Cristina Ionescu/iStock Editorial via Getty Images

Introduction

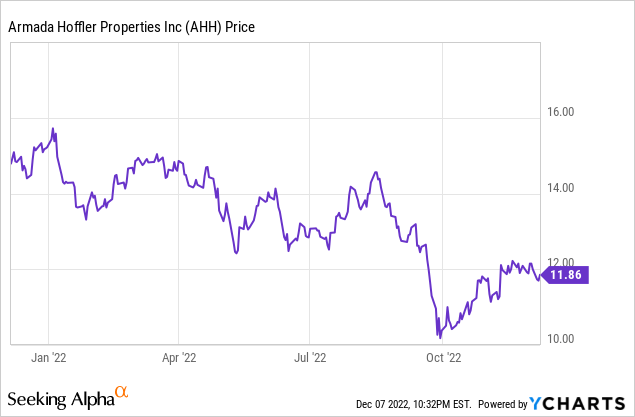

I have only kept an eye on Armada Hoffler Properties (NYSE:AHH) from a distance in the past few years but now the preferred shares are trading below $21, I wanted to have a closer look at this REIT from the perspective of a preferred share investor. In this article, I will mainly zoom in on the risk/reward ratio of the preferred shares and as such, I will not provide an in-depth overview of the REIT. I can strongly recommend to read a recent article of Paul Drake on AHH which contains plenty of background information.

The FFO result was very satisfying in Q3 and 9M 2022

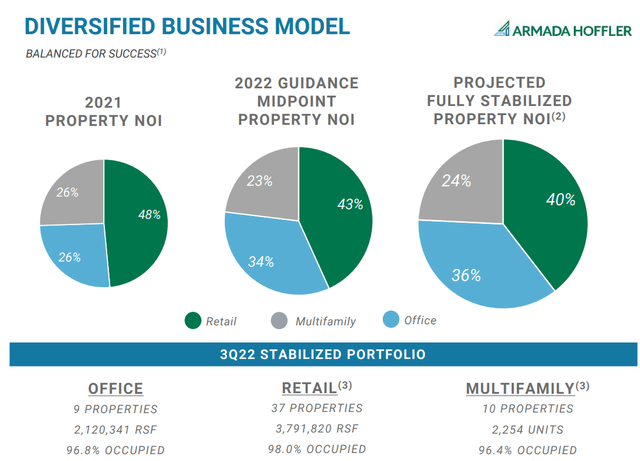

The REIT focus on three specific types of assets: retail, office and multifamily properties. That’s a very strange combination for a REIT as you rarely see a focus on these thee subcategories within one entity.

Armada Hoffler Investor Relations

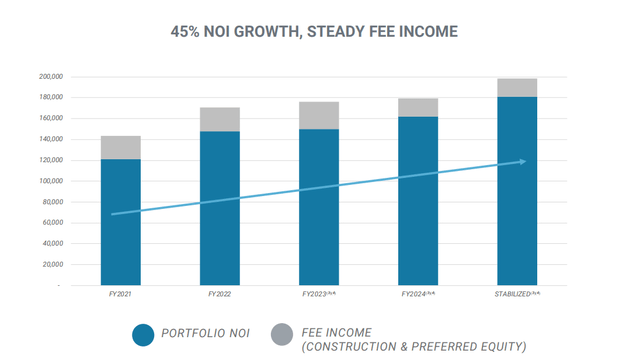

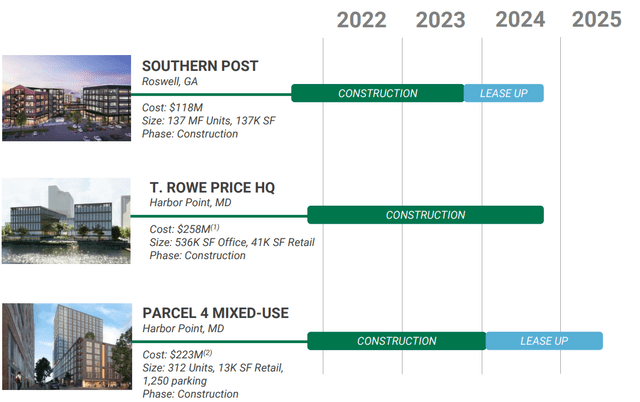

An additional bonus is that the REIT is self-managed and vertically integrated: it doesn’t just own and lease buildings, it also constructs and develops buildings either for its own portfolio or for third parties and this fee-based income provides a nice addition to the REIT’s performance.

