yalcinsonat1

The Fall From the Top

To this day, Apple (NASDAQ:AAPL) is an exciting company, and the giant tech stock has held up like no other major tech company during this downturn. I wrote about the epic drop coming for tech stocks in late November last year, right as the market peaked. Well, some of the declines surpassed even my expectations. So, let’s look at how top-tech stocks have performed during this downturn.

Bear Market Peak to Trough Declines

- Meta Platforms (META): 74%

- Amazon (AMZN): 55%

- Netflix (NFLX): 75%

- Alphabet (GOOG) (GOOGL): 45%

- Nvidia (NVDA): 69%

- Advanced Micro Devices (AMD): 67%

- Tesla (TSLA): 58%

- Microsoft (MSFT): 40%

- Apple: 28%

“FANG” stocks went through considerable declines ranging from 40-75% during the bear market phase. However, one giant tech stock stood out, declining by just 28% during the recent tech drop. I’ve been a fan of Apple for many years, not just the stock but the company’s products. I still have my iPhone 12 Pro Max, which I purchased for $1,300 last year. Moreover, I’ve been shopping for a new notebook and decided to upgrade to the MacBook Pro 14 version. However, perhaps the best Apple purchase was investing in the company’s stock in 2007 when the iPhone came out.

Apple 15-Year Chart

Remarkably, the stock was only around $3 (split adjusted) back then. Apple’s stock has been one of the top performers in this time frame, appreciating by approximately 6,000% (trough to peak). Apple is an excellent company with extraordinary earnings potential. The company also produces arguably the best products in the world, and the company’s services business continues booming. Despite the likelihood of near-term volatility, Apple stock’s downside is probably limited. Moreover, the company’s growth prospects and profitability potential should improve, enabling Apple’s stock price to appreciate considerably in the coming years.

The Apple Advantage

The iPhone accounts for a substantial portion of Apple’s revenues. The iPhone segment raked in approximately $205.5 billion last year, accounting for roughly 52% of total sales. However, the iPhone remains hugely popular in the U.S. and globally and should continue increasing sales as the company moves forward.

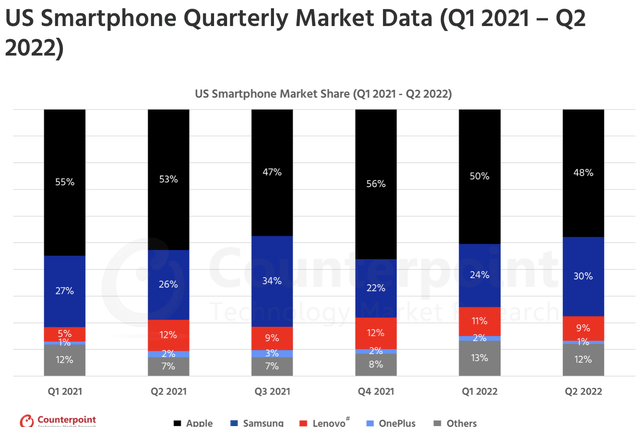

U.S. smartphone market share (couterpointresearch.com)

The iPhone dominates in the U.S. with about a 50% smartphone market share. Many consumers consider Apple’s products superior in quality, and once on an iPhone, many customers become lifelong users. This dynamic separates the iPhone from the Android market. Consumers have several producers to choose from in the Android market, but at the end of the day, there is only one iPhone producer, Apple. Therefore, we should continue seeing robust demand in the U.S., and iPhone sales should continue growing globally.

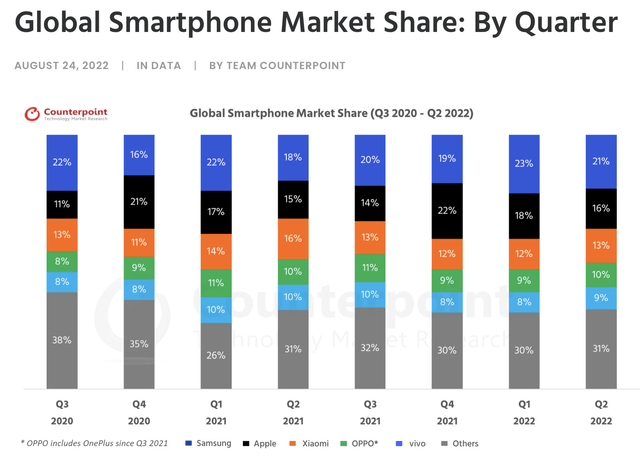

Global smartphone share (counterpointresearch.com)

Globally, Apple’s smartphone market share is only about 16%, second to Samsung’s 21% market share. Therefore, Apple has significant opportunities for growth outside of the U.S. market, and the company could expand its market share substantially in the coming years. While Samsung makes an excellent cellphone, Apple is still the Apple. The new S22 has fantastic features, but the iPhone 14 wins in many categories.

Also, there is just something about the iPhone that makes it a status symbol in many countries. I’ve visited many countries, and in many places, there is nothing more prestigious than having the latest iPhone in your pocket. Therefore, we should continue to see iPhone sales increasing, especially as the downturn concludes, leading to substantially higher revenues for Apple.

Apple’s Revenues

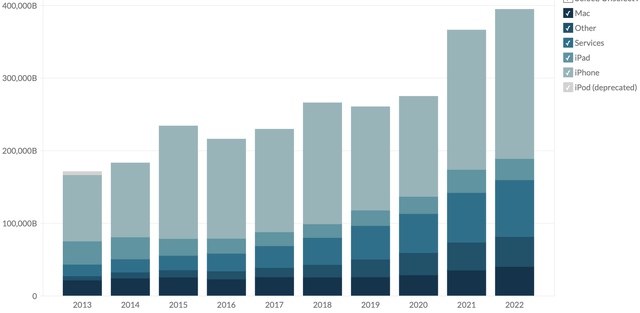

Apple revenues (businessquant.com)

Apple’s revenue has exploded, reaching nearly $400 billion last (fiscal) year. We’ve seen a 73% revenue increase since 2013, and we should continue seeing revenue growth from here.

Revenue by Segment

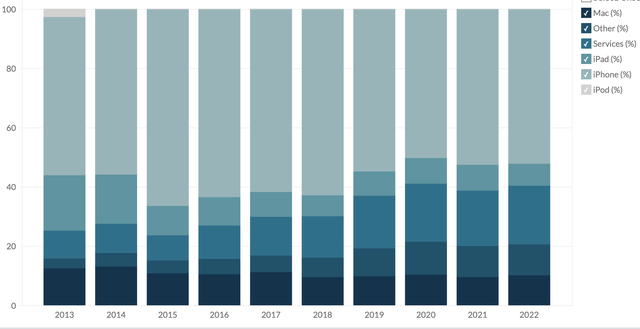

Segment revenues (businessquant.com)

Revenue Breakdown

Segment revenues (businessquant.com)

After being stagnant for several years, Mac revenues have shot up lately, increasing from around $25-26 billion in 2017-2019 to more than $40 billion last year, an increase of 60%. Therefore, the Mac business is working and should continue generating growth and profitability in future years. Services continue doing exceptionally well, growing revenues by a whopping 160% over the last five years. iPhone revenues have surged by 50% in just two years. Perhaps the most exciting segment, “other” revenues, have skyrocketed by 240% in the last five years. Total revenues have increased by 43% over the previous two years.

What We Should See From Apple Moving Forward

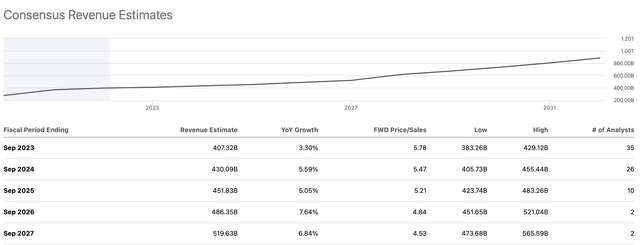

Revenue Estimates

Revenue estimates (seekingalpha.com)

Revenues should continue increasing from here. Consensus estimates are for around $520 billion in revenues in fiscal 2027, but Apple may do better. Apple is accustomed to surpassing analysts’ revenue and EPS estimates, and the company should continue outperforming expectations.

Recent Earnings

Recently, Apple reported revenues of $90.15 billion (8.1% YoY increase), exceeding expectations of $88.9 billion. Q4 EPS came in at $1.29, a beat by two cents. iPhone revenues increased by about 10% YoY, Mac revenues surged by 25% over last year, Other products increased by about 10%, and services came in 5% higher over last year. Despite a challenging economic landscape, Apple continues to perform exceptionally well, bringing in solid growth YoY. Once the downturn concludes, we should see more robust growth, leading to outperformance over current consensus analysts’ figures. Many analysts predict 3-7% revenue growth in the next few years, but we may see 5-10% growth, leading to substantially higher revenues and profitability potential as the company advances.

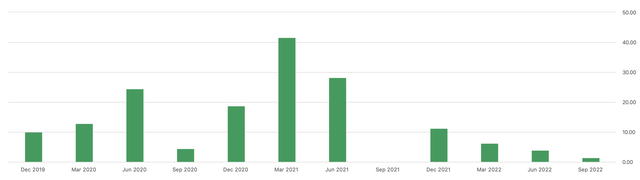

EPS Earnings Surprise

Earnings surprise (seekingalpha.com)

Apple has surprised higher in each of its last twelve earnings announcements, and this trend should continue as we advance. If the trend continues, we could see 5-10% EPS beats in future quarters.

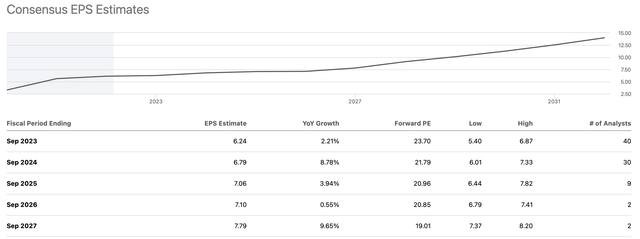

EPS Expectations

Due to the general pessimism surrounding the downturn, consensus EPS estimates are very modest here. We see expeditions of approximately 5% annual growth in the next few years. However, as economic conditions improve, we can see 10-15% EPS growth from Apple in future years.

Here’s what Apple’s financials could look like moving forward:

| Year (fiscal) | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs | $394 | $420 | $450 | $480 | $520 | $555 | $595 | $640 |

| Revenue growth | 8% | 7% | 7% | 7% | 8% | 7% | 7% | 7% |

| EPS | $6.11 | $6.80 | $7.30 | $8.10 | $9 | $10 | $11.50 | $13 |

| Forward P/E | 22 | 23 | 24 | 25 | 24 | 23 | 22 | 22 |

| Stock price | $150 | $170 | $195 | $225 | $240 | $265 | $286 | $330 |

Source: The Financial Prophet

What Price to Buy Apple

Apple may be mildly expensive today at about 22 times forward earnings estimates, but we should see multiple expansion in future years. I have Apple’s valuation peaking at about 25 in 2025, but that is a relatively modest forecast. We could see Apple’s forward P/E ratio increase to 30 or higher when the economy rebounds, sentiment improves, and demand for high-quality stocks increases. However, as we are currently in a slowdown, I recommend stepping back into Apple at about an 18-20 forward P/E ratio, providing a target entry price of around $120-135. That is the price range I prefer to enter a long-term position, as Apple’s stock price will likely appreciate considerably in future years.

Be the first to comment