cemagraphics

Artisan Partners Asset Management Inc. (NYSE:APAM) has positioned itself as a company focused on growth that is “careful, incremental and disciplined,” yet since May 2021, it has been treated like a high-growth tech stock by the market, plunging from approximately $57 per share on May 10, 2021, to a 52-week low of $25.66 on October 13, 2022, before jumping to about $30 per share on November 2, 2022,

Management noted that the traditional 60-40 model has been trashed this year, as both equity and fixed income assets in the third quarter were down 21 percent, resulting in a negative impact on the company; only one other time was it worse since 1900. In other words, within stocks and bonds, there were fewer safe places to invest capital. APAM is going to struggle with that if it continues to operate within the 60-40 model.

In this article I want to focus on its earnings report, economic impact on its business, the Fed’s role, and how I believe it’s going to continue to struggle at least through the end of 2023.

Long-term performance and management comments

Before getting into the numbers, it’s instructive to know that this earnings report was dominated by management philosophy and mindset toward its business model, strategy and tactics, more than it was about the numbers. It also referred to prior experience in dealing with market conditions like it has been facing.

The company also focused on long-term investing time horizons, rather than expectations concerning short-term results.

This is important to understand because if the report focused primarily on raw numbers without the commentary, the results would have lacked a framework for shareholders and potential investors to take into consideration when considering entering a new position, or adding to an existing one. That’s especially true when considering you could go back to the latter part of 2016 and the share price of the company would be close to where it’s trading at today.

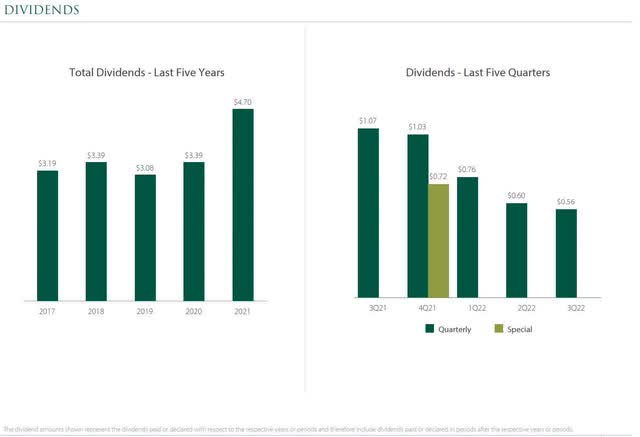

With that in mind, there would only be one reason to take a position in APAM, and that is for income. That isn’t necessarily a bad thing, as at the price it’s trading at this time, the current dividend pays out $0.56; not bad, but it has almost been cut in half from the quarterly dividend of $1.07 in 3Q 2021. With little or no share price growth over the years, and a declining dividend, the reasons to take a position in APAM are diminishing.

Company Presentation

Over a prolonged period of time, you want to see the share price move in at least an incremental upward trajectory. Over that ten years, APAM hasn’t been able to achieve that. So, even with its “thoughtful” investing strategy, it hasn’t resulted in share price growth, on average, over the last 10 years.

Latest numbers

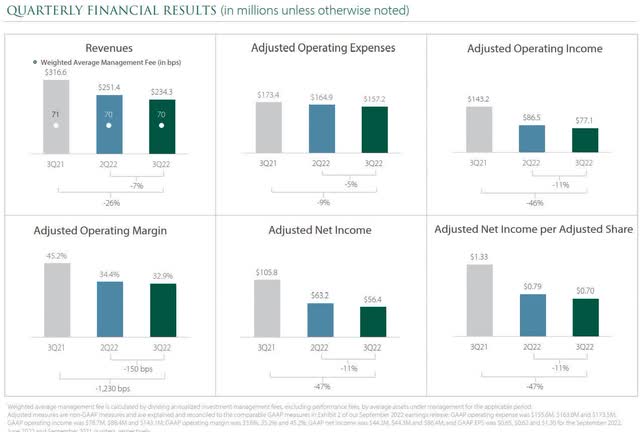

Revenue in the third quarter was $234.3 million, down 26 percent from the $316.6 million generated in the third quarter of 2021, and 7 percent down from $251.4 million of revenue in the prior quarter.

Adjusted net income in the reporting period was $56.4 million, or $0.70 per share, compared to $105.8 million, or $1.38 per share year-over-year, down 47 percent. It was 11 percent down from the $63.2 million, or $0.79 per share in adjusted income for the second quarter.

Adjusted operating margin was 32.9 percent in Q3, compared to 45.2 percent last year in Q3, and 34.4 percent in Q2 2022.

