Editor’s note: Seeking Alpha is proud to welcome Yareach Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

JHVEPhoto/iStock Editorial via Getty Images

Arconic (NYSE:ARNC) will likely benefit from the packaging industry experiencing organic growth of approximately 40%-45%. Management also noted future reduction in the combined pension contributions, which would likely lead to significant FCF generation in the coming years. I see risks from inflation and supply chain disruptions. However, future free cash flow would likely justify a significantly higher stock price. I am a buyer here.

Arconic Corporation

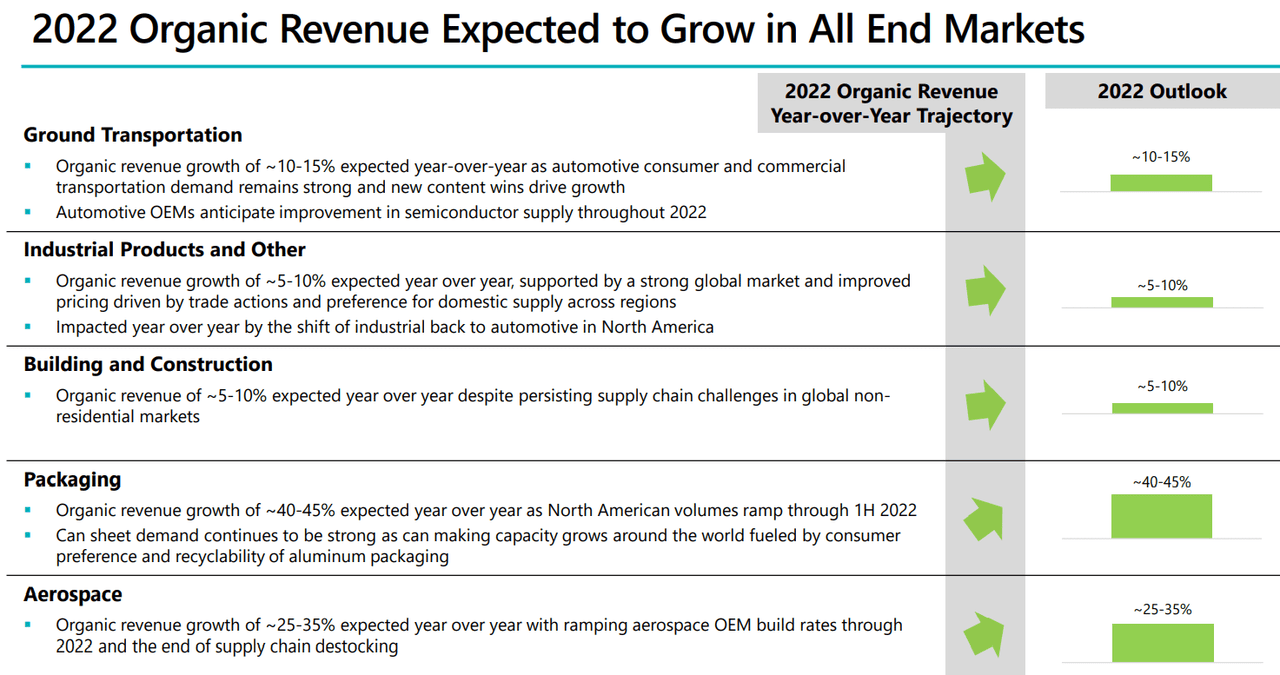

Arconic Corporation manufactures aluminum sheets, plates, extrusions, and architectural products for the ground transportation, aerospace, and packaging end markets. The company’s production appears well diversified with 21 manufacturing facilities in North America, Europe, and Asia. In my view, after the most recent presentation given to investors, many analysts should be right now making their own estimates about Arconic. Let’s mention the most relevant factors. The company believes that the packaging sector is expected to experience organic 2022 sales growth of 40%-45%, and aerospace 20%-35%. In my view, if management is smart, Arconic could deliver significant revenue growth in the coming years:

Presentation

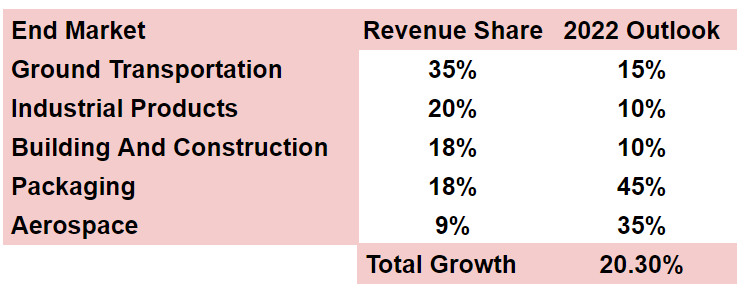

I took a look at the revenue share reported per business segment. Using the outlook for 2022, I obtained 2022 sales growth of 20%:

Presentation

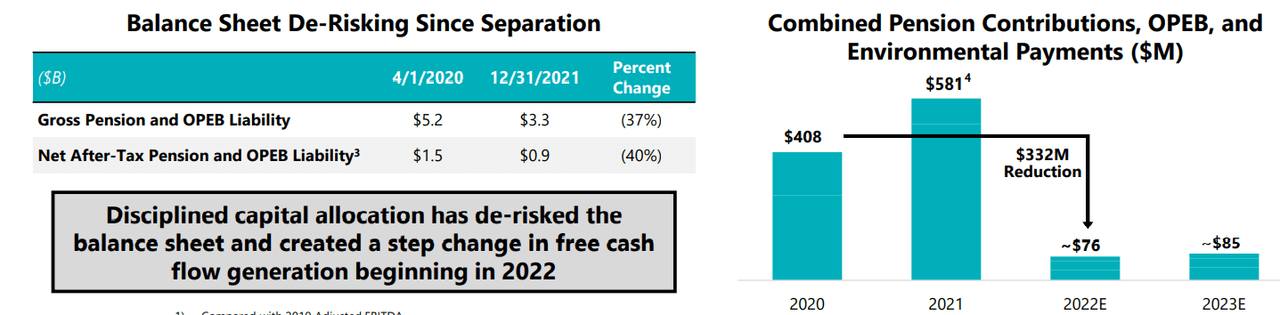

Arconic is also expecting significant free cash flow generation from 2022 because it expects to significantly reduce the combined pension contributions. Notice that the net after-tax pension has already decreased quite a bit since 2020:

