hh5800

ARK Genomic Revolution ETF (BATS:BATS:ARKG) is a wildcard of an ETF with an eclectic mix of holdings that reflect the shop’s investment approach in the same way as the other ARK funds. While its large-cap firms and breakout names provide some anchorage, the fund has high exposure to smaller biotech companies, which are arguably the most unlikely and volatile names around which to build a fund’s core. It is our opinion that a portfolio of this type, while it may produce a handful of superstars, is unlikely to provide sufficient return for the massive risk that names in this space bring to the table.

Fund Objective

ARKG targets long-term capital growth through investment in disruptive companies which stand to benefit from advancements in the “genomics revolution,” as stated in the fund title. There is little doubt that genomics and other -omics in molecular biology (e.g. – proteomics, metabolomics, metagenomics) are some of the field’s “final frontiers,” and that of those, genomics is the most mature (which isn’t saying much, as the discipline only goes back to the 80s/90s). Consequently, genomics is the most likely to be trickling down to all walks of life before too long.

How it gets there is up to interpretation. Human genomes, plant and animal genomes, even bacterial and viral “genomes” are fair game and could be realized in dozens of biotechnology businesses: medical diagnosis, therapeutic development, even advancing nascent fields like synthetic biology and metabolic engineering. Which of these are feasible, let alone profitable, is still a tall order for the average investor to identify.

The appeal of ARKG is their dedicated team braving the proverbial firehose of opportunities and investing with their trademark conviction in the names of the future. While they leave the objective open-ended to provide themselves latitude, they have identified a few solid business avenues around which the current portfolio sits, including “targeted therapeutics” and “molecular diagnostics”. From here, the “disruptor” label makes sense: invest in names that are using genomics to shake up an otherwise established business model, swiftly capturing market share and changing the space.

ARK makes it very clear that their intended investment timeline is five-plus years, and the slant of their holdings towards smaller companies definitely demands a bit more patience for revenue and profitability. Biotech is no stranger to these kinds of companies using these kinds of business models, but to load so many early-stage companies into a single fund is downright bold when long-term capital appreciation is the fund’s mission and the investor’s desire.

Holdings

The broad-sweeping, grand objective translates into a mix of holdings which is equally bold and broad. ARKG has the smallest weighted average market cap of all the actively-managed ARK funds at $8.69B as of Sep. 30, 2022, according to etf.com. Compare this average to the flagship ARK Innovation ETF’s (ARKK) average at $100.21B, driven largely by their concentrated position in Tesla (TSLA) which spills over into sibling funds ARK Autonomous Technology & Robotics ETF (ARKQ) and ARK Next Generation Internet ETF (ARKW). Positions in other large-cap companies such as Deere (DE), Alphabet (GOOG), Amazon (AMZN), Honeywell (HON) and Lockheed Martin (LMT) further inflate the averages of the sibling funds ARKQ ($143.64B), ARKW ($98.57B) and ARK Space Exploration & Innovation ETF (ARKX) ($84.38B); ARK Fintech Innovation ETF (ARKF) is the only family fund with a weighted market cap near ARKG, at $28.10B.

Starting from this high-level view, we can see that ARKG has the heaviest small-cap-tilt of the family. Currently, 25% of the portfolio is in names with a market cap of less than $1B, and the five largest companies in the portfolio – Nvidia (NVDA), Pfizer (PFE), Regeneron (REGN), Vertex (VRTX) and Moderna (MRNA) – only account for 5% of the portfolio. The market caps of the various names drop off quickly after Moderna (around $40B), firmly into mid-cap territory (< $10B) by holding number eight, Signify (SGFY). In fact, the heaviest-weighted names are all mid-cap, with names such as Ionis (IONS) and Exact (EXAS) headlining the Top 10 holdings list.

