MF3d

I am the biggest newshound I know. Doubtless many among you think the same way about yourselves. I don’t feel prepared to trade or invest without feeling like I have a handle on the most current information. So I was frankly shocked that I learned about this very serious lawsuit against Qualcomm (NASDAQ:QCOM). In an ironic twist, it is QCOM getting sued by ARM for infringing its IP instead of QCOM bringing a suit. ARM is up in arms (sorry can’t help that) over QCOM acquiring NUVI who was developing a specialized server chip based on the ARM IP. Nuvi for some inexplicable reason had a blanket license for a specialized performance chip core that was intended for the high-performance server market. QCOM, eyeing the huge market for laptops, PCs, and Servers bought Nuvi for $1.4B with the idea of taking these leading-edge chips and disrupting the duopoly of Advanced Micro Devices (AMD), and Intel (INTC). Very telling is that one of the founders of Nuvi was the lead engineer of Apple’s (AAPL) advanced M-series chip. That M Chip shocked the competition with its clearly superior performance compared to anything AMD and INTC had for laptop chips. The issue at hand was that Nuvi was given that license because they were creating a customized 64-bit ARM processor. QCOM let it be known that it was going after that huge juicy and frankly vulnerable market opportunity for laptops instead of high-end servers. QCOM decided that using the NUVI cores allowed them the legal means to not pay ARM for that new high-performance low-power capability. Meanwhile, ARM does have a special license for high-performance chips, AAPL for instance is paying that special fee, also QCOM pays that fee right now for some other chips. Once ARM got wind of QCOM’s plans it canceled Nuvi’s license, claiming that once Nuvi was acquired, the special license was no longer valid.

A lot of what I have just recounted was reported in terse news releases the day the suit was made known. I did not see these news flashes, including the tiny Reuters entries. Even Barron’s recounted the basic outline of the suit without analyzing the ramifications. Barring QCOM from a huge multi-billion dollar chip market when QCOM is trying to grow outside the boundaries of smartphone 5G chips and IP is like burying the lede. When I say disrupt a duopoly, QCOM comes into this market with a superfast low-power chip that is as good but cheaper (because they aren’t paying for the special 64-Bit cores in this chip) than either AMD and certainly INTC. ARM without a doubt would be happy to disrupt that duopoly. Certainly, they just want to protect their intellectual property and get paid.

There is no analysis of what’s at stake for QCOM, and more importantly what it means for AMD and INTC

The market opportunity is enormous – the market just for laptop CPUs is about $100B. One could imagine QCOM capturing 3% to 5% in the first year or two, and I imagine going to +10% in 4 years. Even with QCOM’s ultra-low PE ratio of 10, that would be an additional $60B in their market cap if you assume a 60% profit. Let’s say that because of this new growth QCOM gets the PE of AMD which is 37. Even cut in half we are at about $100B additional market cap. You can quibble with my math but the general dimension of this market opportunity is hoped for by QCOM is now clear. You’d say it is impossible for QCOM to grow market share to 10% in 4 to 5 years? I suspect that AMD grew as fast in the last 5 years, though I haven’t checked. Let’s have an honest reckoning of this duopoly, AMD will likely hold its share. However, if this chip is as disruptive as it sounds, via power consumption and suitability for the laptop market likely better than AAPL’s M-Chip. I think INTC will be very vulnerable to loss of share, but even AMD’s share might be at risk. I doubt that I have to make any kind of justification regarding INTC giving up market share since it has been hemorrhaging market share to AMD for a number of years now. If you doubt that QCOM can execute, it already has ARM-based chips that are very successful with 64-Bit cores for which QCOM as I said DOES pay ARM extra royalties. Why does QCOM want to circumvent royalties in the laptop opportunity? For one, they think they can, they bought Nuvi of course for their special design capabilities and felt that their special license comes with it. I think there is another layer, keeping the cost as low as possible will allow them to capture market share all that much faster. Quick capture of market share is essential because as time goes on INTC’s comeback potential will grow. It is so important to keep costs lower that there is some speculation that QCOM will find a new chip design like the open source chip design called RISC-V. That could set them back quite a bit of time. The problem is that QCOM is used to having the upper hand in IP disputes. This time ARM is the Intellectual Property owner and is the one that is the claimant. QCOM is casting about for new ways to grow as handset growth is slowing quickly. They are endeavoring to get into car electronics, IoT, and any space that can generate enough revenue to make it worthwhile. I think I can say that the computing CPU market is the juiciest, and moving in on INTC right now is like stealing candy from a baby. There’s no doubt that QCOM will get into the server market and enjoy some pretty fat profits there as well.

