Sundry Photography

Our bullish stance on Applied Materials, Inc. (NASDAQ:AMAT) is very straightforward: we believe the company offers a favorable risk-reward situation because the stock is close to bottoming. We believe AMAT is well-positioned in the Wafer Fabrication equipment (WFE) market. We believe the weakening consumer demand is largely priced into the stock now, and the worse days are behind AMAT.

AMAT is a company that manufactures the semiconductor equipment used in the creation of end-consumer products. AMAT’s products enable the advancement of technology. AMAT equipment allows for the creation of smaller and more precise chips for consumer electronics. We believe the stock is near the bottom, which presents an attractive entry point for long-term investors.

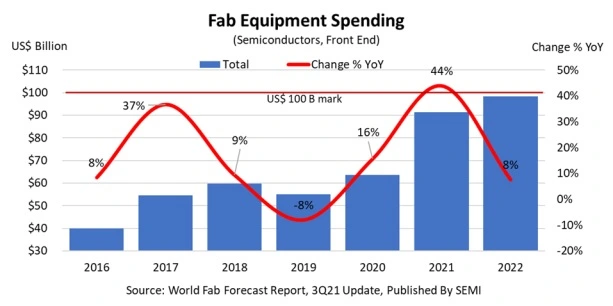

WFE spending is down, temporarily.

AMAT manufactures WFE devices, namely etching and deposition. The WFE market has been growing over the last few years. The following graph shows fab equipment spending over the past several years.

SEMI

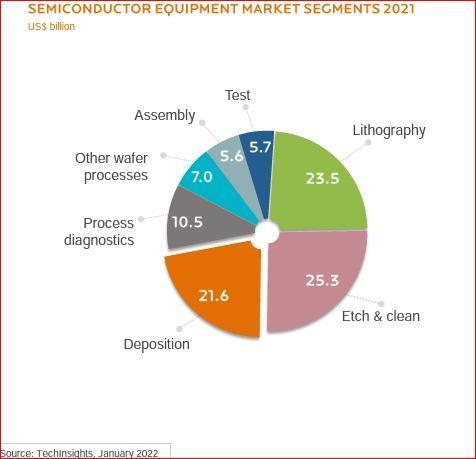

The WFE market is forecasted to grow by 18% in 2022, according to counterpoint. AMAT is among the top five WFE suppliers with a critical customer base, including Samsung, Intel (INTC), and Taiwan Semiconductor Manufacturing Company (TSM). We are optimistic about AMAT’s position within the WFE market. The company works on etching and deposition, both of which are growing. Etching TAM was reported at $25.3B in 2021 compared to $18.2B just a year earlier in 2020. Deposition TAM also appreciated from $15.8B in 2020 to $21.6B in 2021. We believe AMAT is well-positioned to grow in etching/deposition markets. The following graph shows the semiconductor equipment market segments, with etching/deposition TAM making up around 46% of total semiconductor equipment markets.

Techinsights

Risks are priced in, for the most part.

We believe possible cuts in the memory industry are largely priced into the stock. We believe the weakening consumer spending is factored into AMAT stock. Weakening consumer spending is already underway. PC and smartphone shipments have been declining. According to Gartner, PC shipments are forecasted to decline by 9.5% in 2022. Smartphone shipments are also projected to decline by 3.5% this year. We are not too concerned about AMAT’s exposure to weakening consumer demand in its memory sector. We believe possible cuts in industry memory CAPEX are mostly priced into the stock.

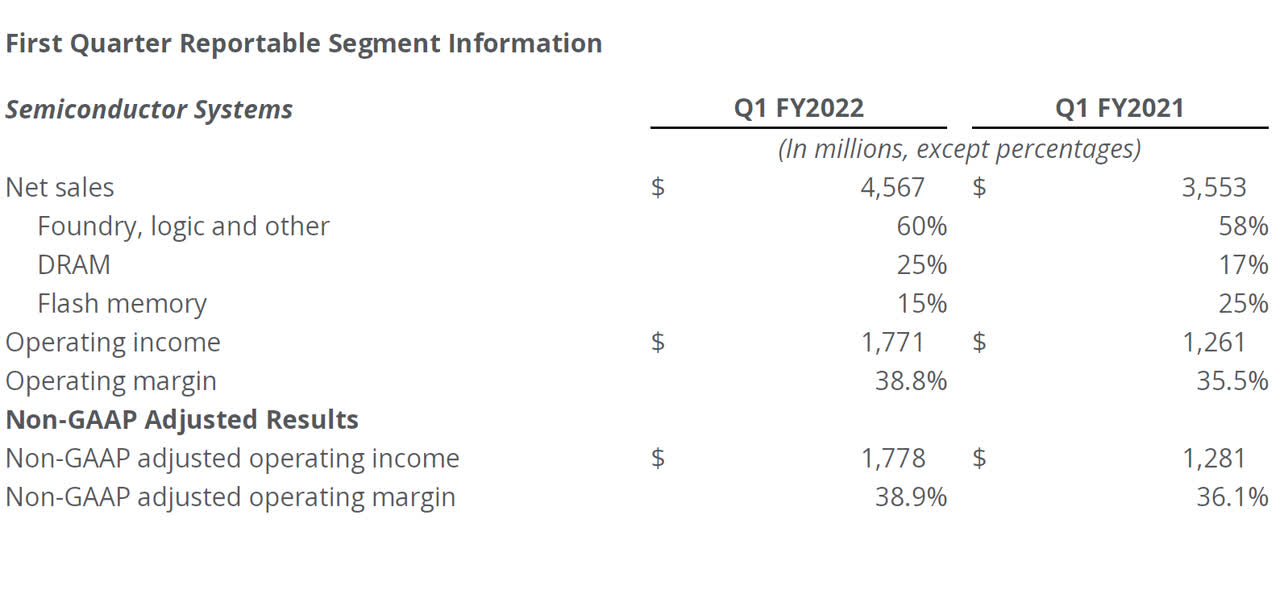

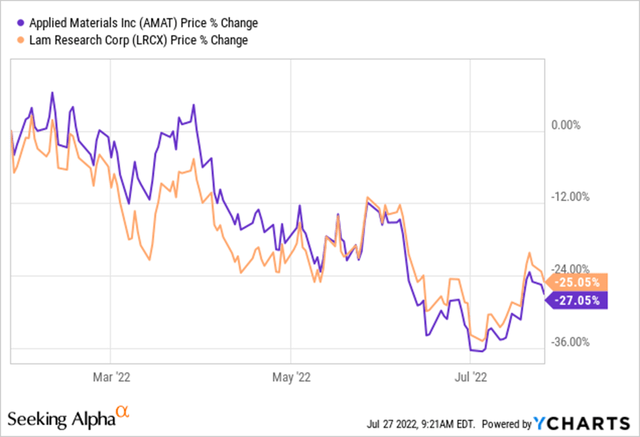

However, unlike competitor Lam Research (LRCX), we believe AMAT remains particularly exposed to possible cuts in its legacy foundry and display businesses. Foundry, logic, and others make up around 60% of the company’s net sales. The following table from the company’s 1Q22 shows AMAT’s semiconductor segments.

Applied Materials

We believe the downside is limited on these fronts, but present, nevertheless. We prefer LRCX as a WFE investment over AMAT because we believe it has less exposure to the legacy foundry and display businesses.

Good entry point at a lower valuation.

At current levels, we believe AMAT’s worse days are behind it. We believe the stock is near the bottom. In turn, we believe AMAT presents a good entry point into the semiconductor manufacturing peer group. According to IDC, the semiconductor industry is forecasted to grow at 13.7% yearly. The role AMAT plays in WFE is fundamental for the semiconductor manufacturing chain. AMAT’s equipment allows semiconductor companies to create the end-consumer products we love. As a result, we are optimistic about AMAT’s prospects and believe the downside is limited.

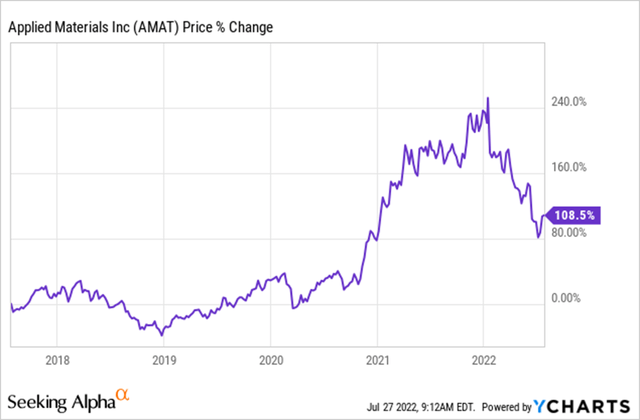

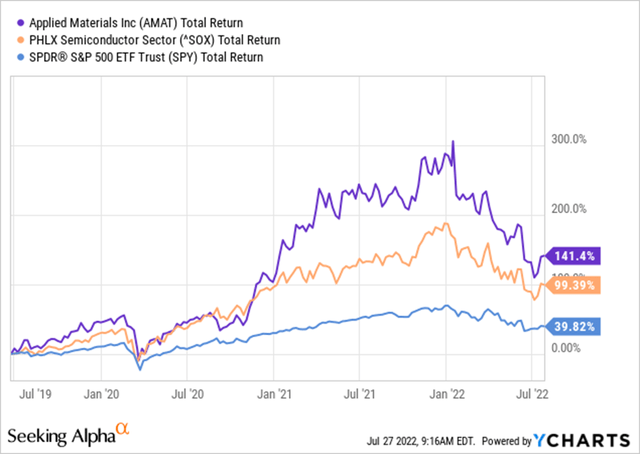

Stock Performance:

AMAT stock had a great run over the past five years. The stock began a rapid ascent when the pandemic began and peaking in early 2022. The stock grew around 108% over the past five years. YTD, the stock is down 35%. We believe the downward trend results from weakening consumer spending on PCs and smartphones. The following chart illustrates AMAT’s performance over the past five years.

Valuation:

AMAT is trading at $99. On the P/E earnings basis, the stock is trading at around 12.0x C2023 EPS of $8.26 compared to the peer group at 14.6x. The stock is trading at 3.2x EV/Sales C2023 compared to the average of 4.2x. On a growth-adjusted basis, AMAT is trading at 0.6x compared to an average of 0.2x. We believe the AMAT is a buy because CAPEX cuts are largely priced into the stock, and the stock is compelling. The following chart illustrates AMAT’s peer group valuation.

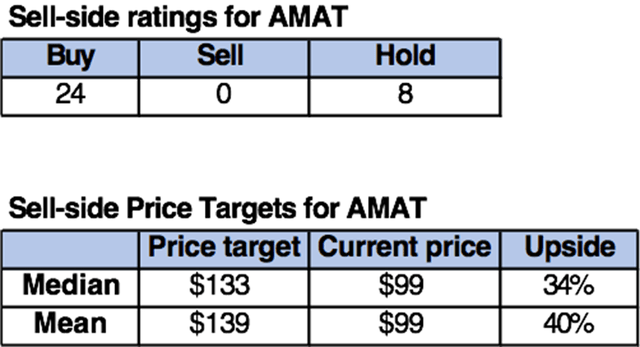

Word on Wall Street:

Market consensus is a buy on AMAT. Of the 32 analysts, 24 are buy-rated, and eight are hold-rated. AMAT is trading at around $99. The median price target is $133, and the mean price target is $139, with a potential 29-35% upside.

What to do with the Stock:

We believe AMAT presents a favorable risk-reward situation because the stock is close to bottoming. We recognize the risk of weakening consumer demand but are not worried because we believe the weakness is priced into the stock for the most part. We are constructive on AMAT and believe LRCX remains a more attractive investment. Nonetheless, we believe AMAT has long-term potential in the WFE etch and deposition markets and believe it is a buy.

Be the first to comment