Armada Hoffler Investor Relations

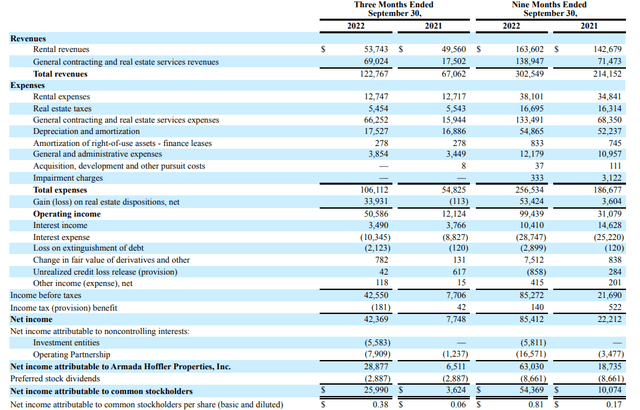

While the FFO result is obviously more important for a REIT than its reported net income, I think it’s also important to have a look at the income statement as it explains how the net income – which is the starting point of the FFO calculation – was derived.

Armada reported a total revenue of just under $123M, but as you can see in the image below, almost 60% of the revenue was generated by fee-related revenue and Armada generated a margin of approximately $3M on these activities in the third quarter.

The operating income of in excess of $50M was attractive, and the bottom line showed a net income of $42.3M of which about $28.9M was attributable to the equity holders of Armada Hoffler Properties.

Armada Hoffler Investor Relations

As you can see above, the total cost of the preferred dividends was just under $2.9M resulting in a net income attributable to the common shareholders of Armada of approximately $26M which works out to $0.38 per share. The total EPS in the first nine months of the year was $0.81.

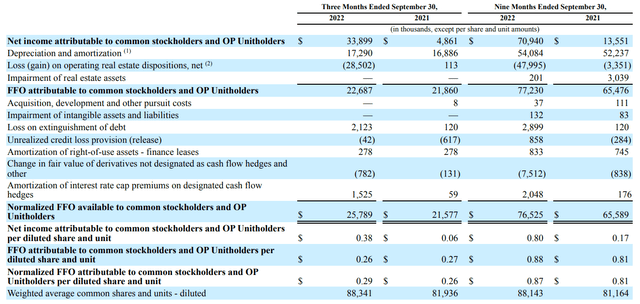

The EPS is interesting but as AHH is a REIT, the FFO per share is a more important metric. As you can see below, the starting point of the FFO calculation is the $33.9M net income attributable to the common equity owners and the operating partner owners at Armada. This starting point already includes the $2.9M in preferred dividend payments, and that’s an important element to remember to discuss the safety and coverage levels of the preferred dividend.

Armada Hoffler Investor Relations

The FFO came in at $22.7M but more importantly, the normalized FFO was $25.8M. The normalized FFO is higher because it excludes a few non-recurring items like the loss on the debt extinguishment and the impact of certain hedges. The normalized FFO per share was $0.29 which is very much in line with the performance in the past few quarters.

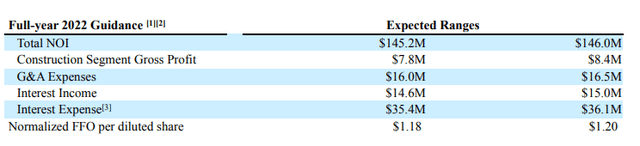

And there’s more to come: in its full-year outlook, Armada Hoffler now confirmed it expects a full-year normalized FFO per share of $1.18- 1.20. This implies the normalized FFO per share in the final quarter of this year will be $0.31-0.33 and this should pave the way for Armada to aim for $1.25 per share in normalized FFO from next year on.

