keni1

I recently spent an hour talking about investments with someone who works at a financial firm about ESG. For the uninitiated, ESG stands for Environmental, Social, and Governance. The short version of my view is that ESG has created malinvestment everywhere you look, especially when it comes to energy policy. It’s why Germany is shutting down nuclear plants and firing up coal plants as the flow of natural gas from Russia slows. It’s why our government subsidizes wasteful energy policies like electric vehicles, solar panels, and wind turbines.

This willful ignorance is what has made the energy sector a good place to be invested over the last couple of years. Combined with cheap valuations because large asset managers won’t invest in the sector, stocks in the energy sector thumped the broader markets over the last couple of years and that has continued in 2022. While my previous rants have typically focused on oil and natural gas with my investments in Magellan Midstream Partners (MMP) and Enterprise Products Partners (EPD), today we are going to take a closer look at coal.

Coal: The Most Hated Industry In America?

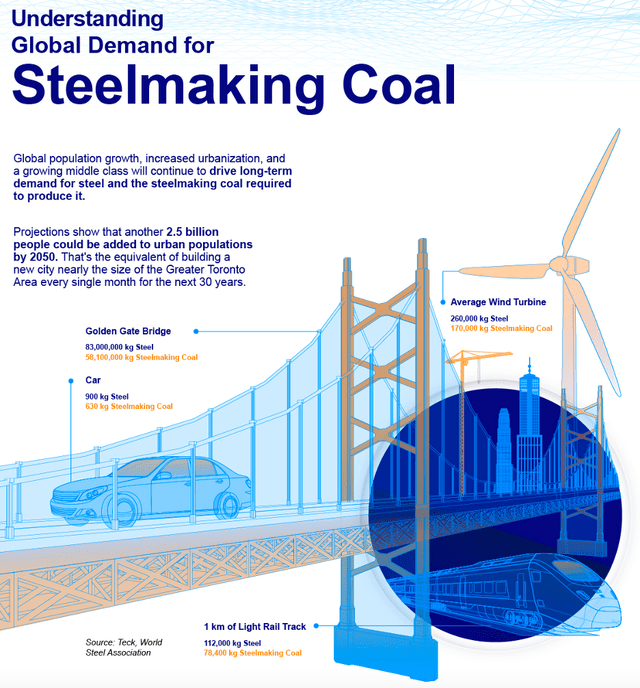

While that might be an exaggeration due to the existence of the tobacco industry, coal is nearly everyone’s favorite commodity to hate. To be fair, it is a dirty source of power, especially compared to some of the alternatives we have today. However, it’s not just used for electricity generation. Coal is required for the steelmaking process. It’s typically called coking or metallurgical coal, while coal burned for energy is known as thermal coal.

Coal for Steel (visualcapitalist.com)

While a shift away from coal has been pushed by the ESG crowd, the coal price has spiked over the last couple of years. After spending the last decade well below $100, coal is now trading at $366 a ton as I write this. While the price spike could be temporary, Japan’s Nippon Steel (OTCPK:NISTF) (OTCPK:NPSCY) recently locked in $375 a ton through March with Glencore. I’m not a commodities trader, but I think high prices are here to stay across the commodity space, especially with the underinvestment in the mining sector for decades.

Investment Thesis

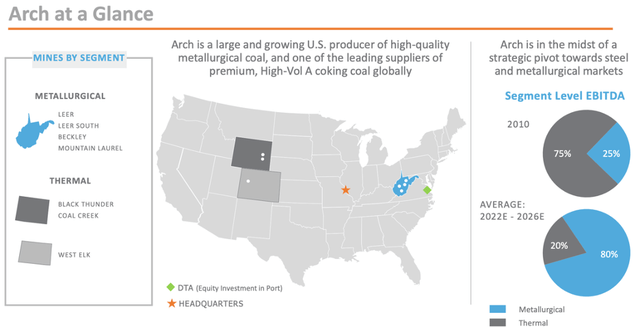

This extended preamble brings me to one of the big players in the met coal space, Arch Resources (NYSE:ARCH). They have mines in the US, and their business is tilted towards met coal versus thermal coal. The spike in coal price means business is booming for Arch, and if coal prices stay high in the coming years, the share price will have nowhere to go but up. Shares dropped below $25 in 2020, and even after a 500% run since then, shares still trade at 3x earnings. The company has also boosted shareholder rewards in the form of a massive dividend in the last couple of quarters and a $500M repurchase program authorized in Q2. If you are looking for a company with a cheap valuation tied to the energy sector with a potential for impressive returns with higher commodity prices, Arch might be worth a closer look.

