3DSculptor/iStock via Getty Images

The technology and the consumer cyclical sectors are among the worst performers in the past year, losing between 30% and 38% of their value. Companies in those two sectors are particularly sensitive to rising inflation and a higher cost of capital, while many suffer from bottlenecks among the supply chains, as well as headwinds caused by pandemic-related restrictions, geo-political tensions between the US and China, and the ongoing war in Ukraine. Looking at more specific groups, the consumer electronics industry has shown to be more resilient in the past year, while only marginally recovering in the past few weeks, whereas other industries set up for a stronger rally. The internet retail industry has instead been among the weakest laggards in the consumer cyclical sector, losing close to 47% in the past year, and continuing to show relative weakness also in the most recent weeks.

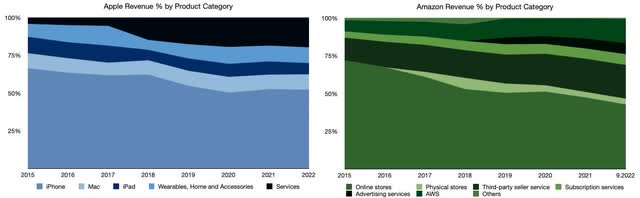

The two selected companies are two global giants in their relevant industries. Despite Apple (NASDAQ:AAPL) still heavily relying on its iPhone sales, the company is progressively diversifying its revenue stream through other sources of income, such as its Mac products, wearables, and home devices, but most of all from its service business.

As I discussed in this article, Amazon.com (NASDAQ:AMZN) is increasingly penetrating the global online advertising business, eroding the duopoly formed by Alphabet (NASDAQ:GOOG) (GOOGL) and Meta Platforms (NASDAQ:META), with a rather conservative estimated revenue of $38B for the current year, while also other emerging competitors such as Alibaba (NYSE:BABA), Tencent (OTCPK:TCEHY), or ByteDance through their social media TikTok, are aggressively gaining market shares.

The global consumer electronics market is expected to grow at a 5.1% Compound Annual Growth Rate [CAGR] through 2030, expanding to a total value of $1.13T, driven by broader adoption of technologies such as Artificial Intelligence [AI], Machine Learning [ML], the emergence of the internet of things, augmented reality [AR] and virtual reality [VR], cloud computing and generally a faster and more reliable connectivity, as well as the miniaturization of electronic products which integrate increasingly wider varieties of digital technologies, by providing a high-quality experience to consumers.

The global e-commerce market is estimated to grow at 11% CAGR through 2030, while the cross-border B2C e-commerce market is anticipated to expand even faster at 26.2% CAGR by 2031, led by the market across Europe, with the fastest growth predicted at 28.9% CAGR.

The global IT Services market is projected to grow at a 9.5% CAGR through 2031, while the global digital advertising market is forecasted to grow even faster at a 13.9% CAGR, reaching a size of $1.79T through 2031. The robust market growth is driven by technological advancement, the broader penetration of internet users, and rising spending in digital advertising, as well as the expanding popularity of mobile phones and digital media across the world, while advertising platforms such as in-app, mobile ads, connected TV or social media, are expected to become even more important by opening new opportunities.