So why the blackout of real commentary about the negative impact on QCOM?

Partly it is part of a quirk in how news flows to market participants. For one ARM is still a private company so its press releases have no way to reach stock market participants. Another more concerning part of this is that QCOM has made no SEC filing regarding the impact, and if you check the IR section of the Qualcomm website there is ZERO-Zilch-Nada press about the lawsuit. I would think the SEC should have something to say about this. However, QCOM’s excuse is probably that the launch is still likely to be close to Q1 2024. Perhaps a bit further out if there was no delay. Who knows, perhaps everyone expects QCOM to knuckle under. I think the culture there believes in digging and slugging it out in the courts. Also, I suspect that they really do need that lower cost, otherwise, why not make nice with ARM and move on? In the meantime, they can still find a new chip architecture to base their chip business on. They may in fact do so. In any case, I can’t imagine the SEC is going to love the fact that they buried this very material information that could stymie their growth plans. Perhaps the financial media assumes that since QCOM is obligated to file information to the SEC a material change in their future growth prospect, and since they filed nothing likely means it is nothing of importance. Ladies and Gentlemen this is clearly untrue.

When a more substantial analysis is disclosed could influence the stock price? Hard to know, it is the job of the financial media to report on what transpires between companies. Merely reporting there was a suit poorly serves the public. Instead of starting this paragraph with “When” perhaps we should start with “If”. Perhaps QCOM decides that it makes sense to start over with another chip design provider, or builds their own from scratch. Or they can stay with the current course and go with the lawsuit hoping to grab IP that might legally belong to them through Nuvi. All the while they continue building this Intel-killer and when it comes they will just open their wallet and pay the piper. A lot of this can transpire without the public ever knowing that this whole market opportunity could be going up in smoke. Clearly, this is something people should know before they invest. I actually discovered this information in an obscure electronic design newsletter, and they went right to the heart of the matter, as far as the business prospects for QCOM. If a media outlet that’s more concerned with successful electronics design and production can do so how come no financial media outlet even the ones that did note the suit make that same leap? Makes one wonder.

Now to the markets and what might transpire this coming week

To see where we are going let’s see where we were. Last week we had what one can only characterize as a “Bear Market Rally”. In this case, we were so oversold that a largely hawkish statement by Esther George, with just one mild reference to fear that the rapid tightening could hurt markets. She didn’t say that the Fed should slow down. She only said that it could affect the economy. With just that an allusion to a concern of rapid tightening, or rather the illusion of concern and more likely a mere observation caused a leap in stock prices this past week. Now with the CPI looming the bullish premise is that the CPI will be much lower than expected and that Powell will have to change his tune. If the market can get oversold, and act over-optimistically, eventually and in this case even rapidly become overbought. It would not surprise me that tonight when the Asian markets open, the Futures for the SPX and NDX will be up significantly. I think that if this continues right into Tuesday when the CPI is revealed I believe we could have a “sell on the news” event as the market seems to be on the edge of euphoria with an expected deep dive in the CPI in some areas, like food and fuel. These are not the core components and now we can understand why, as they are way more volatile than other parts. Other sectors like employment are likely not to show as much improvement since the CPI as an inflation indicator is more backward-looking (August) than the fresher numbers we have gotten recently. Rents which are dependent on a formula based on housing prices will also be more elevated than the most recent drop in home prices (last week). So it is my theory that unless the CPI really comes down, the market sells off. If CPI comes in at the expected level, I think the market falls harder and continues to fall into the FOMC meeting from Sept 20 to 21.

I kept my hedges on and I am underwater

I consider hedges to be like insurance, you accept the cost to guard against a rapid retreat. Right now, it doesn’t feel great that I am down in all of my hedges. I am willing to hold onto them going into the CPI. If the market continues to climb I will sell and take the loss. Overall, my portfolios are up nicely so it’s fine. I will likely add the hedges back going into the FOMC meeting. I won’t say the losses are eye-watering, Insurance can be expensive. Every other time in the last several months I made money with the hedges, so it all evens out.

