Marco Bello

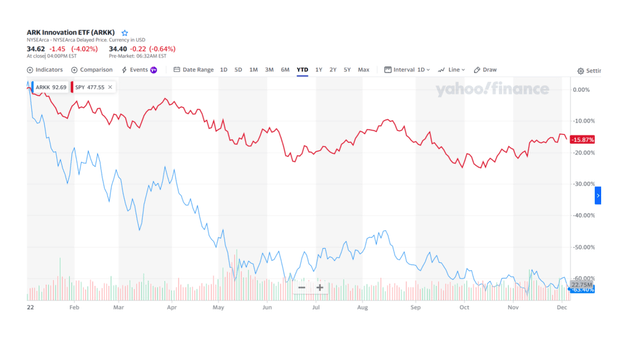

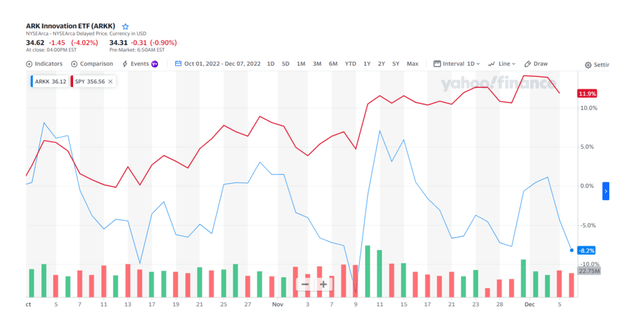

The ARK Innovation ETF (NYSEARCA:ARKK) has returned a negative 63.4% so far this year and underperformed the S&P500 index by an incredible 47.5% from January 1, 2022 to December 7, 2022.

While initially riding a wave of popularity that exploded into the mainstream during the Covid-19 pandemic, the exchange-traded fund has recently fallen out of favor with growth investors due to persistent investment underperformance.

With the U.S. economy facing headwinds and the ARK Innovation ETF remaining overweight unprofitable, high-multiple stocks, 2023 could be another difficult year for the investment firm and Cathie Wood.

Jaw-Dropping Underperformance

With less than three weeks until the end of the year, the performance of the ARK Innovation ETF in 2022 is one that investors would prefer to forget. Many investors will undoubtedly wish they had never invested in the ARK Innovation ETF in the first place.

ARKK has delivered a negative performance of 63.4% year to date, underperforming the broadly diversified S&P 500 Index by a staggering 47.5%.

ARKK Versus S&P500 (Yahoo Finance)

Importantly, the ARK Innovation ETF, which is still heavily overweight unprofitable, high-multiple growth stocks (more on that later), did not participate in the market’s recent rally. While the S&P500 surged, the ARK Innovation ETF did not participate in the recent uptick.

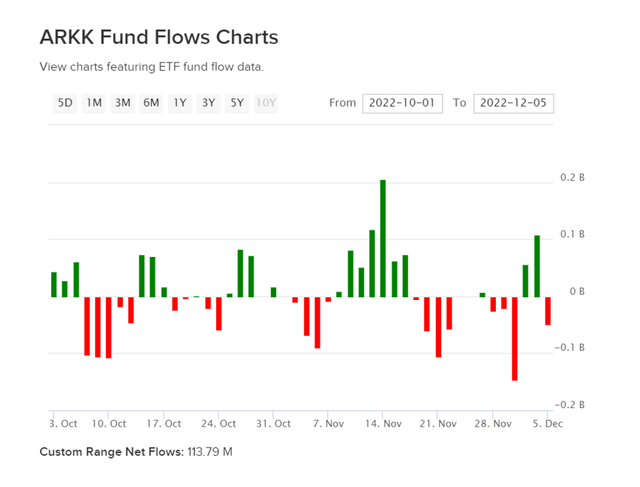

Fund Flow Picture Inconclusive

Fund outflows from the ARK Innovation ETF have recently stabilized, but investors aren’t exactly pouring money into the fund. The current fund situation is probably best described as investors taking a wait-and-see approach.

The recent underperformance of ARKK, in my opinion, strongly speaks against an investment in the fund due to the presence of a couple of over-weighted stocks that are likely to remain a drag on the performance of the ARK Innovation ETF.