An in-depth company comparison

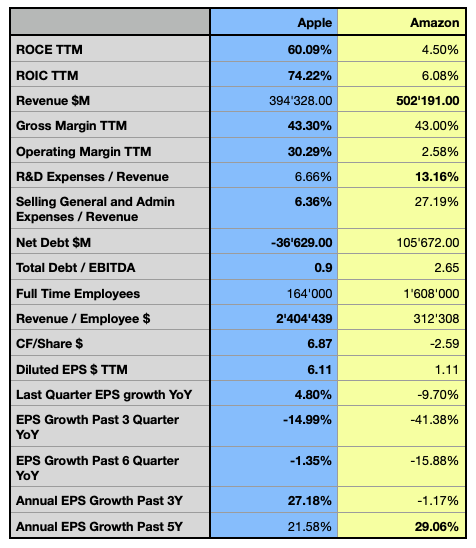

Author, using data from S&P Capital IQ

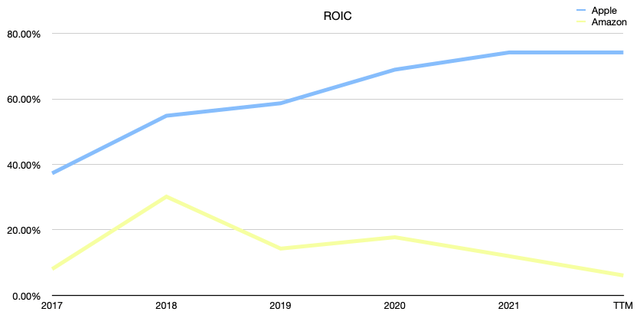

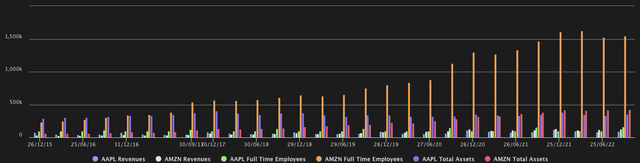

The financial comparison highlights the major relative strengths and weaknesses of the two colossuses. In terms of their Return on Invested Capital [ROIC], a very important metric I consider when pondering an investment decision, as a company must be able to consistently create value to be a sustainable investment, Apple has been able to massively sequentially increase its capital allocation efficiency over the past few years. Amazon’s metric, after peaking in 2018 has instead significantly dropped and is now at the lowest level reported in the past 5 years. Apple reported a gigantic position of $156.4B in cash, cash equivalents, and unrestricted marketable securities on September 24, 2022, leading to negative net debt of over $36.6B. Amazon, despite reporting $58.6B in cash and short-term investments, carries a relatively hefty amount of debt, reported at $164.33B at the end of Q3. Both companies could employ their massive cash position and increase their capital allocation efficiency, observed in the relative spread between their ROIC and the Return on Capital Employed [ROCE].

Author, using data from S&P Capital IQ

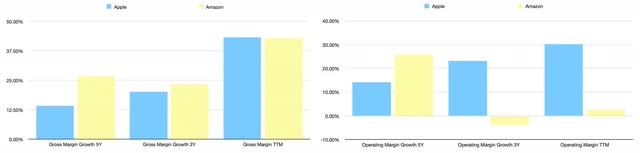

Although both companies reported a similar gross margin, Amazon’s margin growth is seemingly dropping from 26.81% CAGR in the past 5 years to 23.42% CAGR in the past 3 years, while Apple’s gross margin growth accelerated from 14.13% CAGR to 20.18% CAGR over the analyzed time. Despite Apple not providing details about its margins per product category, I assume that a combination of several factors influenced the significant increase in gross margin. A revenue shift toward a higher-end product mix carrying better margins, and the progressive shift toward service revenues, are likely the most important factors. The introduction of the Apple Silicon M CPUs in late 2020, may have a positive impact on its cost base, but I consider the impact being less significant, by estimating it at around 1% margin improvement, while we also have to consider the higher upfront cost of internal chip design. As an Apple Silicon user, I instead recognize the major advantage in terms of efficiency and performance those CPUs have led to, and since with Apple everything starts with the customer experience, I understand the huge strategic benefit the company gained by controlling its own chips designs.

On the operational side, the companies have an even more divergent profile. Apple demonstrated being capable of significantly increasing its operational profitability from 14.25% CAGR in the past 5 years, to 23.16% CAGR over the past 3 years, while Amazon’s operating margin growth is decelerating from 25.87% CAGR to -3.74% CAGR over the same period. The latter is seemingly facing increasing fulfillment and delivery costs, as the company’s promise for ultra-fast delivery comes at high expenses, and excessive capacities built up during the pandemic seem to add pressure on its margins, while the company also faces headwinds in terms of rising inflation.