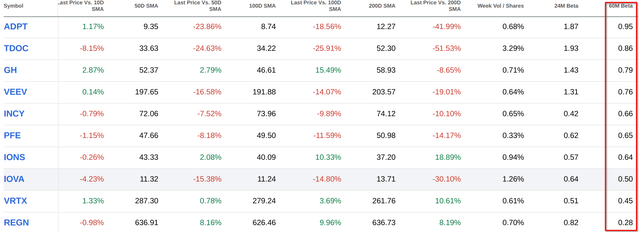

Small-cap-heavy usually means higher volatility, and ARKG’s current slate of holdings definitely fits that bill. Looking at Seeking Alpha’s momentum data, 11 of the 47 holdings do not have a 60-month beta since they have not been public long enough, and of those 11, only one has a 24-month beta under 1: Signify. Of the remaining 37 names, only ten have a 60-month beta under 1, many of which are the larger-cap companies:

60-month beta highlighted in red (Seeking Alpha)

While small-cap and volatility are often associated with each other, here is a Seeking Alpha screen for Biotechnology companies with a market cap of under $2B, a beta of less than 1, and a Quant rating of at least Buy. In fairness, we are value-biased, but we want to hammer the point home that having a portfolio of small-cap biotech names does not have to be inherently volatile, and it seems hard to believe that none of the names on this screen would benefit from the genomic revolution.

Solid Core Names

The large-cap names in this portfolio are genuinely great companies and would be right at home in any healthcare or biotechnology fund. As to their credits for advancing genomics:

-

Pfizer and Moderna have proven themselves with their work on mRNA vaccine development, the COVID-19 pandemic providing the ultimate trial-by-fire for the technology.

-

Regeneron is one of our favorite pharmaceutical holdings, with a growing drug portfolio and a dedicated research focus, as evidenced by the amount of knowledge they contributed to understanding the SARS-CoV-2 virus and their early work in developing and repurposing medicines for treatment.

-

Vertex led the way in developing treatments for cystic fibrosis and are now expanding into other difficult, neglected diseases; meanwhile, they are actively working on a hematological gene therapy in collaboration with CRISPR (CRSP) and MaxCyte (MXCT), bringing their deep R&D pockets to bear on advancing the field.

Contenders

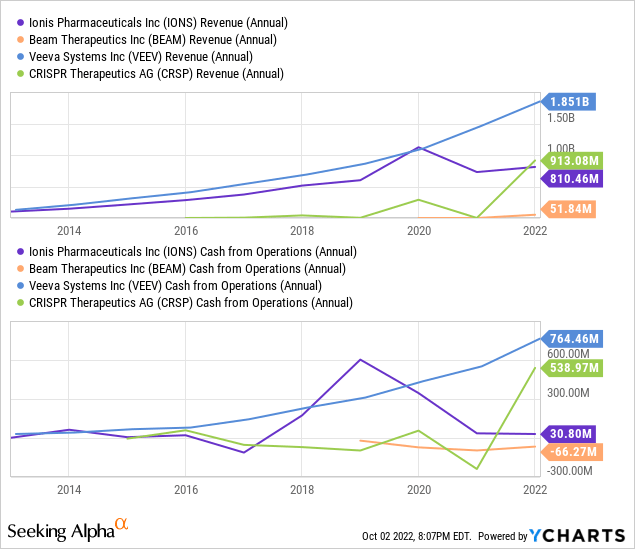

As mentioned previously, the biggest names of this portfolio only make up 5% of the overall allocation. Much of the fund is concentrated in the next “tier” of companies, ones that are still up and coming. Most are still reporting negative earnings, but they are reporting positive revenue and even positive cash flow in some cases:

-

Ionis, the largest holding by a hair, has several products on the market and a strong pipeline, anchored by Spinraza for spinal muscular atrophy (as part of a strategic collaboration with Biogen (BIIB)).

-

Beam Therapeutics (BEAM) is deeply committed to gene therapies for a variety of conditions and has a collaboration deal with Pfizer.

