kiattisakch/E+ via Getty Images

Most people who think about natural gas certainly view it as a non-renewable energy that the world hopes to eventually wean itself off of. Having said that, the picture is far more complicated than that. In addition to traditional natural gas, there’s also something known as RNG, or renewable natural gas. And one company dedicated to its production and sale is Archaea Energy (NYSE:LFG). At this point in time, the enterprise is still small compared to many other energy companies. But it’s undergoing significant change at a rapid pace. If the company can truly achieve what it has started out to do, then it’s not unthinkable that further upside could be around the table before too long. With the path for the company looking straightforward, and shares already priced at reasonable levels for such a rapidly growing business, I cannot help but to rate the enterprise a ‘buy’ at this moment.

Archaea Energy – A player in renewable natural gas

As I mentioned already, Archaea Energy is a company that’s focused on the production and sale of RNG. Unlike traditional natural gas, the natural gas that Archaea Energy produces primarily comes from landfill-sourced biogas that is collected and processed so that impurities can be removed. The reason why biogas is referred to as renewable is because, unlike coming from deposits within the earth, it is sourced from landfills, livestock farms, wastewater resource recovery facilities, organic waste operations, and even forest and wood products. But as I mentioned already, the landfill-sourced biogas is what Archaea Energy specializes in.

At first glance, this may be viewed as a very niche area. But the opportunity seems to be massive. According to the EPA, there are an estimated 2,600 landfills across the US, with roughly 500 of them having operational gas collecting and processing facilities. Some even have multiple such facilities, leading to an estimated 550 locations nationwide. Of course, not all of these are useful for Archaea Energy’s purpose. In fact, only 72 of these facilities are focused on RNG, while the remainder are focused on taking landfill gas and turning it directly into electricity. This is an area that Archaea Energy sees particular promise in, essentially helping to convert these landfill gas-to-electric facilities into RNG production facilities. And naturally, the landfills that do not yet have any such facility also make for attractive targets. In addition to generating revenue off of the production and sale of RNG, the company also generates revenue off of the sale of RINs, or renewable identification numbers. These are credits used for compliance, with the particular numbers assigned to each gallon of renewable fuel that’s produced. The company also is involved in other similar schemes that it refers to as environmental attributes. And finally, a significant chunk of its revenue comes from the production of power, with revenue there generated by selling renewable electricity and the environmental attributes that are specific to that activity.

As a value-oriented investor, I like to put a great deal of emphasis on the fundamental condition of any company that I research. But firms like Archaea Energy prove to be exceptionally difficult. This is because of two reasons. First and foremost, this is a fairly small player that has had, up until very recently, almost no revenue and that has been generating significant net losses and cash outflows. Second, it is undergoing significant rapid change that should create great upside potential if all goes according to plan. Neither of these conditions are very conducive for value analysis. At the same time, however, some discussion of the company’s fundamental past should prove illustrative.

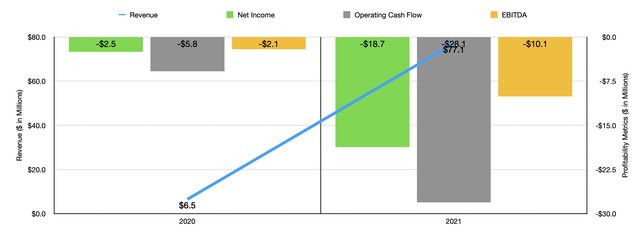

Back in 2021, Archaea Energy generated only $77.1 million in sales. Those small for a business with a $2.36 billion market capitalization as of this writing, it’s significantly higher than the $6.5 million generated one year earlier. This massive increase in sales was driven by a variety of factors. But the single largest, by far, involved the commencement of commercial operations in April of 2021 at its Boyd County facility, the purchase of PEI power assets, and the acquisition of a firm called Aria. All of this alone requires some further detail. Specifics regarding the formation of the enterprise that exists today have been covered in great detail by other authors, such as here and here. Odds are if you are familiar with Archaea Energy, you already have some background on that matter. In short, however, the company has really truly formed as a result of the combination of several other properties. These combinations resulted in, by the end of the 2021 fiscal year, the business owning, either on a wholly owned basis or through joint ventures, a portfolio of 29 landfill gas recovery and processing facilities spread across 18 states. That included 11 operated facilities that produce pipeline quality RNG and 18 facilities that focused on renewable electricity production. On the bottom line, the picture for the company looks quite dubious. Last year, it generated a loss of $18.7 million. That compared to the $2.5 million loss incurred in 2020. Operating cash flow went from negative $5.8 million to negative $28.1 million, while EBITDA turned from negative $2.1 million to negative $10.1 million.

