Nikada/E+ via Getty Images

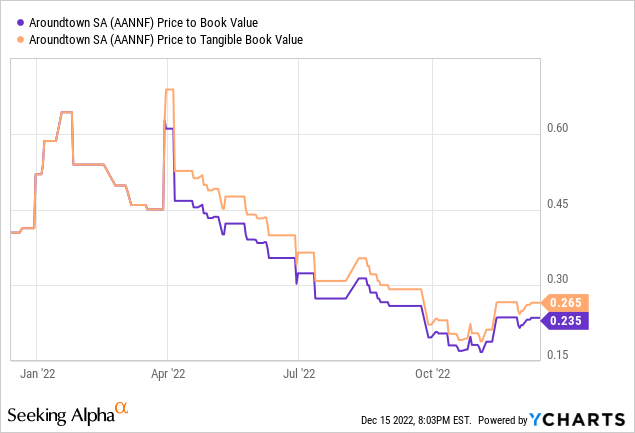

Amid a major interest rate shock, double digits % inflation, and a looming recession, German property bellwether Aroundtown SA (OTCPK:AANNF) has suffered significant drawdowns in its market cap YTD. With Aroundtown trading at a 70-80% discount to book and tangible book, though, the selloff has likely moved the stock into deep value territory. The Fed’s recent decision to slow rate hikes bodes well for a confidence return sooner rather than later, though management will still need to navigate a pending economic recession. The key, in my view, lies in the company’s ability to weather the storm without incurring an equity dilution event. Given the strong liquidity position, robust asset disposal pipeline, and the clear preference for equity over debt holders (as evidenced by the recent coupon deferral), I think investor concerns might be overblown at this point.

Better-Than-Expected Operational Update Highlights Resilience

Aroundtown’s update for Q3 2022 saw stronger numbers across the board. On the hotel side, the rent collection guidance has been revised upward to the 65%-70% range for FY22 (up from 60-70% previously). While profitability hasn’t fully recovered from the COVID impact, the silver lining is that leisure travel is now back to pre-COVID levels, offsetting any lingering business travel weakness on the path to a full recovery by FY24. A key source of the outperformance has been the company’s predominantly fixed rental lease contribution. By comparison, closest peer Covivio (OTCPK:GSEFF) runs half of its portfolio on variable leases or management contracts, which entails a more volatile revenue stream. Similarly, on the office side, Aroundtown has structured its leases as inflation-linked, allowing it to pass on inflation to tenants contractually. So while the company isn’t immune to cost-cutting throughout the industry, it does have some insulation from near-term macro volatility.

Meanwhile, the lack of development exposure presents another key source of through-cycle resilience, insulating Aroundtown against ongoing material cost inflation. With plans to dispose of further development rights as well, the disciplined focus on portfolio management could pay off in a potential downturn. Also helping is the German government’s announcement of direct support and the proposed price cap through April 2024. Given Aroundtown had built in a ~EUR25m provision against the impact of rising energy prices, there could be some upward revisions here. Beyond the macro/industry trends, there also remains upside on the execution side. In particular, management’s progress in reverting to the historical 100% cash collection rate, having allowed for some lease variability during COVID, could unlock incremental earnings.

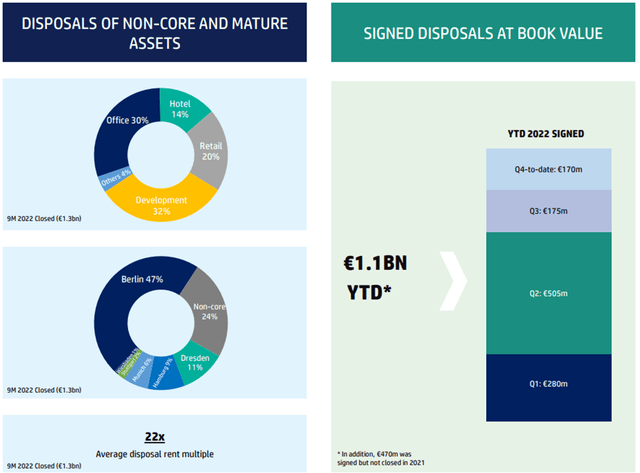

A Comfortable Liquidity Position

The funding environment is getting more challenging, and thus, the company’s decision to slow down the pace of buybacks for Q3 was a prudent one. Yet, supported by the disposal of properties, the current liquidity position remains strong. Per management, there remains a long list of asset disposal deals in the pipeline. This excludes signed but unclosed deals for the year; however, if we were to include these deals, the liquidity would be sufficient to cover debt maturities through 2025. Thus far, execution has been good – asset sales were completed at an ~22x average exit multiple, an excellent outcome given the backdrop of property price declines and rising rates.

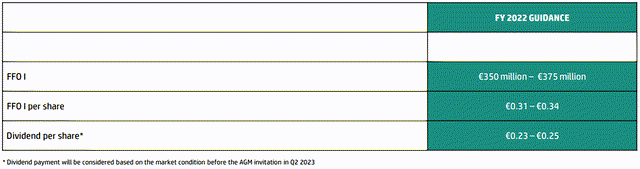

All in all, a comfortable position, and thus, the company can afford to be opportunistic in this regard. No update on the dividend, though, as management reiterated that its dividend policy remains subject to market conditions. A final call on dividend payouts is set to take place in the middle of next year, with current FY22 guidance calling for a EUR0.23-0.25/share range or an implied ~10% yield at the upper end.

Coupon Deferral Highlights Equity Preference

Alongside the update, management also disclosed its decision not to exercise its option to call its Jan 2023 hybrids and will instead defer coupon payments. In line with this decision, Aroundtown will also keep perpetual notes as part of its long-term capital structure, allowing for these to be accounted for as full equity in future covenant calculations. Of note, this contrasts with the company’s equity-friendly distributions of >EUR450m YTD (comprising >EUR200m in share buybacks and the remainder in dividends to common shareholders and non-controlling interests). So while the “cash conservation” rationale might make sense given the current backdrop, the decision to forego the upcoming ~EUR14m coupon payable on the 3.75% note might not sit well with creditors.

More broadly, management is favoring the interests of shareholders over bondholders. On the one hand, this could raise credit concerns down the line, likely in the form of higher debt financing costs. Yet, commentary from ratings agency S&P contrasts this view – per the Q3 presentation, such decisions are “credit supportive, economically rational financing decisions. We expect the reputational impact to be short-lived.” I’m not entirely convinced by this view; however, the benefits of extending the hybrids and deferring the coupon to conserve cash to senior debtholders could outweigh the impact elsewhere in the capital structure.

Entering Deep Value Territory

All in all, the latest operational update from Aroundtown indicates things are holding up well. Yet, the stock continues to trade at a record discount to book/tangible book based on trailing numbers and FY22 guidance. While a potential recession next year is a concern, along with record inflation rates in the EU, the strong liquidity position should mitigate any concerns around access to capital going forward. At current levels, a significant decline in property prices has already been priced in, and with the Fed already slowing its pace of rate hikes, the stock looks primed for a re-rating.

Be the first to comment