Xiaolu Chu/Getty Images News

Introduction

My thesis is that Tesla (NASDAQ:TSLA) is incentivized to win on electrification and autonomy while legacy automakers and dealers are incentivized to continue pushing internal combustion engine (“ICE”) vehicles.

ICE vehicles have many more parts than electric vehicles (“EVs”) and they require significant large sums for parts and service. Automakers are incentivized to manufacture ICE vehicles, so they can make money four years down the road on parts when the warranties expire. Dealers are incentivized to sell ICE vehicles as they make a large part of their gross profit on parts and service. Tesla is highly incentivized to win on electrification and autonomy as they are unable to make substantial money from parts and service.

Legacy Incentives

A June 14th interview with CEO Elon Musk explains the power of incentives with respect to legacy car companies. CEO Musk conveys what a top investor told him about the automobile industry. Legacy carmakers are incentivized to continue selling ICE vehicles as they make a tremendous amount of money on parts:

And he said the car companies don’t make any money on the new car sales. They make all of their money selling parts to cars to the existing fleet. So when the warranty runs out, like the life of a car before it hits the junkyard might be 20 years. The warranty is going to typically run out after four years and there’s a bunch of stuff that’s not covered under warranty. So if you’ve got a steady state fleet, it means that 80% of your fleet is not under warranty. So you can sell high margin parts, replacement parts for the existing fleet and you can sell your new cars at effectively zero margin. It’s like a razors and blades thing. Yeah, you sell the razor for zero margin and you sell the blades at a higher margin.

The above is obfuscated in the filings by legacy carmakers like Ford (F) as new vehicle sales are conflated with parts and service in the income statement. The parts and service incentives are more obvious on the dealer side. Looking at the AutoNation (AN) 2021 10-K filing, parts and service is just 14.3% of the revenue, but the segment is 33.8% of the gross profit. These percentages were even higher for AutoNation in 2020, coming in at 16% and 41%, respectively.

Incentives For Tesla

The musings from CEO Musk in the June 14 interview continue such that Tesla’s incentives are explained. Again, when a newer company like Tesla tries to succeed in this space, they must do something to counter the disadvantage they face from not having parts and service revenue from a legacy fleet. The only way for a new car company like Tesla to succeed without an existing fleet is to charge a premium for their cars. The only way CEO Musk can think of to charge a justifiable premium is to succeed with electrification and autonomy. As such, Tesla is more incentivized by electrification and autonomy than incumbents.

In the June 14 interview, CEO Musk reveals that the death of a cyclist in 2014 made him realize that Tesla had to prioritize autonomy in an effort to make our roads safer. The Mercury News described the tragedy in February 2014 saying a UC Santa Cruz librarian on a bicycle was killed by a Tesla driver who fell asleep. In the above June 14 interview, CEO Musk said the tragedy made him realize Tesla had to get a move on and make Autopilot happen as quickly as possible:

Now if there had been even basic lane following, um that cyclist would still be alive. So I was like man, if anything illustrates the importance of Autopilot, it’s this case here where that innocent cyclist would still be alive if that guy that fell asleep had an Autopilot or any kind of lane following – even basic lane pulling.

The full self-driving (“FSD”) cameras make Teslas safer even when humans are driving. The 2021 Impact Report explains this is due to features like Traffic Light & Stop Sign Warning, Pedal Misapplication Mitigation, Automatic Emergency Braking, Lane Departure Warning, Forward and Side Collision Warning and Obstacle-Aware Acceleration. Here’s an example where my right turn signal is on and my Tesla cameras have determined that this is a terrible time to change lanes due to the van in red on the right:

Tesla safety (Author’s photo)