The Business

Revenue and net income for Arch have exploded in 2022 as the price of coal ran hard in the last year. The company has mines in the US, with the West Virginia mines being focused on met coal, with the mines in Wyoming and Colorado focused on thermal coal. The company continues to focus its capex budget on the metallurgical side of the business.

While countries around the world will continue to use thermal coal (especially India and China), I think Arch’s focus on coal for the steelmaking process means that they will have durable demand for their product, even with higher prices. Arch has also been able to use the ideal operating environment to improve their balance sheet. While the coal business isn’t likely to draw a ton of investors in, the valuation might be enough to entice a new group of investors.

Valuation

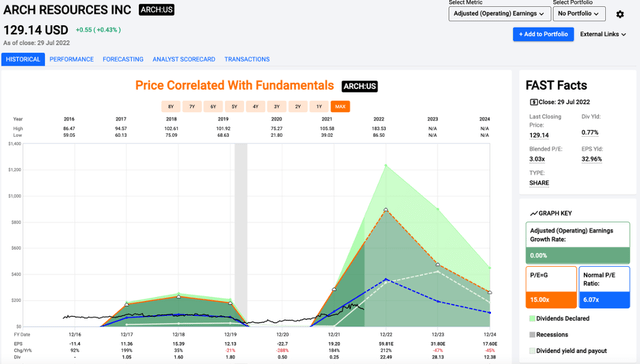

Arch is cheap despite the massive run in shares over the last couple of years. I don’t think we will see shares head for a 15x multiple (the returns would be massive if they did), but I think some degree of multiple expansion is likely, especially if coal prices stay elevated and the company is earning a ton of money each quarter.

Price/Earnings (fastgraphs.com)

One thing that I found interesting on the Seeking Alpha homepage for Arch is the short interest at nearly 18%. I’m not a short investor, but I certainly wouldn’t be short anything like Arch with its cheap valuation, large dividend, and huge buyback program.

Dividends & Buybacks

Arch is set to reward shareholders in a big way in the second half of 2022. After a massive $8.11 dividend was paid out in June, Arch declared a $6 dividend for September. While the dividend will likely fluctuate some due to the price of coal, Arch is planning to pay out 50% of the cash flow in the future. This would include a small, fixed dividend and a larger variable portion. The remaining 50% would be used for various purposes at the board’s discretion. This could be buybacks or special dividends, but also could be used for repurchasing dilutive securities or allowing cash to build up on the balance sheet for future use.

As for the buyback program, the company increased the outstanding buyback authorization to $500M in Q2. They haven’t bought back any shares yet, but the authorization has no termination date. For a company with a market cap of $2.4B, that’s over 20% shares outstanding. I’m assuming they will be fairly aggressive with buybacks with the current valuation, but we will have to wait for the next 10-Q to find out.

Conclusion

Coal is one of the more hated commodities out there, which is one of the reasons I find it interesting. Arch is more focused on the metallurgical coal used to make steel, which should serve it well over the longer term. Despite a massive run in the last couple of years, shares still trade at 3x earnings. Some might argue that it’s a value trap that will struggle if the price of coal falls. That could be true if the price falls significantly.

Feel free to take this opinion with a grain of salt, but I think commodity prices will remain elevated in the next couple of years. The company also has a huge variable dividend policy and is set to buy back a large chunk of shares in the second half of 2022. I’m not a buyer right now due to limited dry powder, but if I were looking at commodity-based stocks, I would take a strong look at Arch Resources.

Be the first to comment