Kevin Dietsch

Thesis

Meta Platform, Inc. (NASDAQ:META) stock behaved like a pandemic boom-and-bust story as it posted a YTD decline of more than 70%. Considering the decline from its September 2021 highs, the compression reached more than 76% over the past year.

Meta bulls like us have failed to justify why investors should continue believing in CEO Mark Zuckerberg & team as Meta undergoes its most critical transition to short-format monetization, coupled with its metaverse investments.

Honestly, we didn’t expect the market would de-rate META to such an extent, as investors lost confidence in Zuckerberg’s metaverse pivot. However, while its Family of Apps core business continues to see strong engagement, it’s unquestionable that revenue growth has slowed significantly.

Coupled with significant macro and forex headwinds impacting the ad industry, Meta investors are left pondering whether META could even retake its September 2021 highs over the next five years.

Our analysis suggests that the market has gotten the de-rating spot on. Meta’s topline growth was already slowing before the unsustainable pandemic surge lifted the company’s confidence. Coupled with Apple’s (AAPL) App Tracking Transparency (ATT) implementation, Meta is compelled to make expensive AI-related investments to drive growth and mitigate the impact on its competitive moat. Also, Zuckerberg’s unflinching commitment to his metaverse bet likely led to many investors throwing in the towel, as META traded near levels last seen in January 2016.

We discuss why META, while battered, is now a value stock. It’s still expected to be profitable, but investors need to be cautious about the recovery of its topline growth rates.

Also, we gleaned that Street analysts have turned increasingly pessimistic as they slashed Meta’s forward estimates and downgraded their ratings. We also highlight why META’s price action since September indicated that sellers were in a hurry to unload their positions. As such, we observed that META’s near-term downside risk has likely subsided.

Hence, we believe a counter-trend opportunity is possible for nimble investors considering leveraging extreme pessimism to add exposure.

Maintain Buy, with a price target of $120 (implying a potential upside of 32%).

Why Has Zuckerberg Not Caved In?

Zuckerberg has steadfastly held on to his beliefs in the metaverse and is convinced that’s Meta’s future. To say that he did not provide sufficient clues to investors is an understatement.

What’s the company’s name now? Meta Platforms. Sure, the company’s operating performance and valuation are still held on by its fast-slowing ad business, worsened by TikTok’s (BDNCE) competition and ad signals losses from Apple’s ATT.

But, Zuckerberg had never wavered even when Menlo Park-headquartered Altimeter Capital fired an open letter to Zuckerberg on “getting fit.” Altimeter CEO Brad Gerstner articulated:

Meta has drifted into the land of excess — too many people, too many ideas, too little urgency. This lack of focus and fitness is obscured when growth is easy but deadly when growth slows and technology changes. – Brad Gerstner Medium blog

However, investors expecting Zuckerberg to change its strategic focus got a rude shock during Meta’s Q3 earnings call. The company demonstrated its resolve to the company’s doubters by telegraphing even more spending to its metaverse game. Zuckerberg also accentuated:

A lot of this is just you can build new and innovative things when you control more of the stack yourself. And you can start to experience that with Quest Pro, which is out now. And it’s just not clear if we weren’t driving this forward that anyone else would be. So I think that, that sort of integration and innovation is really helpful. None of the indications that I have would suggest that anyone else in the world is doing leading work ahead of us in those areas, even though we have not obviously shipped the AR glasses yet. I get that a lot of people might disagree with this investment. But from what I can tell, I think that this is going to be a very important thing, and I think it would be a mistake for us to not focus on any of these areas, which I think are going to be fundamentally important to the future. (Meta FQ3’22 earnings call)

Don’t expect Zuckerberg to give up now. The Information highlighted in an article in late September that Meta could spend much more in CapEx than many of its closest peers’ combined through 2026. So Zuckerberg is telling investors that he is not reversing his direction and will keep moving forward whether they like it or not. So either you are on board, or you can disembark.

Zuckerberg really believes that Meta needs to define this “next computing platform” ahead of Apple. He really believes that Meta’s spending and commitment have given it an edge that Apple will not be able to overtake moving forward, even in the field of AR.

