Nikada/iStock Unreleased via Getty Images

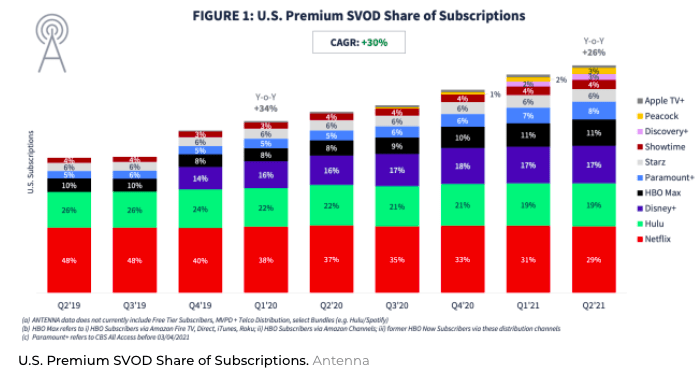

Apple (NASDAQ:AAPL) has been ramping up its investment in the streaming video segment hoping to attract more paying customers. However, it is still far behind most competitors like Disney (DIS), Netflix (NFLX), HBO (WBD), Amazon (AMZN), and others. According to Variety, Apple had mentioned that it has less than 20 million paying customers in US and Canada in the last quarter which allowed the company to pay discounted rates to its production crew. Another estimate mentioned by Observer is 8.1 million paid subscribers in US. These are abysmal numbers when compared to HBO and Disney which were launched after Apple TV+. Even with the lowest subscription rate of $4.99/ month in the industry, Apple could find it difficult to reach a sizable number of paid subscribers within TV+ over the next few years.

The churn rate for TV+ is one of the highest in the industry. This limits the ability of the company to gain a loyal subscriber base and use its TV+ subscription as an anchor service to promote other services and products. The streaming video business is a money pit that requires billions of dollars in annual content investment. It is likely that Apple’s content budget will exceed $100 billion during this decade. At this rate, the streaming business will likely play a big negative impact on the earnings growth of the company which will be a headwind for Apple stock.

Subscribers are still elusive

According to the company’s management, the paid subscriber base in US and Canada is less than 20 million. The company has delivered some Emmy winning shows and we still do not see any major uptick in subscriber base. Even if we take a long-term view of these investments, Apple would need to show at least some progress in subscriber numbers to justify the level of investments. It is spending close to $6.5 billion annually on streaming content which was 10% of the net income in 2020.

Observer

Figure 1: Apple’s slow progress in the SVOD industry. Source: Observer, Antenna

The dearth of content could be a lingering issue for the company. Apple has some hit programs like “Ted Lasso”, “For All Mankind” and “The Morning Show”. However, it creates the issue of short-term subscription to the service. Looky-loos take subscription for some time and cancel their membership after watching their desired content. This creates a massive issue of churn rate. Apple’s churn rate is the highest in this industry.

According to a report by Antenna, Apple’s quarterly churn rate is a staggering 15%. Compared to this, Netflix had a churn rate of only 2.5% and Disney had a churn rate of 4%. Hopefully, as Apple invests heavily over the next few years which should increase its original content library, the churn rate would get lower.

Money pit

While talking about the long-term potential of the streaming business, many analysts forget that this is one of the biggest money pits. Disney has already announced an increase in investment to over $30 billion. Netflix is investing over $15 billion. Amazon spent $11 billion on original content in 2020, $13 billion in 2021 and could easily ramp it up to over $20 billion in the next few years. This makes Apple’s investment look paltry even though the company is spending a big chunk of its profits on this service.

It should not be a surprise if Apple ends up spending over $100 billion in the streaming business in this decade. Even at this investment rate, it would be at the fourth or fifth spot within this industry in terms of investment. This shows the amount of money that is swirling within the streaming video space. Economies of scale work very well within this industry. If Netflix decides to invest another billion on a new series, the cost will be distributed among more than 200 million subscribers. However, if Apple decides to spend a billion dollars on a new program, it will be distributed among less than 20 million subscribers who pay lower subscription costs and have a higher churn rate.

