Maksim Labkouski

When BP p.l.c. (NYSE:BP) and Archaea Energy (NYSE:LFG) announced the takeover, I was writing my fourth article on Archaea. It was going to be called “Growth, Growth and More Growth,” following on from my article “Archaea: Grade A For Execution,” the series having started with my first article, “Rice Acquisition: The Rice Brothers Are Offering A New SPAC, And I Am Buying.“

In that first article, I gave a fair value (DCF calculated) of $69 per share for Archaea, and BP is buying the company for $26 per share. This article will examine the rationale behind the deal, why BP wants to buy, and why the Archaea directors want to sell. Is it a good deal for BP, and are the shareholders of Archaea getting a reasonable price?

Archaea 2022: Growth, Growth, and More Growth

The Rice brothers (it might be worth reading my first article to understand the Rice brothers and their history) brought their SPAC deal to the market in 2021, and they crushed the 2022 forecasts they gave at that time.

At IPO, they were discussing new sites in single figures; in the latest Q2 guidance, they started to talk in thousands.

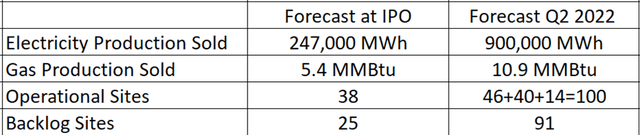

Comparing the forecasts for the full year 2022 in the Q2 earnings call with those given in the SPAC prospectus is illuminating.

LFG Change in production forecast (Author (Q2 earnings and IPO prospectus))

This growth has been achieved through technical excellence and acquisitions (Operational sites: 46 are Archaea, 40 sites from the Lightening JV, and 14 from NextGen Power Holdings acquisition.) This speed of growth has significant Capex and, therefore, debt implications. At IPO, LFG forecasted a Capex of $225m in 2022, falling to $66 million by 2025. They are now indicating $345m in 2022 and have committed to investing $1.1 billion in the Lightning Renewables joint venture with Republic Services (RSG) alone. Debt has surged to $580 million, and a $1 billion credit line is in place, with only $213 million of cash on hand. My model suggests that Archaea now has less than 18 months of cash runway.

CEO Nick Stork talked at length at the Q2 2022 earnings release about the future Capex requirements of Archaea. During the quarter, Archaea won three contracts to capture RNG at government-owned landfill sites bringing the backlog of sites to 91. The average landfill site installation costs $21 million, meaning that Archaea could be looking at short-term Capex requirements in the region of $1.9 billion, quite different from the $440 million forecast at IPO.

This speed of growth reflects two things: Firstly, a change in the market dynamics as RNG becomes more mainstream as a fuel for heavy-duty trucking and more government agencies move to cut their emissions. Secondly, Archaea’s ability to win contracts at the tender stage. The Archaea team is developing a reputation as the industry-leading experts in this field.

Archaea Execution: Best In Class

Archaea now operates the world’s largest landfill RNG site, “Assai,” and holds the world record for daily production at any industry site (Q2 earnings call), a level of production it meets regularly. The Assai site was a big part of the SPAC picture and was brought online on schedule and on budget.

Aria was one of the companies combined in the 2021 SPAC, and its sites are being upgraded with the advanced technical expertise of the new company. Archaea technology is proving that it can significantly increase the output and earnings power of existing RNG facilities. Archaea has identified specific improvements that can be made, including Nitrogen rejection systems and CO2 separation systems that can double the earnings power of these legacy assets. Archaea is leveraging its expertise to upgrade and right-size the systems to deliver its best-in-class operational efficiency.

Archaea now has a reputation as the industry leader for large-scale landfill RNG production and redeveloping existing facilities; this is a key reason it is winning tenders to develop new sites.

Transformational Technology The V1

Archaea has developed technology to reduce the set-up cost of new Landfill sites by 40%. Its latest product, the V1, is a revolution in methane capture.

In the latest earnings call, Nick Stork said that Archaea produced the first models of all components of the V1. In the presentation, we had the first photographs of the finished product.