Company presentation

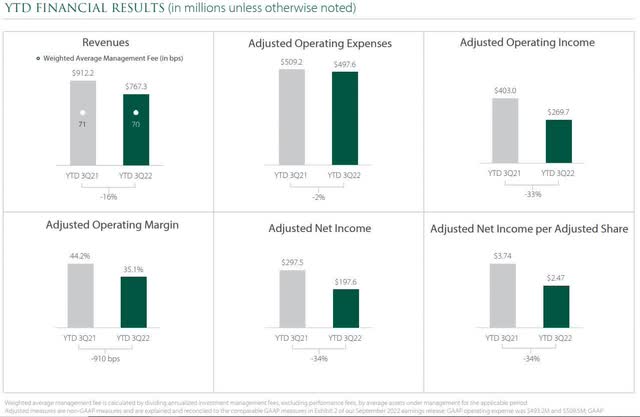

On a YTD basis, revenue is at $767 million, down 16 percent from the $912.2 million in revenue through the third quarter of 2021.

Adjusted net income YTD is $197.6 million, or $2.47 per share, down 34 percent from 2021’s YTD net income of $297.5 million, or $3.74 per share, through the third quarter.

Adjusted operating income YTD is $269.7 million, while last year YTD it was $403.0 million.

Company presentation

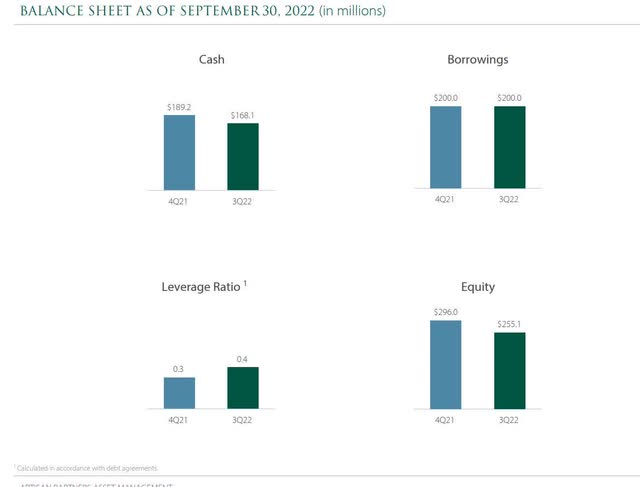

APAM held $168.1 million in cash at the end of the reporting period, in comparison to the $189.2 million in cash held as of 4Q 2021. The company also extended its unused portion of its revolving credit facility for an additional five years.

Company Presentation

Near-term outlook

As with many other companies, APAM is going to be under pressure for the rest of 2022, and at least the first half of 2023. The depth of its struggles will be determined by how much more damage is done to the 60-40 investing model that is getting crushed at this time.

The other major factor is inflation and the response of the Federal Reserve to it if it continues to remain stubbornly high. It is my belief that the Fed won’t be able to boost interest rates much past the 5 percent before it has a material impact on the ability of the U.S. to pay down the $31 trillion in debt it has.

Powell has been talking with conviction recently concerning attacking inflation with higher interest rates, but if the Federal government is revealed as being in danger of not being able to pay on its obligations, the pressure on Powell to relent will be extraordinary.

Until proven different, I’m modeling a 5 percent interest rate, or possibly slightly higher, as the top the Fed will be able to implement before it wreaks havoc on the government, the economy, and the markets.

So while the upside is probably limited, there are at least two more interest hikes in the near future, and those will have a negative impact on stocks and bonds, as it has been for some time now. That in turn will put further downward pressure on the performance of APAM for the rest of the year, and into the first half of 2023.

Long-term outlook

The company noted in its earnings report that it has a proven history of rebounding after economic times like this. Even though that’s provable, investors still have to take into account the fact that it comes after a big hit to the share price of the company, and many times it’s simply returning to its prior levels, or temporarily getting a boost beyond its recent ceiling.

There’s no way of knowing how long this recession will last, or what the Federal Reserve will ultimately do, but we do know any type of recovery will take time, and won’t sustainably proceed until the Fed shows it is pivoting. At that time, APAM will enjoy a period of improved performance, as will most of its peers.

Conclusion

APAM is an income stock that shouldn’t be acquired for any other reason. As the numbers show in its recent earnings report and some before it, the weak economy and effect of higher interest rates from rising inflation, has forced the company to trim its dividend for several quarters. While it’s still offering a decent yield, that, without a doubt in my mind, will continue to be cut until the economy starts to turn around. It’s highly possible that it won’t happen until the middle of 2023 at the earliest, and more likely the latter part of the year, before convincing improvement bolsters market sentiment.

I don’t see APAM as being an unsafe company, but it’s probably better to remain in cash and wait for further stock erosion than be hasty to take a position. I can see nothing that would justify the idea that things are going to turn around for the company by the end of this year or early 2023.

The only catalyst that could do that would be if inflation dropped precipitously and money poured back into stocks. It’s a possibility, but the percentages are very low. Under that scenario, investors interested in APAM would kick themselves for not taking a position.

For that reason, if investors believe that that possibility is legitimate, then dollar-cost averaging with modest position sizing is the way to take a position. That way, both sides of the play are covered.

However, I don’t think that’s how it’ll play out, so being patient and getting a better price and dividend yield makes sense to me.

Be the first to comment