Armada Hoffler Investor Relations

The preferred shares offer an attractive risk/reward ratio

The strong performance of Armada Hoffler Properties is good news for the preferred shareholders. Armada only has one issue of preferred shares currently outstanding and that’s the A-Series trading with (NYSE:AHH.PA) as ticker symbol. These preferred shares have a fixed preferred dividend of 6.75% based on the $25 principal value of the preferred security and this works out to $1.6875 paid per share in four quarterly installments of $0.421875. These securities can be called by Armada from June 2024 on. As AHH.PA is now trading at less than $21/share, the preferred dividend yield now exceeds 8%.

That’s attractive, but we obviously need to make sure Armada can continue to cove these preferred dividends. We have already established Armada generated a normalized FFO of $25.8M in the third quarter, and that this already included almost $3M in preferred dividend payments. This means Armada only needs just about 10% of its pre-dividend FFO to cover the preferred dividends. This coverage ratio of almost 1,000%. That’s good.

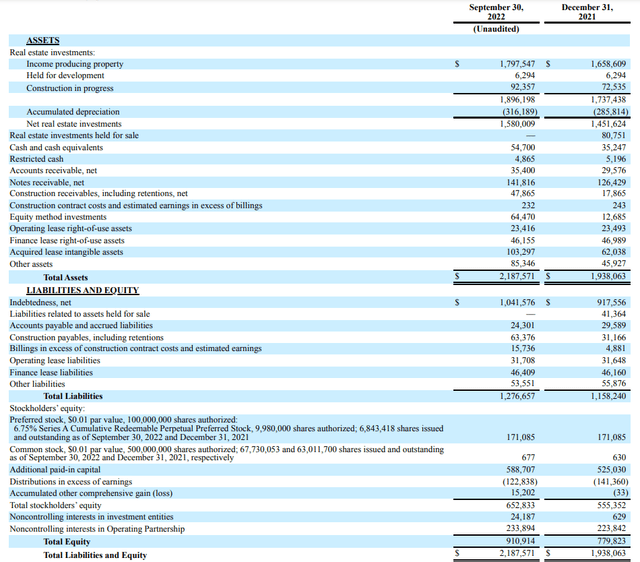

The second portion of my litmus test is the asset coverage ratio. As of the end of September, the total equity value on the balance sheet was $653M. There were about 6.84 million preferred shares outstanding which means the preferred equity represents $171M of the total equity. This means there’s about $480M in common equity ranked junior to the preferred equity for an asset coverage ratio of almost 400%. That’s not very high, but it will do.

Armada Hoffler Investor Relations

Also keep in mind the book value of the assets ($1.58B) already includes in excess of $300M in accumulated depreciation. With a total expected NOI of close to $150M this year (as per Armada’s official outlook), the $1.5B book value and even the $1.8B acquisition cost is likely lower than the current market value. And the NOI will continue to increase as some of the properties under construction will start contributing as well.

That’s also why I’m not too worried about the $1B in net debt which represents an LTV ratio of in excess of 60% versus the book value. Based on the acquisition cost, the LTV ratio is just under 52% which is more reasonable although still relatively high. That’s not an issue as Armada only pays a quarterly dividend of $0.19 which means it retains about $7M per quarter or $28-30M per year in FFO which could help to keep the LTV ratio at acceptable levels.

Armada Hoffler Investor Relations

Investment thesis

I’m looking for safe yields and while you could definitely argue that the 6.5% yield on the common shares is attractive as well, I’m more interested in the preferred shares for my income portfolio where I don’t want to have my eyes glued to the screen and where a quarterly check-up on the financial health of the company is sufficient.

This doesn’t mean I’m entirely discarding Armada Hoffler’s common units and I will add them to my watch list as I’m quite charmed by the development model as well but if I’m buying anything anytime soon, it will be the preferred shares as I like the risk/reward ratio of these 8% yielders.

Be the first to comment