jetcityimage

Aptiv (NYSE:APTV) is one of the largest manufacturers of automotive components and technology solutions for the automotive industry, headquartered in Dublin. The topic of electric and unmanned vehicles has long attracted tremendous investor attention. The company develops the hardware and software basis for the electrical and electronic systems of vehicles produced by the world’s largest automotive companies. Aptiv’s solutions are designed to improve the safety and functionality of vehicles. It is also actively developing autonomous driving technologies.

Company parts presentation (Company presentation)

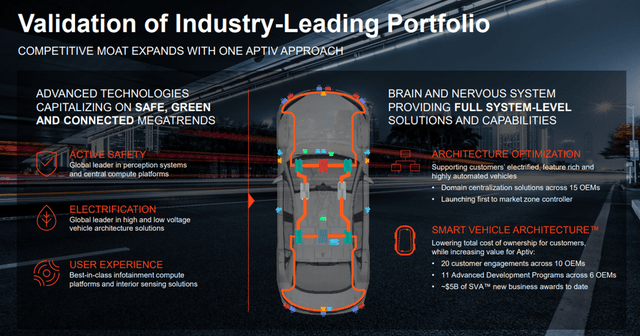

Company portfolio (company presentation)

Market overview

Aptiv’s business is directly linked to the pace of production, and because of logistical problems and production stoppages related to operations at the western Ukrainian border, the car supply chain has been disrupted. According to S&P Global Mobility: “With the March forecast release, we removed 2.6 million units from our 2022 and 2023 outlook, but the downside risk is enormous. Our worst-case contingency shows possible reductions of up to 4 million units for this and next year.” Nevertheless, it is estimated that by 2030 over 75% of cars will have some level of autonomy. Aptiv PLC sees autonomy levels 2 and 2+ as its fastest growing area and its focus.

Financials

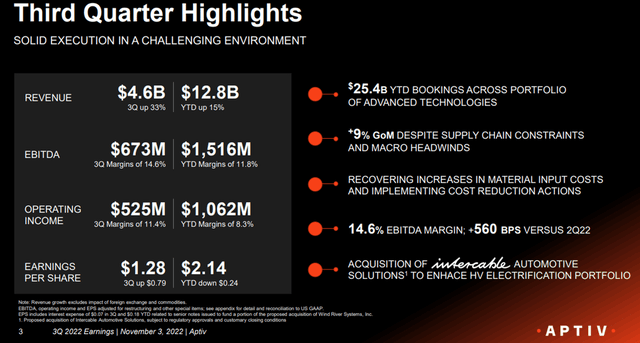

Vehicle production in North America remained strong, while there was a significant decline in Europe. China finished the third quarter very well, despite a slow start due to COVID-related production disruptions. Aptiv is implementing additional overhead cost reductions, which will save 100m$ in 2023; will launch first zone controller with Volvo early next year; and expects to finish the year with strong growth and increased margins.

The results for the 3nd quarter were strong and beat estimates. Operating income was 525m$, compared to 256m$ last year, up by 105% YoY. Most of the loss for last two quarters was due to higher expenses for semiconductors and commodities. In addition, there was a loss from Motional, a joint venture with Hyundai Motor Group focused on the design, development, and commercialization of autonomous driving technologies. On the positive side, bookings (net orders) were up 238% year-on-year. They reached 25bn$ for the first three quarters of 2022, including 14bn$ in the second quarter alone, which is a record. Orders in the “enhanced security and user experience” segment totaled 8.8bn$ during the second quarter, bringing the year-to-date total to 9.6bn$, which is also a record. The growth in bookings demonstrates the company’s strong technology portfolio and the growing value of its products. There have been 6 deals in the last two years, for example, the most recent transaction was the acquisition of an 85% stake in Interactable Automotive Solutions, a subsidiary of Intercable Automotive Solutions, specializing in high voltage power distribution and high precision connection technologies. The company operates manufacturing facilities in Europe and Asia and has estimated sales of more than 250m€ in 2022. The biggest acquisition is the January acquisition of Wind River Systems, a global leader in the supply of software for smart peripherals, for about 4.3bn$. Nevertheless, the company’s balance sheet looks healthy and is not under pressure. The nearest repayment is scheduled for 2025.

Thus, for Q3’22 Revenue was $4.6 bn up by 33%. Adjusted EBITDA was 673m$ (63% y/y), adjusted EBITDA margin 14.6% operating cash flow 437m$ (+0.9% yoy).

Company financial data (company site )

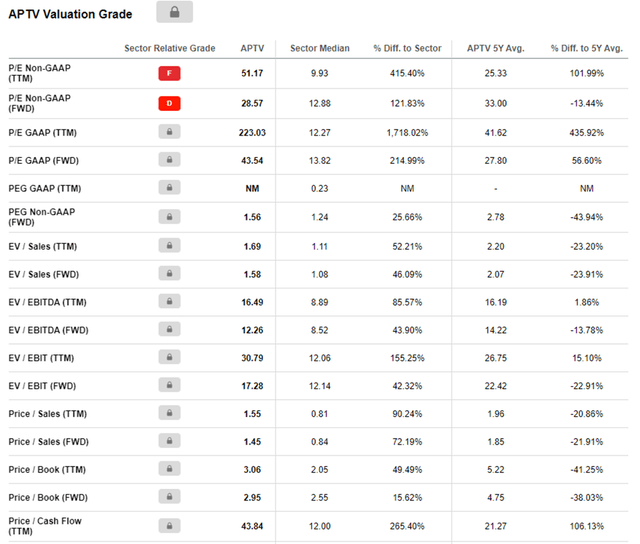

Valuation

By multiples, the company is overvalued, the current decline in profitability is temporary, and management expects to return to values of 10-10.5% in operating margins by the end of the year. by historical roughly mid-range, the 3-year GAGR of revenue is 4%, this year will be around 10%. About a third of the revenue is from stable contracts with OEMs, with Stellantis and GM each accounting for 10% of the revenue and VW accounting for 8%.

Company multiple valuation (Seeking alpha)

Main takeaway

Aptiv has extensive experience in advanced development for the automotive industry and an impressive customer base. Its architecture and software solutions enable increased functionality and safety while reducing the cost of the vehicle. The inevitable expansion of electric car production. New acquisitions are positive and could help revenue growth going forward. In addition, the end of the year could be stronger than the first half. First is the recovery in China, where Aptiv has a strong position, second is the improvement in semiconductors and logistics and the announced cost-cutting programmed. However, it is a European company with a significant production volume on the continent, and the energy aspect, especially related to gas, cannot be discounted. Consequently, current prices do not yet look interesting for long-term investments.

Be the first to comment