-

Veeva Systems (VEEV) provides cloud solutions, primarily CRM, to the life science industry; while not directly involved in research, reducing pain points in developing and bringing drugs to market is still moving the needle in the right direction, and with profitability established, the future seems bright either as a standalone company or as a specialist in a bigger cloud CRM provider like Salesforce (CRM).

-

CRISPR Therapeutics has the exclusive rights for developing drugs using the truly revolutionary (if controversial and/or ethically dubious) CRISPR/Cas9 gene editing platform, as evidenced by the long list of companies which list them as a collaborator, including Bayer (OTCPK:BAYZF) and Vertex.

A common theme emerges with many of these names: profitable or not, they are prime targets for acquisition from bigger names. As a commenter on our Biogen analysis pointed out, Biogen acquiring Ionis seems to make a lot of sense if Biogen can work out financing and clear up their C-suite. The collaboration between Beam and Pfizer suggests a similar deal might be mutually beneficial.

Even Exact Sciences, which has not reached profitability, is nearing $2B in revenue thanks to their growing suite of cancer screening kits, including Cologuard, the at-home stool DNA colon cancer screen (the marketing blitz for this product at launch was nothing if not impressive), and from the outside it appears to be a great acquisition target for any diagnostics-heavy company, like Becton, Dickinson (BDX) or Roche (OTCQX:RHHBY).

All in all, this fund gives off a “venture capital” vibe: invest across a variety of promising names with the expectation that all you need is one or two to bring in a 1000x return in order to make the fund comfortably profitable. That’s very likely what happened in the other funds with Tesla.

This theme, however, is a big if. There needs to be a clear value-add from the target for the acquirer and an ability for an acquirer to make a purchase. All of these acquisition suggestions are best-case speculations. Furthermore, with the macroeconomic environment threatening to become frostier, these names are equally as likely to be the ones left out in the proverbial cold as survival preempts expansion for the big names. Also, limiting the fund to public listings, which theoretically are already past the point of needing VC-type investment, exposes investors to an entirely different set of risks than those a typical VC investor would take on.

Head-scratchers

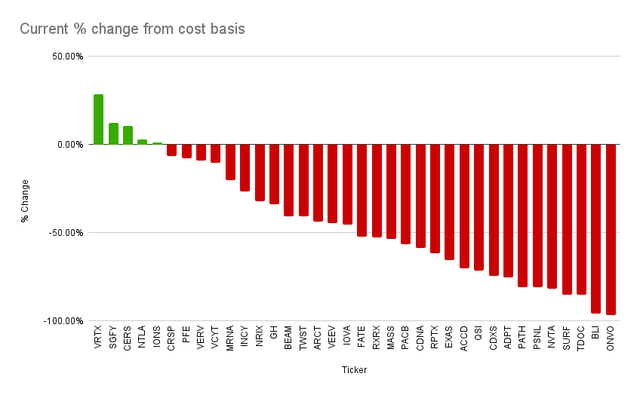

The part we can’t seem to get past, though, is the rest of the portfolio, consisting of micro- and nano-cap firms and companies whose connection to genomics is tenuous at best from where we sit. Many of the smaller firms were purchased at considerable premiums to their current market price: Organovo (ONVO), for example, the smallest company in the portfolio by weight and market cap ($18.64M) was purchased for an average cost of $58.10/sh according to Cathie’s Ark; it currently sits at $2.05/sh. No stock splits or dividends in their history.

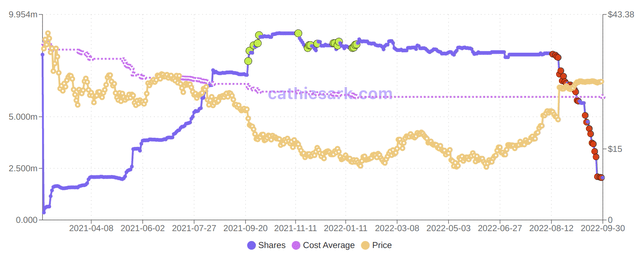

Many other holdings share this dismal story, even the more promising companies. The few bright spots in the portfolio so far barely make up for this broad underperformance. In fact, even as Signify is on the brink of an acquisition by CVS Health which represents a 20% premium to their cost basis ($25.99/sh versus $30.50/sh for the buyout), ARKG has sold 75% of their position since mid-August. While the average cost basis has not moved, this selling could be a tax-harvesting strategy, but it still appears unusual to balk at what appears to be a slam-dunk extra 5% from current market prices:

