JHVEPhoto

Introduction

Aritzia Inc. (TSX:TSX:ATZ:CA, OTCPK:ATZAF) has continued to exceed analyst expectations again and again and provided a spark to an underperforming apparel sector in 2022. The company’s brands continue to impress, and their U.S. focus has generated strong returns. My recent article on ATZ:CA showcased a bull view, and recent fiscal Q2 results proved that key tailwinds remain intact. Aritzia updated their 5-year growth plan at their new Investor Day and announced a bought deal in mid-November worth $70MM to capitalize on the company’s appreciation. ATZ:CA remains one of a select few growth stocks in apparel. I reiterate my “Buy” rating with a $63 ($46 USD) price target over an 18-month period.

On October 27, 2022, ATZ:CA announced a 5-year strategic plan for 2027, highlighted by a key revenue forecast range of $3.5Bn-$3.8Bn, which would constitute a 15%-17% cumulative annual growth rate. This would be an astonishing mark, and matched by only top tier competitors like Lululemon Athletica (NYSE: LULU). The company plans to double net revenue in both the United States and eCommerce businesses, propelled by growing brand awareness and new client acquisition.

The company highlighted 3 strategic levers in its “Powering Stronger” plan to capture the growth, focusing on measured boutique store openings, e-commerce business acceleration, and increased brand awareness. ATZ:CA also plans to post Adjusted EBITA margins of 19% by 2027 and also have EPS growth outpace revenue growth. The company also noted that e-commerce revenue is expected to rise to $1.5Bn-$1.7Bn, representing 45% of the sales mix, which would be a 12% jump from last quarters 33% mark. While the company provided lofty targets, I believe they will meet these metrics, and the strategic clarity provides more support for my previous Buy rating.

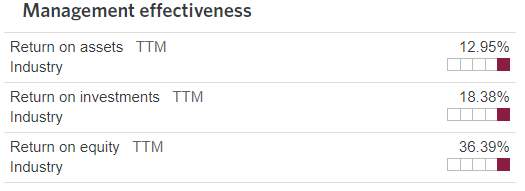

While ATZ:CA has sky high expectations, especially concerning revenue and EBITDA projections, I think management has proven that they can execute with excellence. The company consistently posts high return on asset rates that score well above the industry average, and has seen revenue jump at a CAGR of 19% over the previous 5 years. Margins haven’t lagged as badly as competitors, falling just 270 basis points last quarter versus competitors.

CIBC Capital Markets

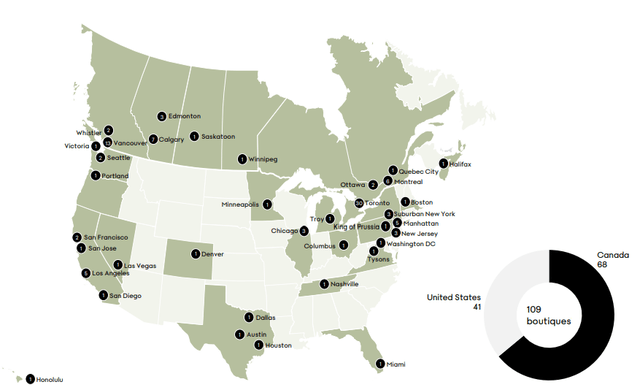

As e-commerce continues to grow as a portion of the sales mix, margins can remain resilient, as long as quality and shipping times remain strong as they currently are. ATZ:CA noted that CAPEX will hit $500MM over the FY2024-FY2027 period, which at first glance looks more than enough to ensure high service quality. The two growth pillars of the revenue estimate, U.S. sales and e-commerce revenue, have both shown impressive strength in recent quarters, and will continue to power the brand forward. The majority of Canada’s large cities have a retail presence, so the pretense that 8-10 yearly boutique openings in the U.S. will drive growth makes sense. There are still several U.S. markets that ATZ:CA doesn’t have a retail presence in, and it will take years to adequately penetrate the total addressable market, if brand strength remains intact.

ATZ:CA also highlighted increasing the square footage in 3-5 boutiques annually, which I think is a good plan similar to the success LULU had. LULU has increased their square footage to improve its in-store appeal and have tried experiential programming on site and partnerships with yoga studios to increase brand penetration. I see ATZ:CA, on a smaller scale, moving in the same direction which has yielded strong results for LULU.

The company also highlighted e-commerce expansion and increased brand awareness as two key pillars to drive growth. E-commerce expansion is important, because it ensures margins remain competitive and allows boutiques to expand their mandates to brand strengthening as well. E-commerce sales rose ~150% between FY2020-FY2022, and now make up a material portion of the sales mix, ranging from 30%-35% in recent quarters. ATZ:CA plan to connect clients to tailored product discovery, creative innovation, and intuitive experiences. They also mentioned that they will create new digital platforms, such as a client app to drive client interaction.

I think this strategy is necessary in today’s day and age. Being able to quickly and efficiently service customers via the internet is important, and I am impressed by the idea of an app. While the company is likely not large enough to create much financial value via an app in the short-term, if ATZ:CA continues, as they have consistently done for years, to deliver good quality and fashionable products, along with partnering with other value-add businesses (like yoga studios, teams, models, events, etc.), an app should assist the company in customer acquisition and retention.

The other pillar of increasing brand awareness is supported by the company’s plan to leverage the power of influence to build a greater following and community by amplifying clients’ voices and augmenting their social media presence through strategic marketing. This sounds like there will be attempts to make some viral moments via customer videos, similar to American Eagle’s Happy Spot. I think this is a bit of a weak pillar, as geographic expansion, service quality enhancements, and technology improvements will all drive brand awareness. That said, given management’s impressive track record, let’s see if they can generate viral sensations.

ATZ:CA also announced a bought deal on November 14, 2022 worth $70.1MM – but not via dilution. The company announced that Brian Hill, Founder and Executive Chair of Aritzia would sell the shares in a private offering at a price of $51.60, which was ~4% below the market price at the time of the announcement. While initially concerning seeing such a big block being sold, Mr. Hill still retains ~18.6% ownership in the company and will remain as Chair. Given these developments, I think raising money after the stock has rallied 37% over the last 6 months is a wise idea for the Chairman, and upon further review, ATZ:CA will not be diluting stock. I don’t see this as a key executive losing faith in the brand.

Overall, I believe the transparency of an investor day was an important move for ATZ:CA as they plan to continue to grow into a large North American apparel brand. While the company doesn’t have a date planned on a U.S. listing, they have started improving its image with investors with its outreach via the investor day. The 2027 goals, while lofty, are well within range to be achieved given the company’s past and recent success. I reiterate Aritzia Inc. stock at a Buy and anticipate a $63 CAD price target within an 18-month view, adding no new changes to my previous model from October.

Be the first to comment