alvarez

Ardmore Shipping Corporation’s (NYSE:ASC) stock price increased by 190% since the beginning of the year. Due to hiked TCE rates for its MR tankers and chemical tankers, the company’s net cash provided by operating activities jumped by 2900% YoY to $9 million at the end of June 2022. After the pandemic setback, the demand for oil products and chemicals increased. The increased use of tankers to transport products, refined oil, and other chemical products will boost the market. Tanker rates are now significantly higher than in the past five years. ASC is a buy.

Quarterly highlights

In its 2Q 2022 financial results, ASC reported revenues of $107 million, compared to 2Q 2021 revenues of $47 million. The company’s voyage expenses increased from $20 million in 2Q 2021 to $41 million in 2Q 2022. ASC reported a net income (attributable to common shareholders) of $29 million in the second quarter of 2022, compared with a net loss of $8 million in the same period last year. The company’s net cash provided by operating activities increased from $0.3 million in 2Q 202 to $9 million in 2Q 2022. Also, its cash flow from investing activities increased from $4 million in 2Q 2021 to $13 million in 2Q 2022, driven by increased proceeds from the sale of vessels. “Completed the previously announced sale of two out of three vessels to Leonhardt & Blumberg for an aggregate price of $26.4million. Both vessels were subsequently time-chartered back from the buyer for a period of 24 months at an attractive hire rate, plus a one-year extension option. The remaining vessel is scheduled to be delivered to Leonhardt & Blumberg on July 29, 2022 and will subsequently be time-chartered back for a period of 24 months, plus a one-year extension option,” the company explained.

On the other hand, ASC’s net cash used in financing activities increased from $7 million in 2Q 2021 to $32 million in 2Q 2022. Altogether, the company’s cash and cash equivalents decreased from $55 million in 2Q 2021 to $45 million in 2Q 2022. ASC reported fleet TCE per day of $30140 in 2Q 2022, compared with TCE per day of $11805 in 2Q 2021. In 2Q 2022, MR tankers earned an average TCE rate of $30,480 per day and chemical tankers earned an average TCE rate of $20,254 per day. The company’s fleet’s distance traveled decreased from 394987 miles in 2Q 2021 to 383953 miles in 2Q 2022.

The market outlook

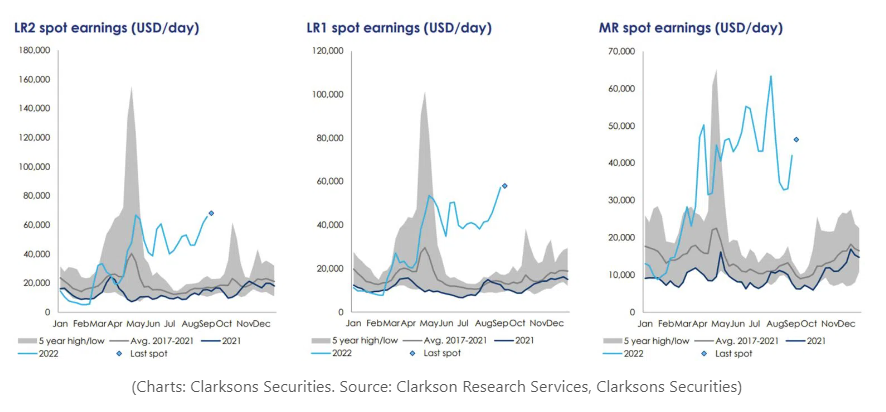

Figure 1 shows that in the third quarter of 2022, time charter estimates for MR IMO3, LR1, and LR2 vessels were higher than in 2Q 2022. Also, we can see that on 12 October 2022, rates were almost the same as on 14 September 2022. Thus, I expect ASC’s revenues in 3Q 2022 to be stronger than in 2Q 2022. Moreover, I expect the company’s results in 4Q 2022 to be as strong as the third quarter of the year. “The product tanker market has continued to strengthen so far into the third quarter, with our MRs earning $46,600 with 45% of days booked, setting the stage for an even better quarter and an anticipated strong finish for the year,” the CEO commented. Figure 2 shows that LR2 spot earnings, LR1 spot earnings, and MR spot earnings are higher than in the past 5 years.

Figure 1 – Wet time charter estimates

www.hellenicshippingnews.com

Figure 2 – LR2 spot earnings, LR1 spot earnings, and MR spot earnings

www.freightwaves.com

I expect the company’s TCE rates to remain high and increase further in the following quarters. European countries are now sourcing CPP from USG and MEG rather than Russia. Thus, disruption to trade flows caused by the war in Ukraine combined with the energy crisis increased the demand for tankers and the current situation is not expected to change soon. Also, increased aviation activity continues to support jet fuel demand.