Even if a name like ONVO were to break back out and reach, say, 100x of its current price, that would still only return something like 3x of the average cost, calling into question the prudence of the VC-like approach to the small-cap space when the paper losses have racked up like they have.

Holdings without a cost basis listed have been omitted from this chart. (cathiesark.com + Author’s own work)

Several other names in this fund are still in healthcare, but how they benefit from “advances in genomics” is much harder to pin down. Some are involved in the business side of medicine, such as Veeva, Signify or Teladoc (TDOC), one of the most polarizing names to include in this particular portfolio.

Arguably, the common thread here is the idea of “personalized medicine” and the increasing pervasiveness of genomics in doctor’s offices beyond the serious specialists like oncology. Perhaps genomics gives these businesses a new revenue stream, a new “pain point” to streamline for their consumers, a broader addressable market, etc. Speculation is pretty much all we can pin to these names, that and whatever the fund managers are willing to share.

And then there are names which defy all but the most dramatic leaps of logic. Just this week, ARKG added a 1% position in Nvidia to the portfolio, likely due to the selloff the semiconductor industry is experiencing. The connection here pretty much has to be Nvidia GPUs for processing large biological data sets and molecular modeling simulations; their involvement with AI and the metaverse are ancillary to their inclusion here. How much of Nvidia’s revenue actually comes from healthcare applications, let alone genomics, is likely immaterial in our opinion to their other lines of business.

UiPath (PATH) is the poster child for inexplicable inclusion, a company whose main business is robotic process automation. Their website discusses healthcare in the same way as businesses like Signify and Teladoc, from the “doctor’s office” automation perspective, not in terms of what direct benefits they get from scientific advancements, or what value they bring a research lab or for companies actually developing genomic advancements aside from reducing pain points. UiPath is one of ARK’s largest holdings across the entire group, sitting at fourth with just over 4%, so their reason for inclusion must be set in stone to warrant such involvement.

With all of this said, we also have to wonder why a name like Alphabet is not included in this portfolio. Alphabet is included in ARKQ and ARKX, but their “other bet” DeepMind rocked the computational biology world when their model AlphaFold blew away the latest CASP competition after entering the field only two years prior. Along with their other “other bets” Calico and Verily focused on transformational life science work, they feel quite fitting to include as a large-cap anchor that has the firepower to disrupt and stands to benefit from advancements in genomics. Given the paring back of the other bets focused on aerospace, ARKG seems a better home for them than ARKX, in our opinion.

Competitors

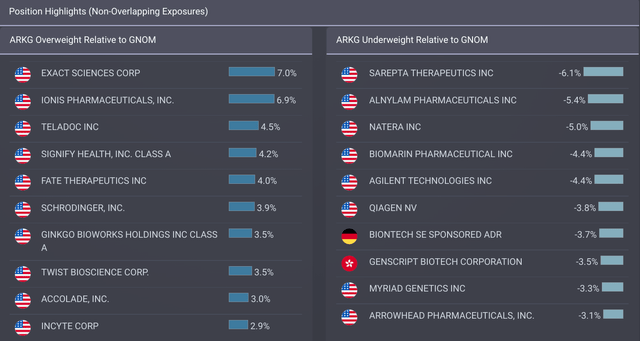

Inevitably, with the massive runup the ARK funds experienced during 2020, those in the “thematic investing” space saw a renaissance of sorts. ARK copycats sprung up, and ARKG is no exception. The two largest competitors – if you can call 10% of ARKG’s $2B AUM “large” – are Global X Genomics & Biotechnology ETF (GNOM) from Global X, an old hand in the thematic ETF space; and iShares Genomics Immunology and Healthcare ETF (IDNA) from iShares, an old hand in the ETF space period.

