Inna Dodor/iStock via Getty Images

Back in January, I published my first analysis of Artisan Partners (NYSE:APAM), a comparatively small asset management firm that provides a broad range of high value-added investment strategies to its clients throughout the world. I provided a general overview of the company, highlighting a possible misconception related to APAM’s apparent dilution behavior, and discussed its profitability in comparison to a number of other investment managers.

In this follow-up article, I would like to share with you why I believe the stock has underperformed the broader market in general, and other investment managers in particular. Also, I will explain why I remain bullish, even though it is very well possible that Artisan will rebase its dividend.

APAM is an income-generating stock and priced accordingly

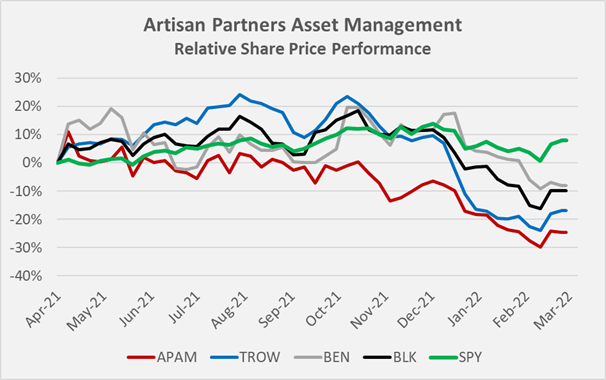

Naturally, most all of APAM’s revenues are derived from investment management agreements, according to which the fees are generally tied to the value of the company’s assets under management (AUM) and the agreed-upon fee rate. A negligible amount (i.e., 1% of 2021 total revenues) of the company’s revenues is performance-related. Nevertheless, if Artisan’s AUM decline as a result of stock and bond market depreciation, the company’s revenues and consequently also net income and free cash flow will decline. This is the main risk underlying an investment in an asset management firm and the broader market has obviously begun to price in a decline in overall valuations, as can be noticed from the relative underperformance of asset managers compared to the SPDR S&P 500 ETF Trust (SPY) in Figure 1. Small asset managers, such as APAM, have underperformed larger asset managers such as BlackRock (BLK), T. Rowe Price (TROW, see my recent article) and Franklin Resources (BEN, see my recent article). This appears comprehensible since larger firms typically benefit from economies of scale and have also, especially as it pertains to BLK, adopted low-cost investment vehicles such as index-tracking exchange-traded funds.

Figure 1: Relative performance of selected asset management firms and the SPDR S&P 500 ETF Trust (own work, based on weekly closing share prices)

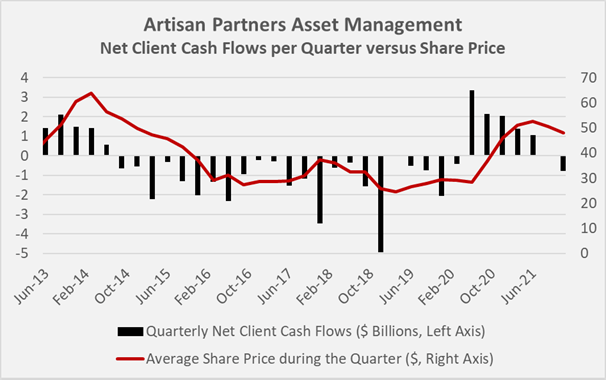

Besides these factors, APAM’s comparatively pronounced decline in share price is in part attributable to the strong performance in late 2020 and the first half of 2021. During that time, the company reported – for the first time since mid-2014 – net cash inflows from clients, and quite significant ones at that. In Figure 2, you can see a plot of APAM’s quarterly cash flows from clients. Notably, the share price (red line in the graph) tracks APAM’s reported client cash flows pretty well.

Figure 2: APAM’s net client cash flows per quarter, in relation to the average share price observed during the period (own work, based on the company’s 2013 to 2021 10-Qs and 10-Ks and APAM’s weekly closing share price)

Another reason for the decline could be seen in the decline of APAM’s fee rate from 76 basis points in 2013 to 71 basis points in 2021. However, it should be kept in mind that the company managed to maintain operating profitability at around 40-44% of revenues, offsetting the likely intentional rebasing of their fee structure. The decline in fee rate made the company more competitive and also dampens the dependence of APAM’s top-line on market declines.