Meta believes these technologies are closely intertwined. Therefore, investors expecting Zuckerberg to stop now fail to understand the level of his conviction. He believes that Meta’s future and competitiveness are predicated on beating its closest peers to building out its metaverse technologies.

Zuckerberg also highlighted his conviction in a recent interview held before Meta’s earnings release with Stratechery and Microsoft (MSFT) CEO Satya Nadella. He articulated:

Is this going to be a big thing? I’m highly confident it will be a big thing. Timing I think is harder to predict but the thing that I feel pretty confident about is that if you look at the other big tech companies, they typically have decades of building out their own operating systems and this kind of computing platform infrastructure, they just have a lot of other technology to bring to bear. Which I think means that if we develop this at the same time as an Apple or a Google or an Amazon, then there are a lot of advantages that they might have. So on timing what that suggests to me is we need to be on the early edge of this, not the late edge or showing up at the same time if we want to help push this forward and really help to shape what the standards are. – Stratechery

Also, Zuckerberg doesn’t have to cave in. Remember, Tesla (TSLA) CEO Elon Musk highlighted that Meta has a “share ownership structure that will have Mark Zuckerberg the 14th still controlling those entities.”

Hence, with Zuckerberg’s outsized voting rights giving him “unquestioned power,” investors can’t force Zuckerberg out so easily. And it doesn’t appear that the Board is giving him any no-confidence vote, even as investors seemed less convinced after Meta’s Q3 earnings. Chief funding officer for US development at AllianceBernstein (AB) Jim Tierney, a Meta investor, highlighted:

Follow-up meetings [after Meta’s earnings] made people “more disgusted, not less disgusted. They’re spending $15 billion a year on the metaverse and they can’t give us any mile-markers. It’s just a big hope.” – Insider

Is META Stock A Buy, Sell, Or Hold?

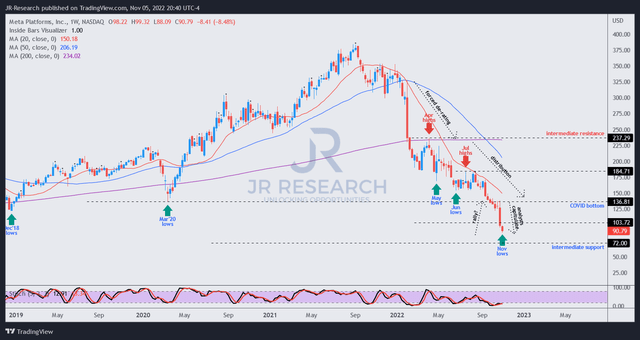

META price chart (weekly) (TradingView)

Our analysis shows that investors who wanted to leave early in the game have done so in early 2022 (see forced de-rating above). The market clearly de-rated META as it rejected buyers’ attempt to retake its 200-week moving average (purple line) in April.

Therefore, it suggested that the market is not convinced by Zuckerberg’s expensive and ambitious pivot (at its valuations then), with sellers using rallies to disembark, pressuring META’s momentum down further.

From April to October (pre-earnings), the price action continued to distribute with sellers in complete control, as META couldn’t retake its pivotal 20-week moving average (red line). As a result, sellers again used any attempt to rally to get out. However, no capitulation attempt was seen as compared to earlier in the year, suggesting sellers were not in a hurry to unload.

However, we gleaned that a potential mean reversion opportunity appeared after its Q3 call.

Investors appeared to have bailed out in a hurry, and the price action has fallen way below its 20-week moving average. But remember, nothing sinks in a straight line.

Some investors could point out that META couldn’t recover its upside bias in early 2022, even after the initial capitulation. That’s correct, but META last traded at an NTM EBITDA of 4.9x, well below its peers’ median of 8.4x (according to S&P Cap IQ data). Also, its NTM P/E of 12.6x is well below the S&P 500’s (SPX) (SP500) forward P/E of about 16x. It’s well below the levels in early 2022, with META significantly de-rated.

Hence, we believe a counter-trend opportunity seems appropriate for nimble investors. Maintain Buy with a PT of $120.

Be the first to comment