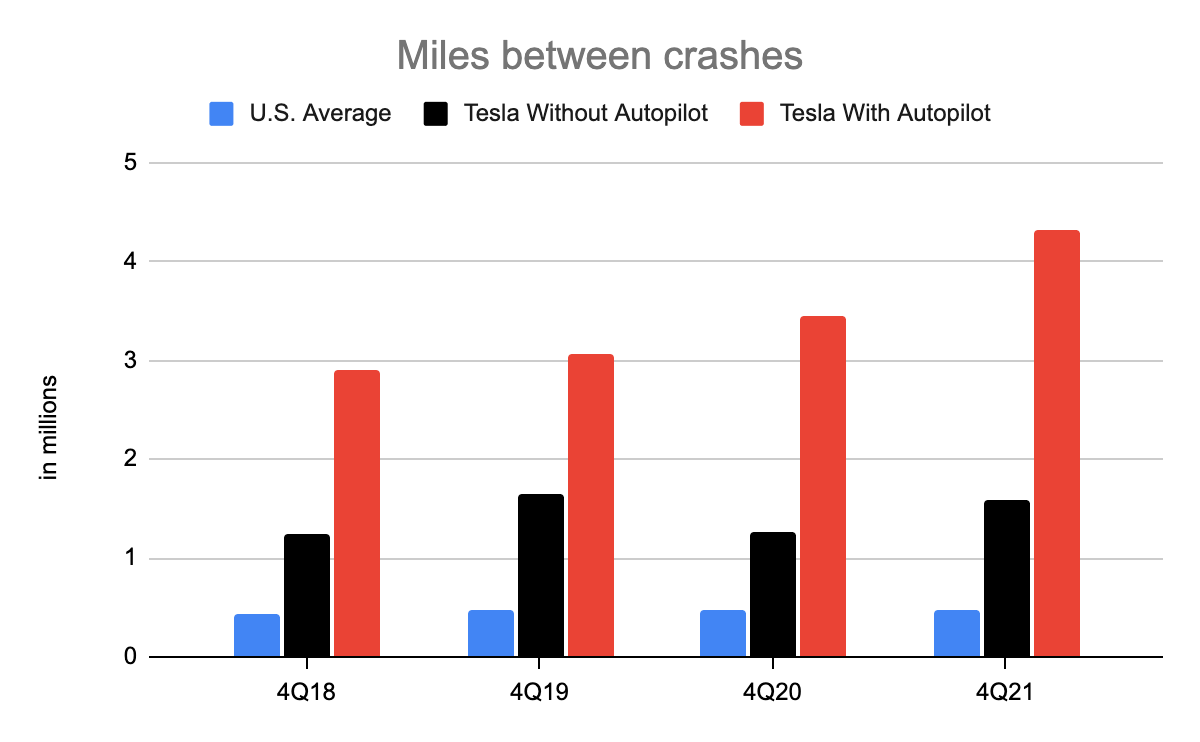

Safety reports show that when Autopilot is used, the number of miles between crashes has increased:

Miles between crashes (Author’s spreadsheet from Tesla’s safety reports)

Regarding the above U.S. average of one crash for every 484,000 miles, I can’t find this stated directly from NHTSA, but there are indirect numbers that get part of the way there. A February 2022 Reuters article says 3.23 trillion miles were driven in the U.S. in 2021. NHTSA says 5 to 6 million crashes occur annually. 5.5 million crashes for 3.23 trillion miles equates to about one crash for every 587,000 miles. Tesla’s vehicles continue to get safer as their autonomy investments improve. This tech indirectly helps even when AutoPilot is not engaged:

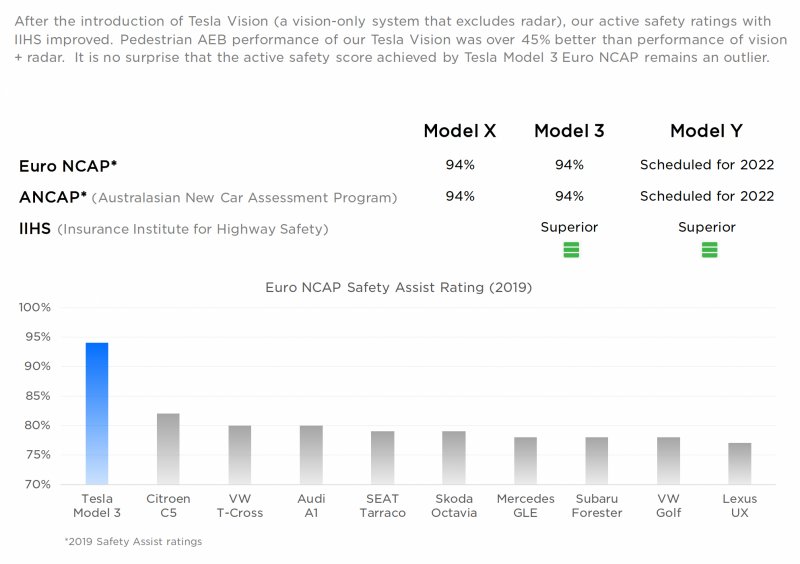

The 2021 Impact Report shows that Tesla’s Model 3 is an outlier as it is much safer than other vehicles in Europe:

Model 3 safety (2021 Impact Report)

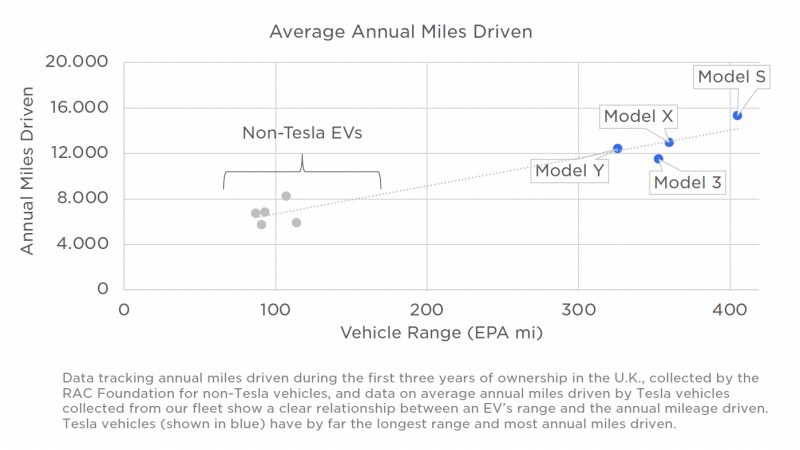

In addition to winning on Autopilot and safety, Tesla is winning on electrification as they sell more EVs than competitors. Tesla EVs tend to have a longer range than other EVs and Tesla EVs tend to have higher usage. They’re driven more miles. This usage disparity reminds me of something we saw with Apple (AAPL) years ago. Shortly after the iPad was introduced in March 2012, other tablets joined the marketplace but iPads dominated with respect to web usage rates. The Tesla 2020 Impact Report shows EV miles driven in the United Kingdom and Tesla overshadows competitors:

Tesla usage (Tesla 2020 Impact Report)

Valuation

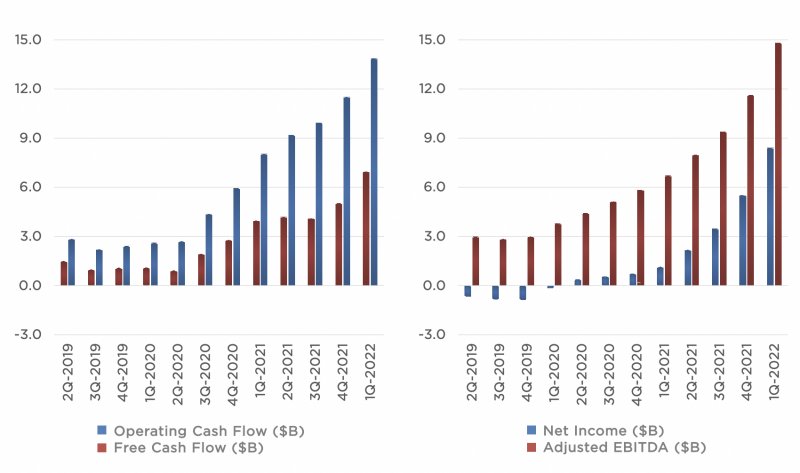

1Q22 revenue was $18,756 million which was almost 81% above the 1Q21 level of $10,389 million per the 1Q22 10-Q. Gross profit went up nearly 147% from $2,215 million in 1Q21 to $5,460 million in 1Q22. Shifting from quarterly numbers to year-long numbers, the 1Q22 shareholder deck shows that trailing-twelve-month (“TTM”) operating cash flow, free cash flow (“FCF”), net income and adjusted EBITDA are on the rise:

TTM FCF (1Q22 shareholder deck)

There’s a good article by RD Barris which points out that the above FCF numbers need to be adjusted downward. Specifically, he cites stock-based compensation, EV credit sales, income taxes, R&D and servicing. I treat stock-based compensation like a cash expense. As such, one can make the case that adjusted 1Q22 TTM FCF is $1,925 million lower ($418 million + $2,121 million – $614 million) than what’s shown above. As RD Barris remarks, the sustainability of EV credits should be less material over time which means part of the above FCF number is non-enduring. Tesla CFO Zach Kirkhorn said the following about this in the 4Q21 call:

We also saw regulatory credits accounting for a relatively small portion of our 2021 profitability, which we expect to continue to reduce in materiality going forward.