My Trades

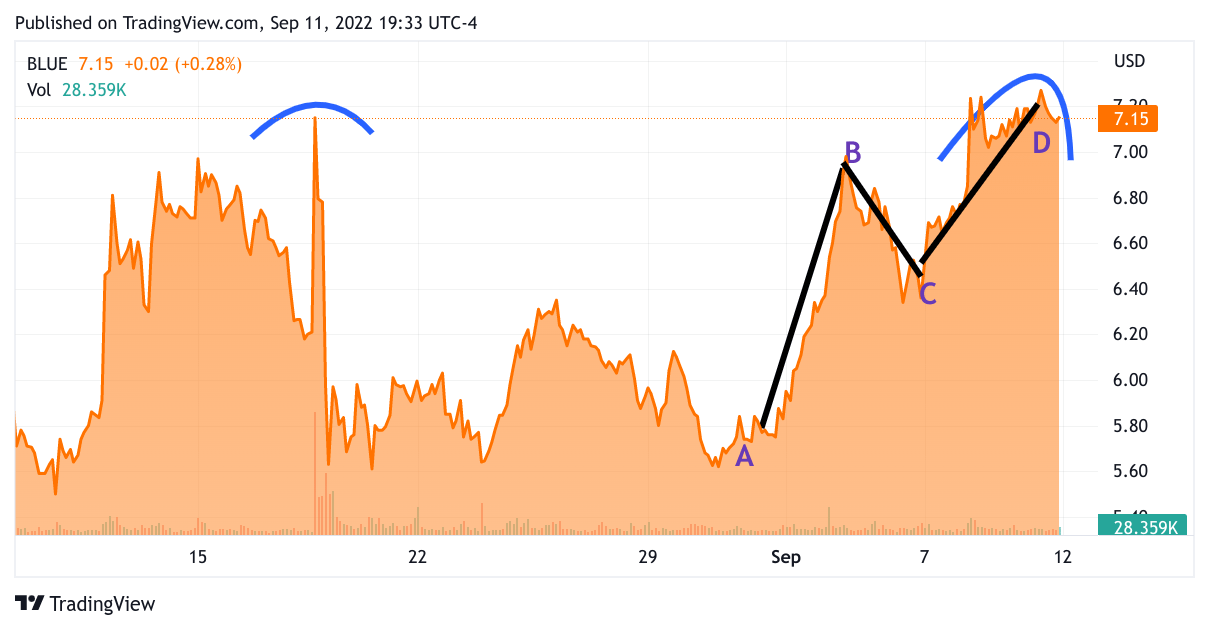

I started trimming my position in bluebird bio (BLUE) on Friday in preparation for their FDA approval later this week. The chart is telling us that BLUE may just run out of steam after the announcement. I will hold on to a bit as a longer-term slow money trade. Let me share that chart that shows you what we saw in our community “Chart Chat”.

trading view

The above is a one-month chart of BLUE. You see the 2 blue arches above two separate peaks, this denotes a double top could be forming. Then it was pointed out by one of our community members that on the right is an ABCD Fibonacci pattern which confirms the double top. They are both pointing to a downturn in the stock. So while I trimmed about 20% of BLUE on Friday, I will continue to do so into Wednesday morning.

