Eoneren/iStock via Getty Images

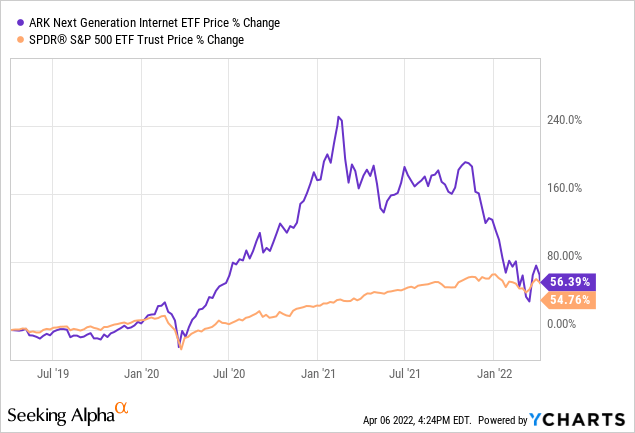

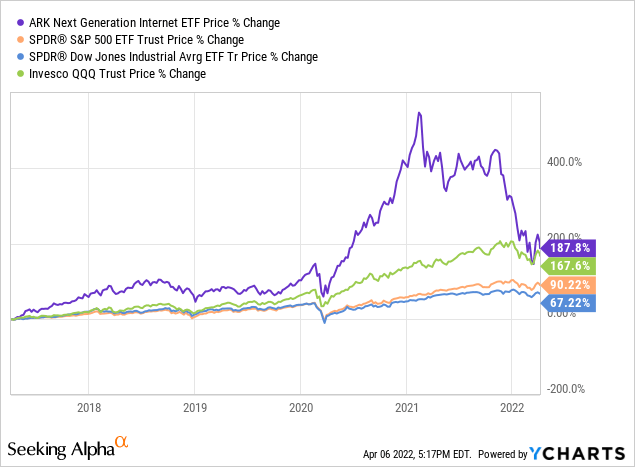

As most of you know, Cathie Wood’s high-flying ARK ETFs have been grounded by the market’s rotation out of speculative growth stocks and into more value or dividend oriented companies. With the ARK Next Generation Internet ETF’s (NYSEARCA:ARKW) big gains being more than cut-in-half since it peaked last February, over the past 3-years it has roughly mirrored the price returns of the S&P 500 as represented by the (SPY) ETF (see chart below). That being the case, is ARKW now a bargain and is it time to jump in to potentially participate in another big rally? I’ll take a fresh look at ARKW today and see if there might be reasons to allocate some capital to the fund.

Investment Thesis

In general, the ARK Invest management team tries to uncover companies that will grow at a CAGR of 15% (or more). That being the case, such a company’s stock should theoretically double every 5-years. But of course it matters exactly what is growing at 15%? Is it revenue? Free-cash-flow or EPS? If it’s just revenue, that might be a concern depending on the TAM and the investment money required to capture growth and or market share. If it’s FCF or EPS, that’s great and I’d be inclined to join the party.

Let’s take a fresh look at how the ARKW is positioned today and see if it should be considered by the ordinary investor who wants to allocate some portion of his or hers well-diversified portfolio to the “speculative growth” bucket.

Top-10 Holdings

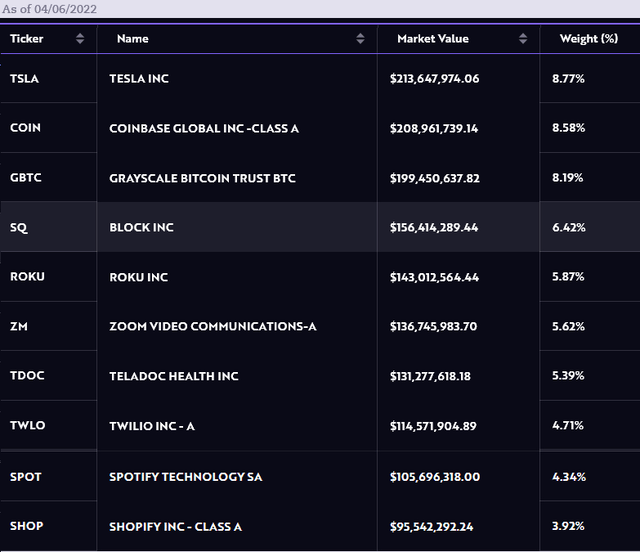

The top-10 holdings in the ARKW ETF are shown below and equate to what I consider to be a relatively concentrated 62% of the entire 37 company portfolio:

ARKW Top-10 Holdings (ARK Invest)

The good news for shareholders is that the #1 holding continues to be Tesla (TSLA) – and its stock is up 51% over the past year. Tesla recently announced it shipped 310,000 units in Q1 and the company is expected to exit the year with an exit capacity to produce 2 million units annually. In addition, prospects for another stock split recently caused the stock to rally and reclaim the $1,000 level (and then some). On the downside, there have been covid-19 related factory shut-downs in China and some are predicting lithium supply-chain issues in the near future (not necessarily for Tesla, just for the EV-market in general). Note that Tesla is solidly profitable now – delivering GAAP EPS of $2.05 in its latest quarter – a $0.24 beat.

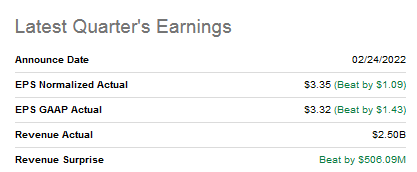

FinTech cryptocurrency infrastructure company Coinbase Global (COIN), the #2 holding with an 8.6% weight, also delivered strong quarterly results, with huge beats on both the top- and bottom-lines:

Coinbase Quarterly Earnings Summary (Seeking Alpha)

COIN currently trades with a forward of 36.4x and has a market-cap of $38.9 billion.

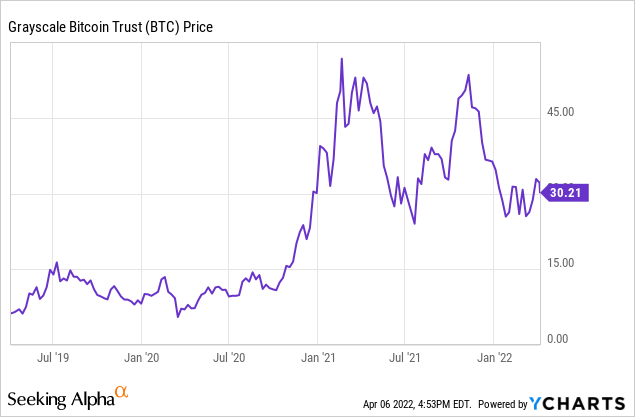

The #3 holding with an 8.4% weight is the Grayscale Bitcoin Trust (OTC:GBTC), a pure-play on the value of Bitcoin. Bitcoin broke out into a huge rally right after I wrote my first Seeking Alpha BUY article on GBTC in November of 2020 (see Bitcoin Penetrates Further Into The ‘Mainstream’ – It Should Penetrate Your Portfolio Too). However, BTC has since given up much of the gains from that initial rally and GBTC has seemed to be range bound between $25 & $50. It is currently trading toward the lower-end of that range:

It would not surprise me to see the price of Bitcoin rally again and drive GBTC back to the $45-$50 range, and that would bode well for the ARKW ETF.

Streaming platform company ROKU (ROKU) is the #5 holding with a 5.9% weight. ROKU is down 67% over the past year and according to Seeking Alpha is expected to lose $1.02/share this year. While revenue growth has been relatively strong, EPS growth has not followed.

Teladoc (TDOC), the #7 holding with a 5.4% weight, is also down 60%+ over the past year. This is another company demonstrating relatively strong revenue growth, however it too is expected to lose money this year (-$1.54/share). Teladoc provides virtual healthcare services to the global market.

The #10 holding is Shopify (SHOP) with a 3.9% weight. SHOP is profitable but Seeking Alpha assigns SHOP a Valuation Grade of D- and points out that the company has a Non-GAAP forward P/E of 180.9x while the Information Technology sector median is 19.9x.

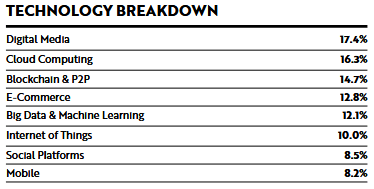

For the portfolio as a whole, as of end-of-year 2021, ARKW’s allocation to various tech sub-sectors is shown below:

ARKW Sub-Sector Allocation (ARK Invest)

One would think the ARKW managers would find a way to include mainstream, highly profitable, FCF generating giants like Google (GOOG) (GOOGL) and Apple (AAPL) into its top-10 list to counter-balance the more risky and unprofitable companies it holds. Yet that is still not the case.

Risks

The risk/reward profile of the ARKW ETF is still negative in my opinion, but not nearly as much as it was to start-off the year (-30% YTD). I like the top-three holdings in the fund, but as investors work their way down the list there are still some relative high-flyers with no real solid Google or Apple to help offset the associated risks of holding those (still unprofitable) companies.

Given the current macro environment of rising interest rates, high inflation, and the massive geopolitical risks associated with Putin’s invasion of Ukraine and the resulting economic sanctions placed on Russia by the US and its Democratic allies, the prospects for some of the riskier and unprofitable companies in the ARKW portfolio appear to be very challenging in my opinion.

Meantime, the 0.83% expense ratio is exorbitantly expensive in my opinion.

Summary & Conclusion

The ARKW ETF is getting much closer to my BUY zone than it was to start this year. However, I still find the ETF to be unnecessarily risky due to its refusal to buttress the top-10 holdings by including some solid companies like Google, Apple, or even Amazon (AMZN) – which should all qualify for inclusion into the fund – especially GOOG.

I will have to pass on the ARKW ETF for now, but I will keep my eye on it going forward and, hopefully, ARK will reduce its expense ratio to a more tolerable fee. I won’t say sell it, but it is a “weak” HOLD here.

I’ll end with a 5-year price chart of the ARKW ETF versus the broad market indexes – the S&P 500, DJIA, and Nasdaq-100 – as represented by the (SPY), (DIA), and (QQQ) ETFs, respectively, and note that despite the recent massive correction in ARKW, the ETF has still outperformed the major market indexes:

Be the first to comment