The V1 first Photo (Archae Investor Presentation Q2)

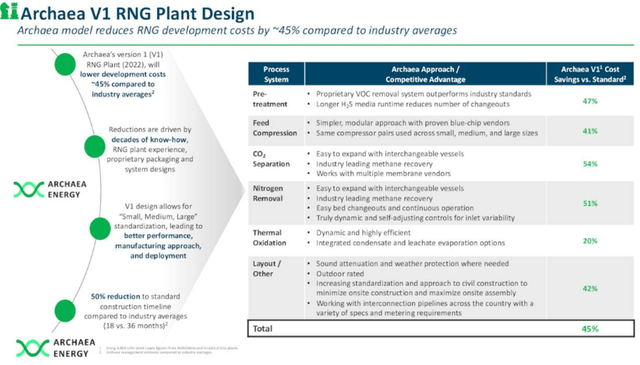

The V1 is a single unit, sled based, that can replace the previous bespoke systems; this slide from the investor presentation explains the system and where savings were made.

v1 product spec (Investor slide show Q2 2022)

The V1 reduces costs by around 45%, implying an average landfill cost of $8 million and a dairy installation cost of $4 million. This reduction in cost means that the V1 can profitably recover RNG from more than 1,000 landfill sites in the US alone (figure from earnings call). The V1 is not patent protected; however, it does provide a unique standardized and modular design providing a significant competitive advantage over the competition.

Having proved their technical expertise and operational excellence, this new product significantly increases Archaea’s potential. It might cost as much as $8 billion to capture that potential, and it would appear to be beyond the financial reach of Archaea.

Archaea The Conclusion

The Rice brothers have turned Archaea into an industry-leading landfill RNG company; they have developed a new technology that makes more sites profitable and the techniques to increase the profitability of older legacy sites. The demand for RNG is growing fast, and to make the most of the opportunity, they need cash and lots of it. Enter BP.

BP Performing whilst transforming.

Bernard Looney became the Chief Executive of BP in 2020. He has since made it clear that he intends to transform BP into a clean energy company, and he is betting big that he can beat the other majors to this goal. Looney announced that he aims to cut BP’s oil production by a million barrels a day (about 40% of current production) as he tries to win a race towards a clean energy future.

The scale of this venture is staggering; BP will be transformed. It aims to increase its electricity output to 50 gigawatts, an increase of 2,000%. Looney is offloading fossil fuel assets at quite a pace to fund this transition; $ 15 billion has already been raised by disposing of assets in Oman, Alaska, and the North Sea. BP’s entire petrochemical operation was sold off, a division that was producing $400 million a year.

In the 2021 annual report, BP wrote that it would spend 40-50% of its Capex on biofuels (p16); it is a big commitment, and Archaea fits perfectly.

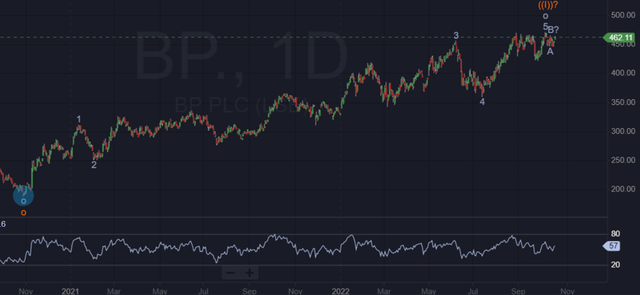

BP is having a good year; the share price is up significantly and it maintains its strong balance sheet.

BP Share Price (Author EW path)

This chart shows my BP chart (it is in British pennies, so 462.11 represents GBP4.62 from the London Stock Exchange); it is not a company I regularly track (I hold it in my long-term pension fund and do not actively trade it, for UK investors it is in my ISA), so the EW count is not so precise. However, the trend is clear, and although a pullback may be underway, I think a substantial wave (III) higher is not far away.