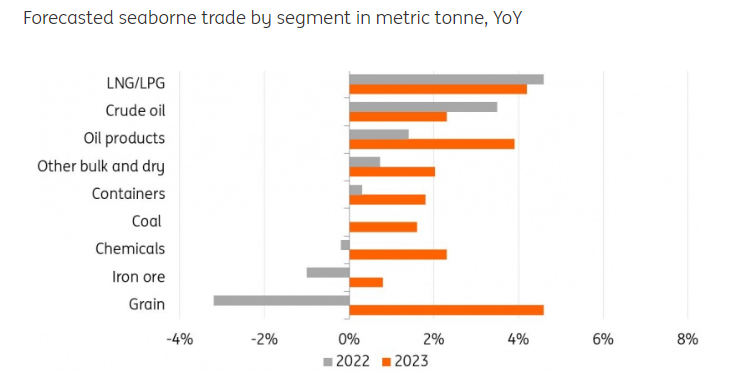

Figure 3 shows ING’s forecasted seaborne trade by segment in 2022 and 2023. We can see that despite the lower crude oil and LNG/LPG seaborne trade in 2023, the oil products and chemicals seaborne trade is expected to increase significantly in the next year.

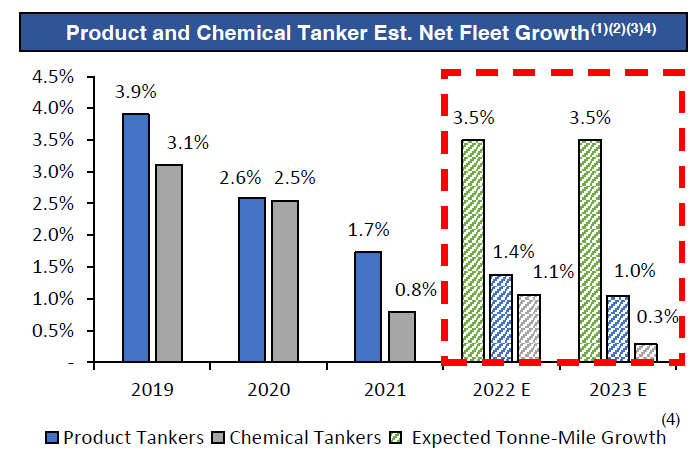

Due to the increasing demand for refined products and chemicals and the adoption of sustainable and eco-friendly processes to eliminate the negative impact of chemical manufacturing on the environment, chemical companies’ production will hike in the following years. The global chemicals market is expected to grow from $4620 million in 2022 to $6371 billion in 2026 at a CAGR of 8.4%. The chemical tankers market is expected to grow to $38.38 billion in 2026 at a CAGR of 4.7%. Furthermore, on the supply side, net fleet growth is expected to be lower than demand growth in the following years (see Figure 4). Thus, the market outlook for ASC is promising.

Figure 3 – Forecasted seaborne trade by segment

think.ing.com

Figure 4 – Product and chemical tankers estimated net fleet growth

2Q 2022 presentation

Performance outlook

In this detailed analysis, I have done some investigations on Ardmore Shipping Corporation’s profitability ratios to evaluate its abilities to bring income and utilize its assets to generate profit for its shareholders. To cater beneficial insights into the company, I have analyzed the profitability ratios across the board of margin and return ratios. To be more insightful, I have calculated these ratios compared to previous years.

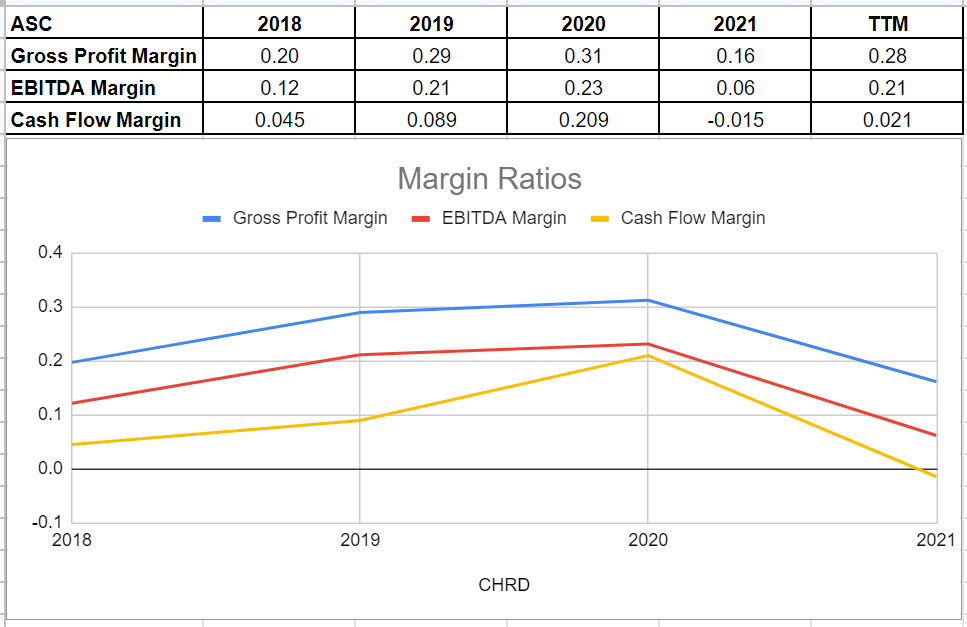

Generally, margin ratios capture the capability of the company to convert sales into profits in different measurements. In this regard, I would investigate Ardmore Shipping Corporation’s gross profit, EBITDA, and cash flow margin conditions and compare them with previous years.