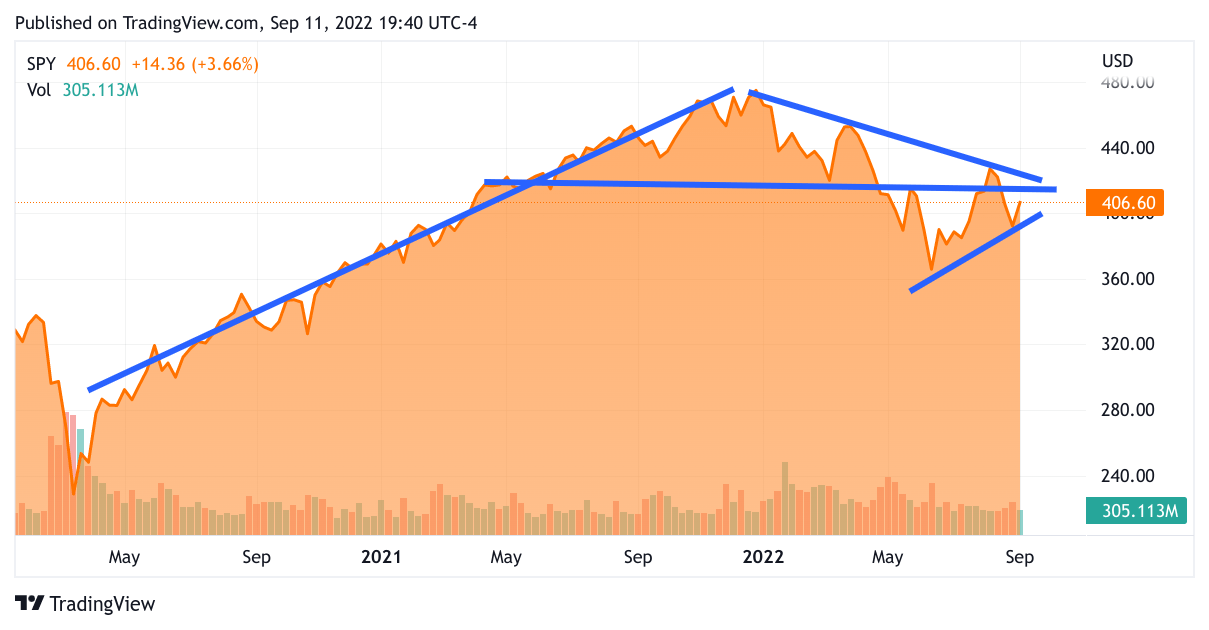

As far as the overall market I do feel that we are getting over-bought and I think this chart lays it out for you. This chart is based on the SPY ETF since I have trouble finding a chart for the SPX.

So some of the price movement has been smoothed out a bit. Hopefully, you will see what we see. Below is the 2-year chart of the SPY

tradingview

The lower blue line is the current rally, the horizontal line is where I see resistance. I just looked at the futures (8 pm) – the SPX futures are 4096 right now. Perhaps there are another 40 points of upside before the rally meets overhead resistance.

With the above as the background, I did reallocate cash to my Oil and Gas names, like Coterra (CTRA), Devon (DVN), Ovintiv (OVV), EQT (EQT), and Equinor (EQNR), also more LNG-related names like Excelerate Energy (EE), New Fortress Energy (NFE), Navigator Holdings (NVGS). I see them as a mild hedge since oil is considered to rise with inflation.

I have been placing more attention to the healthcare area, mostly with biotech names Seattle Genetics (SGEN), Sarepta (SRPT), Veeva Systems (VEEV), and a new old name Progyny (PGNY), Even though I am reducing BLUE I will keep some shares since it has a number of candidates in its pipeline.

As far as IT, software firm MongoDB (MDB) bounced up so hard that before I realized it, it didn’t make sense to buy more now. Since I expect renewed downward pressure shortly and give me better prices. The same with Snowflake (SNOW) it ran up again so fast that I would rather be patient before I start a new position in SNOW. Since I’m a glutton for punishment I did start positions in Zoom Video (ZM), PayPal (PYPL), and DocuSign (DOCU) albeit tiny starts, hopefully, the expected downdraft will give us better opportunities.

I want to take a moment to introduce a new Known Unknown: the Railroad Union is about to strike; their decision will be made known by Sept. 16. If this strike goes through it will have a huge impact on food, cars, lumber, chemicals supplies, you name it. It will have a much greater impact than the LA dock overload of several months ago. I am talking about supplies, not even the rising costs as well. Another “Known Unknown” was over $1T (yes Trillion with a “T”) in margin calls for NatGas futures as reported by EQNR. The head of the ECB just announced that it is not going to bail out the energy companies. Christine Lagarde asserted that it is up to the individual countries to bail out their individual energy companies. We seem to have a lot of hidden bombs here and there, including a reassertion of the price of oil and higher LNG pricing.

Perhaps I am talking my own book in that I am pretty hedged out, that could be coloring my view, but if not then I hope you all have cash on hand and some hedging of your own. Our community at Dual Mind is fairly well hedged and cash built up for such an eventuality. Remember it is the easiest hedge, and CASH is a value all its own. There is no rule that says an individual investor has to be fully invested at all times. In our Cash Management Discipline, we call for trimming older positions – both winning positions and losing ones. If you sell a few shares off each position, even 1 or 2 shares, over time you will have a significant pool of cash. By trimming you don’t have to worry, am I selling too soon? Did I lose so much money that I can’t sell at all? Selling a tiny bit of your losers eliminates all that emotional baggage that builds up making these decisions. We at the DMR Community have found that managing a portfolio by generating cash and reallocating at the right time is an excellent way to manage these volatile times.

With that, I wish you all much luck.

Be the first to comment