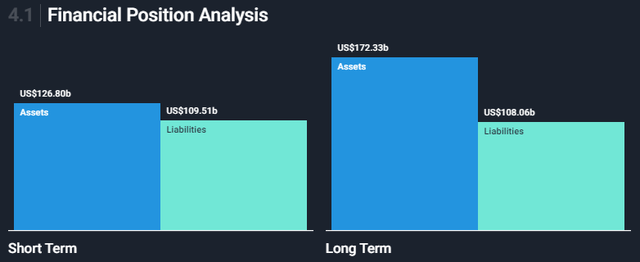

Bp Balance Sheet summary (Simply Wall St)

Wall Street Analysts give a consensus 1-year price forecast of GBP7, some 30% higher than today’s value.

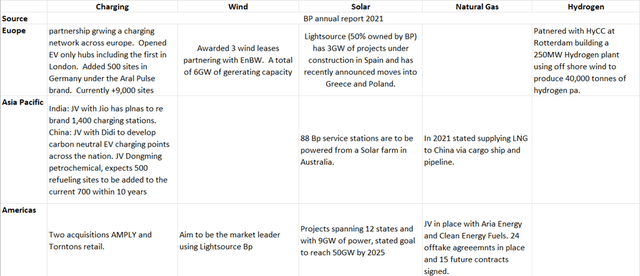

BP is transforming its operations by growing in three areas: electric charging stations, wind and solar electricity plus natural gas and hydrogen. They are growing all of these divisions in the US, Europe, and Asia.

Progress is significant in all areas.

Bp clean energy progress (2021 Annual report)

The Archaea takeover is a part of this plan. As this transition takes place, BP is shedding jobs: more than 10,000 in the last three years, about 15% of its workforce.

BP will be able to use the Archaea technology and its expertise to maximize its value and extend its use outside of the US to Europe and India, both of which are large BP customers with a large number of landfill sites currently not having methane collected.

The technical expertise and experience, along with their unique V1 combined with a large backlog, will give BP a moat around its operation; the long-term nature of Archaea’s contracts ensures that the operation will be profitable for decades to come.

BP has several joint ventures for the production of RNG, the first with ARIA (part of Archaea and soon to be a BP company) the second is with Clean Energy Fuels (CLNE). CLNE appears to focus on RNG production from dairy farms, whereas Archaea focuses more on landfill sites. CLNE has a market cap below $1.5 billion and hopes to achieve a production level of 29 million gallons of RNG in 2022. 1 gallon of LNG contains 69,000 MMBtu. Using these figures puts CLNE’s projected production at 2 MMBtu which is less than a fifth of the output at Archaea. The BP/CLNE joint venture has said it will move forward with projects at dairy farms in South Dakota and Iowa, with estimated additional production of 7 million gallons.

CleanBay Renewables, founded in 2013, collects RNG (and other products) from poultry waste. BP signed a 15-year agreement with CleanBay in 2021 to purchase RNG and sell it to the US transportation sector.

Conclusion

The rationale for the takeover is clear: BP is in the midst of a business transformation to a clean energy company, and RNG is a vital part of the plan. In buying Archaea, it gets an industry-leading company with advanced technology and proven operational expertise. Archaea has long-term contracts for its landfill sites and sells much of its RNG on long-term deals.

Archaea has grown quickly and would have needed significant funding to make the most of its new technology. The sale to BP crystalizes a profit for all of its investors.

I owned Archaea shares for over 12 months, buying first at $15.50 in April 2021. I sold for $25.90, a 67% return when the takeover was announced.

It is the second time a company started by the Rice family has made a good return for investors; Rice Energy was sold to EQT Corporation (EQT) for nearly $9 million in 2019, representing a 3,000 percent return for early investors.

I have used the unexpected profit to take my wife to Madrid for the weekend and take a position in Rice Acquisition Corp .II (RONI). I have no idea what the company will do, but the Rice brothers are a proven money-maker for me, and I will continue to invest with them.

I will be looking at CLNE and other potential BP targets in the coming months and will write about anything interesting I find.

Be the first to comment