These two run their ETFs closer to funds more familiar to most ETF investors: “passively” managed, about 20-30 basis points cheaper than ARKG, and tied to indices which appear to have strong human elements and idiosyncracies in their construction (i.e. – restricting which industries they pick from and performing data mining on company documents to identify the “buzzwordiest” businesses). Their success has not been as dramatic as ARK, but ARKG wasn’t in the $200M AUM range until around 2018, about four years since inception.

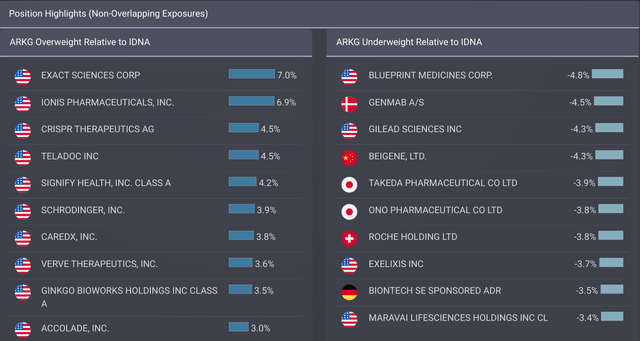

Quickly comparing the portfolios of these newer entrants, we see that there is a shocking lack of overlap with ARKG, only 20-25% by weight according to ETF Research Center’s Fund Overlap tool. Moreover, many of the top holdings of these funds do not overlap, even though their weighted average market caps are in the same range:

ETF Research Center ETF Research Center

IDNA seems to favor the larger pharmaceutical companies, while GNOM plays much closer to the same style of portfolio as ARKG. All the same, these various offerings suggest, as one might guess, there is no “silver bullet” portfolio when it comes to thematic investing.

Recommendation

ARKG certainly offers a lot to those who believe that genomics is a disruptive force and who want to catch the wave before it crests, but the fund’s unique aspects – portfolio holdings, management and expenses – trip it up too much for us to suggest it to someone unfamiliar with the space altogether. They appear to be serving a larger narrative, one that ties into the ARK group of funds as a whole and requires taking their day trades, paper losses and rebalances with a certain amount of salt.

Meanwhile, the portfolio is heavily tilted towards volatile small-cap pre-profit companies which are on the brink of breaking out, but would require a considerable number of bounces to go their way in order to provide ARKG with a satisfactory return. It smacks of venture capital-style investing, the risks of which are not clearly communicated to investors.The typical risk tolerance for a VC-type investor is much greater than someone who might invest in the public markets via ETF.

Thematic and sector funds have burned us more than we’d like to admit while trying to shore up perceived coverage gaps or chasing short-term macroeconomic trends. Our strong preference is for broad-market funds or individual stocks held as part of a themed basket. We do like the biotechnology space as one of our baskets, and if one is interested in constructing a themed basket of stocks, our advice is to look at a variety of funds in the theme of choice and look for blue-chip names or companies which are a significant part of multiple different funds to research further (e.g. – Intellia (NTLA) and Beam for the genomics funds). We target three or four names, adjust to your taste depending on your capital, the number of stocks in your portfolio and how much you feel reasonably comfortable holding in any one stock.

Conclusion

ARKG has a mission to identify the leaders of the genomic revolution, but their efforts to be different ultimately make them exceedingly hard to understand and subsequently to recommend. The bulk of their holdings are unproven, scattershot, and highly volatile, making it hard to see how they will translate into long-term capital appreciation as the fund holds large paper losses on their books and turns names over according to their unique methodologies. If you are still interested in ARKG after reading this tirade, we would warn you to buy them only on a flyer, think of it as a quasi-venture capital fund, and only to put in as much money as one is willing to potentially lose entirely.

Be the first to comment