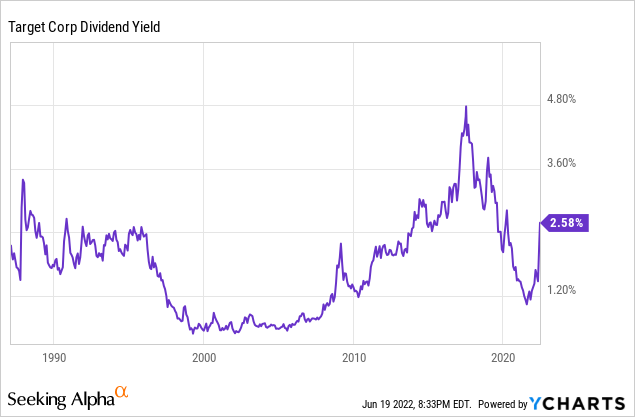

The Yield: At current prices, Target’s quarterly dividend of $0.90 per share yields nearly 2.6%, one of the stock’s best yields in the past three years:

More importantly, the company announced it will be hiking its dividend a whopping 20% to $1.08 per share beginning in September. The boost brings Target’s forward yield to 3.10%, a level it has not reached since August of 2019 and, excepting the three-year period between November 2016 and August 2019, is the stock’s highest yield over the past thirty years:

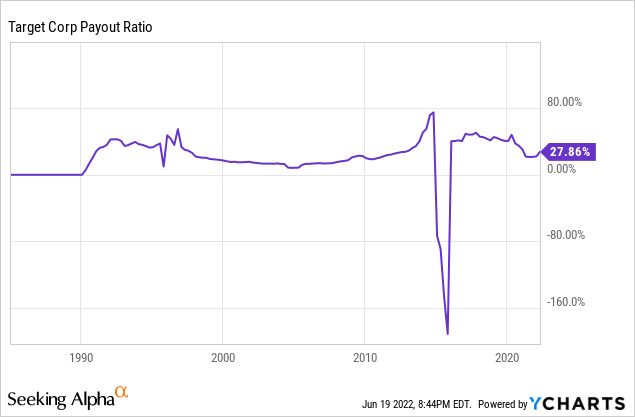

The Payout Ratio

At 27.86%, Target’s current payout ratio is well within the company’s historical range. Even with the large forthcoming dividend hike, the payout ratio remains safely within the company’s historical range:

In fact, a payout ratio hovering around 30% remains substantially lower than Target’s historical norm of around 50%. Barring some sort of cataclysmic black swan event, Target’s dividend is both well-covered and likely to continue climbing for years to come.

There Are Some Good Numbers Amid The Bad Ones

But, is Target a buy at this price point? Plenty of my fellow Seeking Alpha contributors make strong cases arguing that now is not a good time to pick up shares. Albert Lin and Ian Bezek, among others, make particularly compelling arguments to avoid Target and I strongly suggest reading their articles as a counterpoint to my own view. That said, I do not have as bleak an outlook on Target’s numbers as they do.

It is true that despite reporting 3.4% same-store sales growth in Q1 2022, comps were negative year-over-year when adjusted for inflation. Furthermore, when compared with Q1 2021’s 23% comps, the most recent quarter looks even worse.

But a few other numbers are encouraging. The company did report revenue of $25.17B, a year over year increase of 4.02%, beating estimates by $688.71M. Significantly, despite stiff competition from Amazon (AMZN) and Walmart (WMT), among others, Target has made significant strides in e-commerce with online sales responsible for $13 billion of the $28 billion dollar increase in Target’s revenue over the last two years. Importantly, in addition to the company’s growing presence in the online retail space, Target enjoyed a 4% increase in foot traffic over the past year. Even with the weight of Target’s bloated inventory dragging on earnings, the company’s updated fiscal guidance assures investors that it “continues to expect full-year revenue growth in the low- to mid-single digit range, and expects to maintain or gain market share in 2022.”

The Verdict

For investors looking for share appreciation in the short-to-medium term, I echo the cautions of my fellow Seeking Alpha contributors who rate Target a hold or even a sell. I simply do not see the stock taking off anytime soon and I would not be surprised if inventory concerns, inflation, and supply chain disruptions continue to drag on the company’s growth for the foreseeable future. However, for dividend growth investors such as myself, I do believe that Target represents a wonderful opportunity to secure a safe, growing income stream. While Target’s share price may certainly continue to drop in the short term, I would expect the strong dividend to buoy the stock as dividend investors jump in. If you’re looking for a SWAN with a robust dividend and don’t mind waiting a while for capital appreciation to kick in again, you won’t find many better companies out there.

Be the first to comment