imaginima

(Note: This is a Canadian company reporting in Canadian dollars unless otherwise noted.)

ARC Resources (OTCPK:AETUF) is a large investment grade Canadian company that reports in Canadian dollars. The management of the company has generally made conservative deals that have a way of benefitting shareholders to make for a decent return for a large company. The company is investment grade and has been for a while. The company focus appears to be much better than I usually find for companies this size.

Costs

The company remains a significant natural gas producer. But the addition of condensate production by way of a previous merger has allowed the company to benefit from the premium price of condensate while holding costs constant.

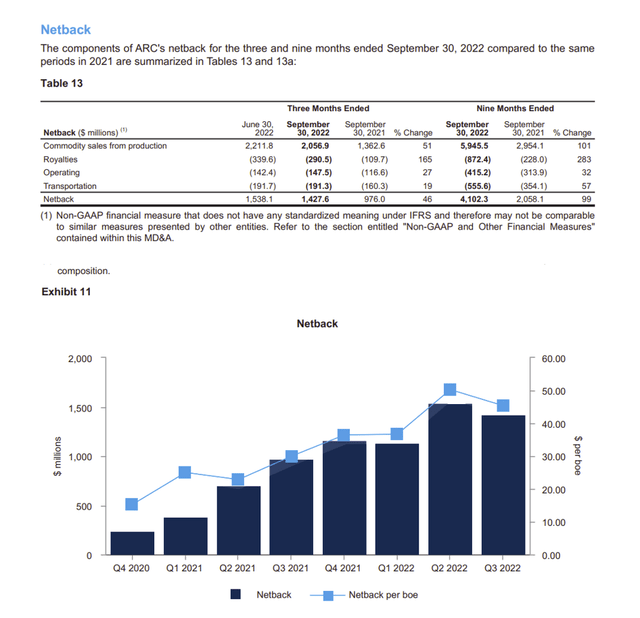

ARC Resources Netback Calculation History (ARC Resources Management And Discussion Analysis Third Quarter 2022 Part Of The Combined Report Released To Shareholders)

The company gets the benefit of the premium price of condensate while maintaining the operating costs of a typical natural gas producer. Because condensate in Canada sells at a premium to light oil, any rise in oil prices is usually exceeded by the rise in condensate prices. The result is additional cash flow that many competitors can only dream about.

The very low costs combined with the considerable condensate production usually allow for decent cash flow during times of cyclical pricing weaknesses.

Canada has long needed to import condensate to meet the industry needs. Therefore, condensate often becomes a product with a premium selling price to WTI. That makes it one of the few products that can be more profitable to produce than light oil.

Operating History Results

The natural gas business was unusually profitable before the business combination. So far, the combination of two very profitable companies has been a runaway success.

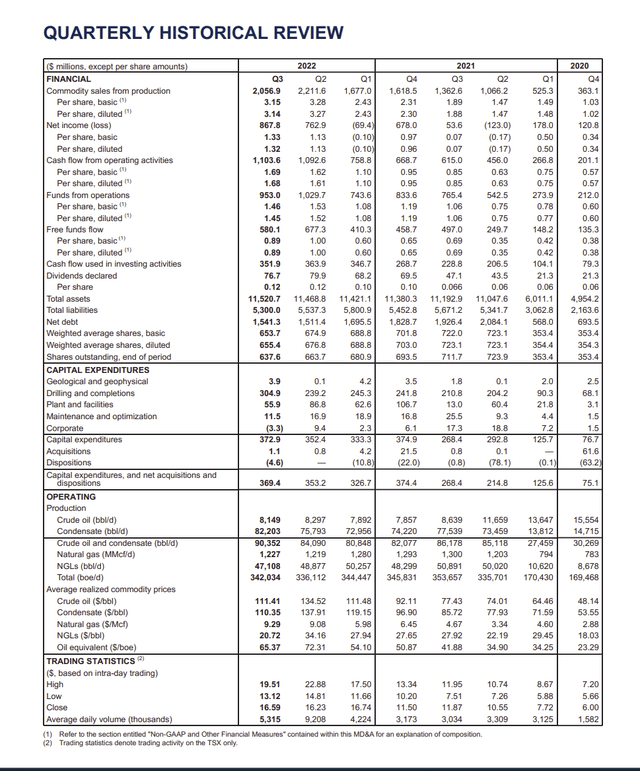

ARC Resources Operating Results History For 8 Quarters ( (ARC Resources Management And Discussion Analysis Third Quarter 2022 Part Of The Combined Report Released to Shareholders)

The natural gas business was unusually profitable in fiscal year 2020 not only due to the low costs shown above but also because the Canadian natural gas business had begun a price recovery from an earlier crash.

The business combination can be seen when the number of shares outstanding roughly doubled. Yet there was enough debt used to keep the per share statistics on an upward trajectory as the industry recovery continued.

Many disagreed with the business combination because there was at least some thought that the combination was expensive. Yet the unanticipatedly strong commodity price recovery of both natural gas and light oil has made a lot of business combinations look very good.

Debt is being repaid (as shown above) at a blistering pace while the company has also repurchased a sizable amount of the issued shares. Despite the apparent pause in the brisk pace of net debt decline (as shown above for the third quarter), net debt is still down quite a bit from the beginning of the year.

The repurchasing of shares is likely to continue because this company intends to try to maintain the dividend (short of an extreme case like the fiscal year 2020 challenges).

Dividend Strategy

The strategy is not a typical dividend strategy that one often sees in Canadian companies. More often than not, a typical Canadian dividend strategy is to increase the dividend during the good times and then ratchet that same dividend down during industry downturns.

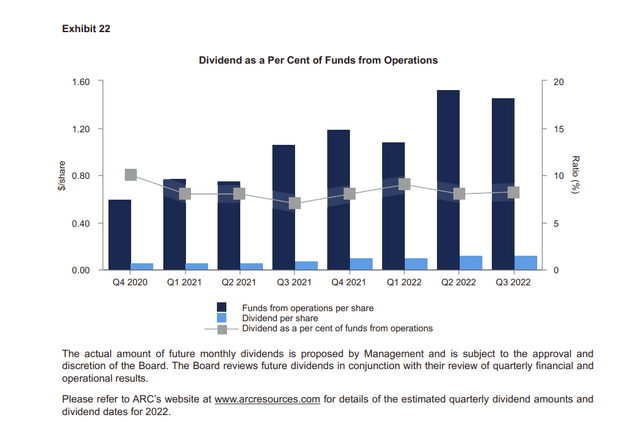

ARC Resources Dividend Payout History (ARC Resources Management And Discussion Analysis Third Quarter 2022, Part Of The Combined Report Released To Shareholders)

In the current recovery cycle, the payout shown above is uncharacteristically low compared to many companies that I follow. So far, this management has not followed the industry trend by paying a special dividend (like so many others with this strategy). Instead, much of the excess cash flow has gone to reduce the number of shares outstanding.

Mr. Market may not initially like the choices of management as the market has absolutely been screaming for a large return of capital distribution. However, this strategy will produce a steady per share growth.

The earlier chart showed that the number of shares has decreased from the peak amount of issued and outstanding by roughly 15%. Management will likely continue to repurchase shares well into the future as that has been a hallmark of this company’s strategy to increase value to shareholders.

Cash Flow Emphasis

Management has long emphasized cash flow. Quarterly earnings can be influenced by a lot of things well beyond the control of management. But a steady cash flow increase at various pricing points has long been a company hallmark.

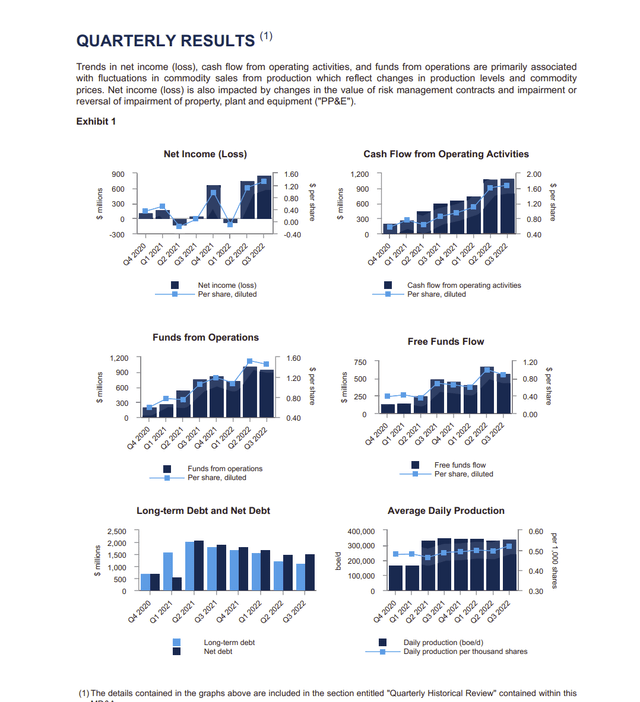

ARC Resources Review Of History Of Cash Flow, Debt Levels, And Production (ARC Resources Management And Discussion Analysis Third Quarter 2022, Part Of The Combined Report Released To Shareholders)

A lot of companies that have a merger along the lines of the one that happened here in 2021 would suffer some sort of temporary setback from all the shares issued. That clearly was not the case here.

Some of the improvement can be attributed to the combination of debt and shares issued that led to the deal being accretive to both groups of shareholders. The other part of the improvement was the unexpectedly strong rise in prices of both liquids and natural gas.

By repurchasing shares, management can “lock in” a significantly accretive per share performance for a wider variety of industry outcomes. Mr. Market loves a growth story on a per share basis. So, this company is trying to make that growth story as obvious as possible (for as long as possible in the industry cycle).

As a result, the strategy of repurchasing shares could result in more long-term appreciation potential than would be the case of cash results from returning that money to shareholders. It is a big statement that management believes that the shares are undervalued enough to go against current industry trends (of special dividends) to result in a more profitable long-term outcome.

The Future

This company generally keeps a very conservative debt level that results in a far better credit rating than is available to much of the industry. The merger that gained the company condensate and oil production has so far proved to be a profit bonanza to both the acquiring shareholders and the acquired shareholders.

The roughly 15% of outstanding shares repurchased will provide a per share performance boost that will likely exceed the long-term results of those returning cash to shareholders. It remains to be seen which the market prefers long term.

In the past Mr. Market has valued growth stories. Those share repurchases make this a growth story that is typically in excess of growth for companies this large. It probably means that long-term returns to common holders of both the dividend and share price appreciation will be in the teens.

That means that shareholders can expect future outperformance of competitors of the same size.

Additionally, this well-run company may be acquired at some point. The low debt and low operational costs make this company attractive to potential purchasers. Investors need to remember that purchasers of companies typically want well run companies with no trouble and low debt. This company satisfies those goals.

Be the first to comment