Nikada/iStock Unreleased via Getty Images

Thesis

Before I introduce this article, let me say that I am bullish on Apple (NASDAQ:AAPL). I have initiated my coverage on the stock with the article: Apple: 3 Reasons Why The Stock Could Trade Higher. And I still believe in the thesis.

However, I am aware that many extremely successful and smart investors, most notably Michael Burry, are bearish on the stock. According to the latest SEC filing from his firm Scion Capital, Michael Burry holds PUT options on 206,000 Apple shares. What could possibly be his thesis?

In this article, I argue the bear case for Apple. I present four key risks that, if materialized, could cause Apple stock to trade lower.

Apple shares have slightly outperformed the market YTD, being down only about 9% versus a loss of about 14% for the S&P 500.

Rich Valuation: Relative Investing

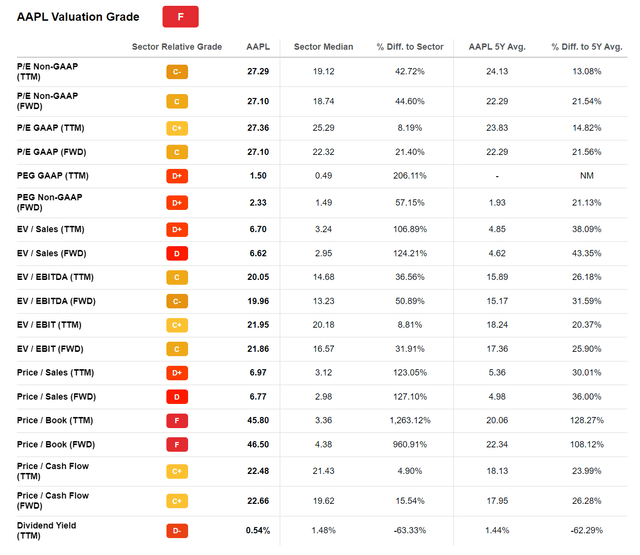

First let us start with the most easy, but also most superficial argument, which is about valuation. Trading at a one-year forward P/E of x17, a P/B of x46 and a P/S of about x7, investors could easily argue that Apple is overvalued. The thesis is supported by an industry comparison, which indicates that Apple trades at a 40% – 1200% premium, depending on which metric an investor would like to compare.

Seeking Alpha

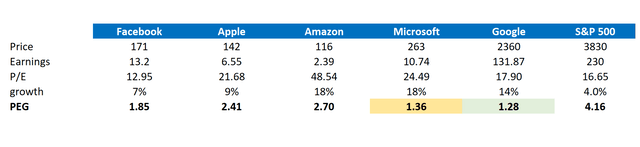

But comparing Apple against ‘peers’ is arguably a fool’s game, because in my opinion, Apple has no peers. Thus, a comparison against the FAAMG universe might provide a more relevant picture. Moreover, As PE metrics do not really account for a company’s implied growth, I would advise to use the PEG comparison. The PEG ratio is broadly considered as an informative valuation metric to capture the relative tradeoff between the company’s current stock price, current earnings and the expected growth. The ratio is calculated as a P/E divided by three-year CAGR expectation.

Most notably, Apple’s x2.41 PEG ratio does indeed imply a material premium to peers. Google appears only half as expensive as Apple. And of the FAAMG universe, only Amazon has a higher PEG: x2.7. However, if we consider the S&P 500 as the relevant benchmark (PEG of x4.1), Apple stock could be a bargain.

(PE numbers are adjusted for non-recurring expenses to anchor on a sustainable operating profit)

Analyst Consensus; Author’s Calculation

Macro Thesis: A Market Correction

Michael Burry is arguably a strong believer of a brutal market crash. On Twitter he voiced concerns multiple times about market excesses and the potential possibility of the ‘Mother of all Crashes’. If investors believe that the market correction has more room to go, shorting Apple might not be that stupid after all. Arguably much of Apple’s current share price volatility is currently driven by investor sentiment towards risk and growth assets. Investors should consider that Apple is the largest component of both the S&P 500 and the Nasdaq 100, accounting for about 7% and 13% respectively. Moreover, Apple shares are more sensitive to market fluctuations than the index, having a 5-year Beta of about 1.23. Thus, if the market drops steeply, Apple is likely to follow suit. Note how closely AAPL shares track the broader market fluctuations YTD.

Seeking Alpha

That said, Michael Burry has significant long exposure to Meta (META), Alphabet (GOOG), Warner Bros. Discovery (WBD) and other value stocks. He might therefore look to use his PUT options on Apple as a hedge against non-idiosyncratic market risk.

Earnings contraction: Consumer Slowdown

On July 28th Apple reported Q3 results and personally was positively surprised by the company’s business resilience, as I believed the macro-environment would force a slowdown in the demand for Apple’s value proposition. But until June 30, Apple has continued to perform:

Our June quarter results continued to demonstrate our ability to manage our business effectively despite the challenging operating environment. We set a June quarter revenue record and our installed base of active devices reached an all-time high in every geographic segment and product category

However, this does not necessarily imply that Apple is not vulnerable to a sharp recession. Investors should consider that at its core Apple is a consumer-centric business with about 75% of revenues being exposed to discretionary non-recurring spending.

It is worth noting that the current market environment is absolutely not favorable for consumer sentiment, given: (1) falling asset prices and savings, (2) rising interest rates, (3) inflation, (4) international trade tensions, and (5) a strong dollar. That said, a continued worsening of the macro-environment could lengthen consumers device replacement cycles, which would temporarily impact Apple’s business performance. Arguably, many of the macro-challenges, will only materialize with a 3-6 month lag. Thus, Apple’s earnings slowdown might only materialize in the September or December quarter 2022, or even only in the first half 2023.

China Exposure: Supply & Demand

As tensions with China are increasing, which has been even further accelerated by Pelosi’s visit in Taiwan, I feel the market is complacent about Apple’s material exposure to China — both on the demand side and on the supply side.

On the demand side, China accounts for approximately 20% of Apple’s total revenues. And on the supply side, we know that 90% of the company’s hardware is sourced in Asia, most of which is connected to China.

Paradoxically, the market is enormously concerned about investing in China tech/internet companies such as Alibaba (BABA), Tencent (OTCPK:TCEHY) and Baidu (BIDU), because investors are worried the CCP would somehow punish its domestic firms. But what about international tech/internet giants operating in China? Meta and Google are not allowed to operate in China, given data and security concerns. What if Apple’s products and services were suddenly deemed a threat to China’s security?

That said, any China-related tensions could considerably disrupt Apple’s business operations, profitability and value chain.

Conclusion

It is always valuable to consider what could develop as a risk for any specific stock. For Apple, I see four key risks: (1) relative rich valuation, (2) the risk of an accelerating market correction, (3) EPS contraction given consumer slowdown and (4) supply & demand issues relating to the company’s China exposure. If you can think of any more risks that Apple might need to face, please write them in the comments. Happy to engage in a discussion.

I would like to conclude, however, that I remain an Apple bull. And I continue to sustain my view that Apple could trade significantly higher in the next 12-36 months due to: 1. New market opportunities including VR/AR and the Apple Car, 2. Accelerating strength in Apple’s service portfolio, and 3. Continued financial engineering.

My coverage initiation article on Apple: Apple: 3 Reasons Why The Stock Could Trade Higher

Be the first to comment