I view APAM as an income-generating stock and my investment thesis is almost exclusively based on the expectation that Artisan continues to pay out a sizable dividend.

In this context, it is important to note that the interests of management, employees and partners are naturally aligned with those of other shareholders, since employee stock grants play a significant role in the compensation structure, and the company’s dividend policy is to return most of the cash generated to the owners. To further substantiate this point, it is important to review the behavior of executives with regard to the possible sale of company stock. APAM’s form 4 filings with the SEC show that on a net basis, insiders and 10%+ owners sold $241 million worth of stock since the company went public in 2013. This appears concerning at first sight but it should be noted that the private equity firm Hellman & Friedman LLC sold $1.8 million shares in mid-2014, worth more than $100 million at that time. In mid- to late-2014, director Trench Coxe sold over 1 million shares for almost $60 million but has repurchased almost 500k shares in early 2020 and mid- to late 2021. Other directors, such as Stephanie Dimarco and Seth Brennan have occasionally purchased shares as well. More importantly, I only noticed five transactions from company executives, namely one (immaterial) buying transaction by EVP, CFO and Treasurer Charles Daley, two sale transactions by him ($1.3 million in total, see here and here) and two sale transactions by EVP Jason Gottlieb ($0.7 million in total, see here and here). Hence, it can be concluded that while insiders were net sellers of company stock, the transactions do only relate to a very small extent to company executives and I believe that APAM’s management, employees and partners remain strongly aligned with common shareholders.

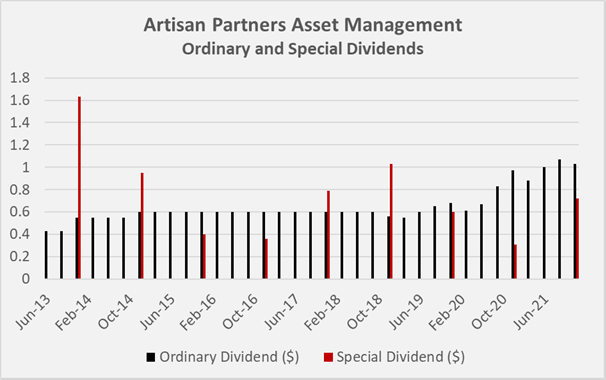

Consequently, not only ordinary shareholders like myself, but also employees and partners of the company count on a robust payout. Besides the sizable quarterly dividend, owners expect APAM to pay out remaining cash from operations after the release of the full-year earnings. For 2021, the company declared a special annual dividend of $0.72 in addition to the regular quarterly dividend of $1.03. A graphical representation of the company’s historic payments is shown in Figure 3, which also illustrates the change in dividend policy, i.e., prioritizing quarterly payments and hence resulting in a comparatively smaller special dividend at the end of the year, against the backdrop of very solid earnings in 2020 and 2021.

Figure 3: APAM’s historical dividend payout (own work, based on the data published on the company’s website)

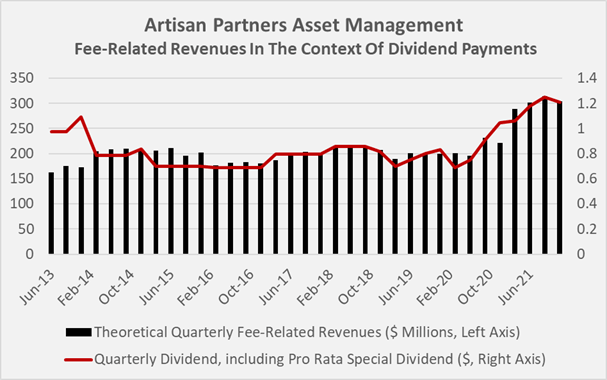

Adding the special dividend to the quarterly payments on a pro rata basis yields a more normalized view on the payout, suggesting that the company’s payout is closely tied to the amount of fee-related revenues and hence very sensitive to stock market gyrations (Figure 4). In this context, the operating leverage of the company should also be considered, amplifying the potential decline in net earnings and cash flows, even though the cost structure of the company remains largely variable.

