JHVEPhoto

Thesis

Leading commodities mining company Rio Tinto Group (NYSE:RIO) has outperformed our expectations over the past two months. We urged investors to ignore the pessimism at its September lows, as we posited long-term buyers could return to support RIO.

Accordingly, since our update, RIO has outperformed the S&P 500 (SPX) (SP500), posting a price performance of nearly 22%, relative to the SPX’s 10.8% gain. It’s also above RIO’s 5Y and 10Y total return CAGR of 16.3% and 10.6%, respectively.

Hence, we believe it’s appropriate for us to update investors on whether they should continue adding exposure or wait for a healthy pullback first.

We gleaned that RIO’s forward estimates have been cut materially, including its dividend per share projections. However, as we highlighted in our previous update, the Street may not have contemplated a weaker performance yet, as global macroeconomic headwinds intensified.

Yet, RIO outperformed the market over the past two months despite the estimates cuts, reflecting significant pessimism may have been reflected. Notwithstanding, the worst of China’s COVID and property malaise could be behind us, as China recently refined its zero COVID guidelines.

Hence, we parse the market has likely reflected China’s near-term optimism in its recent recovery, even though iron ore futures are still way below their August highs.

With the momentum spike over the past two months, we believe RIO’s valuation is more well-balanced now. Furthermore, its price action also suggests caution, as a pullback is looking increasingly likely to digest some of its recent gains.

Hence, we urge investors to be patient and wait for a potential pullback first.

Revising from Buy to Hold for now.

China Is Progressively Refining Its Zero COVID Restrictions

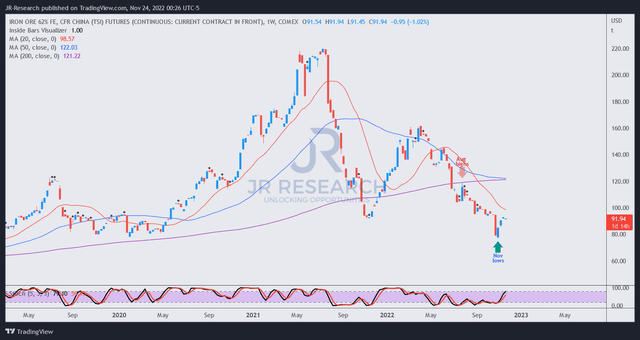

Iron ore 62% Fe futures price chart (weekly) (TradingView)

Iron ore futures (TIOC:COM) have been hammered since July 2021, as they lost nearly 65% toward their recent November lows. However, China’s recent COVID refinement program has momentarily lifted sentiments even though TIOC remains embedded in a medium-term downtrend.

Furthermore, China’s COVID cases have surged above the highs last seen in April, testing the resolve of China’s health regulators in their progress to adjust their zero COVID stance.

Notwithstanding, China’s monetary regulators have attempted to shore up the property market by extending $38B in credit to embattled property developers. As such, it’s spurring investors’ confidence that China is committed to its drive to return its economy to growth and remove past policy overhangs.

As such, it corroborates China’s central bank’s recent optimism that the country could recover its GDP growth rate toward at least the 5% zone in 2023 as President Xi Jinping attempts to stage a solid recovery to mark his unprecedented third term.

Therefore, we believe the medium-term outlook for Rio Tinto is constructive, justifying its recent recovery.

However, the critical question is whether the recent optimism has been reflected in its valuation.

RIO: Valuation More Well-Balanced

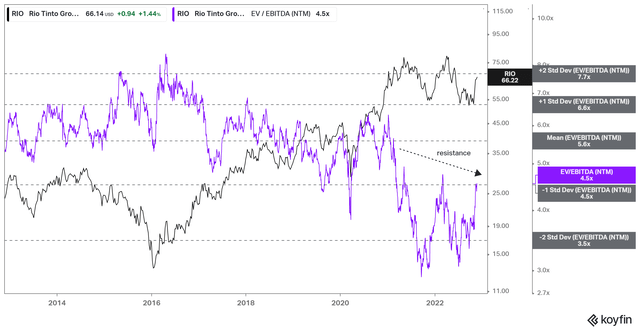

RIO NTM EBITDA multiples valuation trend (koyfin)

RIO last traded at an NTM EBITDA multiple of 4.5x, surging from its September lows. However, it remains well below its 10Y average of 5.6x. It’s also below its peers’ median of 5.2x, suggesting that RIO’s valuation is not aggressively configured.

Despite that, we believe RIO has already been de-rated to reflect the worsening macro risks and the ongoing China headwinds. Hence, we believe the discount from its historical average is appropriate.

Is RIO Stock A Buy, Sell, Or Hold?

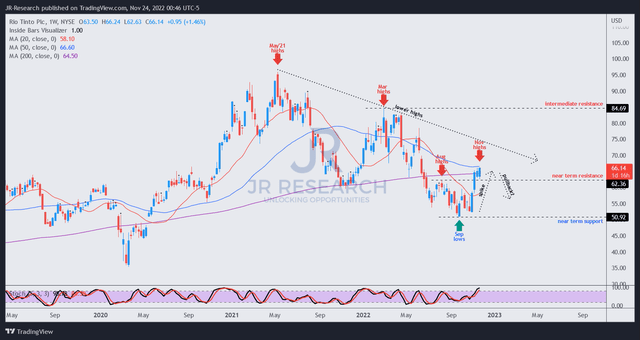

RIO price chart (weekly) (TradingView)

RIO has come a long way from its May 2021 highs, falling nearly 47% to its September lows. Hence, a significant level of excess has likely been digested.

However, the recent momentum spike from its September highs has also normalized its valuation in line with what we assess as appropriate for a recessionary base case.

Moreover, a series of resistance zones remain in place to deny much further upside from these levels.

Hence, we urge investors to consider waiting for a potential pullback first before adding more positions.

Revising from Buy to Hold.

Be the first to comment