ARKK Fund Flows Charts (The ARK Innovation ETF)

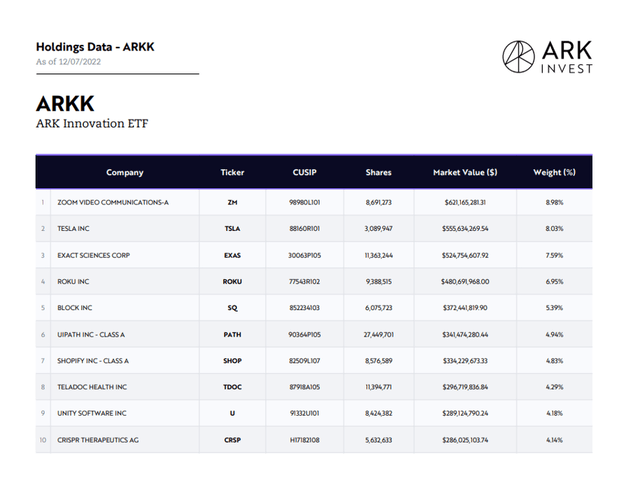

A Look At ARKK’s Updated Portfolio Concentration

The ARKK’s lack of upside participation since October, in my opinion, is due to the fund’s excessive concentration in a few names that have underperformed and are limiting the fund’s rebound potential.

The fund’s holdings remained concentrated in a few high-multiple stocks, including Zoom Video Communications (ZM), Tesla (TSLA), Roku (ROKU), and telehealth pioneer Teladoc Health (TDOC). Zoom Video Communications was the fund’s largest holding as of December 7, 2022, with an 8.98% stake.

Top 10 Holdings (The ARK Innovation ETF)

Having said that, the majority of the ARK Innovation ETF’s holdings remain primarily of companies that have yet to turn the corner in terms of profitability in 2022.

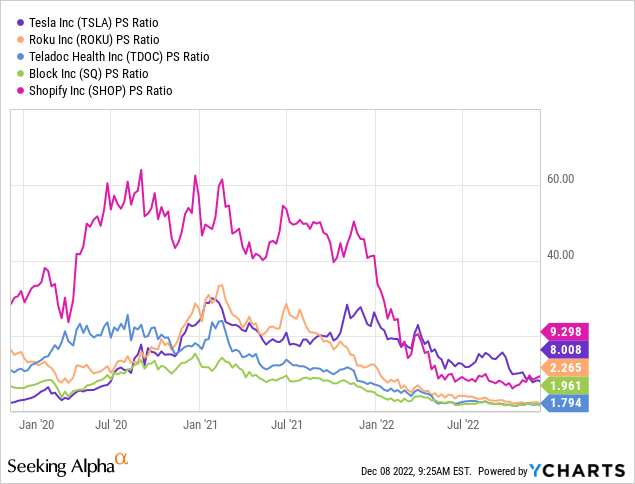

Roku, Teladoc Health, Block, and Shopify (SHOP) continue to dominate the fund’s top ten holdings, but all of them continue to rack up massive losses while trading at extremely high (and arguably unsustainable) sales multiples.

These persistently high sales multiples, in my opinion, represent an excessive risk for investors in the ARK Innovation ETF, compounding the underlying concentration risk, especially if a recession worsens the market situation.

According to a recent KMPG survey, the majority of CEOs (91%) believe a recession is on the way, which, in my opinion, could result in a new round of valuation cuts for high-priced pandemic winners.

Why ARKK Could See A Higher Valuation

Despite a significant valuation haircut in 2022, the ARK Innovation ETF, in my opinion, remains exposed to significant net asset value risk. This risk is primarily caused by the fund’s overexposure to a few high-risk names such as Roku, Teladoc Health, and Shopify, which continue to lose money and are thus particularly vulnerable during a recession.

At the very least, avoiding a recession would necessitate a resurgence of valuations for the pandemic’s fallen winners.

My Conclusion

Despite the fact that the ARK Innovation ETF has lost more than 63% of its value in 2022, and the degree of underperformance relative to the S&P500 is striking, it appears the fund managers have learned nothing about ARKK’s underlying problem in my view.

The fund continues to maintain an overly aggressive allocation to high-multiple growth stocks, particularly in sectors that have recently fallen out of favor with investors seeking more defensive exposure.

Given the likelihood of a major economic recession in the United States in 2023, I doubt that 2023 will be a good year for an offensively positioned investment fund with concentrated exposure to a few high-valued technology names.

Be the first to comment