Presentation

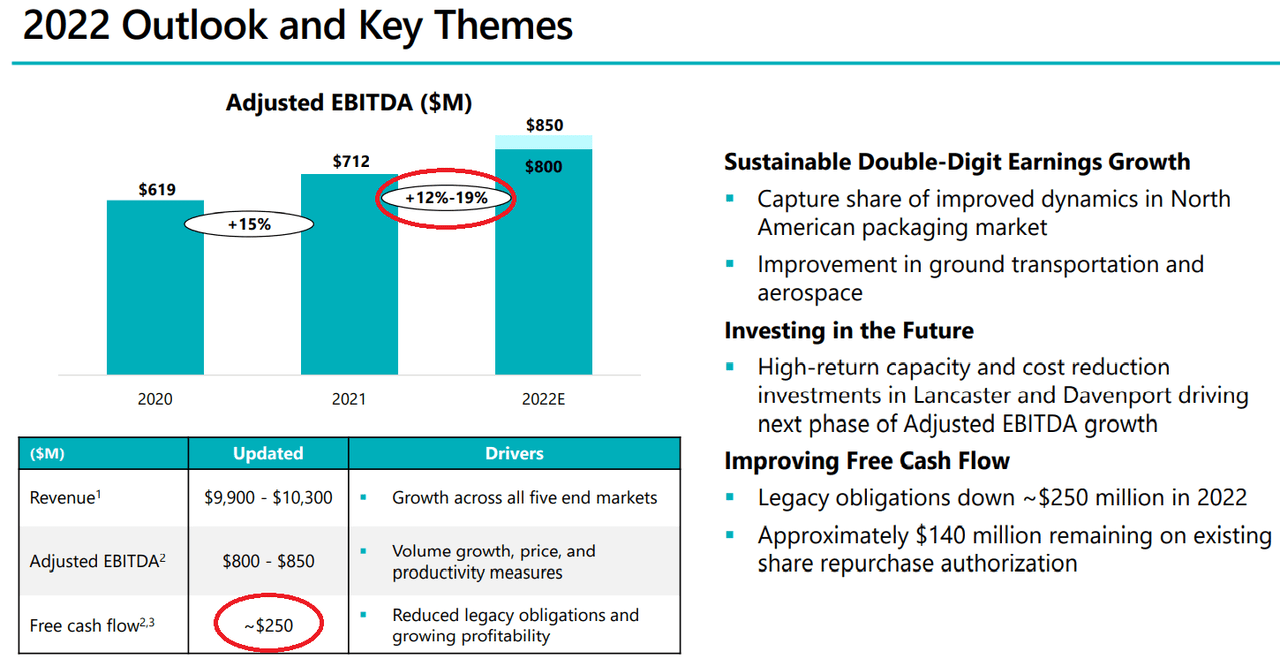

In my view, management also reported quite beneficial 2022 EBITDA. The company is expecting a 2022 EBITDA margin close to 12%-19%. Thanks to volume growth, productivity measures, and less legacy obligations, FCF should stay close to $250 million:

Presentation

Analysts Are Optimistic

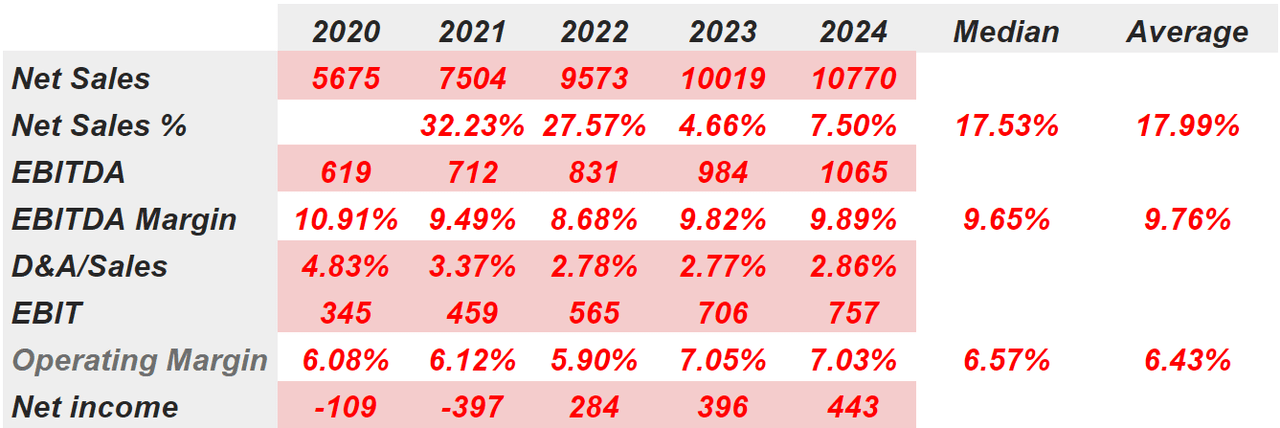

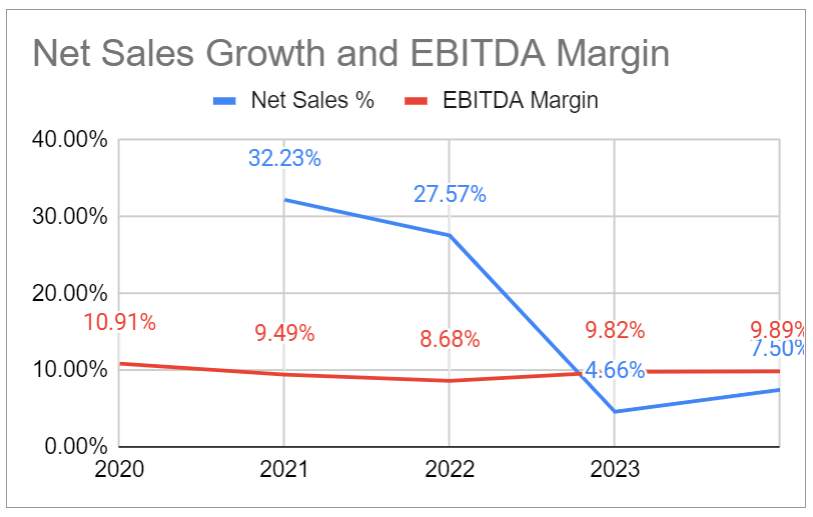

Analysts believe that sales growth could stand at 27% in 2022, and the median sales growth including their forecasts is 17%. They also expect a stable EBITDA margin close to 9.64%, D&A/Sales between 4% and 2%, and operating margin of 6%:

marketscreener.com

marketscreener.com

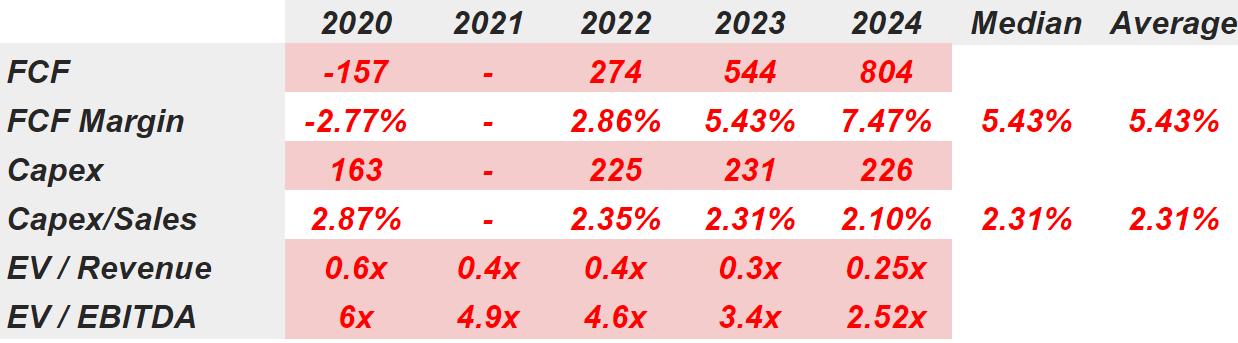

In my view, market participants don’t seem to be aware of future free cash flow because the current valuation appears cheap. FCF should grow from $274 million from 2022 to close to $804 million in 2024. Therefore, we would be talking about a significant increase in FCF/Sales, up to 5%-7%, with a capex/sales ratio of 2%. With the industry trading at a median of 7x EBITDA, Arconic trades at 4.6x:

marketscreener.com

Emerging Technological and Broader Industry Trends

Under this case scenario, I expect that Arconic will be able to identify emerging technological and broader industry trends in the packaging and aerospace markets. With some of the company’s target markets growing at a double digit, I would say that this case scenario is somewhat likely.

I also expect that the company would manufacture and bring innovative products, and will be able to market them quickly and cost-effectively. I really don’t think that this case scenario is out of the box. Take into account that Arconic was part of Alcoa, which was founded in 1888. The amount of know-how accumulated should be substantial. In my view, Arconic counts with talented personnel, which will likely offer new innovative ideas.

I am also quite optimistic about the company’s new organic capital projects in the Rolled Products segment. In my view, shareholders will likely see an increase in the EBITDA margin from 2023 thanks to this project:

We also repurchased $161 of shares of the Company’s common stock and initiated two organic capital projects in the Rolled Products segment that are expected to drive future EBITDA growth starting in 2023. (Source: 10-k)

