imaginima

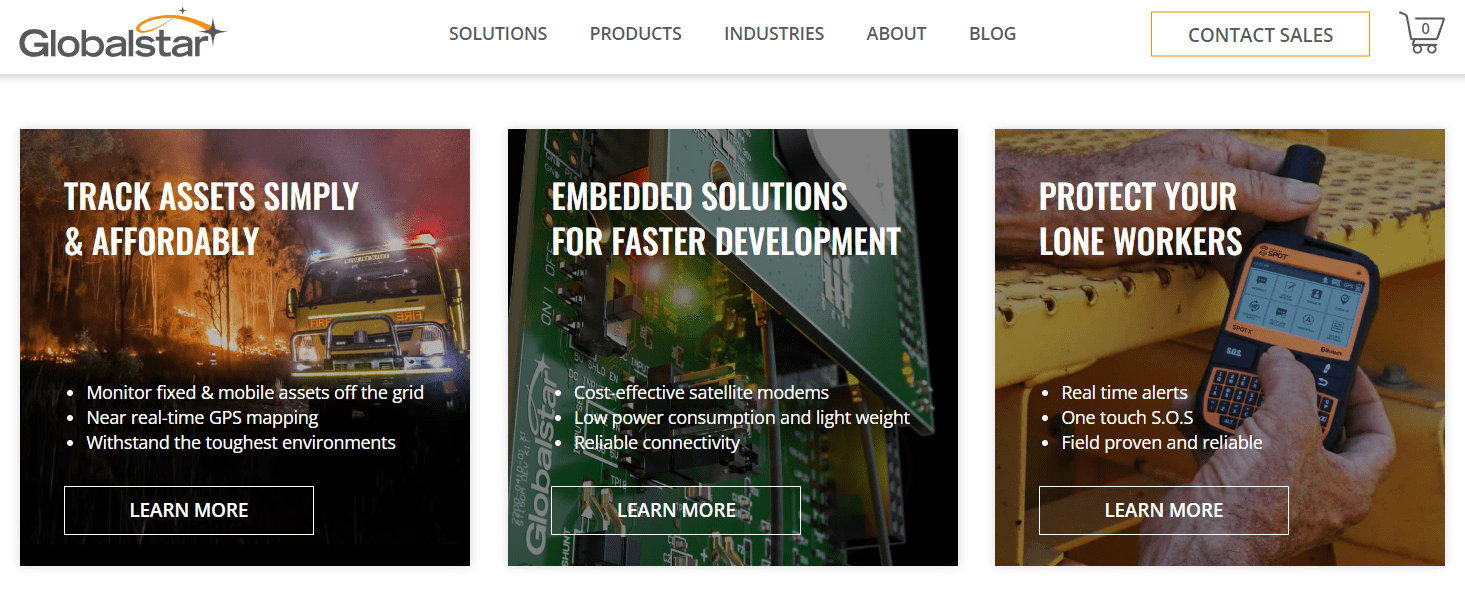

With the latest developments around its iPhone 14 and its agreement with Globalstar (GSAT) for satellite communications which is completely independent of ground-based cellular mobile networks, Apple (NASDAQ:AAPL) seems to be laying the foundation for a broader role in telecommunications that should considerably increase the number of devices it sells in fiscal 2023.

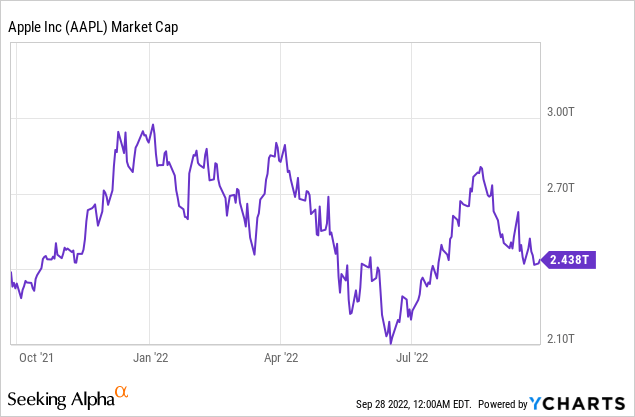

In so doing, it is adding to its market size which is already worth trillions of dollars, while, at $2.4 trillion, its market cap is 20% down from its January 2022 high of $3 trillion.

In addition to determining a target share price in light of the new opportunities, this thesis will consider the competition, as well as how Apple’s moves somehow put into question years-old partnership agreements with mobile service providers.

The Changes brought by Apple

One of the major changes is Apple’s removal of the SIM card tray altogether. This is where you insert the SIM module, which identifies you as a subscriber on a particular operator’s network. It has been getting smaller from the large SIM of five years ago to the Nano SIM, till Apple effectively reduced its size to zero. This may look like a small change, but, represents a paradigm shift, as it implies that Apple now exclusively favors eSIM or electronic SIM.

Digitalization of the SIM is not a new concept as it is supported by previous iPhone models and is already offered by many carriers, but, is offered as an add-on to existing physical cards especially when you are traveling to foreign countries. It avoids the hassle of having to physically swap the SIM at each destination, with eSIM-only even viewed as a “more secure alternative to a physical SIM card”.

In this respect, such changes were already tried by others before, namely Motorola (MSI), about 3 years ago, without much success. However, this time it is the turn of giant Apple which boasts more than 50% of the U.S. smartphone market share. The company is also adept at transformational changes like getting rid of the headphone jack for its iPhone 7, which was subsequently followed by the industry’s move to wireless.

Still, one can argue whether Apple’s gamble may not backfire, possibly, with operators not providing its device as part of their plans because the iPhone 14 makes it feasible to have many cellular plans at the same time, implying that it is easier for subscribers to switch providers too. Along the same lines, considering the recent agreement with Globalstar for satellite communications in areas deprived of cellular coverage, Apple seems to be laying the base for a broader role in the telecom ecosystem.

With the stakes so high, it becomes important to assess what competitors are up to.

The competition

According to one source, Google (GOOG)(GOOGL), has started to program its Android 14 software to support direct-to-satellite phone connectivity. Now, Google already has a long-standing partnership with T-Mobile (NASDAQ:TMUS) stretching back to 2008 for cellular and WiFi testing on the G1. Interestingly, at the beginning of this month, Google’s Vice President of Platform and Ecosystems talked about “designing for satellites”. Now, this announcement came just one week after T-Mobile’s collaboration with SpaceX (SPACE) for satellite connectivity as I had covered in my thesis in August.

Google’s Collaboration with T-Mobile for Open Infrastructure Cloud (seekingalpha.com)

Now, in addition to the Android version which will be available only by mid-2023, the device, be it a Samsung (OTCPK:SSNLF) Galaxy, Xiaomi (OTCPK:XIACF), or Oppo, all need to be equipped with the right modem which can allow direct satellite access. Compare this with Apple and Globalstar which have already conducted feasibility, including field tests, with the service launch planned for this year itself. To support the launch, a satellite-based feature, which is most probably Qualcomm’s (QCOM) X65 modem including Globalstar’s band 53 already equip the latest iPhone 14 as I had explained in an earlier thesis.

Pursuing further, Apple may face future competition from other companies like Samsung, in addition to AST SpaceMobile (ASTS), or Lynk Global which are at more advanced testing phases, but, the fact that it has better control of its smartphone ecosystem since it owns both the IOS software and iPhone hardware confers to it more nimbleness than competitor Google. Also, empowered by one of the most recognizable brands, Apple can aggressively drive the adoption of its direct-to-satellite iPhone and it should be valued accordingly.

The global satellite phone market is predicted to reach $5.2 billion in 2027 from $3.8 billion in 2019, or grow at a CAGR of 4%. However, this includes traditional players like Iridium (IRDM), Globalstar and Thuraya, etc. proposing satellite phones (picture below) with subscription plans averaging $835 per year, plus additional charges depending on the number of voice calls made. Now, unless you are a professional hunter, seafarer, or ranger, these fees plus the inconvenience of carrying out a satellite phone in addition to your smartphone may deter you to subscribe to a satellite phone service. This constitutes more of a niche market numbering millions of units when considering that the total number of smartphones is estimated to reach a whopping 7.33 billion in 2025 from 6.37 billion in 2021.