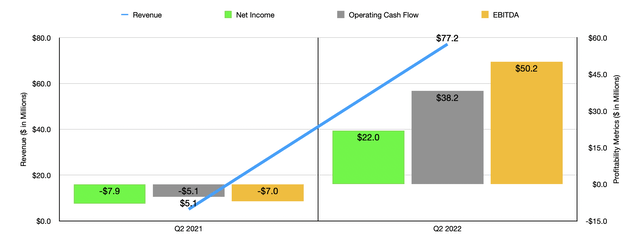

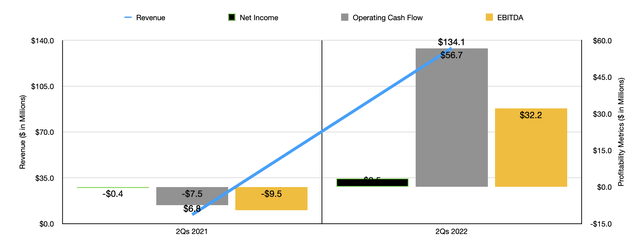

To see what I mean by referring to the company as a rapidly growing enterprise, we need only look at its most recent financial performance. In the second half of the 2022 fiscal year, sales came in strong at $134.1 million. $77.2 million of this was generated in the second quarter alone. Although this rapid increase in sales compared to the $6.8 million generated in the first half of 2021 and the $5.1 million generated in the second quarter of 2021 alone, might be viewed as extreme, it’s worth noting that sales in the second quarter missed analysts’ expectations by $2.28 million. According to management, this significant increase in revenue was driven largely by the company’s acquisitions, activities that ultimately resulted in significant increases in energy sold. In the second quarter of this year, for instance, the firm sold 1,755,145 MMBtu of RNG, while electricity sold totaled 142,977 MWh. The same time one year earlier, these numbers were 47,592 MMBtu and 47,847 MWh, respectively. The acquisition of Aria contributed $48.1 million of the sales increase for the company in the second quarter, comprising the largest chunk of the company’s expansion.

On the bottom line, meanwhile, the company did post some interesting results. Net income came in positive at $22 million during the second quarter, pushing profitability for the first half of the year as a whole up to $3.5 million. On a per-share basis, the company generated a profit of $0.27. That beat analysts’ expectations by $0.24 per share. But if we look at the picture from an adjusted basis, the company did miss expectations by $0.12 per share. Operating cash flow in the latest quarter went from negative $5.1 million to positive $38.2 million, while in the first half it rose from negative $7.5 million to positive $56.7 million. Meanwhile, EBITDA turned from negative $7 million to positive $50.2 million, while for the first half of the year it went from negative $9.5 million to positive $32.2 million.

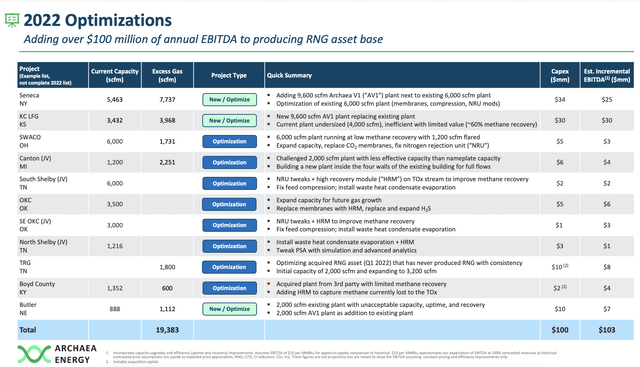

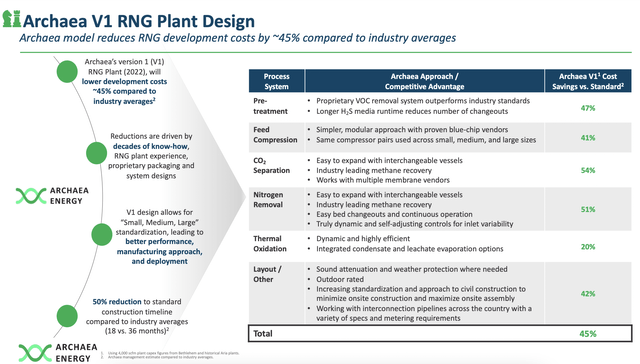

All of this is important for investors to know. But given the rapid change management is pushing, what’s more important is where the company seems to be going. Through various acquisitions and continued organic growth, the company is truly focused on transforming itself. There are multiple things that could be brought up along these lines to illustrate what I mean. For instance, this year alone, the company is working to optimize its existing asset base through the deployment of $100 million spread across no fewer than 11 of its different projects. That alone is forecasted to add $103 million in EBITDA to the company. Its activities involve improved plant design for its RNG facilities aimed at reducing RNG development costs by 45% compared to industry averages. More details about this can be seen in the image below.