Lack of anchor service

Apple does not have a membership like Amazon Prime which can be used to subsidize investment in the streaming business. The retention rate of Amazon Prime members is very high which allows the company to divert funds towards other subscription services like music and streaming video. A lack of anchor service will hurt Apple’s potential to gain new subscribers who can be provided a strong value proposition in this service.

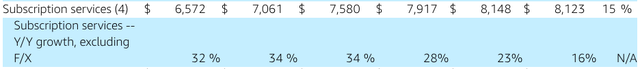

Figure 2: Amazon’s subscription revenue is over $30 billion in trailing twelve months. Source: Company Filings

The subscription segment of Amazon has been growing at a strong rate over the last few quarters with annualized revenue rate of $30 billion in the trailing twelve months. Amazon has an anchor service due to Prime membership. It is also doing very well in Echo products and music streaming where it competes directly with Apple. Rapid increase in subscription revenue should allow Amazon to divert more revenue towards streaming video. This will make Amazon one of the biggest competitors for Apple in a number of services. Lack of anchor service by Apple will be the biggest headwind for the company within its subscription business.

Impact on earnings and stock

Apple is trying to move away from being labeled a products company to a more service-oriented company. It would be very important for the company to build a strong subscription business to deliver Services growth. Within the subscription business, Apple TV+ plays a central role for the company. Wall Street has given Apple a lot of time to grow its streaming video and subscription business. However, if we continue to find reports of a very low subscriber base, high churn rate, and massive investments then the stock could start showing bearish sentiment.

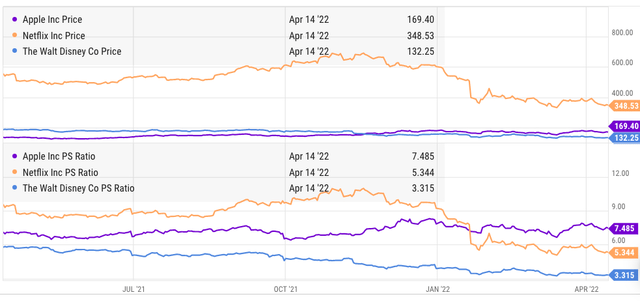

Figure 3: Comparison of price and P/S ratio of Apple, Netflix and Disney. Source: YCharts

We have already seen massive correction in Netflix and Disney stock when they reported fewer net subscription additions. Apple’s streaming business forms a smaller portion of the total valuation for the company. However, Wall Street would still be interested in knowing the improvement in subscriptions within this segment, especially after spending tens of billions of dollars. TV+ could take up investment of 10% to 20% of the net income of Apple over the next few years. This will be a big drag on EPS growth and future estimates should be revised accordingly.

If the outlook toward streaming industry turns bearish, Apple’s subscription plans can face headwinds which will lead to a big decline in the growth of the Service segment. A lower growth rate in Services segment would be a headwind for Apple stock as it is already trading at close to its peak PE multiple in over a decade.

Investor takeaway

Apple has not made much progress in its paid subscriber base within its TV+ service. Recent reports suggest that the paid subscriber numbers would be less than 20 million. On the other hand, Apple is investing heavily in this industry which has a negative impact on profits and earnings over the next few years. Apple’s investment in TV+ has been more than 10% of the net income in 2020 and it could easily increase to over 20% of net income as Apple ramps up investment to match other peers.

The churn for TV+ is the highest in the industry which will reduce the ability of the management to create loyalty toward other services and products and gain a pricing leverage. Despite heavy investments, Apple could end up in the fifth or lower rank in terms of subscriber base over the long run. Lack of success in TV+ will reduce the growth runway for Services segment and will also be one of the biggest headwind for Apple stock in the next few quarters.

Be the first to comment