Picture of a satellite phone (investors.globalstar.com)

Therefore, by commoditizing the satellite phone market, Apple should scale it way beyond the $5.2 billion mark, depending on how it drives its iPhone 14 as a substitute for the features like S.O.S calls that have traditionally been provided by specialized and relatively expensive devices. Now, add to this the existing $6.3 trillion of opportunities from the app (smartphone applications) economy, which comprises Apple’s services revenue, namely advertising, and commissions from the AppStore, and it becomes evident that the company deserves to be richly valued.

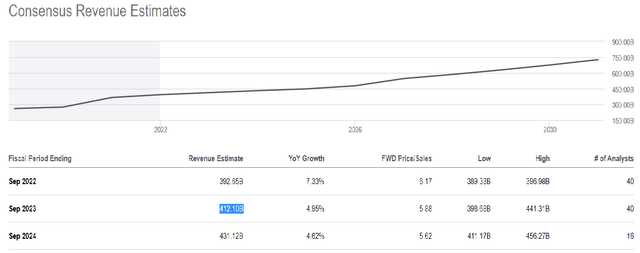

As for valuations, the company generated $190 billion from iPhones in 2021, or 52% of the total $365 billion revenues. It sold 13.5% more units in 2021 than in 2020, but, little progression is expected for fiscal 2022 which ends in September. Assuming that the rate of growth doubles in fiscal 2023 (October 2022 to September 2023) to 27% as a result of more direct-to-satellite iPhone 14 sales, this should translate into $51.3 billion (190 x 0.27) of device revenues. Adding this to the $412.1 billion of expected sales for 2023, I obtain $463.4 billion, or 12% more. Multiplying this by the forward price-to-sales of 5.87x, I obtain a reviewed P/S of 6.6x for 2023. This translates to a share price of $170.7 (151.8 x 1.12), based on the current share price of $151.8, which makes Apple a buy.

Consensus Revenue Estimates (www.seekingalpha.com)

The $463.4 billion expected for 2023 does not include services which constituted 18% of revenues in 2021. My optimism also stems from the fact that Apple is applying a “freebie marketing strategy” consisting of offering a free satellite-based “Emergency SOS” feature and generating more sales in return. This feature will be available for an initial period of two years initially covering the U.S. and Canada and can prove to be life-saving for someone stranded in a remote location with no mobile coverage or in case of a fire or flooding. These are strong enough reasons to believe that subscribers will be willing to upgrade their iPhones or Android users making the switch.

On, the other hand, Apple will have to pay Globalstar between $185 million and $230 million as part of the partnership agreement, while providing the service for free. Also, the removal of the SIM tray somehow puts into question partnership agreements with operators, whereby these would sell iPhones as part of their 5G service plans, thereby indirectly subsidizing the Nasdaq’s most valued company.

Therefore, it is important to observe how Verizon (VZ) and AT&T (T) adapt to Apple’s new role, especially given the fact that they already have partnerships with Google for private cloud and edge networks. Also, with the Federal Reserve unlikely to turn dovish any time soon, more value-oriented investors may choose to watch out for the next fiscal year’s profitability before investing.

Conclusion

Still, boasting a profitability grade of A+, it is unlikely for Apple’s margin to be impacted much as the company can also adjust product pricing to make up for additional costs. Moreover, it is difficult to envision Verizon or AT&T constituting any obstacle, considering that the satellite service is solely for low-bandwidth messaging, not fifth-generation wireless, implying that Apple is not venturing on their turf. On the contrary, they can get to sell more subscriptions.

Therefore, Apple’s foray into satellite communications looks to bolster sluggish iPhone sales, while at the same time, this ability to come up with a plan to boost market share through innovation is audacious, and, consequently, I have a price target of $170.7.

Ending on a cautionary note, after the feasibility and testing phases, comes implementation when subscribers actually start using the new direct-to-satellite iPhone, which means that depending on the way news updates about product adoption hit the market, the stock may be volatile.

Be the first to comment