Author, using data from S&P Capital IQ

Apple reportedly has a much more cash-rich business than the analyzed peer, and is also the only one who is paying a dividend, despite its annual yield being only 0.61%, the company spent $14.8B in the fiscal year 2022. Both companies spend billions in share-repurchase programs, but Apple reaches much deeper into its pockets. The company extended its share repurchase program on April 28, increasing the total amount to $405B, and repurchased about $90.2B in the fiscal year 2022. Amazon extended its share repurchase program in March 2022 to up to $10B, while having repurchased $6B during the first nine months of the fiscal year 2022.

Apple also reports significantly higher EPS, has had a less negative development over the most recent quarters, and reported consistently higher growth over the past few years, despite Amazon having a notable spike in its profitability during the pandemic and its expanding advertising and cloud businesses are driving its profitability, its EPS dropped massively in the last 3 quarters. As discussed before, both companies are relying on debt for sustaining their business, increasing significantly their debt reliance since 2013. While Apple seems to be stagnant and even scaling back on its debt reliance with a leverage ratio of 0.9, Amazon took on massive amounts of debt in the past few years, taking advantage of historically low-interest rates, resulting in a leverage ratio of 2.65.

The stocks’ performance

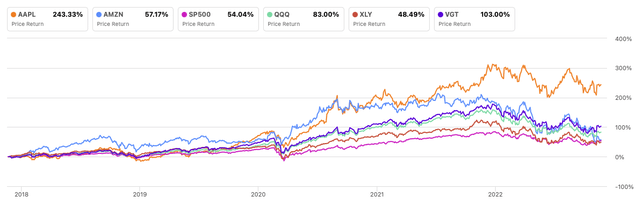

Considering both stocks’ performance in the past 5 years, AAPL outperformed all the analyzed references, reporting a monumental performance of 249%, while Amazon performed significantly less well, reporting a gain of 57.17% over the analyzed period, slightly better than the S&P 500 (SP500). The most significant references show a mixed picture, with the Nasdaq technology index, tracked by the Invesco QQQ ETF (QQQ) marking 83% performance, while more industry-focused references, such as the Vanguard Information Technology ETF (VGT) performed even better, and the Consumer Discretionary Select Sector SPDR ETF (XLY) being the biggest underperformer of the analyzed references.

Author, using SeekingAlpha.com

While both stocks display periods of relative strength, with AMZN particularly strong even before the pandemic-related market crash in 2020, AAPL reported massive resilience after every major drop, emerging consistently stronger than its references from the pandemic-low. AMZN has significantly suffered after forming a major double top in November 2021, leading to massive value destruction for its investors, as the stock lost more than 50% since. In the next section, I will show how the next few years are forecasted to play out for both companies and if the actual stock price may offer an interesting opportunity, while also assessing the possible risks in different scenarios.

Valuation

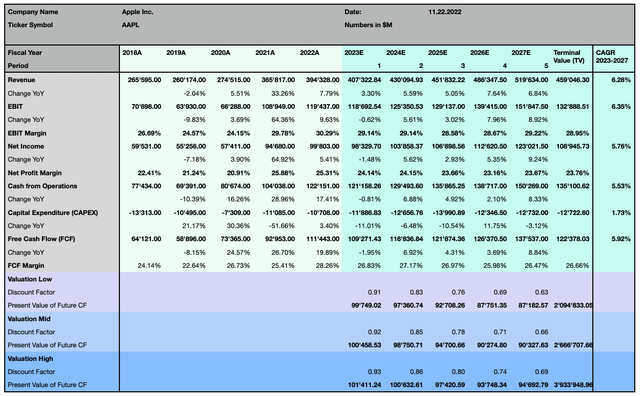

To determine the actual fair value for both company’s stock prices, I rely on the following Discounted Cash Flow [DCF] model, which extends over a forecast period of 5 years with 3 different sets of assumptions ranging from a more conservative to a more optimistic scenario, based on the metrics determining the WACC and the terminal value. As forecasted by the street consensus, Apple is anticipated to generate 5.92% Free Cash Flow [FCF] CAGR over the coming 5 years, with its operating and net profitability increasing at respectively 6.35% and 5.76% CAGR, while its revenue is projected to expand at solid 6.28%, above the expected growth in the global consumer electronics industry, but slower than the global IT Services market.

Author, using data from S&P Capital IQ

The valuation takes into account a tighter monetary policy, which will undeniably be a reality in many economies worldwide in the coming years and lead to a higher weighted average cost of capital.

Author

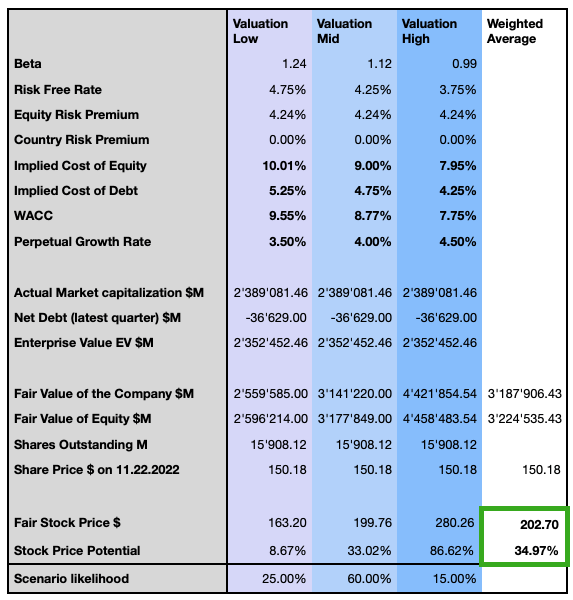

I compute my opinion in terms of likelihood for the three different scenarios, and I, therefore, consider the stock to be significantly undervalued with a weighted average price target with about 35% upside potential at $203.

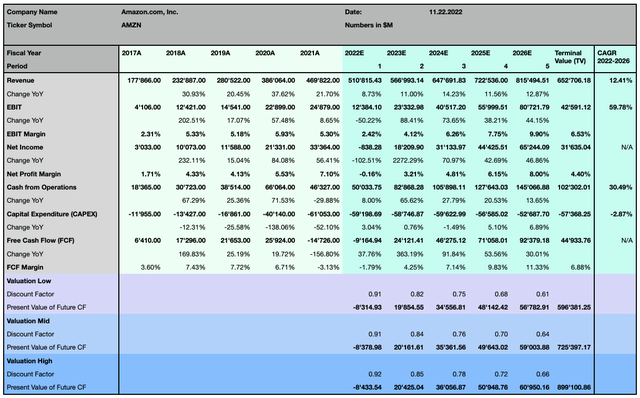

Amazon is forecasted to expand faster than its peer, with its sales growing at 12.41% CAGR over the next 5 years, faster than the global e-commerce industry and the global IT Services market, but significantly slower than the cross-border B2C e-commerce market. Its operating and net profit margins are expected to grow significantly, while it has to be considered that the reference year is particularly weak in terms of profitability. The company’s FCF is anticipated to substantially increase, as the company is expected to massively increase its cash from operations by 30.49% CAGR through 2026.

Author, using data from S&P Capital IQ

I then consider the same three scenarios affected by the company’s fundamentals and by the exogenous factors.

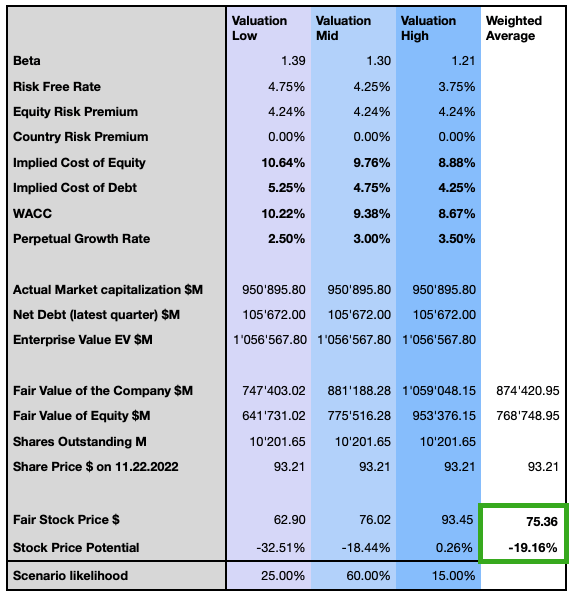

Author

Despite this rather promising outlook, AMZN is seemingly overvalued, when considering the weighted average price target. The two modelizations suggest that AAPL may offer a substantially high expected return, while AMZN’s is seen as overpriced by 19% from its latest closing price, with the price target seen at $75.40. Additionally, in AAPL’s modelization, all three scenarios forecast a positive return, in AMZN’s modelization instead even the most optimistic scenario just values the company at an actual fair price, emphasizing the seemingly massive divergence in the companies’ valuation.

Investors should consider that those forecasts are based on a relatively conservative assumption in terms of perpetual growth rates, higher discount rates, and the recent trend in increased interest rates, which reflects the actual situation and forecast possible scenarios. An inversion of this trend would change this perspective and value the company at a higher price.

Outlook and Risk discussion

With both colossuses having tremendous optionality to expand or diversify their strong product ecosystem, it’s arduous to pragmatically estimate their relevant total addressable market [TAM], although both peers have demonstrated to be able to significantly grow their business either organically or through strategic acquisitions. Apple and Amazon own strong brands with Apple ranked in the first position in Interbrand‘s Best Global Brands, while Amazon is ranked in third place.

Apple has become one of the most iconic and reliable companies when considering their advanced hardware and smart technology devices, which are designed with particular attention to the customer experience and to aesthetics. Apple’s services segment, once its “side business”, has expanded dramatically, averaging 44% YoY growth since 2015, and generating $78.13B in its fiscal year 2022, being its second biggest contributor to the company’s revenue, after the iPhone. The company’s strict app tracking transparency privacy policy, requiring the user’s approval for apps to be able to track their data, had an estimated two-digit billion impact on Meta’s revenue. An extremely important move, as Apple’s actual digital advertising efforts consist of display advertising in its News and Stocks app, as well as inside the App Store, across the iPhone, iPad, and Mac, could expand to other Apple products such as Apple TV+ or Apple Music, while discouraging third-party ads on its own platforms. Considering that Apple doesn’t figure under the ten biggest companies in the digital advertising market, led by Alphabet and Meta, and where Amazon is rapidly gaining market shares, the company could rapidly gain a massive new revenue stream with extremely lucrative margins. Although, aggressively expanding into the advertising industry would likely risk irritating loyal customers of the brand who are ready to pay the relatively steep price for its hardware, while trusting the high degree of safety and privacy the company’s reputation is famous for, and such a move would be in contrast with Apple’s CEO Tim Cook criticism on rival tech companies for selling user’s personal data.

The truth is we could make a ton of money if we monetized our customer. If our customer was our product, we could make a ton of money. We’ve elected not to do that.

Tim Cook, CEO Apple

That said, Apple may find a way to expand in the ad space while still keeping its stance on privacy and data protection, as the company is also rumored to be developing its own search engine, although this still may take several years before being ready, and its functionality would need to be proven, as it could bring back memories of the failure of Apple Maps when the company ditched a loved and functional product for a homegrown lacking solution.

Apple’s smart wearable segment offers great opportunities, as this technology is increasingly broadly adopted and becoming part of people’s everyday life. The company is seemingly also developing its own driverless car, or could just sell its self-driving technology to other car manufacturers. Both companies are strongly positioned in terms of Artificial Intelligence [AI] and Machine Learning [ML] and can use those technologies in order to develop more products or increase their profit margins.

The iPhone manufacturer is facing critical headwinds in its supply chain, mostly due to significant production cuts caused by China’s draconian zero-COVID-19 policy, as reportedly high-end iPhones will come in short supply at stores during the holiday season. The advancement and broader accessibility of technologies are exposing Apple to tougher competition in all its product categories, while the company could also face headwinds from regulators because of its dominant market position.

Amazon counts over 310M active users and 200M Prime subscribers, being the world’s leading online retailer, while due to the high traffic volume on its websites, a large number of third-party retailers have joined the platform to sell their own merchandise, by significantly increasing the revenue stream from this segment. While the company has been struggling with lower margins, its subscription-based business, the cloud services AWS segment, and the advertising services are growing fast and having a significant positive impact on its profitability. However, as reported in the financial comparison, Amazon is massively investing in R&D, has been investing in advanced robotic systems for its fulfillment centers for the past decade, and has a history of successful acquisitions that lead to significant revenues and profits. Despite major concerns and headwinds that will likely not be solved any time soon, the company has the capacity and the optionality to overcome them, but it should focus on generating substantially more FCF, as the company recently burned huge amounts of cash, while also increasing its debt reliance.

Amazon’s ROIC is significantly smaller than its WACC, which means that the company is seemingly destroying shareholder value. This situation is not sustainable and the company should take serious steps to increase its overall profitability. To do so, the company could choose to further increase its prices, reduce its cost basis, or scale back in investments, while the expansion in more profitable segments is ongoing and will most likely bring significant benefits.

Despite an expansion in profitable developing markets is likely a necessary step in the long-term, it comes at an increasingly higher cost, as once local players grow stronger and turn into powerful platforms, such as Flipkart in India or Tokopedia (IDX:GOTO) in Indonesia, and other international players such as Alibaba, Shopee (NYSE:SE), MercadoLibre (NASDAQ:MELI), or JD.com (NASDAQ:JD), are as well pushing their boundaries.

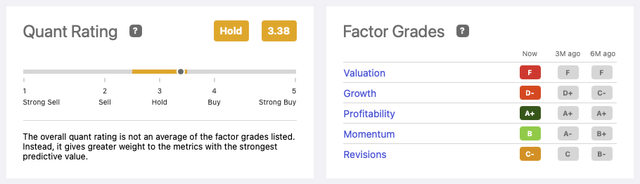

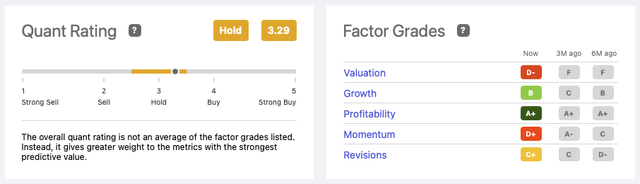

Apple is rated with a Hold rating from Seeking Alpha’s Quant Rating since September 2021, and holds the fifth position out of 30 in the technology hardware, storage, and peripherals industry.

Amazon has instead been consistently qualified as a Hold position for over three years and is ranked 14th out of 62 in the internet and direct marketing retail industry. Both companies are, with some surprise concerning Amazon, ranked high in terms of profitability, while valuation seems to be the weakest point for both peers, growth is seen as a major problem for Apple, and Momentum seems to be a less favorable factor for Amazon.

The Verdict: Which stock is the better buy?

Apple and Amazon are two global leaders in their specific industries and despite not competing in their actual main business, both companies are substantially investing in the technology services industry, and will increasingly compete against each other. From an investor’s point of view, it’s important to consider the company’s ability to create value for its shareholders, while minimizing the risks. Past performance is not a guarantee for future results, but AAPL seems to be set for further substantial growth, which is still underappreciated in its stock price. Despite AMZN seemingly facing higher growth opportunities, the company has to solve major headwinds and is struggling to report consistent profitability. Apple reports far stronger financials and offers consistently high profitability, while the company is even forecasted to improve it in the coming years. While both companies are owning a massive idling cash position that offers incredibly many options, Apple significantly leads the comparison also in those terms, and reported a much lower financial leverage, while through its highly cash-rich business, the company could even further increase its already superior capital allocation efficiency. Despite I consider both companies as being very interesting and will continue to monitor their developments, at this point, I recognize only AAPL as a buy position, categorizing AMZN as a relatively higher-risk hold position, as the stock seems to be overpriced, and is likely still not pricing in all risk factors. All elements considered, Apple offers outstanding opportunities with a lower risk profile, while seemingly also offering great potential in its stock performance when considering all three forecasted scenarios, suggesting it is a great stock pick for long-term oriented investors.

Be the first to comment