Nikada/iStock Unreleased via Getty Images

One day after Apple (NASDAQ:AAPL) delivered yet another consensus-beating set of results, one CNBC poll caught my attention. When asked which July winner investors might want to “fade”, nearly one in four Twitter respondents suggested that Apple stock should be the one sold into strength. Mind you, skepticism towards shares of the Cupertino company is nothing new.

Despite the stock being richly valued relative to the broad market and its own history, which may explain why some may fear that the recent rally could be short-lived, I believe that many continue to underestimate the appeal of AAPL amid a deteriorating macroeconomic environment. Below, I explain why.

Apple’s earnings beats are not a coincidence

According to Seeking Alpha, Apple has met or topped EPS consensus in each of the past 20 quarters, if not longer. The average beat has been 15 cents per quarter since the start of the COVID-19 crisis, compared to only 3 cents per quarter in the previous ten periods.

To be clear, part of the reason why Apple has managed to impress Wall Street as much as it has lately is the lack of full guidance, coupled with high levels of uncertainty that probably caused analysts to be overly conservative at projecting financial results. Still, I think it would be a mistake to discount Apple’s pristine execution during this very challenging COVID-19 period.

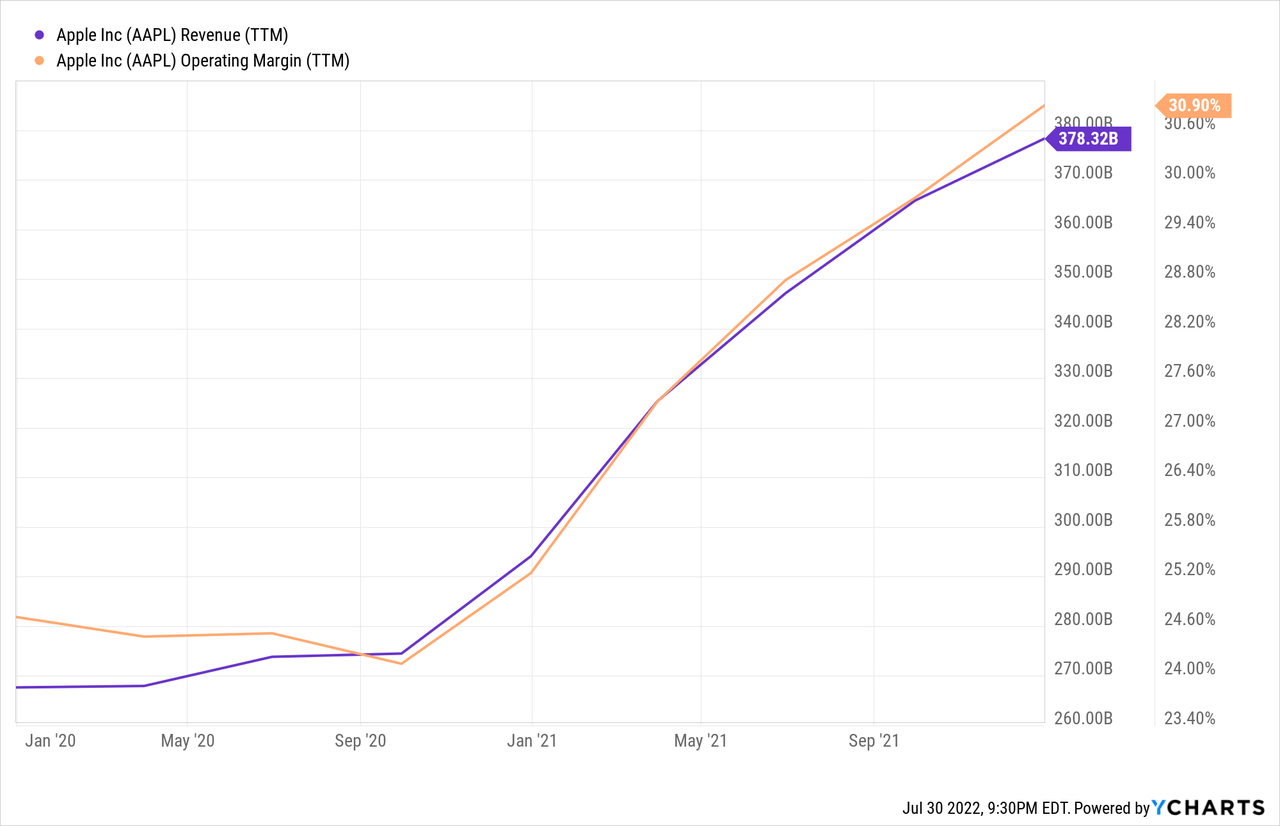

Since 2019, the company’s revenues have grown by an annualized 19% through the end of last year (see chart below), while operating margin has expanded by a whopping 600 bps over the period - partly due to operating leverage, but also as a result of much better gross margin. Mere industry-wide tailwinds driven by the stay-at-home and work-from-home phenomena are not enough to explain such strong results, in my opinion.

In my view, it is about time that Apple’s management team be credited for the stock’s resilient valuations. If 25 times 2022 earnings may seem rich for a moderate growth stock like AAPL when the S&P 500 trades at only 17 times instead, maybe the premium is properly justified by Tim Cook and the team’s ability to pull rabbits out of a hat when few other companies seem capable of doing so in 2022.

Now is the time for quality

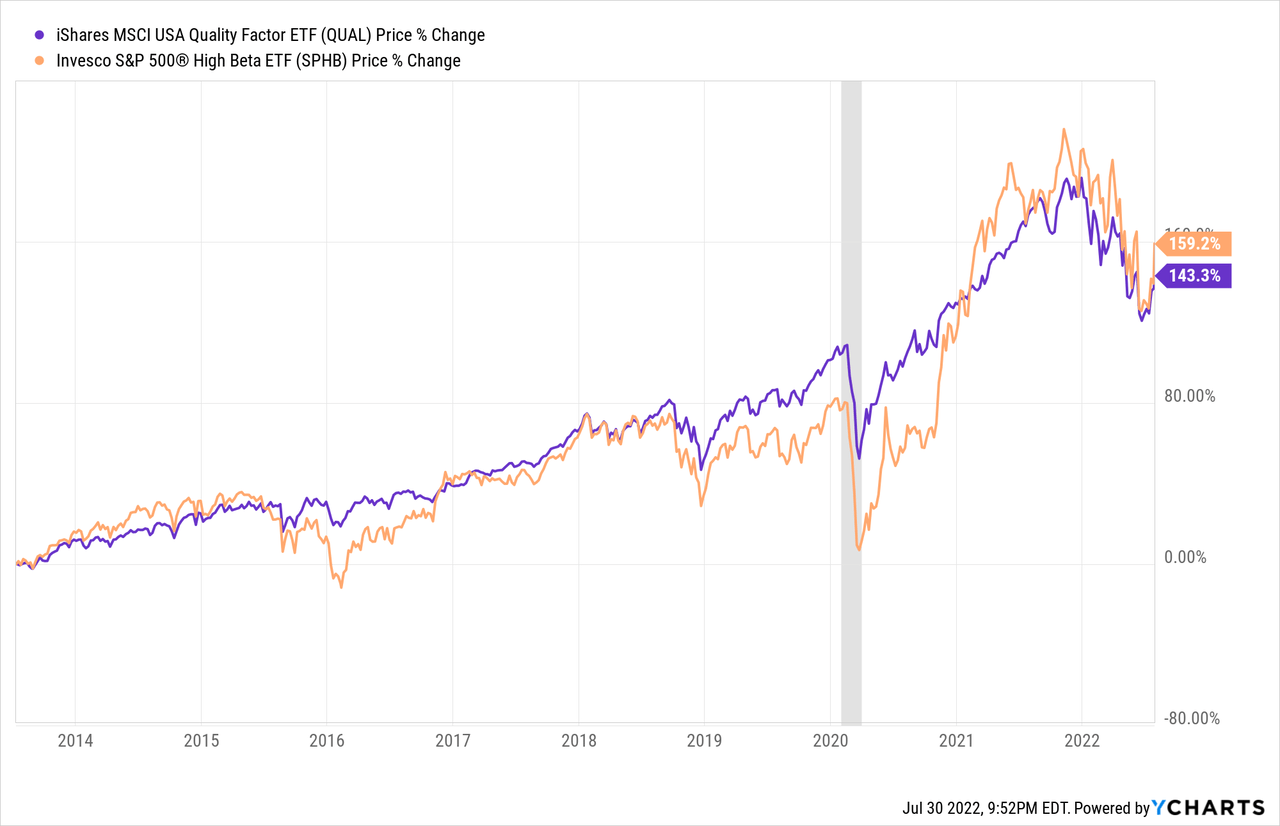

It has become somewhat of a consensus view that investing in high-quality companies in the face of macroeconomic uncertainty may be the best strategy today. The graph below seems to support the idea.

Notice the price behavior of the iShares MSCI USA Quality Factor ETF (QUAL), which leans toward companies with “high return on equity, stable year-over-year earnings growth, and low financial leverage”, compared to the Invesco S&P 500 High Beta ETF (SPHB) composed of stocks that are most sensitive to market-wide movements. The former did particularly well relative to the latter in 2015-2016 (the start of the US Presidential election cycle), late 2018 (the quasi-bear of Q4 driven by monetary policy jitters), and the start of the pandemic. The reverse was true during the late 2020 recovery that was unleashed by the release of the first COVID-19 vaccines and the end of the election period in the US. In other words: quality tends to trump risk in times of distress.

Those that fear stock market softness in the face of high inflation, rising interest rates, and the first signs of an economic slowdown might be better served by holding Apple. In addition to the competence of the management team mentioned above, the following points suggest to me that the Cupertino company checks the “high quality” boxes better than most other companies and stocks in the market:

- The Apple brand, as qualitative a measure as it may be, continues to be a great asset for the company. During a time when established consumer companies have struggled to sell inventory and meet expectations on financial results – think Walmart (WMT) and Target (TGT) in the past couple of months – CEO Tim Cook said, during Apple’s most recent earnings call, that “there was no obvious evidence of macroeconomic impact during the June quarter besides FX” within the iPhone and possibly Mac and iPad segments. A weakening economy, so far, has not meant soft demand for Apple’s core products.

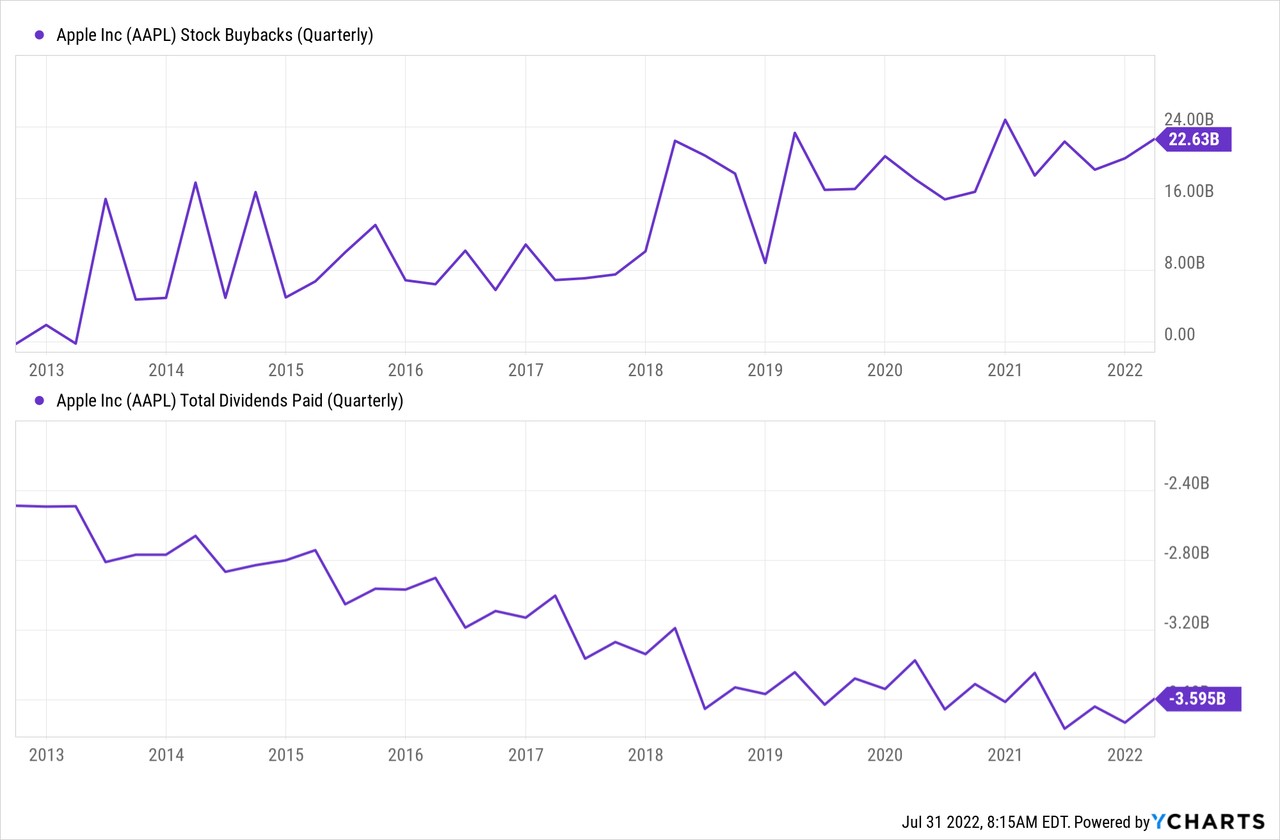

- Cash is a desirable asset during tough times, and Apple has proven to be very effective at producing and keeping it. Despite a still aggressive cash return program (see historical share repurchases and dividends below, the latter represented as a negative), Apple continues to hold over $70 billion in cash net of debt. This is more than 20% of total assets due, in part, to very tight working capital management helping to produce $93 billion in free cash flow last fiscal year, or about 25% of total revenues. On the point of working capital dynamics, Apple’s negative net operating cycle (i.e., working capital liabilities like payables are larger than working capital assets) is a rare and impressive feat that effectively means that the company’s operations are financed mostly by its suppliers.

- When supply chains are as constrained as they have been, it helps to be the king of inventory management. Apple has substantial control over its suppliers, allowing the company to operate a very lean business model. In fiscal 2021, the total inventory balance amounted to an astonishingly low 3.4% of annual COGS. This is impressive for a consumer company that is still heavily dependent on the sale of physical products – 81% of the top line last year.

AAPL is a buy and hold stock

Make no mistake: Apple is an expensive stock by almost any measure. But because of the quality of the business and the management team, I believe that shares of the Cupertino-based company can both (1) continue to rise in the foreseeable future and (2) weather the deterioration of the global economies better than most of its peers.

Being an Apple bear has never been too easy. More so now, I believe that skeptics might want to rethink their stance towards this stock and consider owning it for the long haul.

Be the first to comment