Ivan-balvan/iStock Editorial via Getty Images

This story was originally written on March 7 for subscribers of Reading The Markets, an SA Marketplace service. This story has been updated as of March 9.

Apple (AAPL) shares have come under pressure in recent weeks, along with the broader equity markets, as the war in Ukraine escalates, sending oil and the dollar surging. That, coupled with the potential for several Fed rate hikes as inflation spirals out of control, is resulting in valuation and multiple compression. Apple is not immune to these macro forces.

Even the latest Apple event on March 8, with the unveiling of a new iPhone SE, iPad Air, and new Mac Studio, will be enough to change the course of Apple over the near term. The issue with Apple is not the fundamentals of the business. The problem with Apple is that the stock’s valuation is high on a historical basis. Right now, investors are re-pricing risk, leading to board multiple compression across the entire market.

AAPL’s Valuation Is Still High

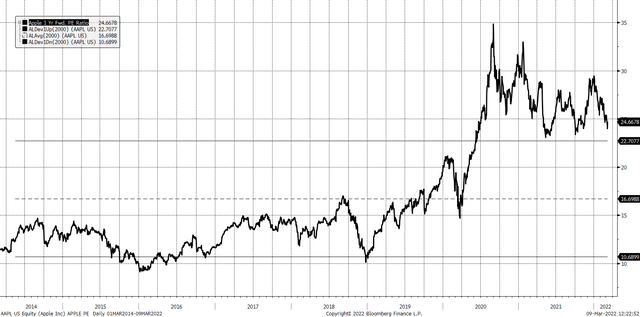

Bloomberg

Apple’s stock is certainly not cheap, trading at 24.7 it 1-yr Fwd EPS estimates, which doesn’t sound high compared to other stocks in the S&P 500. But it’s very high for Apple on a historical basis. Since 2014, Apple has had an average PE ratio of 16.7. Now it’s reasonable to assume some added multiple expansion over the years due to the company’s addition of its services business. However, despite its decline, the current PE ratio is still more than one standard deviation above the historical average.

It probably signals a lot more multiple compression to go for Apple’s stock, should the general trend in the broader market continue to hold. That multiple could fall dramatically, potentially to 20 or lower.

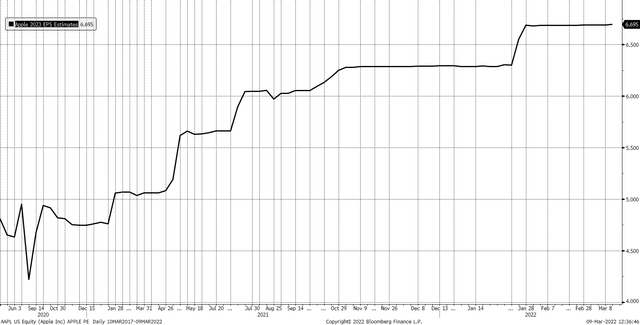

If Apple is forecast to earn around $6.69 per share in 2023 and sees its PE ratio fall to about 20 times earnings, the stock would only be valued at approximately $134. That would be a considerable drop from its current price of roughly $162 on March 9, a decline of about 17.4%.

The valuation may especially matter given that company is only expected to see earnings grow 9.6% in the fiscal year 2022 and 6.8% in the fiscal year 2023, which doesn’t justify the historically high valuation.

Bloomberg

Betting Shares Drops

This type of thinking could have led someone to make a massive bet that Apple’s stock will see lower prices soon. On March 7, the April 14 $150 puts saw their open interest rise by an eye-popping 45,000 contracts. The data shows the contracts were bought on the ASK at various prices during the trading session on March 4 for around $3. That would imply that the stock would need to fall below $147 for the trader to profit if holding the contracts until the expiration date.

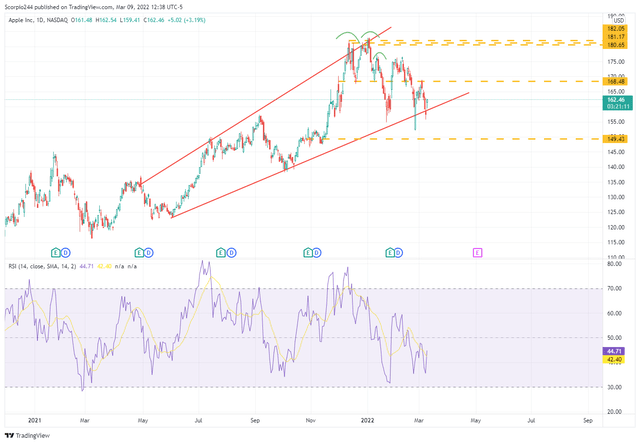

Trends Breaking Down

The technical chart does not look strong and shows that prices have been declining and approaching a critical long-term uptrend that started in May. The technical pattern itself is a rising broadening wedge, which tends to be a bearish pattern. A break of that uptrend would result in the stock falling to around $149, the next level of crucial support for the equity. Additionally, the relative strength index is trending lower, suggesting a loss of bullish momentum.

Tradingview

The decline in Apple shares may have nothing to do with the fundamentals of the business, which seem pretty strong right now, especially in the face of the strong product line-up. The company has recently started rolling out its chip designs into its Mac and iPad line-ups. Plus, the recent event showed the addition of a new Mac.

None of this is to say that Apple doesn’t have a strong path forward in the future. It does. At this point, the macro backdrop has shifted, resulting in changes in the stock’s valuation.

It’s more likely that Apple will fall victim to changing market dynamics that favor further multiple compression, not due to the strength and positioning of the company.

Be the first to comment