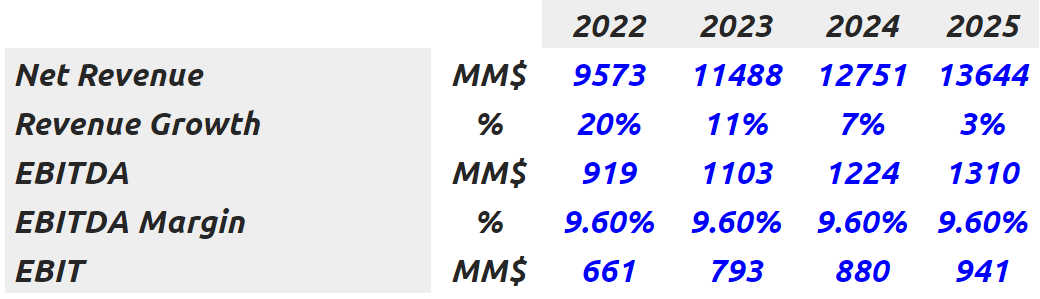

My figures in this case scenario are pretty much close to that of other analysts. I assumed 20% sales growth in 2022, 11% sales growth in 2023, and 7% sales growth in 2024. I also assumed a 2025 EBITDA margin of 9.6%, so that 2025 EBITDA equals $1.31 billion:

My Own Assumptions

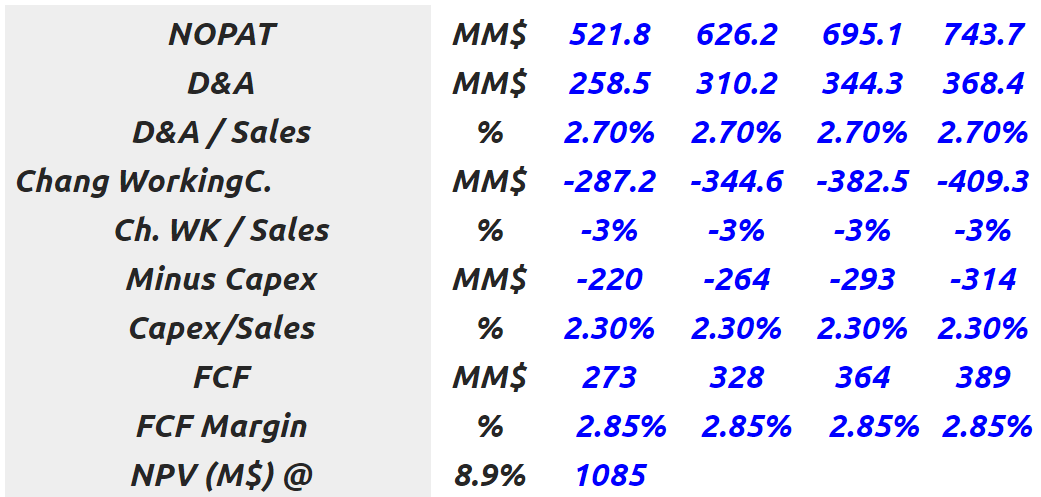

With the previous assumptions and effective tax of 21%, the NOPAT should stand between $521 million and $743 million. With change in working capital/sales of 3%, the free cash flow should grow from $273 million to $389 million. If we assume a conservative WACC of 8.9%, the net present value would be close to $1 billion:

My Own Assumptions

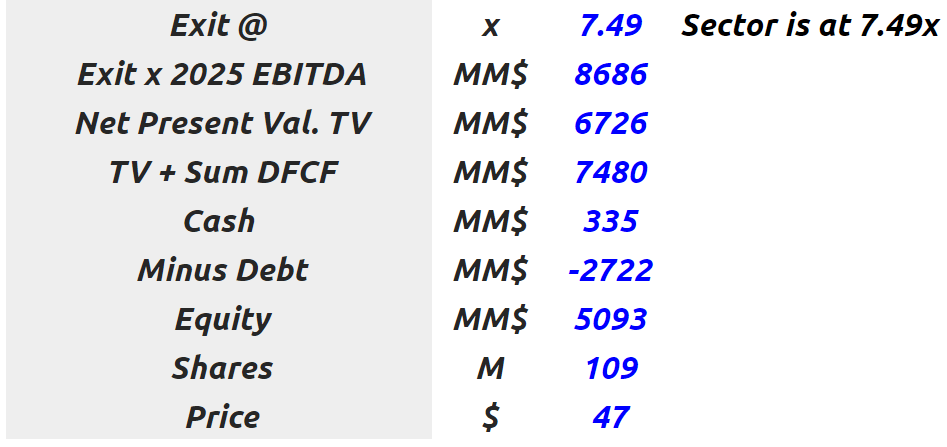

If we use the sector median EV/EBITDA of 7.49x, the implied equity should be $5.093 billion, and the implied stock price should be close to $47:

My Own Assumptions

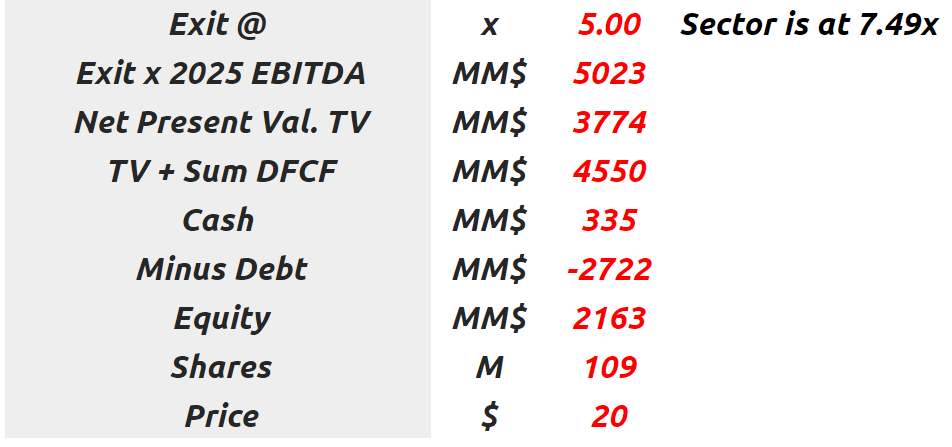

Risks Would Imply A Stock Price Of $20

With the most recent increase in the oil price, I believe that Arconic could suffer a significant decrease in the demand for aircraft. If the airline industry is not profitable in the next four to six years, I believe that Arconic may sell less products to this industry. It represents close to 9% of the company’s total revenue:

The U.S. and international commercial aviation industries may face challenges arising from competitive pressures and fuel costs. Demand for commercial aircraft is influenced by airline industry profitability, trends in airline passenger traffic, the state of U.S., regional and world economies, the ability of aircraft purchasers to obtain required financing and numerous other factors, including the effects of terrorism, health and safety concerns, environmental constraints imposed upon aircraft operators, the retirement of older aircraft, the performance and cost of alternative materials, and technological improvements to aircraft. (Source: 10-k)

A generalized increase in oil prices and supply chain disruptions could also destroy automotive and commercial transportation sales. As a result, in my view, Arconic will likely sell less products to the automotive industry, which would diminish the company’s free cash flow, and lower its valuation:

The automotive industry is sensitive to general economic conditions, including credit markets and interest rates, and consumer spending and preferences regarding vehicle ownership and usage, vehicle size, configuration and features. Automotive and commercial transportation sales and production can also be affected by other factors, including supply chain disruptions. (Source: 10-k)

Inflation could also be very detrimental for Arconic. If the aluminum price increases, and Arconic can’t increase the price of its products, the company’s EBITDA margin would decrease significantly. In the worst case scenario, the expectations of free cash flow would diminish, and the stock price would likely fall:

We have experienced, and continue to experience, inflationary pressures on the prices of aluminum, materials, transportation, energy and labor. In an inflationary environment, such as the current economic environment, our ability to implement customer pricing adjustments or surcharges to pass-through or offset the impacts of inflation may be limited. Continued inflationary pressures could reduce our profit margins and profitability. (Source: 10-k)

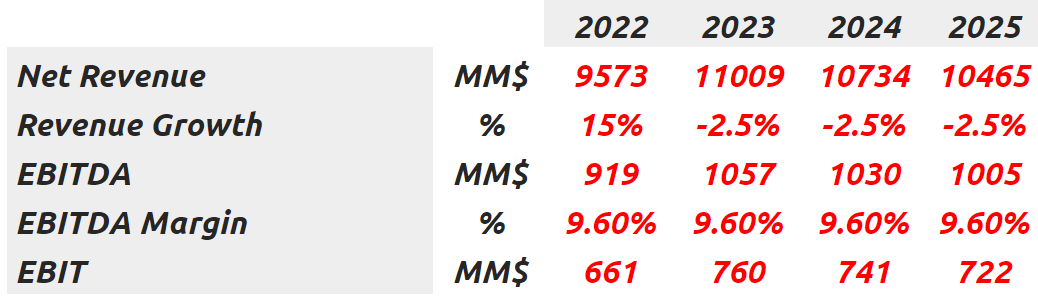

In the worst case scenario, I assumed net revenue growth of -2.5% y/y from 2023 to 2025, and an EBITDA margin close to 10%. The results include 2025 EBITDA of $1.005 billion:

My Own Assumptions

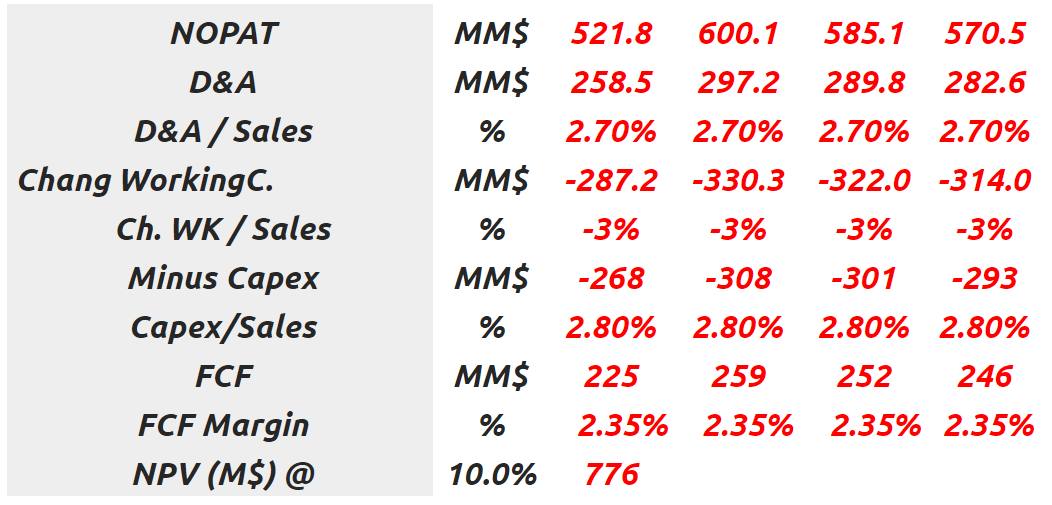

Under this case scenario, I obtained NOPAT of $570 million, D&A close to $280 million, and a capex close to $265-$300 million for 2025. My results include free cash flow between $225 million and $260 million, and a free cash flow margin of 2%. If we sum all the discounted free cash flow with a WACC of 10%, the total net present value equals around $775 million:

My Own Assumptions

Even with the median EV/EBITDA ratio in the industry at 7.5x, I believe that using an EV/EBITDA ratio of 5x is reasonable in this case. The result includes an implied equity valuation of $2.105 billion and an implied price of $20:

My Own Assumptions

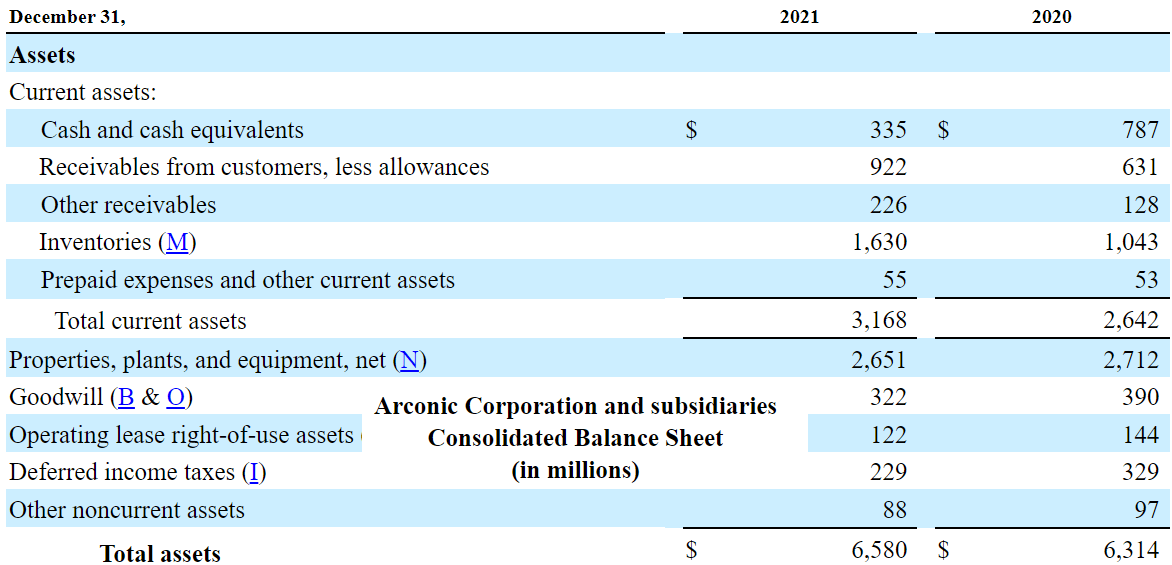

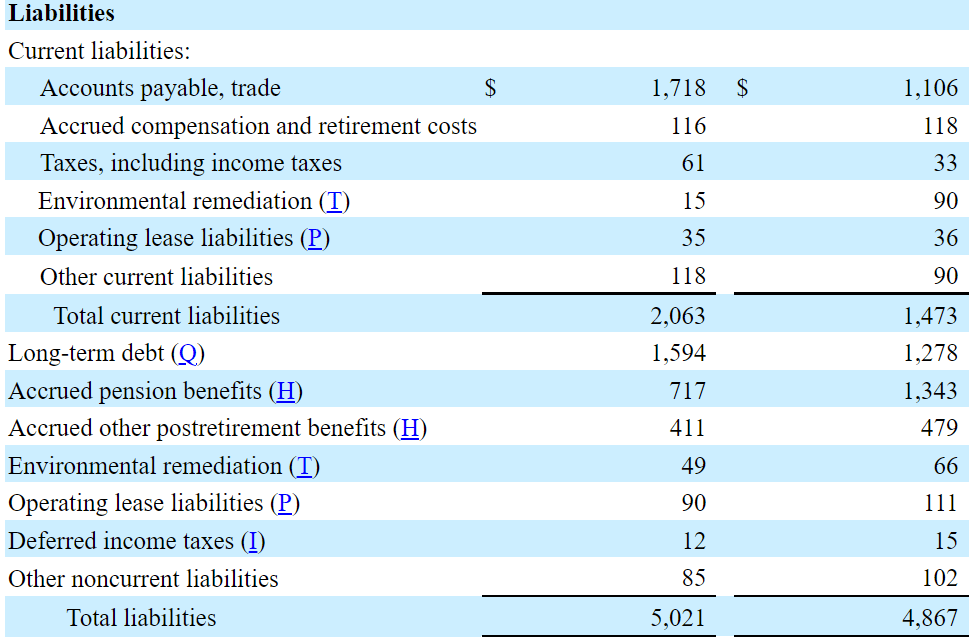

I Am Not Concerned About The Debt

With $335 million in cash, goodwill worth $322 million, and an asset/liability ratio of more than 1x, in my view, the company’s balance sheet is in good shape:

10-k

Certain investors may not appreciate Arconic’s long-term debt. In the last report, Arconic reported long-term debt worth $1.59 billion, accrued pension benefits of $717 million, and $411 million other postretirement benefits. In the worst case scenario, I would be expecting 2022 EBITDA of $919 million, so I would say that the total amount of leverage is healthy. Management may ask for more debt if needed.

10-k

Conclusion

With Arconic announcing a significant increase in the packaging and aerospace business segments, in my view, the company is becoming more interesting for the years 2022 and 2023. I also don’t believe that market participants are fully aware of the company’s reduction in pension benefits, which will likely bring more free cash from 2022-2023. Even considering the risks from inflation, in my opinion, the upside potential in the stock price is quite significant. At the current stock price, Arconic is a buy in my opinion.

Be the first to comment