Of course much of the above capex is for growth investments as opposed to treading water so FCF adjustments can be made in both directions. In other words, many investors would only subtract the maintenance capex above and not the total capex of $6,901 million [$1,767 million + $6,482 million – $1,348 million].

There’s much more to Tesla than electrification and FSD. CEO Musk said the following about the Optimus robot program in the 1Q22 earnings call:

Those who are insightful or listen carefully will understand that Optimus ultimately will be worth more than the car business, worth more than FSD. That’s my firm belief.

CEO Musk said Tesla is a chain of start-ups in the 3Q20 call:

And the whole autonomy thing is a start-up. The computer chip was – designing our computer chips was a start-up. Obviously, cells are a start-up. Designing and making our own power electronics for the drive units, designing, manufacturing our own motors. Chargers, the Supercharger network is a start-up. The thing, I think, that people just don’t really understand about Tesla is that it’s a whole chain of start-ups.

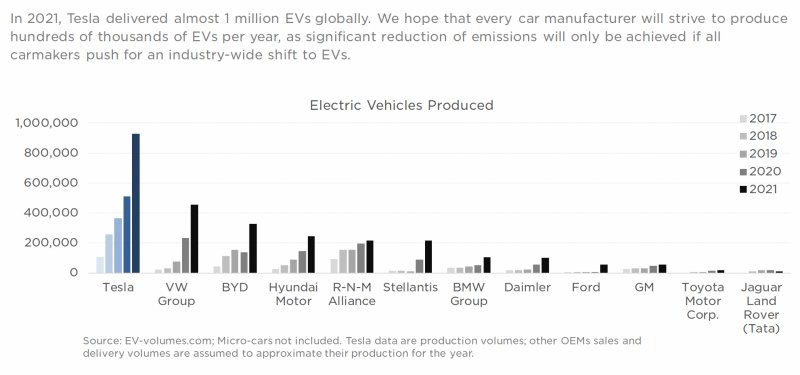

In the 1Q22 call, CEO Musk repeated CFO Kirkhorn’s statements that Tesla remains confident of 50% growth in vehicle production from 2021 to 2022. He then went on to say they have a reasonable chance of a 60% increase. Noting that Tesla recently crossed 1 million units in the past 12 months, CEO Musk repeated the aspiration of 20 million units per year. Many investors say Tesla needs to ship x number of vehicles in order to justify their current valuation. These investors assume Tesla’s future operating margins for EVs will be similar to the current operating margins for legacy automakers with ICE vehicles. I believe this is wrong. Per an October 2021 TechSpot article, Apple had just 13% of the global handset shipping share in 2Q21 but this was 75% of the global profit. EVs are the future and I think Tesla can have 13% or more of the EV shipments over extended periods of time which could mean much more than 13% of the profit. The 2021 Impact Report shows that apart from VW Group, legacy carmakers are not yet producing EVs in large numbers:

EV production (2021 Impact Report)

It’s hard to separate FSD from the electric car business. CEO Musk said the following in the June 14 interview mentioned above:

But the overwhelming focus is solving full self-driving so um, yeah. And that that’s essential and like that’s really the difference between Tesla uh being worth a lot of money and being worth basically zero.

I think the electric car business and the FSD business are worth about $500 billion combined. I believe other considerations like the Optimus robot program, energy storage and other start-ups are worth another $200 to $300 billion for a total valuation range of $700 to $800 billion. The 1Q22 10-Q shows 1,036,009,925 shares outstanding as of April 19. Multiplying this by the June 16 share price of $639.30 gives us a market cap of $662 billion. Unlike some other car companies that carry heavy debt loads, Tesla’s enterprise value is relatively close to their market cap. In fact, Tesla’s enterprise value is less than their market cap as the $17.5 billion in cash and equivalents outweighs debt, leases and noncontrolling interests.

The market cap and enterprise value are less than my valuation range, so I think the stock is undervalued.

Some actionable advice is to think independently and recognize that we’re at an inflection point with the automobile business such that the EV business of the future will have little in common with the ICE business of the past. I believe Tesla has a chance of doing to automobiles what Apple did to mobile phones.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment