Apisorn

Tech earnings week is finally here, and Apple’s (NASDAQ:AAPL) highly anticipated fiscal Q4 report will be released on October 27, after the closing bell. On average, analysts expect revenue growth to reach a timid 7%, but on top of last year’s impressive 29% increase in the comparable period. EPS of $1.27 would be barely an improvement YOY — but again, against very tough comps.

I believe that Apple will report another of its trademark mic drops in the September quarter. When many fear for deceleration in economic activity and an eventual softening in consumer discretionary spending, worries that I believe to be very well justified, CEO Tim Cook and company will likely prove that Apple can still sustain strong demand with a compelling product portfolio and the power of its brand.

iPhone and Mac will carry Apple’s Q4…

It should not be a surprise that Apple’s fiscal Q4 results will depend largely on the iPhone. While the handheld devices were once thought by some experts to be in their mature-to-declining life cycle, COVID-19 at least (and maybe other factors, including the 5G transition) helped to breathe life into the product category. The iPhone accounted for 52% of Apple’s revenues in fiscal 2021, and the number should climb to 54% this year.

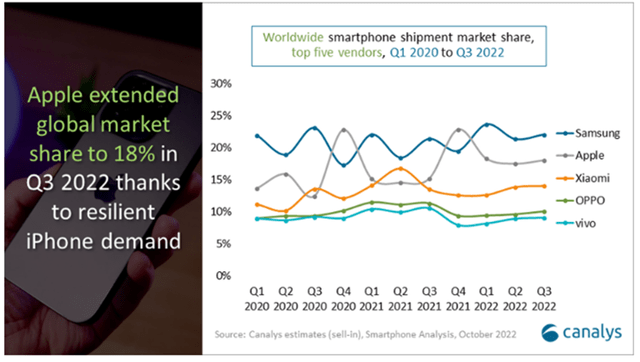

Research company Canalys has already previewed the story in the smartphone space in calendar Q3 (see chart below): “harsh business conditions” caused by “the gloomy economic outlook” and lingering supply chain constraints have resulted in a decline of nearly 10% in device shipments globally, which could have been worse if not for aggressive discounting. But Apple seems very much immune to these challenges. Canalys estimates that iPhone shipments increased in calendar Q3 instead, to the tune of almost 10%.

If the estimates above are right, fiscal Q4 will serve as another piece of evidence that Apple has hit the nail on the head with its smartphone strategy. Year-to-date and compared to pre-pandemic, pre-5G levels, iPhone sales have increased by an annualized 14%. I believe that the impressive growth run rate will remain unchanged in the September 2022 quarter, aided by a heavy mix of higher-end Pro devices that should also drive better ASPs (average selling prices) and, possibly, higher margins.

The other part of Apple’s product portfolio that will likely shine this time is the Mac, which represents just short of 10% of total company revenues. We already know from research company IDC that, not unlike the iPhone, the Mac defied the industry-wide trends that have been discouraging and witnessed a YOY increase in shipments that may have surpassed 40% in fiscal Q4. To credit may be the new MacBook Air equipped with the M2 chip, whose launch in July was timely and should help to lavishly beat fairly easy 2021 segment comps.

… but services could be a concern

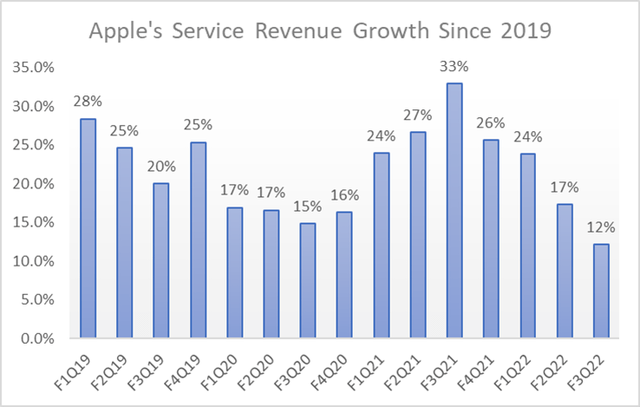

On the other end of the spectrum is the services segment. In great part, I credit this business and the business model transition that it helped to spark for Apple stock’s P/E having skyrocketed from the low teen levels in the early 2010s. But now, services may be experiencing a slow growth problem due to (1) the pandemic and stay-at-home tailwinds subsidizing, most importantly, and (2) a strong dollar.

In fact, when I look at the quarter-by-quarter services growth chart below, it becomes clear that the services segment is no longer the exciting growth engine that it once was. Notice (1) the descending trend through 2019 that may have been secular, followed by (2) a spike that coincided with the monetary and fiscal incentives during the first half of the COVID-19 crisis, followed by (3) another leg lower in the post-pandemic period that could now culminate in the slower growth rate since 2019 at least, if not much longer.

Research published on the App Store’s recent performance supports the idea that service revenues could disappoint this time. According to Morgan Stanley, September was the slowest month of growth for the App Store since 2015 at least, which would have led to quarterly revenues having declined by 2%.

Last quarter, CFO Luca Maestri had already spoken of services revenue increasing YOY “but decelerating from the June quarter due to macroeconomic factors and foreign exchange”.

Own AAPL stock for the long haul

I think that Apple will impress again in fiscal Q4, despite certain parts of the portfolio (namely the services segment) possibly being a disappointment. However, I must admit that I am not much of a short-term trader. I do not have a strong opinion on whether AAPL is a good stock to buy ahead of earnings day and sell right after it, for example.

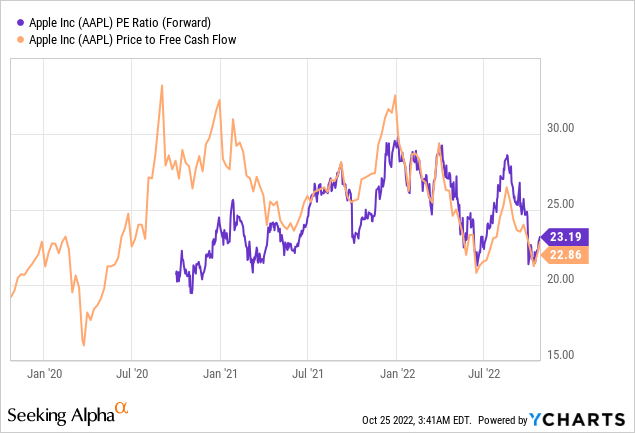

Instead, I maintain my long-term stance that Apple is a great stock to have in the portfolio, especially if bought 18% below all-time highs. While valuations remain far from depressed (see chart below), I like the product portfolio that seems to support strong demand and the company’s recent track record of executing well in virtually any macro environment.

Be the first to comment