Figure 4: APAM’s historical dividend payout on a normalized basis, compared to quarterly fee-related revenues, that were obtained by multiplying the average assets under management per quarter with the corresponding weighted-average fee in basis points (own work, based on the company’s 2013 to 2021 10-Qs and 10-Ks)

As it pertains to the special dividend, CEO Eric Colson indicated that the payout could be reduced as required, in order to fund the company’s strategies announced during the FY2021 earnings call:

[…] it wouldn’t be unrealistic to think that we would eat into the special, as we have done on several occasions to see products.

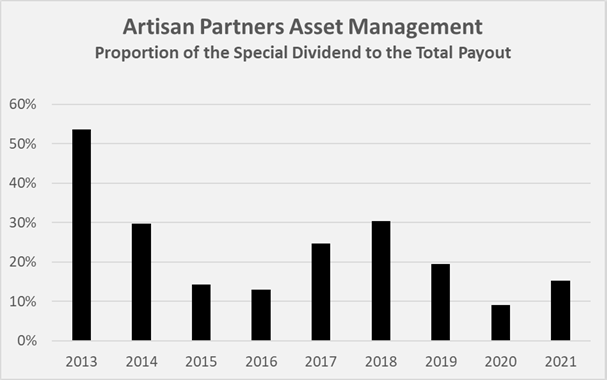

However, it is hypothesized that another reason for the relatively pronounced decline in share price is related to the market participants’ expectation of also the ordinary dividend being cut. This does not appear overly unrealistic, considering the high payout ratio (APAM typically pays out all of its excess cash) and the consequently tight linkage to fee-related revenues as shown above. Naturally, the special dividend serves as a buffer until the ordinary dividend will require rebasing. Nevertheless, due to the company’s altered dividend policy, the special dividend plays an increasingly subordinate role (see Figure 5), potentially amplifying the signaling effect of a dividend rebasement on the market participants.

Figure 5: Proportion of APAM’s special dividend to the total annual payout (own work, based on the company’s 2013 to 2021 10-Qs and 10-Ks)

Quick Takeaway

With a dividend yield of currently well above 10%, the shares of Artisan Partners are potentially – and in my opinion falsely – viewed as a value trap, especially in the context of the company’s potentially misunderstood dilution behavior. Investors are increasingly pricing a recession into the stock of APAM and other investment managers. A recession would certainly go in hand with declining revenues due to the associated broader stock market depreciation. However, I believe that smaller investment managers with a strong track record like APAM will be affected less severely than asset managers with a substantial exposure to passive, low-cost products.

As the company typically pays out virtually all excess cash, I believe that APAM’s payout will be rebased in the event of a broader stock market depreciation. Also, the company has announced novel investment products that require an infusion of capital.

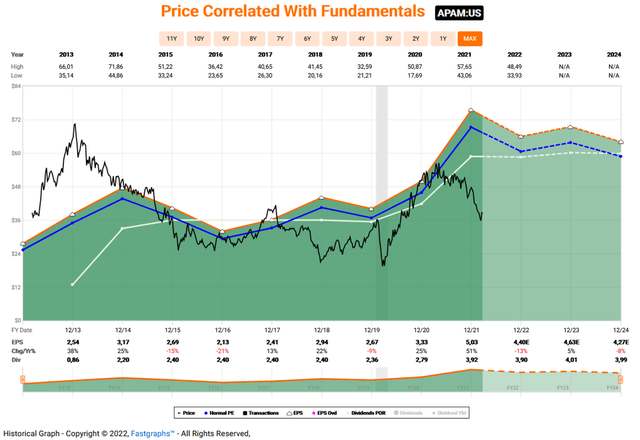

However, as the interests of APAM’s managers, employees and partners are well-aligned with those of common shareholders and the company exhibits a very strong track record, in that most of its funds outperform their respective benchmark by a significant margin, I remain confident that the payout will continue to closely track the company’s top-line, as it has done in the past. Hence, I remain bullish on the company, also since I strongly believe that active asset management firms are able to outperform the broader market especially during rough times. At a share price of $38, I consider APAM undervalued, as is also underscored by the FAST Graphs chart shown below.

Figure 6: APAM’s FAST Graphs chart, based on adjusted operating earnings (obtained with permission from FAST Graphs)

Be the first to comment