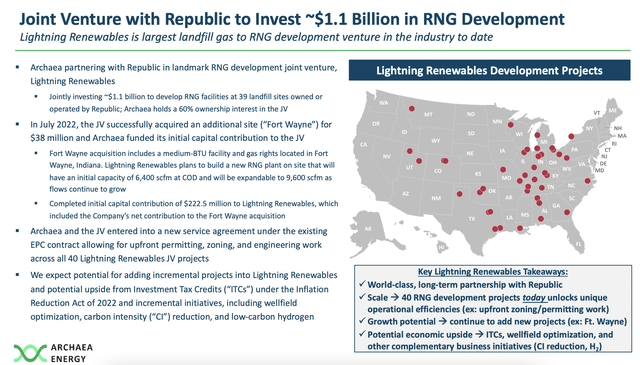

Another big catalyst for the company is its joint venture with Republic Services (RSG), which is certainly one of the largest waste-oriented firms out there. This particular joint venture, known as Lightning Renewables, will result in $1.1 billion being used to develop RNG facilities at 39 landfill sites owned or operated by Republic, with Archaea Energy ultimately owning 60% of the joint venture entity. Of course, this is an evolving relationship. In July of this year, the entity in question purchased an additional site at Fort Wayne for $38 million. It’s also important to note that, as of the end of the latest quarter, Archaea Energy has already made its initial capital contribution of $222.5 million to the joint venture, an amount that included its share of the Fort Wayne acquisition. Also, in July of 2022, Archaea Energy completed the acquisition of NextGen Power Holdings in a deal that ultimately added 14 landfill gas to electric plants to the company’s asset platform and that will allow it to develop 11 RNG development projects at sites moving forward.

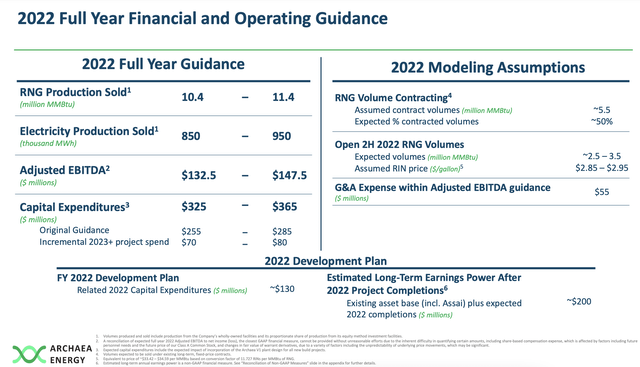

Management has big plans for the future as well. For starters, the company hopes to engage in RNG development projects in 2023. They are also hoping to reduce costs in a way that should add $20 million or more in additional EBITDA to their bottom line. And they want to pave the way, from an organic perspective, to $1 billion or more in annualized EBITDA. Right now, the company already sees a path, 6 to 8 years out into the future, of $600 million in EBITDA per annum. That’s 50% higher than what the company’s prior projected timeline implied in March of this year. But of course, this will take time and capital. For the 2022 fiscal year, the company is expecting EBITDA of between $132.5 million and $147.5 million. That should be based on RNG production sold of between 10.4 million MMBtu and 11.4 million MMBtu. For 2022, the company hopes for EBITDA to be even higher at $200 million or more.

Already, these numbers imply a scenario where shares of the business are not outrageously priced. On an EV to EBITDA basis, using our 2022 estimates, the company is trading already at a multiple of 23.6. Of course, as continued investments are made, and as the market goes up or down, the enterprise value of the business will change significantly. But if nothing were to change from today, using our 2023 figures, the multiple would drop even further to 16.5. For a company with a clear path to even greater profitability in the future, these numbers are not unreasonable at all.

Takeaway

At this point in time, Archaea Energy seems to offer investors a fascinating opportunity to buy into a niche part of the energy market. Long term, it’s unclear what the future holds. But based on everything that management has achieved so far, it’s likely that further upside revisions will be made and that, on a forward basis, shares will get cheaper as a result. If the company were priced at ridiculous levels, I would be far less optimistic. But given pricing today, it doesn’t look to me like a lot of its upside potential is priced in. This, combined with the continued push that society has toward renewable sources of energy, leads me to rate the enterprise a ‘buy’ at this time, even though it doesn’t make for a particularly good value prospect.

Be the first to comment