After a deep drop to half from 0.31 in 2020 to 0.16 at the end of 2021, ASC’s gross profit margin increased back by 75% and sat at 0.28 in TTM. Additionally, the cash flow margin indicates the relation between operating cash flow and the company’s total revenue. Ardmore Shipping Corporation has been able to recover and convert its revenue to cash after the downturn of 2021. Its cash flow margin increased to 0.02 in TTM versus its negative amount of (0.015) in 2021. As a result, its cash flow margin is in solid condition and shows that the management is able to balance its cash flow. Thus, not only can they minimize expenses, but also take advantage of upcoming growth opportunities.

Ardmore Shipping Corporation’s EBITDA has increased by five times in TTM compared with its previous level in 2021 and led to an increase in EBITDA margin to 0.21 in TTM. The benefit of investigating the EBITDA margin is that it excludes volatile expenses and thus is a good measurement to represent a clear picture of the performance. In short, Ardmore Shipping Corporation’s margin ratios indicate the company’s scope of capability to convert its revenues into profits so far (see Figure 5).

Figure 5 – ASC’s margin ratios

Author (based on SA data)

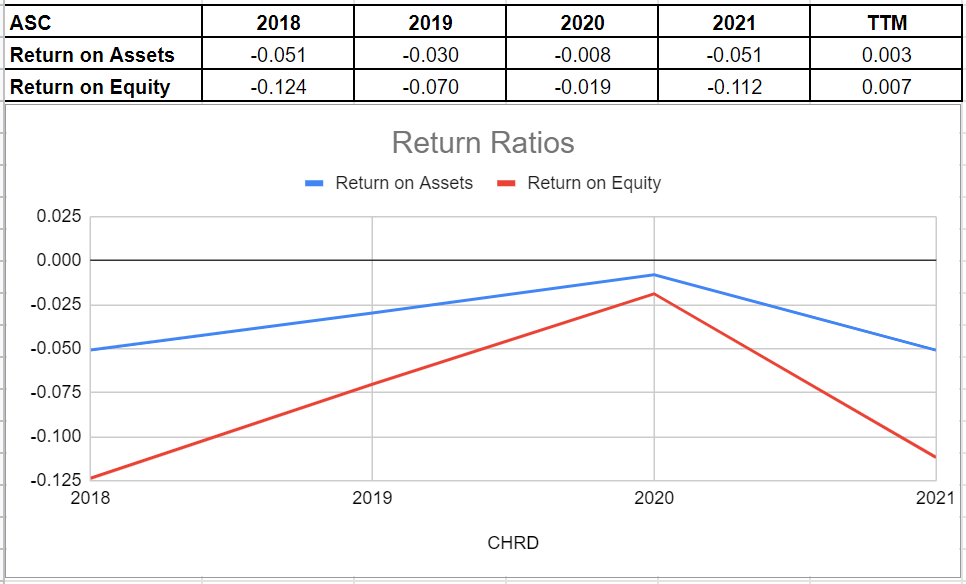

To represent Ardmore Shipping Corporation’s ability to provide returns to its shareholders, I have investigated its return on assets and return on equity ratios. The return on assets ratio reflects how much profit a company can generate for every dollar of its assets. After years of negative return on assets in a row, ASC’s ROA ratio has developed to 0.003 in TTM for the first time.

Similarly, its return on equity experienced a positive result for the first time in recent years. Its ROE improved and sat at 0.007 in TTM. This ratio indicates the net income of the company, which is relative to the shareholders’ equity. The return on equity ratio is crucial as it measures the rate of return on the money that has been invested into the company. Generally, considering Ardmore Shipping Corporation’s profitability metrics, there is a witness that the company is in a healthy position and can bring benefits to its shareholders (see Figure 6).

Figure 6 – ASC’s return ratios

Author (based on SA data)

Summary

The demand for refined products and chemicals will continue to increase, and due to the current growth rate of the global tankers fleet, the rates will remain high in the next few quarters. Also, considering Ardmore Shipping Corporation’s profitability metrics, the company is in a healthy position and can stay profitable. The company is well-positioned to extend its operations in the current market condition. The stock is a buy.

Be the first to comment